正在加载图片...

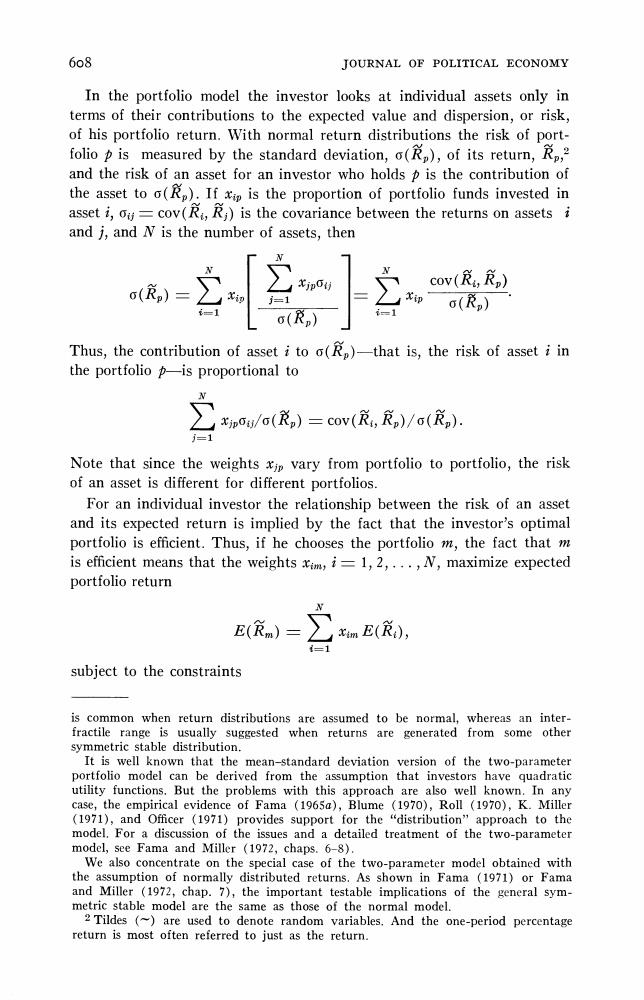

6o8 JOURNAL OF POLITICAL ECONOMY In the portfolio model the investor looks at individual assets only in terms of their contributions to the expected value and dispersion,or risk, of his portfolio return.With normal return distributions the risk of port- folio is measured by the standard deviation,()of its return,p,? and the risk of an asset for an investor who holds is the contribution of the asset to (R).If is the proportion of portfolio funds invested in asset i,oy=cov(Rj)is the covariance between the returns on assets i and j,and N is the number of assets,then (成,)= cov(Ri,R) () (R) Thus,the contribution of asset i to o(Rp)-that is,the risk of asset i in the portfolio pis proportional to xjpag/a(Rp)=cov(Ri,Rp)/a(Rp). j=1 Note that since the weights ip vary from portfolio to portfolio,the risk of an asset is different for different portfolios. For an individual investor the relationship between the risk of an asset and its expected return is implied by the fact that the investor's optimal portfolio is efficient.Thus,if he chooses the portfolio m,the fact that m is efficient means that the weightsx,=1,2,...,N,maximize expected portfolio return E(nm) xmE(), subject to the constraints is common when return distributions are assumed to be normal,whereas an inter- fractile range is usually suggested when returns are generated from some other symmetric stable distribution. It is well known that the mean-standard deviation version of the two-parameter portfolio model can be derived from the assumption that investors have quadratic utility functions.But the problems with this approach are also well known.In any case,the empirical evidence of Fama (1965a),Blume (1970),Roll (1970),K.Miller (1971),and Officer (1971)provides support for the "distribution"approach to the model.For a discussion of the issues and a detailed treatment of the two-parameter model,see Fama and Miller (1972,chaps.6-8). We also concentrate on the special case of the two-parameter model obtained with the assumption of normally distributed returns.As shown in Fama (1971)or Fama and Miller (1972,chap.7),the important testable implications of the general sym- metric stable model are the same as those of the normal model. 2 Tildes (~are used to denote random variables.And the one-period percentage return is most often referred to just as the return