正在加载图片...

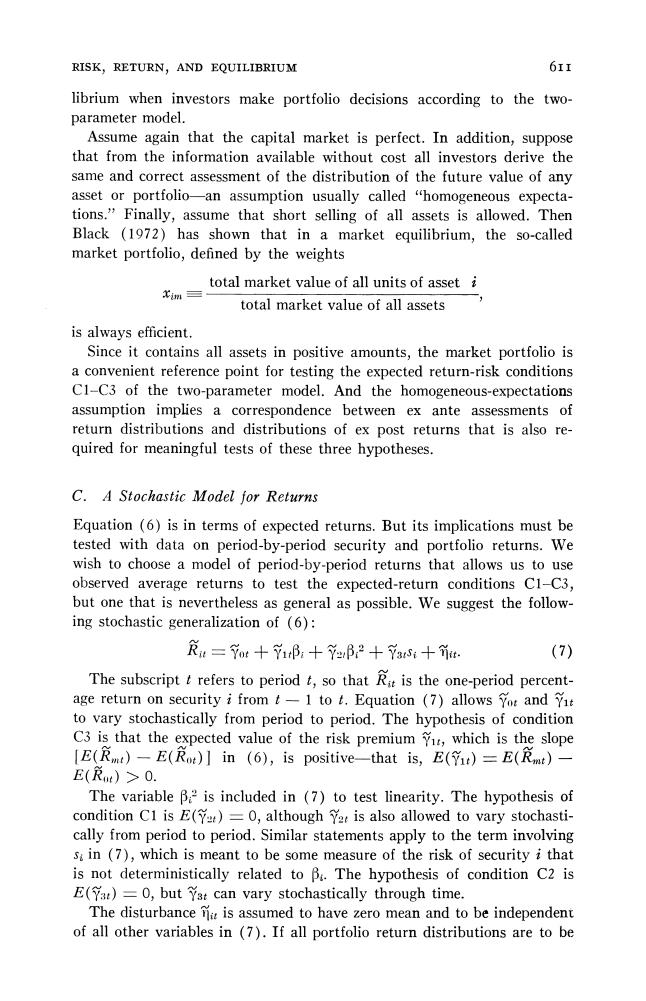

RISK,RETURN,AND EQUILIBRIUM 611 librium when investors make portfolio decisions according to the two- parameter model. Assume again that the capital market is perfect.In addition,suppose that from the information available without cost all investors derive the same and correct assessment of the distribution of the future value of any asset or portfolio-an assumption usually called "homogeneous expecta- tions."Finally,assume that short selling of all assets is allowed.Then Black (1972)has shown that in a market equilibrium,the so-called market portfolio,defined by the weights total market value of all units of asset i xim三 total market value of all assets is always efficient. Since it contains all assets in positive amounts,the market portfolio is a convenient reference point for testing the expected return-risk conditions C1-C3 of the two-parameter model.And the homogeneous-expectations assumption implies a correspondence between ex ante assessments of return distributions and distributions of ex post returns that is also re- quired for meaningful tests of these three hypotheses. C.A Stochastic Model for Returns Equation(6)is in terms of expected returns.But its implications must be tested with data on period-by-period security and portfolio returns.We wish to choose a model of period-by-period returns that allows us to use observed average returns to test the expected-return conditions C1-C3, but one that is nevertheless as general as possible.We suggest the follow- ing stochastic generalization of (6): a=ot+71B:+Yβ:2+7s+it. (7) The subscript t refers to period t,so that R is the one-period percent- age return on security i from t-1 to t.Equation (7)allows yot and Yit to vary stochastically from period to period.The hypothesis of condition C3 is that the expected value of the risk premium,which is the slope [E(Rmt)-E(Rot)in (6),is positive-that is,E()=E(Rit)- E()>0. The variable Bis included in (7)to test linearity.The hypothesis of condition C1 is E()=0,although 2 is also allowed to vary stochasti- cally from period to period.Similar statements apply to the term involving s in (7),which is meant to be some measure of the risk of security i that is not deterministically related to B.The hypothesis of condition C2 is E(Yat)=0,but Yat can vary stochastically through time. The disturbance ne is assumed to have zero mean and to be independent of all other variables in (7).If all portfolio return distributions are to be