正在加载图片...

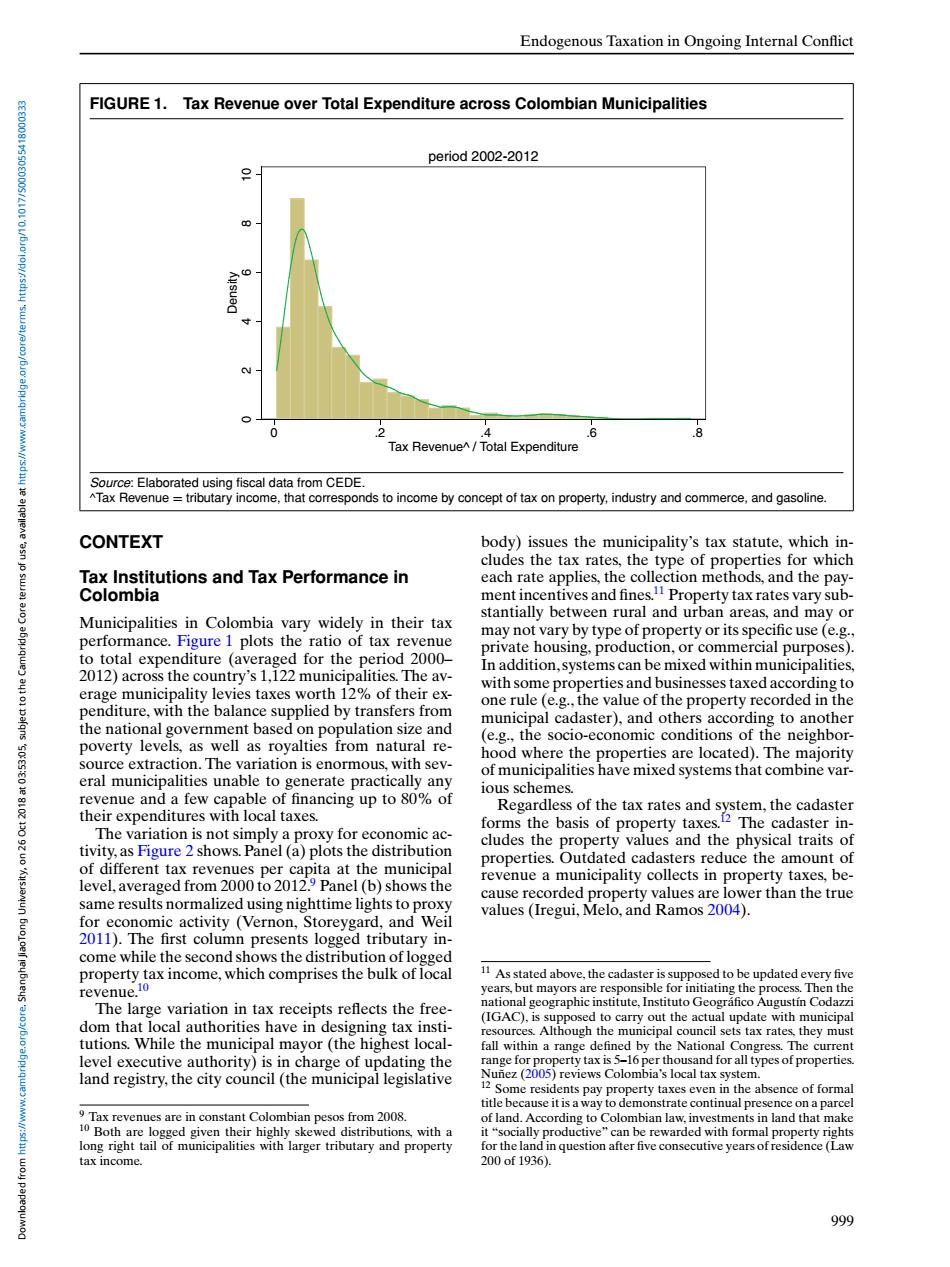

Endogenous Taxation in Ongoing Internal Conflict FIGURE 1.Tax Revenue over Total Expenditure across Colombian Municipalities period2002-2012 .4 .6 8 Tax Revenue^/Total Expenditure Source:Elaborated using fiscal data from CEDE. ^Tax Revenue tributary income,that corresponds to income by concept of tax on property,industry and commerce,and gasoline 4号元 CONTEXT body)issues the municipality's tax statute,which in- cludes the tax rates,the type of properties for which Tax Institutions and Tax Performance in each rate applies,the collection methods,and the pay- Colombia ment incentives and fines.1 Property tax rates vary sub- Municipalities in Colombia vary widely in their tax stantially between rural and urban areas,and may or performance.Figure 1 plots the ratio of tax revenue may not vary by type of property or its specific use(e.g., private housing,production,or commercial purposes). to total expenditure (averaged for the period 2000- 2012)across the country's 1,122 municipalities.The av- In addition,systems can be mixed within municipalities, erage municipality levies taxes worth 12%of their ex- with some properties and businesses taxed according to penditure,with the balance supplied by transfers from one rule (e.g.,the value of the property recorded in the municipal cadaster),and others according to another the national government based on population size and (e.g.,the socio-economic conditions of the neighbor- poverty levels,as well as royalties from natural re- source extraction.The variation is enormous,with sev- hood where the properties are located).The majority of municipalities have mixed systems that combine var- eral municipalities unable to generate practically any ious schemes revenue and a few capable of financing up to 80%of Regardless of the tax rates and system,the cadaster their expenditures with local taxes. forms the basis of property taxes.2 The cadaster in- The variation is not simply a proxy for economic ac- tivity,as Figure 2 shows.Panel (a)plots the distribution cludes the property values and the physical traits of properties.Outdated cadasters reduce the amount of of different tax revenues per capita at the municipal level,averaged from 2000 to 2012.9 Panel(b)shows the revenue a municipality collects in property taxes,be- same results normalized using nighttime lights to proxy cause recorded property values are lower than the true values(Iregui,Melo,and Ramos 2004). for economic activity (Vernon,Storeygard,and Weil 2011).The first column presents logged tributary in- come while the second shows the distribution of logged property tax income,which comprises the bulk of local 1 Asstated above.the cadaster is supposed to be updated every five revenue.10 years,but mayors are responsible for initiating the process.Then the The large variation in tax receipts reflects the free- national geographic institute,Instituto Geografico Augustin Codazzi dom that local authorities have in designing tax insti- (IGAC),is supposed to carry out the actual update with municipal resources.Although the municipal council sets tax rates,they must tutions.While the municipal mayor(the highest local- fall within a range defined by the National Congress.The current level executive authority)is in charge of updating the range for property tax is 5-16 per thousand for all types of properties. land registry,the city council (the municipal legislative Nufez (2005)reviews Colombia's local tax system. 12 Some residents pay property taxes even in the absence of formal title because it is a way to demonstrate continual presence on a parcel 9 Tax revenues are in constant Colombian pesos from 2008. of land.According to Colombian law,investments in land that make 10 Both are logged given their highly skewed distributions with a it"socially productive"can be rewarded with formal property rights long right tail of municipalities with larger tributary and property for the land in question after five consecutive years of residence (Law tax income. 200of1936). 999Endogenous Taxation in Ongoing Internal Conflict FIGURE 1. Tax Revenue over Total Expenditure across Colombian Municipalities 0 2 4 6 8 10 Density 0 .2 .4 .6 .8 Tax Revenue^ / Total Expenditure period 2002-2012 Source: Elaborated using fiscal data from CEDE. ^Tax Revenue = tributary income, that corresponds to income by concept of tax on property, industry and commerce, and gasoline. CONTEXT Tax Institutions and Tax Performance in Colombia Municipalities in Colombia vary widely in their tax performance. Figure 1 plots the ratio of tax revenue to total expenditure (averaged for the period 2000– 2012) across the country’s 1,122 municipalities. The average municipality levies taxes worth 12% of their expenditure, with the balance supplied by transfers from the national government based on population size and poverty levels, as well as royalties from natural resource extraction. The variation is enormous, with several municipalities unable to generate practically any revenue and a few capable of financing up to 80% of their expenditures with local taxes. The variation is not simply a proxy for economic activity, as Figure 2 shows. Panel (a) plots the distribution of different tax revenues per capita at the municipal level, averaged from 2000 to 2012.9 Panel (b) shows the same results normalized using nighttime lights to proxy for economic activity (Vernon, Storeygard, and Weil 2011). The first column presents logged tributary income while the second shows the distribution of logged property tax income, which comprises the bulk of local revenue.10 The large variation in tax receipts reflects the freedom that local authorities have in designing tax institutions. While the municipal mayor (the highest locallevel executive authority) is in charge of updating the land registry, the city council (the municipal legislative 9 Tax revenues are in constant Colombian pesos from 2008. 10 Both are logged given their highly skewed distributions, with a long right tail of municipalities with larger tributary and property tax income. body) issues the municipality’s tax statute, which includes the tax rates, the type of properties for which each rate applies, the collection methods, and the payment incentives and fines.11 Property tax rates vary substantially between rural and urban areas, and may or may not vary by type of property or its specific use (e.g., private housing, production, or commercial purposes). In addition, systems can be mixed within municipalities, with some properties and businesses taxed according to one rule (e.g., the value of the property recorded in the municipal cadaster), and others according to another (e.g., the socio-economic conditions of the neighborhood where the properties are located). The majority of municipalities have mixed systems that combine various schemes. Regardless of the tax rates and system, the cadaster forms the basis of property taxes.12 The cadaster includes the property values and the physical traits of properties. Outdated cadasters reduce the amount of revenue a municipality collects in property taxes, because recorded property values are lower than the true values (Iregui, Melo, and Ramos 2004). 11 As stated above, the cadaster is supposed to be updated every five years, but mayors are responsible for initiating the process. Then the national geographic institute, Instituto Geográfico Augustín Codazzi (IGAC), is supposed to carry out the actual update with municipal resources. Although the municipal council sets tax rates, they must fall within a range defined by the National Congress. The current range for property tax is 5–16 per thousand for all types of properties. Nuñez (2005) reviews Colombia’s local tax system. 12 Some residents pay property taxes even in the absence of formal title because it is a way to demonstrate continual presence on a parcel of land. According to Colombian law, investments in land that make it “socially productive” can be rewarded with formal property rights for the land in question after five consecutive years of residence (Law 200 of 1936). 999 Downloaded from https://www.cambridge.org/core. Shanghai JiaoTong University, on 26 Oct 2018 at 03:53:05, subject to the Cambridge Core terms of use, available at https://www.cambridge.org/core/terms. https://doi.org/10.1017/S0003055418000333