正在加载图片...

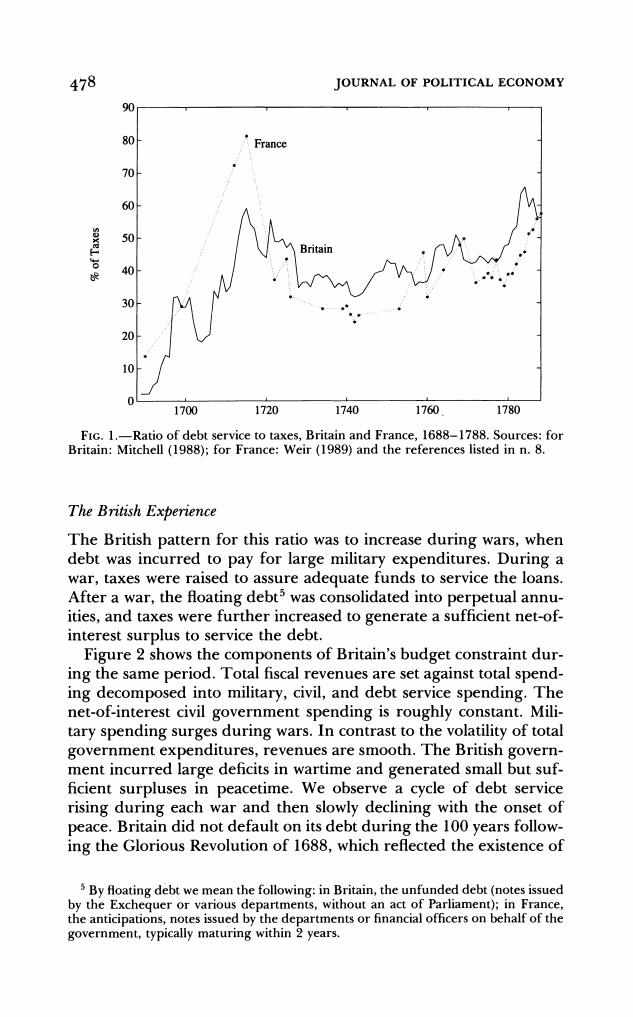

478 JOURNAL OF POLITICAL ECONOMY 90 80 France 70 60 50 40 30 20 10 1700 1720 1740 1760 1780 FIc.1.-Ratio of debt service to taxes,Britain and France,1688-1788.Sources:for Britain:Mitchell(1988);for France:Weir (1989)and the references listed in n.8. The British Experience The British pattern for this ratio was to increase during wars,when debt was incurred to pay for large military expenditures.During a war,taxes were raised to assure adequate funds to service the loans. After a war,the floating debt5 was consolidated into perpetual annu- ities,and taxes were further increased to generate a sufficient net-of- interest surplus to service the debt. Figure 2 shows the components of Britain's budget constraint dur- ing the same period.Total fiscal revenues are set against total spend- ing decomposed into military,civil,and debt service spending.The net-of-interest civil government spending is roughly constant.Mili- tary spending surges during wars.In contrast to the volatility of total government expenditures,revenues are smooth.The British govern- ment incurred large deficits in wartime and generated small but suf- ficient surpluses in peacetime.We observe a cycle of debt service rising during each war and then slowly declining with the onset of peace.Britain did not default on its debt during the 100 years follow- ing the Glorious Revolution of 1688,which reflected the existence of 5By floating debt we mean the following:in Britain,the unfunded debt(notes issued by the Exchequer or various departments,without an act of Parliament);in France, the anticipations,notes issued by the departments or financial officers on behalf of the government,typically maturing within 2 years.478 JOURNAL OF POLITICAL ECONOMY 90 80 -France 70 60- 50 4o 40 30 20 1700 1720 1740 1760 1780 FIG. 1.-Ratio of debt service to taxes, Britain and France, 1688-1788. Sources: for Britain: Mitchell (1988); for France: Weir (1989) and the references listed in n. 8. The British Experience The British pattern for this ratio was to increase during wars, when debt was incurred to pay for large military expenditures. During a war, taxes were raised to assure adequate funds to service the loans. After a war, the floating debt5 was consolidated into perpetual annuities, and taxes were further increased to generate a sufficient net-ofinterest surplus to service the debt. Figure 2 shows the components of Britain's budget constraint during the same period. Total fiscal revenues are set against total spending decomposed into military, civil, and debt service spending. The net-of-interest civil government spending is roughly constant. Military spending surges during wars. In contrast to the volatility of total government expenditures, revenues are smooth. The British government incurred large deficits in wartime and generated small but sufficient surpluses in peacetime. We observe a cycle of debt service rising during each war and then slowly declining with the onset of peace. Britain did not default on its debt during the 100 years following the Glorious Revolution of 1688, which reflected the existence of 5By floating debt we mean the following: in Britain, the unfunded debt (notes issued by the Exchequer or various departments, without an act of Parliament); in France, the anticipations, notes issued by the departments or financial officers on behalf of the government, typically maturing within 2 years