正在加载图片...

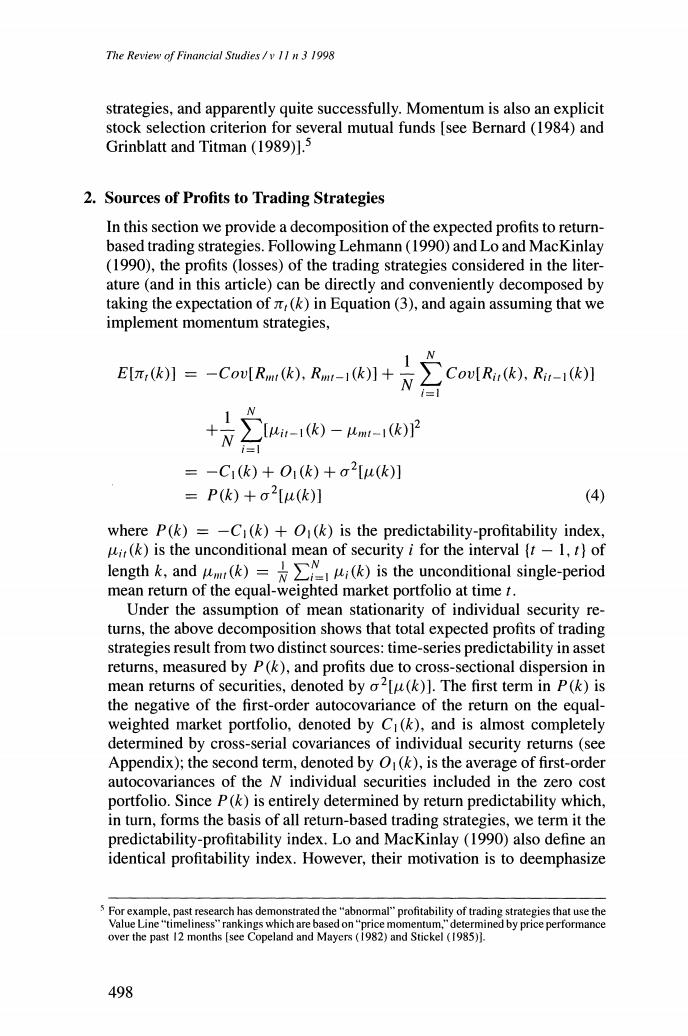

The Review of Financial Studies /y II n 3 1998 strategies,and apparently quite successfully.Momentum is also an explicit stock selection criterion for several mutual funds [see Bernard (1984)and Grinblatt and Titman(1989)]. 2.Sources of Profits to Trading Strategies In this section we provide a decomposition of the expected profits to return- based trading strategies.Following Lehmann(1990)and Lo and MacKinlay (1990),the profits (losses)of the trading strategies considered in the liter- ature (and in this article)can be directly and conveniently decomposed by taking the expectation of (k)in Equation(3),and again assuming that we implement momentum strategies, N Eπ,k1=-CovIRm(k),Rm-1k]+N Cov[Rit(k),Rit-1(k)] =-C1(k)+O1(k)+o2[u(k)] =P(k)+o2[u(k)] (4) where P(k)=-C1(k)+O1(k)is the predictability-profitability index, ir(k)is the unconditional mean of security i for the interval (t-1,t)of length k,and(k)(k)is the unconditional single-period mean return of the equal-weighted market portfolio at time t. Under the assumption of mean stationarity of individual security re- turns,the above decomposition shows that total expected profits of trading strategies result from two distinct sources:time-series predictability in asset returns,measured by P(k),and profits due to cross-sectional dispersion in mean returns of securities,denoted by o2[u(k)].The first term in P(k)is the negative of the first-order autocovariance of the return on the equal- weighted market portfolio,denoted by Ci(k),and is almost completely determined by cross-serial covariances of individual security returns(see Appendix);the second term,denoted by O(k),is the average of first-order autocovariances of the N individual securities included in the zero cost portfolio.Since P(k)is entirely determined by return predictability which, in turn,forms the basis of all return-based trading strategies,we term it the predictability-profitability index.Lo and MacKinlay (1990)also define an identical profitability index.However,their motivation is to deemphasize 5 For example.past research has demonstrated the"abnormal"profitability of trading strategies that use the Value Line"timeliness"rankings which are based on"price momentum,"determined by price performance over the past 12 months [see Copeland and Mayers (1982)and Stickel (1985). 498