正在加载图片...

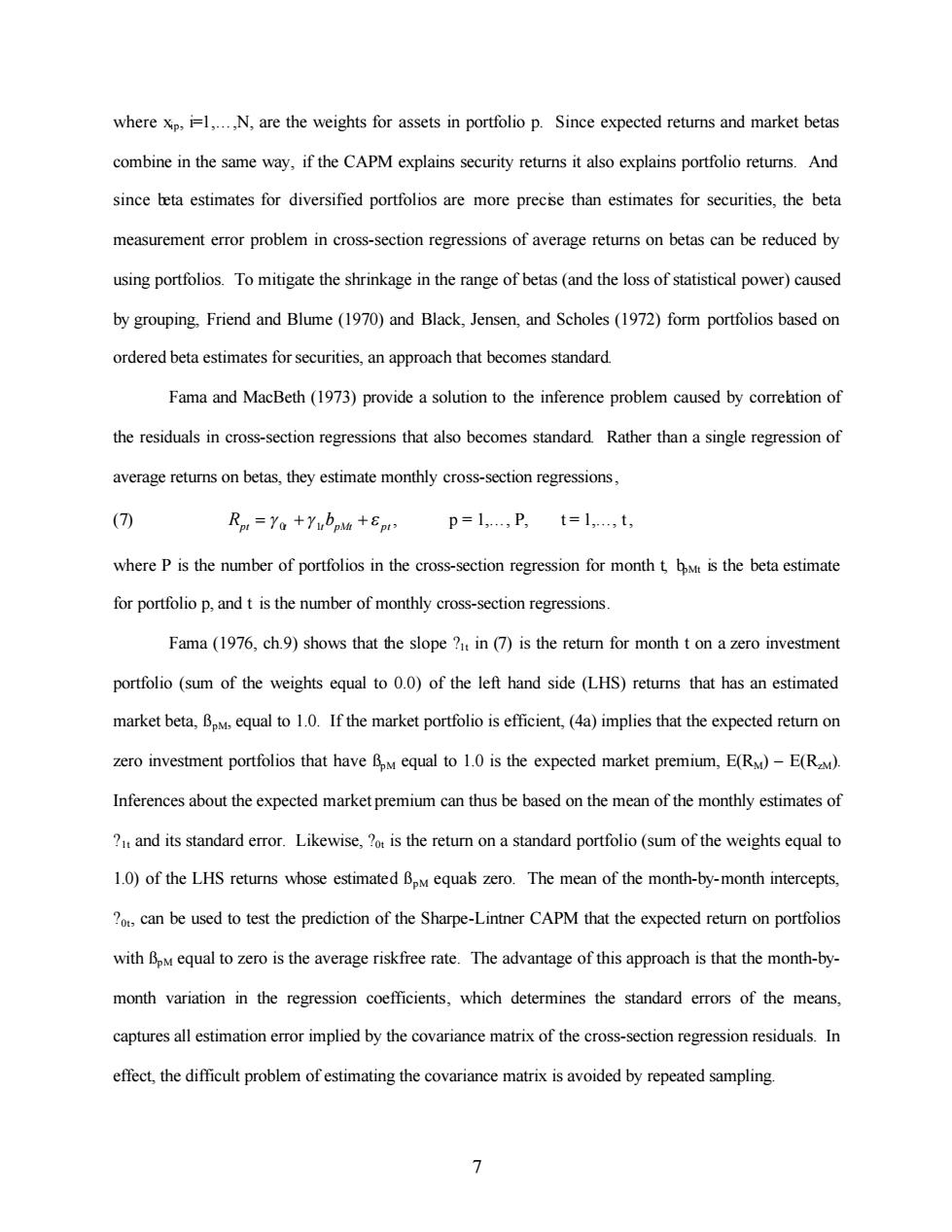

where xp,i=1,...,N,are the weights for assets in portfolio p.Since expected returns and market betas combine in the same way,if the CAPM explains security returns it also explains portfolio returns.And since beta estimates for diversified portfolios are more precise than estimates for securities,the beta measurement error problem in cross-section regressions of average returns on betas can be reduced by using portfolios.To mitigate the shrinkage in the range of betas(and the loss of statistical power)caused by grouping,Friend and Blume(1970)and Black,Jensen,and Scholes(1972)form portfolios based on ordered beta estimates for securities,an approach that becomes standard. Fama and MacBeth(1973)provide a solution to the inference problem caused by correlation of the residuals in cross-section regressions that also becomes standard.Rather than a single regression of average returns on betas,they estimate monthly cross-section regressions, (7) Rp=Ya +YubpM +Epr p=1,,P,t=1,t, where P is the number of portfolios in the cross-section regression for month t,bMt is the beta estimate for portfolio p,and t is the number of monthly cross-section regressions. Fama (1976,ch.9)shows that the slope in(7)is the return for month t on a zero investment portfolio (sum of the weights equal to 0.0)of the left hand side (LHS)returns that has an estimated market beta,BoM,equal to 1.0.If the market portfolio is efficient,(4a)implies that the expected return on zero investment portfolios that have BoM equal to 1.0 is the expected market premium,E(RM)-E(RM). Inferences about the expected market premium can thus be based on the mean of the monthly estimates of and its standard error.Likewise,?o is the return on a standard portfolio(sum of the weights equal to 1.0)of the LHS returns whose estimated BoM equals zero.The mean of the month-by-month intercepts, ?ot,can be used to test the prediction of the Sharpe-Lintner CAPM that the expected return on portfolios with BoM equal to zero is the average riskfree rate.The advantage of this approach is that the month-by- month variation in the regression coefficients,which determines the standard errors of the means, captures all estimation error implied by the covariance matrix of the cross-section regression residuals.In effect,the difficult problem of estimating the covariance matrix is avoided by repeated sampling. 77 where xip, i=1,…,N, are the weights for assets in portfolio p. Since expected returns and market betas combine in the same way, if the CAPM explains security returns it also explains portfolio returns. And since beta estimates for diversified portfolios are more precise than estimates for securities, the beta measurement error problem in cross-section regressions of average returns on betas can be reduced by using portfolios. To mitigate the shrinkage in the range of betas (and the loss of statistical power) caused by grouping, Friend and Blume (1970) and Black, Jensen, and Scholes (1972) form portfolios based on ordered beta estimates for securities, an approach that becomes standard. Fama and MacBeth (1973) provide a solution to the inference problem caused by correlation of the residuals in cross-section regressions that also becomes standard. Rather than a single regression of average returns on betas, they estimate monthly cross-section regressions, (7) R b pt t0 1t pMt pt = g + + g e , p = 1,…, P, t = 1,…, t, where P is the number of portfolios in the cross-section regression for month t, bpMt is the beta estimate for portfolio p, and t is the number of monthly cross-section regressions. Fama (1976, ch.9) shows that the slope ?1t in (7) is the return for month t on a zero investment portfolio (sum of the weights equal to 0.0) of the left hand side (LHS) returns that has an estimated market beta, ßpM, equal to 1.0. If the market portfolio is efficient, (4a) implies that the expected return on zero investment portfolios that have ßpM equal to 1.0 is the expected market premium, E(RM) – E(RzM). Inferences about the expected market premium can thus be based on the mean of the monthly estimates of ?1t and its standard error. Likewise, ?0t is the return on a standard portfolio (sum of the weights equal to 1.0) of the LHS returns whose estimated ßpM equals zero. The mean of the month-by-month intercepts, ?0t, can be used to test the prediction of the Sharpe-Lintner CAPM that the expected return on portfolios with ßpM equal to zero is the average riskfree rate. The advantage of this approach is that the month-bymonth variation in the regression coefficients, which determines the standard errors of the means, captures all estimation error implied by the covariance matrix of the cross-section regression residuals. In effect, the difficult problem of estimating the covariance matrix is avoided by repeated sampling