正在加载图片...

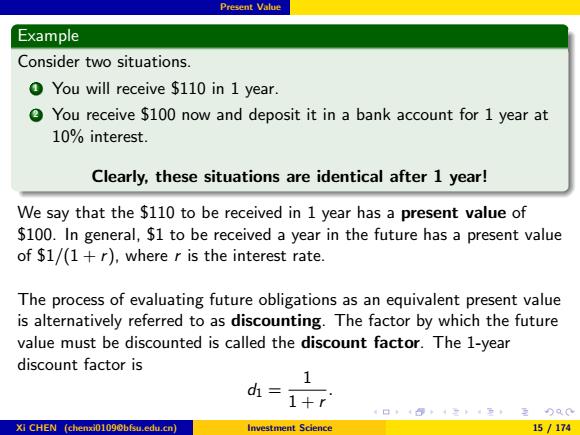

Present Value Example Consider two situations. O You will receive $110 in 1 year. You receive $100 now and deposit it in a bank account for 1 year at 10%interest. Clearly,these situations are identical after 1 year! We say that the $110 to be received in 1 year has a present value of $100.In general,$1 to be received a year in the future has a present value of $1/(1+r),where r is the interest rate. The process of evaluating future obligations as an equivalent present value is alternatively referred to as discounting.The factor by which the future value must be discounted is called the discount factor.The 1-year discount factor is 1 d= 1+r Xi CHEN (chenxi01090bfsu.edu.cn) Investment Science 15/174Present Value Example Consider two situations. 1 You will receive $110 in 1 year. 2 You receive $100 now and deposit it in a bank account for 1 year at 10% interest. Clearly, these situations are identical after 1 year! We say that the $110 to be received in 1 year has a present value of $100. In general, $1 to be received a year in the future has a present value of $1/(1 + r), where r is the interest rate. The process of evaluating future obligations as an equivalent present value is alternatively referred to as discounting. The factor by which the future value must be discounted is called the discount factor. The 1-year discount factor is d1 = 1 1 + r . Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 15 / 174