正在加载图片...

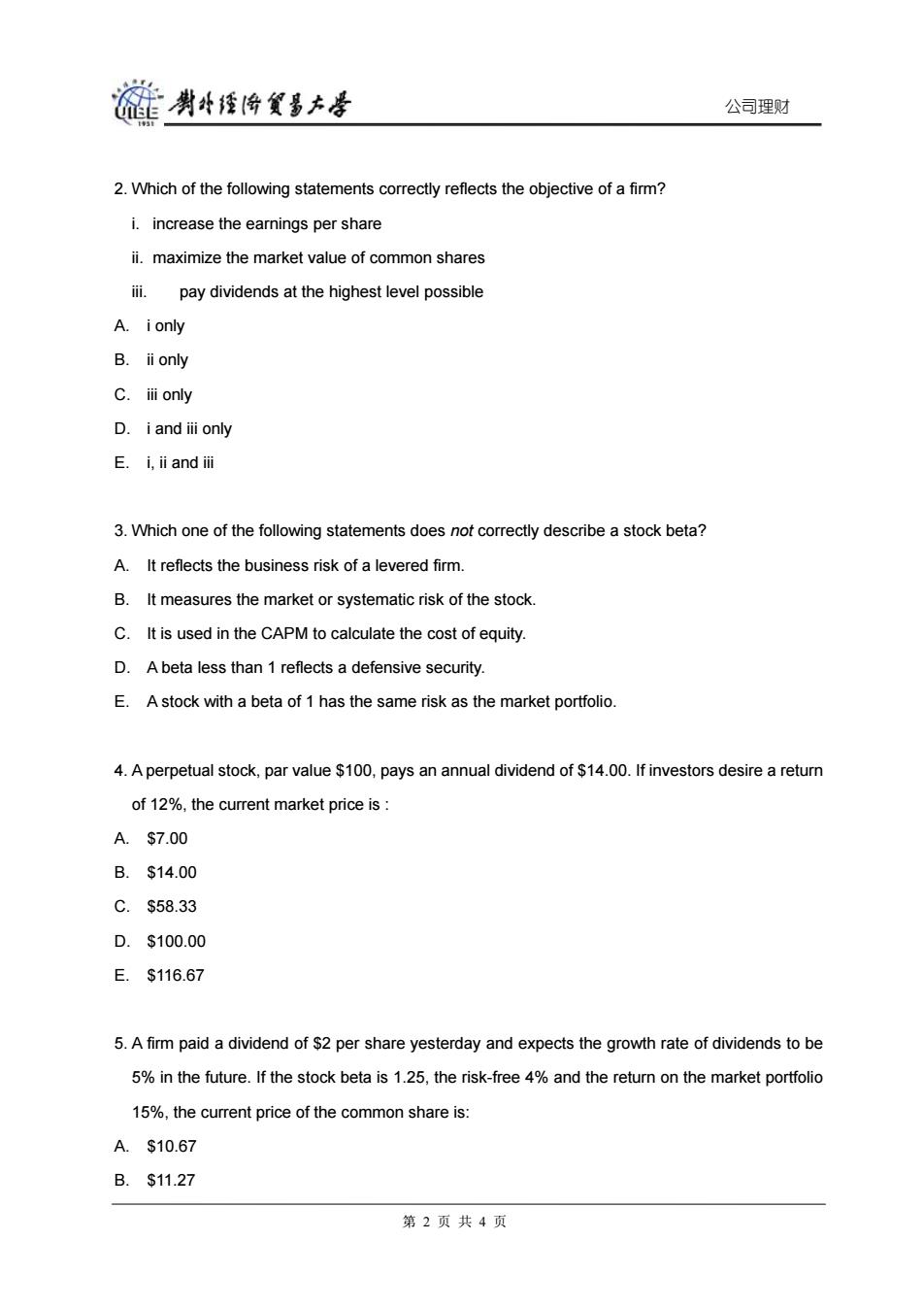

爸剥斗煙怜食多大岸 公司理财 2.Which of the following statements correctly reflects the objective of a firm? i.increase the earnings per share ii.maximize the market value of common shares 说. pay dividends at the highest level possible A.ionly B.ii only C.iii only D.i and iii only E.i,ii and ii 3.Which one of the following statements does not correctly describe a stock beta? A.It reflects the business risk of a levered firm. B.It measures the market or systematic risk of the stock. C.It is used in the CAPM to calculate the cost of equity. D.A beta less than 1 reflects a defensive security. E.A stock with a beta of 1 has the same risk as the market portfolio. 4.A perpetual stock,par value $100,pays an annual dividend of $14.00.If investors desire a return of 12%,the current market price is: A.$7.00 B.$14.00 C.$58.33 D.$100.00 E.$116.67 5.A firm paid a dividend of $2 per share yesterday and expects the growth rate of dividends to be 5%in the future.If the stock beta is 1.25,the risk-free 4%and the return on the market portfolio 15%,the current price of the common share is: A.$10.67 B.$11.27 第2页共4页公司理财 2. Which of the following statements correctly reflects the objective of a firm? i. increase the earnings per share ii. maximize the market value of common shares iii. pay dividends at the highest level possible A. i only B. ii only C. iii only D. i and iii only E. i, ii and iii 3. Which one of the following statements does not correctly describe a stock beta? A. It reflects the business risk of a levered firm. B. It measures the market or systematic risk of the stock. C. It is used in the CAPM to calculate the cost of equity. D. A beta less than 1 reflects a defensive security. E. A stock with a beta of 1 has the same risk as the market portfolio. 4. A perpetual stock, par value $100, pays an annual dividend of $14.00. If investors desire a return of 12%, the current market price is : A. $7.00 B. $14.00 C. $58.33 D. $100.00 E. $116.67 5. A firm paid a dividend of $2 per share yesterday and expects the growth rate of dividends to be 5% in the future. If the stock beta is 1.25, the risk-free 4% and the return on the market portfolio 15%, the current price of the common share is: A. $10.67 B. $11.27 第 2 页 共 4 页