正在加载图片...

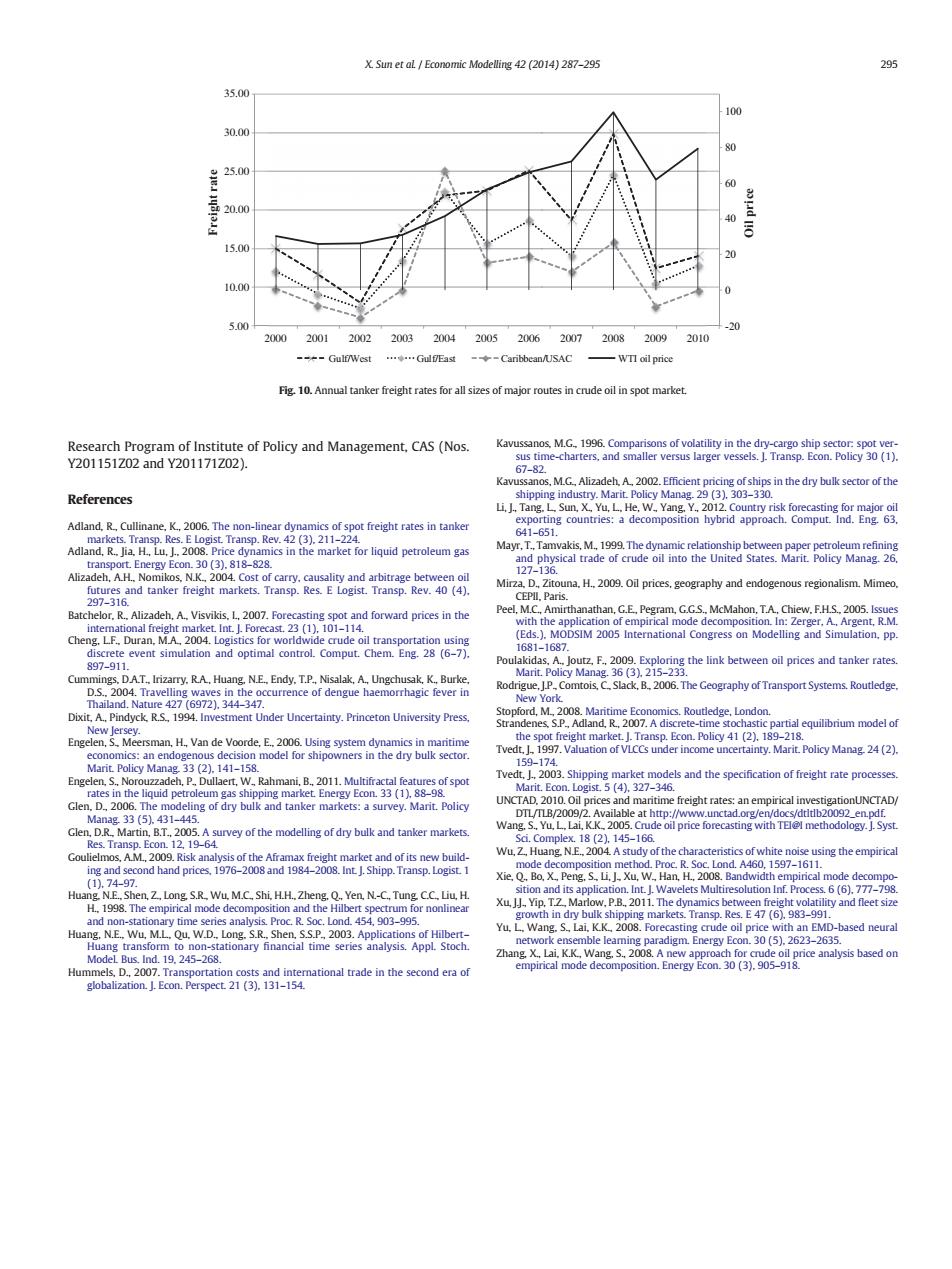

X.Sun et al Economic Modelling 42 (2014)287-295 295 35.00 100 30.00 25.00 60 15.00 10.00 0 5.00 -20 200020012002 200320042005 20062007 200820092010 -Gulf/West -◆-Caribbean/USAC WTI oil price Fig.10.Annual tanker freight rates for all sizes of major routes in crude oil in spot market. Research Program of Institute of Policy and Management,CAS(Nos. Kavussanos,M.G.1996.Comparisons of volatility in the dry-cargo ship sector:spot ver- Y201151Z02andY201171Z02) sus time-charters,and smaller versus larger vessels.J.Transp.Econ.Policy 30(1). 67-82 Kavussanos,M.G,Alizadeh,A,2002.Efficient pricing of ships in the dry bulk sector of the References shipping industry.Marit.Policy Manag.29(3).303-330. Li,J..Tang.L.Sun,X.Yu,L.He,W..Yang.Y..2012.Country risk forecasting for major oil Adland,R Cullinane,K.,2006.The non-linear dynamics of spot freight rates in tanker exporting countries:a decomposition hybrid approach.Comput.Ind.Eng.63. 641-651. markets.Transp.Res.E Logist.Transp.Rev.42 (3).211-224. Adland.R..lia.H..Lu,1.2008.Price dynamics in the market for liquid petroleum gas Mayr,T.,Tamvakis,M.,1999.The dynamic relationship between paper petroleum refining transport.Energy Econ.30(3).818-828. and physical trade of crude oil into the United States.Marit Policy Manag.26. 127-136. Alizadeh,A.H..Nomikos,N.K,2004.Cost of carry,causality and arbitrage between oil futures and tanker freight markets.Transp.Res.E Logist.Transp.Rev.40(4). Mirza D.Zitouna.H.009.Oil prices.geography and endogenous regionalism.Mimeo. CEPII,Paris. 297-316. Batchelor.R..Alizadeh.A..Visvikis,L.2007.Forecasting spot and forward prices in the Peel,M.C.,Amirthanathan,G.E,Pegram,G.G.S..McMahon,T.A,Chiew.F.H.S..2005.Issues intemational freight market Int.J.Forecast.23 (1),101-114. with the application of empirical mode decomposition.In:Zerger. A.Argent,R.M Cheng.LF.Duran.MA,2004.Logistics for worldwide crude oil transportation using (Eds.).MODSIM 2005 International Congress on Modelling and Simulation.pp. discrete event simulation and optimal control.Comput.Chem.Eng.28(6-7). 1681-1687. 897-911. Poulakidas,A..Joutz,F.2009.Exploring the link between oil prices and tanker rates. Marit.Policy Manag.36 (3).215-233. Cummings.DA.T..Irizarry.RA.Huang.N.E..Endy,T.P.Nisalak,A.Ungchusak.K.Burke Rodrigue.J.P.Comtois,C.Slack,B.2006.The Geography of Transport Systems.Routledge. D.S..2004.Travelling waves in the occurrence of dengue haemorrhagic fever in Thailand.Nature 427 (6972).344-347. New York. Dixit,A..Pindyck.R.S.,1994.Investment Under Uncertainty.Princeton University Press Stopford,M.008.Maritime Eco nomics.Routledge,London Strandenes,S.P.Adland,R,2007.A discrete-time stochastic partial equilibrium model of New lersev. Engelen,S.Meersman.H.Van de Voorde.E2006.Using system dynamics in maritime the spot freight market.J.Transp.Econ.Policy 41 (2).189-218. economics:an endogenous decision model for shipowners in the dry bulk sector. Tvedt.1997.Valuation of VLCCs under income uncertainty.Marit Policy Manag 24(2). Marit.Policy Manag.33 (2).141-158. 159-174. Engelen.S.Norouzzadeh,P.Dullaert,W.Rahmani,B..2011.Multifractal features of spot Tvedt.J 2003.Shipping m arket odels and the specification of freight rate processes rates in the liquid petroleum gas shipping market.Energy Econ.33 (1).88-98. Marit.Econ.Logist.5 (4),327-346. Glen.D.2006.The modeling of dry bulk and tanker markets:a survey.Marit.Policy UNCTAD.2010.Oil prices and maritime freight rates:an empirical investigationUNCTAD/ Manag.33(5).431-445. DTL/TLB/2009/2.Available at http://www.unctad.org/en/docs/dtltlb20092_en.pdf. Wang.S..Yu,L.Lai,K.K.2005.Crude oil price forecasting with TEll methodology.Syst. Glen,D.R.Martin,B.T.,2005.A survey of the modelling of dry bulk and tanker markets Res.Transp.Econ.12.19-64 Sdi.Complex.18(2).145-166. Goulielmos,A.M.,2009.Risk analysis of the Aframax freight market and of its new build- Wu,Z.Huang.N.E.,2004.A study of the characteristics of white noise using the empirical ing and second hand prices,1976-2008 and 1984-2008.Int J.Shipp.Transp.Logist.1 mode decomposition method.Proc.R.Soc.Lond.A460,1597-1611. (1).74-97. Xie.Q.Bo.X.Peng.S..Li.J.Xu,W.Han,H.2008.Bandwidth empirical mode decompo Huang.NE..Shen,Z.Long.S.R.Wu.M.C.Shi.H.H..Zheng.Q.Yen.N.-C.Tung C.C.Liu,H sition and its application.Int.J.Wavelets Multiresolution Inf.Process.6(6).777-798. H..1998.The empirical mode decomposition and the Hilbert spectrum for nonlinear Xu,JJYip,T.Z Marlow.P.B.2011.The dynamics between freight volatility and fleet size and non-stationary time series analysis.Proc.R.Soc.Lond.454,903-995. growth in dry bulk shipping markets.Transp.Res.E 47 (6).983-991. Huang.N.E..Wu.M.L.Qu.W.D..Long.S.R..Shen.S.S.P 2003.Applications of Hilbert- Yu.LWang.Lai.K.K.2008.Forecasting crude oil price with an EMD-based neural Huang transform to non-stationary financial time series analysis.Appl.Stoch. network ensemble leaming paradigm.Energy Econ.30(5).2623-2635. Model Bus.Ind.19.245-268. Zhang.X.,Lai.K.K.,Wang.S..2008.A new approach for crude oil price analysis based on Hummels,D.,2007.Transportation costs and international trade in the second era of empirical mode decomposition.Energy Econ.30(3).905-918. globalization.J.Econ.Perspect.21(3).131-154.Research Program of Institute of Policy and Management, CAS (Nos. Y201151Z02 and Y201171Z02). References Adland, R., Cullinane, K., 2006. The non-linear dynamics of spot freight rates in tanker markets. Transp. Res. E Logist. Transp. Rev. 42 (3), 211–224. Adland, R., Jia, H., Lu, J., 2008. Price dynamics in the market for liquid petroleum gas transport. Energy Econ. 30 (3), 818–828. Alizadeh, A.H., Nomikos, N.K., 2004. Cost of carry, causality and arbitrage between oil futures and tanker freight markets. Transp. Res. E Logist. Transp. Rev. 40 (4), 297–316. Batchelor, R., Alizadeh, A., Visvikis, I., 2007. Forecasting spot and forward prices in the international freight market. Int. J. Forecast. 23 (1), 101–114. Cheng, L.F., Duran, M.A., 2004. Logistics for worldwide crude oil transportation using discrete event simulation and optimal control. Comput. Chem. Eng. 28 (6–7), 897–911. Cummings, D.A.T., Irizarry, R.A., Huang, N.E., Endy, T.P., Nisalak, A., Ungchusak, K., Burke, D.S., 2004. Travelling waves in the occurrence of dengue haemorrhagic fever in Thailand. Nature 427 (6972), 344–347. Dixit, A., Pindyck, R.S., 1994. Investment Under Uncertainty. Princeton University Press, New Jersey. Engelen, S., Meersman, H., Van de Voorde, E., 2006. Using system dynamics in maritime economics: an endogenous decision model for shipowners in the dry bulk sector. Marit. Policy Manag. 33 (2), 141–158. Engelen, S., Norouzzadeh, P., Dullaert, W., Rahmani, B., 2011. Multifractal features of spot rates in the liquid petroleum gas shipping market. Energy Econ. 33 (1), 88–98. Glen, D., 2006. The modeling of dry bulk and tanker markets: a survey. Marit. Policy Manag. 33 (5), 431–445. Glen, D.R., Martin, B.T., 2005. A survey of the modelling of dry bulk and tanker markets. Res. Transp. Econ. 12, 19–64. Goulielmos, A.M., 2009. Risk analysis of the Aframax freight market and of its new building and second hand prices, 1976–2008 and 1984–2008. Int. J. Shipp. Transp. Logist. 1 (1), 74–97. Huang, N.E., Shen, Z., Long, S.R., Wu, M.C., Shi, H.H., Zheng, Q., Yen, N.-C., Tung, C.C., Liu, H. H., 1998. The empirical mode decomposition and the Hilbert spectrum for nonlinear and non-stationary time series analysis. Proc. R. Soc. Lond. 454, 903–995. Huang, N.E., Wu, M.L., Qu, W.D., Long, S.R., Shen, S.S.P., 2003. Applications of Hilbert– Huang transform to non-stationary financial time series analysis. Appl. Stoch. Model. Bus. Ind. 19, 245–268. Hummels, D., 2007. Transportation costs and international trade in the second era of globalization. J. Econ. Perspect. 21 (3), 131–154. Kavussanos, M.G., 1996. Comparisons of volatility in the dry-cargo ship sector: spot versus time-charters, and smaller versus larger vessels. J. Transp. Econ. Policy 30 (1), 67–82. Kavussanos, M.G., Alizadeh, A., 2002. Efficient pricing of ships in the dry bulk sector of the shipping industry. Marit. Policy Manag. 29 (3), 303–330. Li, J., Tang, L., Sun, X., Yu, L., He, W., Yang, Y., 2012. Country risk forecasting for major oil exporting countries: a decomposition hybrid approach. Comput. Ind. Eng. 63, 641–651. Mayr, T., Tamvakis, M., 1999. The dynamic relationship between paper petroleum refining and physical trade of crude oil into the United States. Marit. Policy Manag. 26, 127–136. Mirza, D., Zitouna, H., 2009. Oil prices, geography and endogenous regionalism. Mimeo, CEPII, Paris. Peel, M.C., Amirthanathan, G.E., Pegram, G.G.S., McMahon, T.A., Chiew, F.H.S., 2005. Issues with the application of empirical mode decomposition. In: Zerger, A., Argent, R.M. (Eds.), MODSIM 2005 International Congress on Modelling and Simulation, pp. 1681–1687. Poulakidas, A., Joutz, F., 2009. Exploring the link between oil prices and tanker rates. Marit. Policy Manag. 36 (3), 215–233. Rodrigue, J.P., Comtois, C., Slack, B., 2006. The Geography of Transport Systems. Routledge, New York. Stopford, M., 2008. Maritime Economics. Routledge, London. Strandenes, S.P., Adland, R., 2007. A discrete-time stochastic partial equilibrium model of the spot freight market. J. Transp. Econ. Policy 41 (2), 189–218. Tvedt, J., 1997. Valuation of VLCCs under income uncertainty. Marit. Policy Manag. 24 (2), 159–174. Tvedt, J., 2003. Shipping market models and the specification of freight rate processes. Marit. Econ. Logist. 5 (4), 327–346. UNCTAD, 2010. Oil prices and maritime freight rates: an empirical investigationUNCTAD/ DTL/TLB/2009/2. Available at http://www.unctad.org/en/docs/dtltlb20092_en.pdf. Wang, S., Yu, L., Lai, K.K., 2005. Crude oil price forecasting with TEI@I methodology. J. Syst. Sci. Complex. 18 (2), 145–166. Wu, Z., Huang, N.E., 2004. A study of the characteristics of white noise using the empirical mode decomposition method. Proc. R. Soc. Lond. A460, 1597–1611. Xie, Q., Bo, X., Peng, S., Li, J., Xu, W., Han, H., 2008. Bandwidth empirical mode decomposition and its application. Int. J. Wavelets Multiresolution Inf. Process. 6 (6), 777–798. Xu, J.J., Yip, T.Z., Marlow, P.B., 2011. The dynamics between freight volatility and fleet size growth in dry bulk shipping markets. Transp. Res. E 47 (6), 983–991. Yu, L., Wang, S., Lai, K.K., 2008. Forecasting crude oil price with an EMD-based neural network ensemble learning paradigm. Energy Econ. 30 (5), 2623–2635. Zhang, X., Lai, K.K., Wang, S., 2008. A new approach for crude oil price analysis based on empirical mode decomposition. Energy Econ. 30 (3), 905–918. -20 0 20 40 60 80 100 5.00 10.00 15.00 20.00 25.00 30.00 35.00 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Freight rate Oil price Gulf/West Gulf/East Caribbean/USAC WTI oil price Fig. 10. Annual tanker freight rates for all sizes of major routes in crude oil in spot market. X. Sun et al. / Economic Modelling 42 (2014) 287–295 295