正在加载图片...

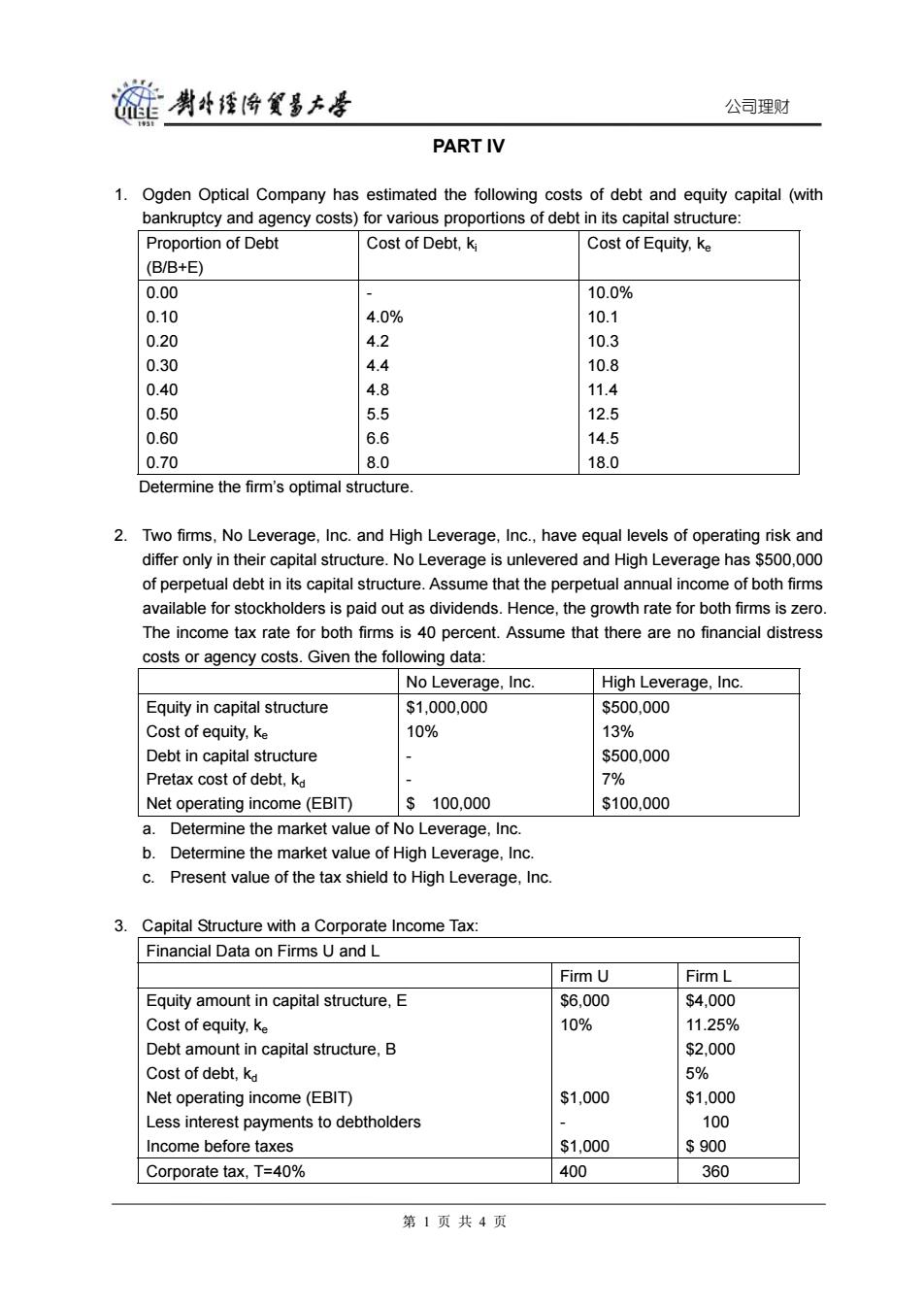

裢贵华经将贸墨去号 公司理财 PART IV 1.Ogden Optical Company has estimated the following costs of debt and equity capital(with bankruptcy and agency costs)for various proportions of debt in its capital structure: Proportion of Debt Cost of Debt,ki Cost of Equity,Ke (B/B+E) 0.00 10.0% 0.10 4.0% 10.1 0.20 4.2 10.3 0.30 4.4 10.8 0.40 4.8 11.4 0.50 5.5 12.5 0.60 6.6 14.5 0.70 8.0 18.0 Determine the firm's optimal structure. 2.Two firms,No Leverage,Inc.and High Leverage,Inc.,have equal levels of operating risk and differ only in their capital structure.No Leverage is unlevered and High Leverage has $500,000 of perpetual debt in its capital structure.Assume that the perpetual annual income of both firms available for stockholders is paid out as dividends.Hence,the growth rate for both firms is zero. The income tax rate for both firms is 40 percent.Assume that there are no financial distress costs or agency costs.Given the following data: No Leverage,Inc. High Leverage,Inc. Equity in capital structure $1.000,000 $500,000 Cost of equity,ke 10% 13% Debt in capital structure $500,000 Pretax cost of debt,kd 7% Net operating income(EBIT) $100,000 $100,000 a.Determine the market value of No Leverage,Inc. b.Determine the market value of High Leverage,Inc. c.Present value of the tax shield to High Leverage,Inc. 3.Capital Structure with a Corporate Income Tax: Financial Data on Firms U and L FirmU FirmL Equity amount in capital structure,E $6,000 $4,000 Cost of equity,Ke 10% 11.25% Debt amount in capital structure,B $2,000 Cost of debt,ka 5% Net operating income(EBIT) $1,000 $1,000 Less interest payments to debtholders 100 Income before taxes $1,000 $900 Corporate tax,T=40% 400 360 第1页共4页公司理财 PART IV 1. Ogden Optical Company has estimated the following costs of debt and equity capital (with bankruptcy and agency costs) for various proportions of debt in its capital structure: Proportion of Debt (B/B+E) Cost of Debt, ki Cost of Equity, ke 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 - 4.0% 4.2 4.4 4.8 5.5 6.6 8.0 10.0% 10.1 10.3 10.8 11.4 12.5 14.5 18.0 Determine the firm’s optimal structure. 2. Two firms, No Leverage, Inc. and High Leverage, Inc., have equal levels of operating risk and differ only in their capital structure. No Leverage is unlevered and High Leverage has $500,000 of perpetual debt in its capital structure. Assume that the perpetual annual income of both firms available for stockholders is paid out as dividends. Hence, the growth rate for both firms is zero. The income tax rate for both firms is 40 percent. Assume that there are no financial distress costs or agency costs. Given the following data: No Leverage, Inc. High Leverage, Inc. Equity in capital structure Cost of equity, ke Debt in capital structure Pretax cost of debt, kd Net operating income (EBIT) $1,000,000 10% - - $ 100,000 $500,000 13% $500,000 7% $100,000 a. Determine the market value of No Leverage, Inc. b. Determine the market value of High Leverage, Inc. c. Present value of the tax shield to High Leverage, Inc. 3. Capital Structure with a Corporate Income Tax: Financial Data on Firms U and L Firm U Firm L Equity amount in capital structure, E Cost of equity, ke Debt amount in capital structure, B Cost of debt, kd Net operating income (EBIT) Less interest payments to debtholders Income before taxes $6,000 10% $1,000 - $1,000 $4,000 11.25% $2,000 5% $1,000 100 $ 900 Corporate tax, T=40% 400 360 第 1 页 共 4 页