正在加载图片...

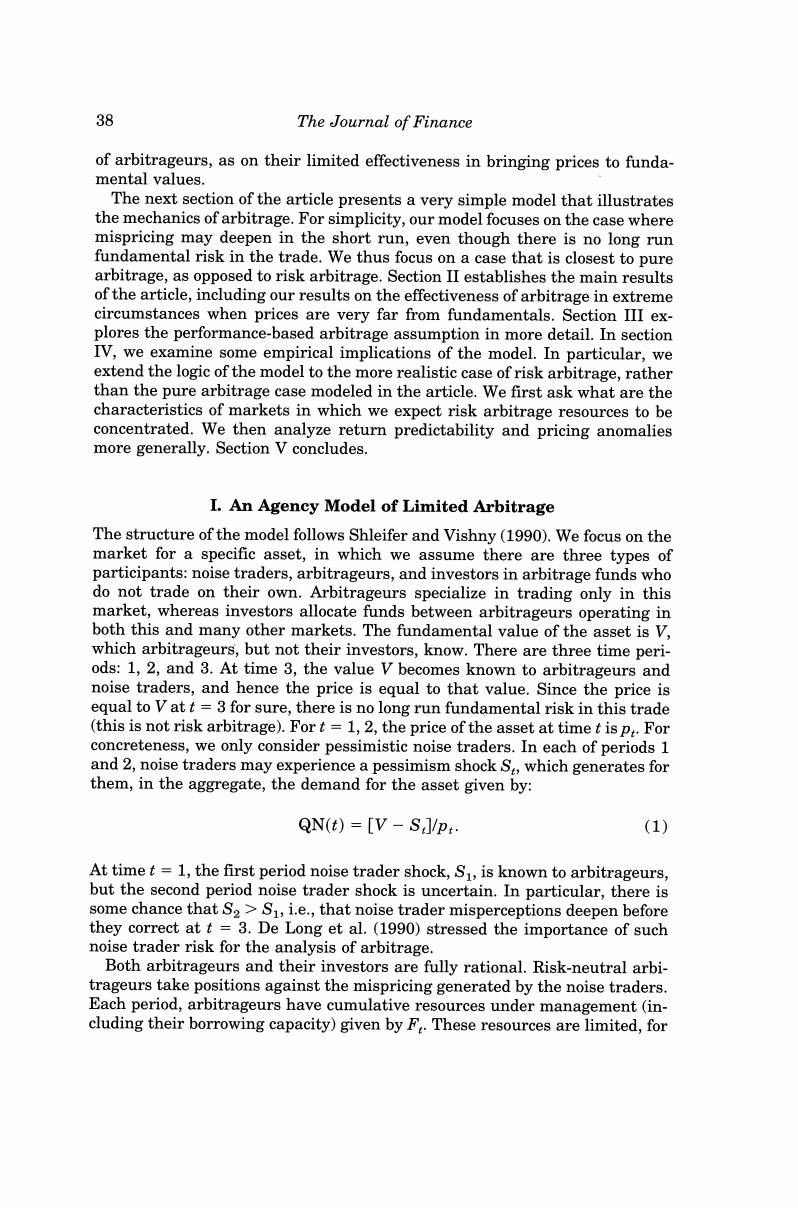

38 The Journal of Finance of arbitrageurs,as on their limited effectiveness in bringing prices to funda- mental values. The next section of the article presents a very simple model that illustrates the mechanics of arbitrage.For simplicity,our model focuses on the case where mispricing may deepen in the short run,even though there is no long run fundamental risk in the trade.We thus focus on a case that is closest to pure arbitrage,as opposed to risk arbitrage.Section II establishes the main results of the article,including our results on the effectiveness of arbitrage in extreme circumstances when prices are very far from fundamentals.Section III ex- plores the performance-based arbitrage assumption in more detail.In section IV,we examine some empirical implications of the model.In particular,we extend the logic of the model to the more realistic case of risk arbitrage,rather than the pure arbitrage case modeled in the article.We first ask what are the characteristics of markets in which we expect risk arbitrage resources to be concentrated.We then analyze return predictability and pricing anomalies more generally.Section V concludes. I.An Agency Model of Limited Arbitrage The structure of the model follows Shleifer and Vishny(1990).We focus on the market for a specific asset,in which we assume there are three types of participants:noise traders,arbitrageurs,and investors in arbitrage funds who do not trade on their own.Arbitrageurs specialize in trading only in this market,whereas investors allocate funds between arbitrageurs operating in both this and many other markets.The fundamental value of the asset is V, which arbitrageurs,but not their investors,know.There are three time peri- ods:1,2,and 3.At time 3,the value V becomes known to arbitrageurs and noise traders,and hence the price is equal to that value.Since the price is equal to V at t=3 for sure,there is no long run fundamental risk in this trade (this is not risk arbitrage).For t=1,2,the price of the asset at time t is p:.For concreteness,we only consider pessimistic noise traders.In each of periods 1 and 2,noise traders may experience a pessimism shock S,which generates for them,in the aggregate,the demand for the asset given by: QN(t)=[V-SJ/p:. (1) At time t 1,the first period noise trader shock,S,is known to arbitrageurs, but the second period noise trader shock is uncertain.In particular,there is some chance that S2>S1,i.e.,that noise trader misperceptions deepen before they correct at t 3.De Long et al.(1990)stressed the importance of such noise trader risk for the analysis of arbitrage. Both arbitrageurs and their investors are fully rational.Risk-neutral arbi- trageurs take positions against the mispricing generated by the noise traders. Each period,arbitrageurs have cumulative resources under management (in- cluding their borrowing capacity)given by F.These resources are limited,for