正在加载图片...

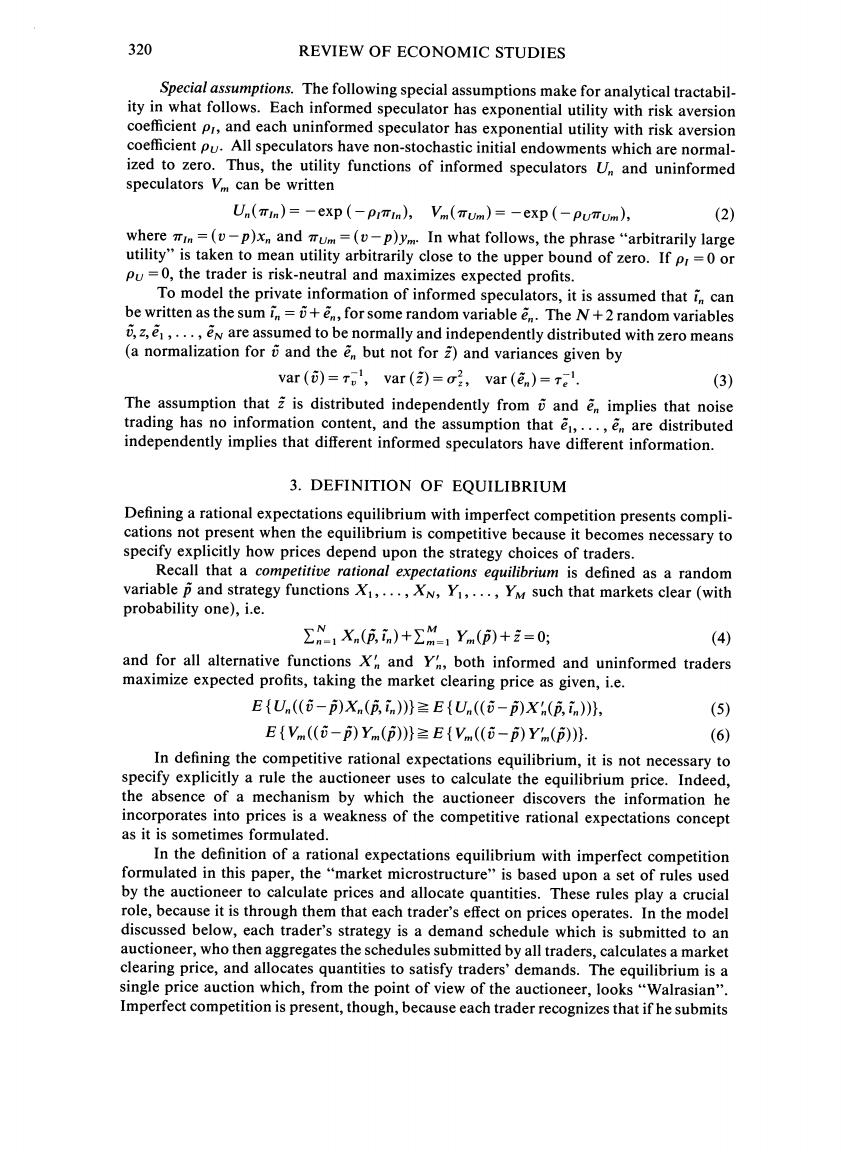

320 REVIEW OF ECONOMIC STUDIES Special assumptions.The following special assumptions make for analytical tractabil- ity in what follows.Each informed speculator has exponential utility with risk aversion coefficient pr,and each uninformed speculator has exponential utility with risk aversion coefficient Pu.All speculators have non-stochastic initial endowments which are normal- ized to zero.Thus,the utility functions of informed speculators U and uninformed speculators Vm can be written Un(TIn)=-exp(-prTIn),Vm(Tum)=-exp (-PuTUm), (2) where Tin=(v-p)xn and Tum =(v-p)ym.In what follows,the phrase "arbitrarily large utility"is taken to mean utility arbitrarily close to the upper bound of zero.If pr=0 or Pu =0,the trader is risk-neutral and maximizes expected profits. To model the private information of informed speculators,it is assumed that in can be written as the sum in=+,for some random variable en.The N+2 random variables ,z,e1,...,ew are assumed to be normally and independently distributed with zero means (a normalization for and the en but not for 2)and variances given by var ()=T,var ()=2,var (n)=Te. (3) The assumption that is distributed independently from and en implies that noise trading has no information content,and the assumption that e,...,e are distributed independently implies that different informed speculators have different information. 3.DEFINITION OF EQUILIBRIUM Defining a rational expectations equilibrium with imperfect competition presents compli- cations not present when the equilibrium is competitive because it becomes necessary to specify explicitly how prices depend upon the strategy choices of traders. Recall that a competitive rational expectations equilibrium is defined as a random variable p and strategy functions X1,...,XN,Y1,...,YM such that markets clear(with probability one),i.e. ,X.(ii)+∑M,y()+=0: (4) and for all alternative functions X and Y,both informed and uninformed traders maximize expected profits,taking the market clearing price as given,i.e. EU((p)xn(p,in)))EU((-p)xh(p,in))), (5) EVm ((-p)Ym(p))Ev((-p)Ym(p))). (6) In defining the competitive rational expectations equilibrium,it is not necessary to specify explicitly a rule the auctioneer uses to calculate the equilibrium price.Indeed, the absence of a mechanism by which the auctioneer discovers the information he incorporates into prices is a weakness of the competitive rational expectations concept as it is sometimes formulated. In the definition of a rational expectations equilibrium with imperfect competition formulated in this paper,the "market microstructure"is based upon a set of rules used by the auctioneer to calculate prices and allocate quantities.These rules play a crucial role,because it is through them that each trader's effect on prices operates.In the model discussed below,each trader's strategy is a demand schedule which is submitted to an auctioneer,who then aggregates the schedules submitted by all traders,calculates a market clearing price,and allocates quantities to satisfy traders'demands.The equilibrium is a single price auction which,from the point of view of the auctioneer,looks"Walrasian". Imperfect competition is present,though,because each trader recognizes that if he submits