正在加载图片...

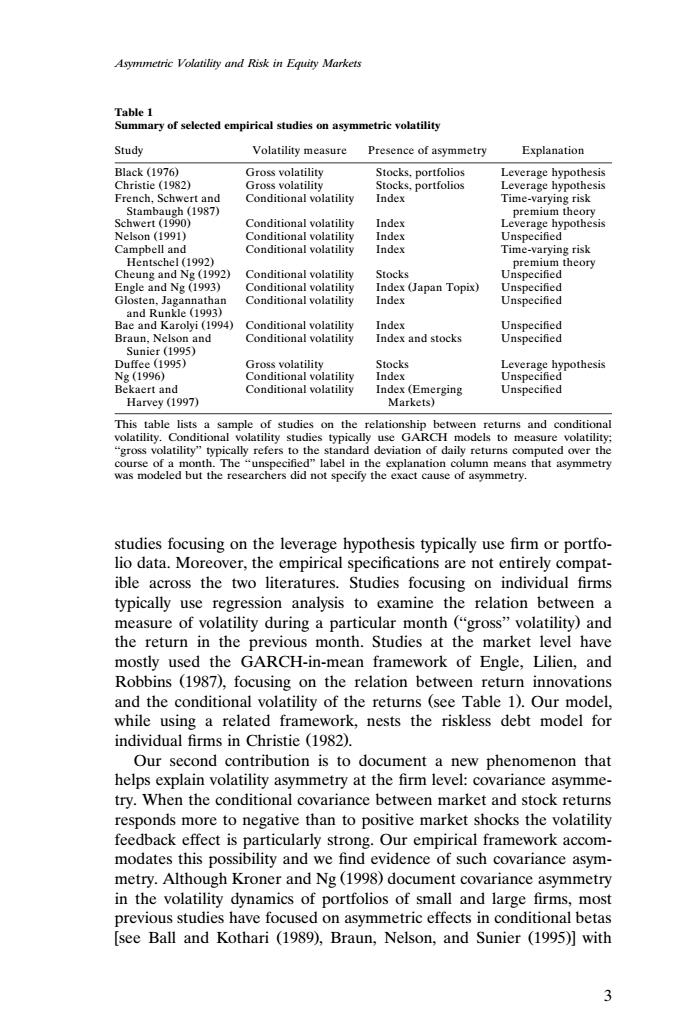

Asymmetric Volatility and Risk in Equity Markets Table 1 Summary of selected empirical studies on asymmetric volatility Study Volatility measure Presence of asymmetry Explanation B1ack(1976) Gross volatility Stocks.portfolios Leverage hypothesis Christie(1982) Gross volatility Stocks.portfolios Leverage hypothesis French,Schwert and Conditional volatility Index Time-varying risk Stambaugh (1987) premium theory Schwert(1990) Conditional volatility Index Leverage hypothesis Nelson (1991) Conditional volatility Index Unspecified Campbell and Conditional volatility Index Time-varying risk Hentschel (1992) premium theory Cheung and Ng(1992) Conditional volatility Stocks Unspecified Engle and Ng (1993) Conditional volatility Index (Japan Topix) Unspecified Glosten,Jagannathan Conditional volatility Index Unspecified and Runkle (1993) Bae and Karolyi (1994) Conditional volatility Index Unspecified Braun,Nelson and Conditional volatility Index and stocks Unspecified Sunier(199s)】 Duffee (1995) Gross volatility Stocks Leverage hypothesis Ng(1996) Conditional volatility Index Unspecified Bekaert and Conditional volatility Index(Emerging Unspecified Harvey (1997) Markets) This table lists a sample of studies on the relationship between returns and conditional volatility.Conditional volatility studies typically use GARCH models to measure volatility; "gross volatility"typically refers to the standard deviation of daily returns computed over the course of a month.The "unspecified"label in the explanation column means that asymmetry was modeled but the researchers did not specify the exact cause of asymmetry. studies focusing on the leverage hypothesis typically use firm or portfo- lio data.Moreover,the empirical specifications are not entirely compat- ible across the two literatures.Studies focusing on individual firms typically use regression analysis to examine the relation between a measure of volatility during a particular month ("gross"volatility)and the return in the previous month.Studies at the market level have mostly used the GARCH-in-mean framework of Engle,Lilien,and Robbins (1987),focusing on the relation between return innovations and the conditional volatility of the returns (see Table 1).Our model, while using a related framework,nests the riskless debt model for individual firms in Christie (1982). Our second contribution is to document a new phenomenon that helps explain volatility asymmetry at the firm level:covariance asymme- try.When the conditional covariance between market and stock returns responds more to negative than to positive market shocks the volatility feedback effect is particularly strong.Our empirical framework accom- modates this possibility and we find evidence of such covariance asym- metry.Although Kroner and Ng(1998)document covariance asymmetry in the volatility dynamics of portfolios of small and large firms,most previous studies have focused on asymmetric effects in conditional betas [see Ball and Kothari (1989),Braun,Nelson,and Sunier (1995)]with 3Asymmetric Volatility and Risk in Equity Markets Table 1 Summary of selected empirical studies on asymmetric volatility Study Volatility measure Presence of asymmetry Explanation Black 1976 Gross volatility Stocks, portfolios Leverage hypothesis Ž . Christie 1982 Gross volatility Stocks, portfolios Leverage hypothesis Ž . French, Schwert and Conditional volatility Index Time-varying risk Stambaugh 1987 premium theory Ž . Schwert 1990 Conditional volatility Index Leverage hypothesis Ž . Nelson 1991 Conditional volatility Index Unspecified Ž . Campbell and Conditional volatility Index Time-varying risk Hentschel 1992 premium theory Ž . Cheung and Ng 1992 Conditional volatility Stocks Unspecified Ž . Engle and Ng 1993 Conditional volatility Index Japan Topix Unspecified Ž. Ž . Glosten, Jagannathan Conditional volatility Index Unspecified and Runkle 1993 Ž . Bae and Karolyi 1994 Conditional volatility Index Unspecified Ž . Braun, Nelson and Conditional volatility Index and stocks Unspecified Sunier 1995 Ž . Duffee 1995 Gross volatility Stocks Leverage hypothesis Ž . Ng 1996 Conditional volatility Index Unspecified Ž . Bekaert and Conditional volatility Index Emerging Unspecified Ž Harvey 1997 Markets Ž. . This table lists a sample of studies on the relationship between returns and conditional volatility. Conditional volatility studies typically use GARCH models to measure volatility; ‘‘gross volatility’’ typically refers to the standard deviation of daily returns computed over the course of a month. The ‘‘unspecified’’ label in the explanation column means that asymmetry was modeled but the researchers did not specify the exact cause of asymmetry. studies focusing on the leverage hypothesis typically use firm or portfolio data. Moreover, the empirical specifications are not entirely compatible across the two literatures. Studies focusing on individual firms typically use regression analysis to examine the relation between a measure of volatility during a particular month ‘‘gross’’ volatility and Ž . the return in the previous month. Studies at the market level have mostly used the GARCH-in-mean framework of Engle, Lilien, and Robbins 1987 , focusing on the relation between return innovations Ž . and the conditional volatility of the returns see Table 1 . Our model, Ž . while using a related framework, nests the riskless debt model for individual firms in Christie 1982 . Ž . Our second contribution is to document a new phenomenon that helps explain volatility asymmetry at the firm level: covariance asymmetry. When the conditional covariance between market and stock returns responds more to negative than to positive market shocks the volatility feedback effect is particularly strong. Our empirical framework accommodates this possibility and we find evidence of such covariance asymmetry. Although Kroner and Ng 1998 document covariance asymmetry Ž . in the volatility dynamics of portfolios of small and large firms, most previous studies have focused on asymmetric effects in conditional betas see Ball and Kothari 1989 , Braun, Nelson, and Sunier 1995 with Ž. Ž. 3�