正在加载图片...

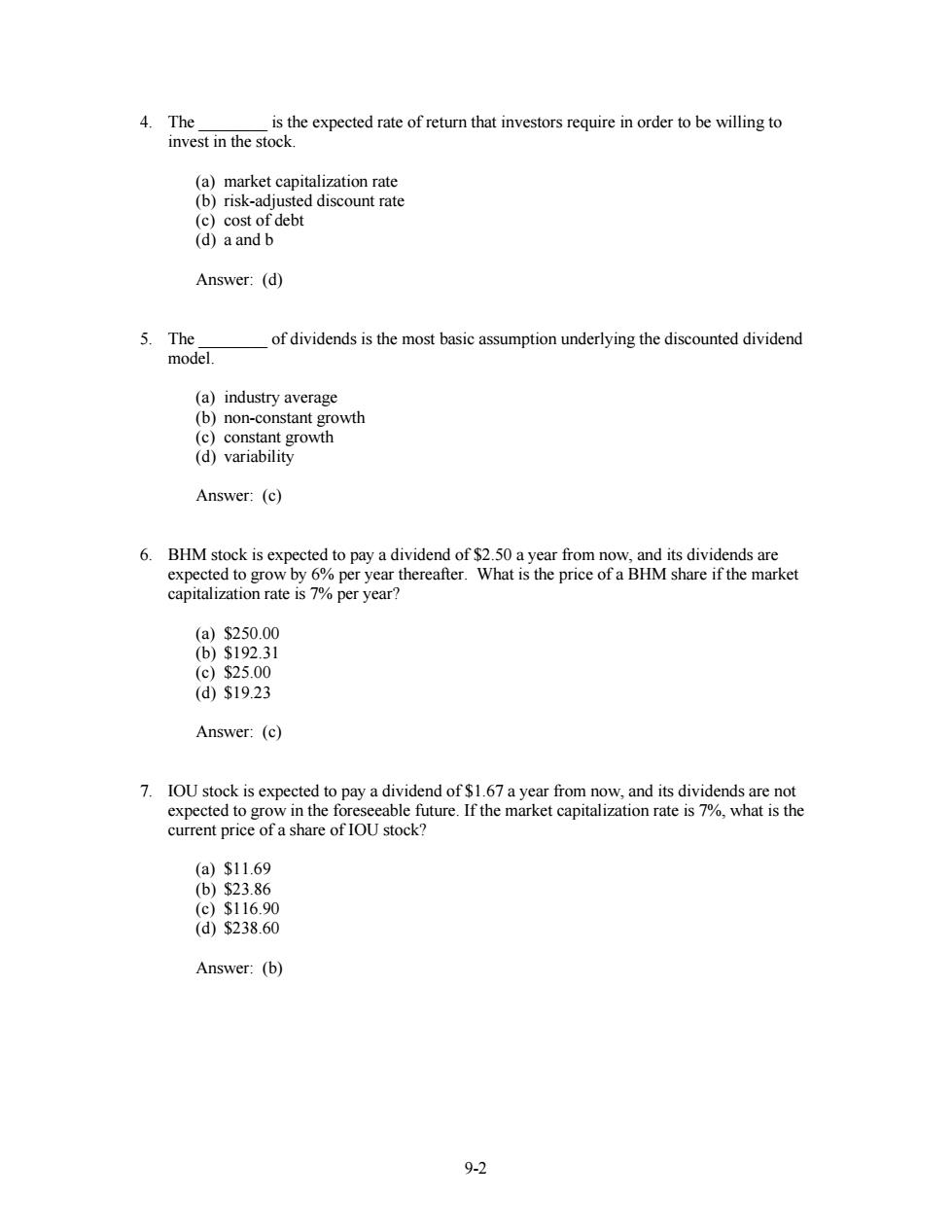

4.The is the expected rate of return that investors require in order to be willing to invest in the stock (a)market capitalization rate (b)risk-adjusted discount rate (c)cost of debt (d)a and b Answer:(d) 5.The of dividends is the most basic assumption underlying the discounted dividend model. (a)industry average (b)non-constant growth (c)constant growth (d)variability Answer:(c) 6. BHM stock is expected to pay a dividend of $2.50 a year from now,and its dividends are expected to grow by 6%per year thereafter.What is the price of a BHM share if the market capitalization rate is 7%per year? (a)$250.00 (b)$192.31 (c)$25.00 (d)$19.23 Answer:(c) 7.IOU stock is expected to pay a dividend of $1.67 a year from now,and its dividends are not expected to grow in the foreseeable future.If the market capitalization rate is 7%,what is the current price of a share of IOU stock? (a)$11.69 (b)$23.86 (c)$116.90 (d)$238.60 Answer:(b) 9-29-2 4. The ________ is the expected rate of return that investors require in order to be willing to invest in the stock. (a) market capitalization rate (b) risk-adjusted discount rate (c) cost of debt (d) a and b Answer: (d) 5. The ________ of dividends is the most basic assumption underlying the discounted dividend model. (a) industry average (b) non-constant growth (c) constant growth (d) variability Answer: (c) 6. BHM stock is expected to pay a dividend of $2.50 a year from now, and its dividends are expected to grow by 6% per year thereafter. What is the price of a BHM share if the market capitalization rate is 7% per year? (a) $250.00 (b) $192.31 (c) $25.00 (d) $19.23 Answer: (c) 7. IOU stock is expected to pay a dividend of $1.67 a year from now, and its dividends are not expected to grow in the foreseeable future. If the market capitalization rate is 7%, what is the current price of a share of IOU stock? (a) $11.69 (b) $23.86 (c) $116.90 (d) $238.60 Answer: (b)