正在加载图片...

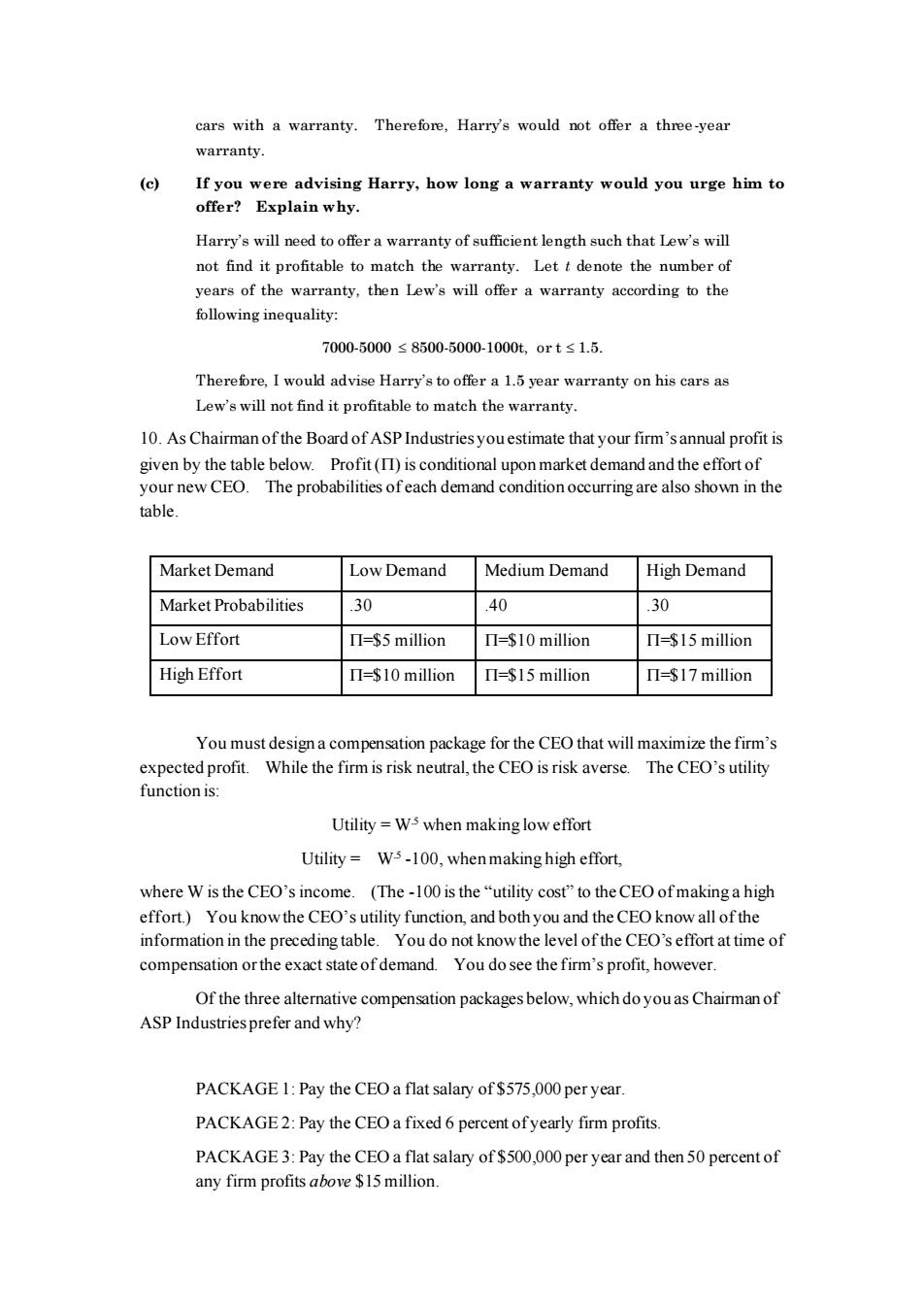

cars with a warranty.Therefore,Harry's would not offer a three-year warranty (c) If vor were advising Harry,how long a warranty would you urge him to offer? Explain why. Harry's will need to offera warranty of sufficient length such that Lews will not find it profitable to match the warranty.Let t denote the number of years of the warranty.then Lew's will offer a warranty according to the following inequality: 7000-5000≤8500-5000-1000t,0rt≤1.5. Therefore,I would advise Harry's to offer a 1.5 year warranty on his cars as Lewswill not find it profitable to match the warranty. 10.As Chairman of the Board of ASP Industriesyouestimate that your firm'sannual profit is given by the table below.Profit (11)is conditional upon market demand and the effort of your new CEO.The probabilities ofeach demand condition occurring are also shown in the table. Market Demand Low Demand Medium Demand High Demand Market Probabilities 30 40 .30 Low Effort I=$5 million I=$10 million Π-$15 million High Effort Π=s10 nillion Π=s15 million Π-S17 million You must design a compensation package for the CEO that will maximize the firm's expected profit.While the firm is risk neutral,the CEO is risk averse.The CEO's utility function is: Utility=Ws when making low effort Utility=W3-100.whenmakinghigh effort where W is the CEO's income.(The-100is the"utility cost"to the CEO ofmakingahigh effort.)You knowthe CEO's utility function,and both you and th eCEO know all ofthe information in the preceding table.You do not knowthe level of the CEO's effort at time of compensation orthe exact state of demand.You do see the firm's profit,however. Of the three alternative compensation packages below,which doyouas Chairman of ASP Industries prefer and why? PACKAGE 1:Pay the CEO a flat salary of$575,000 peryear. PACKAGE2:Pay the CEOa fixed 6 percent ofyearly firm profits PACKAGE3:Pay the CEOa flat salary of$500,000peryear and then 50 percent of any firm milliocars with a warranty. Therefore, Harry’s would not offer a three -year warranty. (c) If you were advising Harry, how long a warranty would you urge him to offer? Explain why. Harry’s will need to offer a warranty of sufficient length such that Lew’s will not find it profitable to match the warranty. Let t denote the number of years of the warranty, then Lew’s will offer a warranty according to the following inequality: 7000-5000 8500-5000-1000t, or t 1.5. Therefore, I would advise Harry’s to offer a 1.5 year warranty on his cars as Lew’s will not find it profitable to match the warranty. 10. As Chairman of the Board of ASP Industries you estimate that your firm’s annual profit is given by the table below. Profit () is conditional upon market demand and the effort of your new CEO. The probabilities of each demand condition occurring are also shown in the table. Market Demand Low Demand Medium Demand High Demand Market Probabilities .30 .40 .30 Low Effort =$5 million =$10 million =$15 million High Effort =$10 million =$15 million =$17 million You must design a compensation package for the CEO that will maximize the firm’s expected profit. While the firm is risk neutral, the CEO is risk averse. The CEO’s utility function is: Utility = W.5 when making low effort Utility = W.5 -100, when making high effort, where W is the CEO’s income. (The -100 is the “utility cost” to the CEO of making a high effort.) You know the CEO’s utility function, and both you and the CEO know all of the information in the preceding table. You do not know the level of the CEO’s effort at time of compensation or the exact state of demand. You do see the firm’s profit, however. Of the three alternative compensation packages below, which do you as Chairman of ASP Industries prefer and why? PACKAGE 1: Pay the CEO a flat salary of $575,000 per year. PACKAGE 2: Pay the CEO a fixed 6 percent of yearly firm profits. PACKAGE 3: Pay the CEO a flat salary of $500,000 per year and then 50 percent of any firm profits above $15 million