正在加载图片...

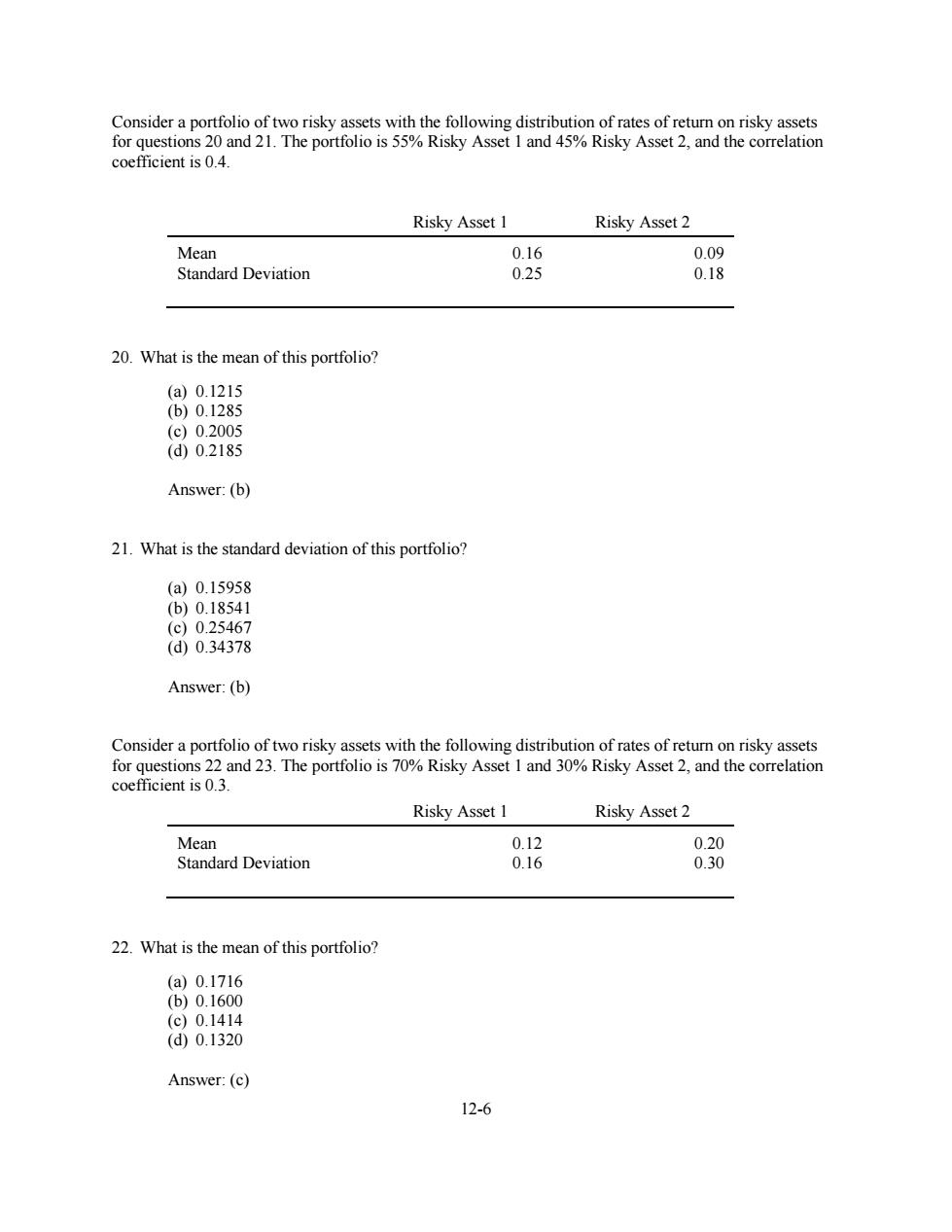

Consider a portfolio of two risky assets with the following distribution of rates of return on risky assets for questions 20 and 21.The portfolio is 55%Risky Asset 1 and 45%Risky Asset 2,and the correlation coefficient is 0.4. Risky Asset 1 Risky Asset 2 Mean 0.16 0.09 Standard Deviation 0.25 0.18 20.What is the mean of this portfolio? (a)0.1215 (b)0.1285 (c)0.2005 (d)0.2185 Answer:(b) 21.What is the standard deviation of this portfolio? (a)0.15958 (b)0.18541 (c)0.25467 (d0.34378 Answer:(b) Consider a portfolio of two risky assets with the following distribution of rates of return on risky assets for questions 22 and 23.The portfolio is 70%Risky Asset 1 and 30%Risky Asset 2,and the correlation coefficient is 0.3. Risky Asset 1 Risky Asset 2 Mean 0.12 0.20 Standard Deviation 0.16 0.30 22.What is the mean of this portfolio? (a)0.1716 (b)0.1600 (c)0.1414 (d)0.1320 Answer:(c) 12-612-6 Consider a portfolio of two risky assets with the following distribution of rates of return on risky assets for questions 20 and 21. The portfolio is 55% Risky Asset 1 and 45% Risky Asset 2, and the correlation coefficient is 0.4. Risky Asset 1 Risky Asset 2 Mean Standard Deviation 0.16 0.25 0.09 0.18 20. What is the mean of this portfolio? (a) 0.1215 (b) 0.1285 (c) 0.2005 (d) 0.2185 Answer: (b) 21. What is the standard deviation of this portfolio? (a) 0.15958 (b) 0.18541 (c) 0.25467 (d) 0.34378 Answer: (b) Consider a portfolio of two risky assets with the following distribution of rates of return on risky assets for questions 22 and 23. The portfolio is 70% Risky Asset 1 and 30% Risky Asset 2, and the correlation coefficient is 0.3. Risky Asset 1 Risky Asset 2 Mean Standard Deviation 0.12 0.16 0.20 0.30 22. What is the mean of this portfolio? (a) 0.1716 (b) 0.1600 (c) 0.1414 (d) 0.1320 Answer: (c)