正在加载图片...

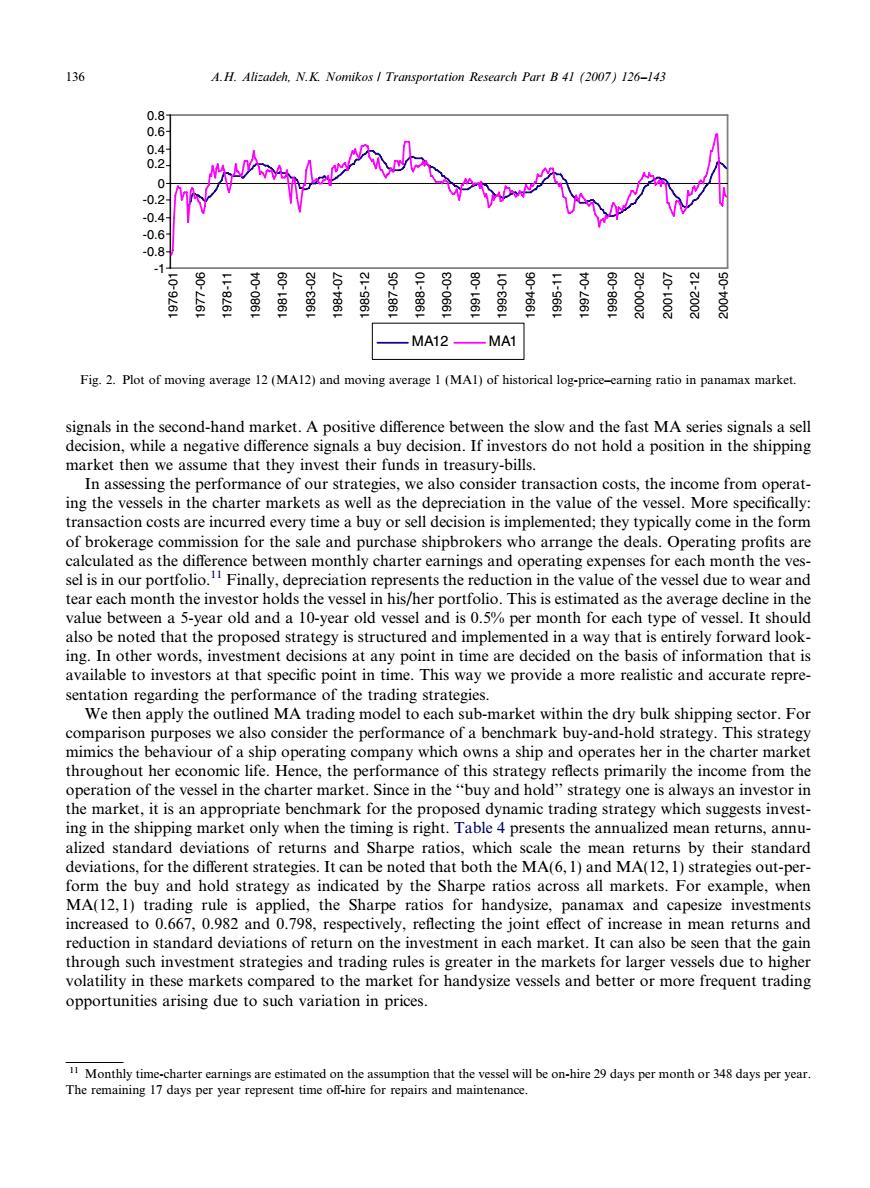

136 A.H.Alizadeh.N.K.Nomikos Transportation Research Part B 41 (2007)126-143 0.8 0.6 0.4 0.2 -0.4 -0.6 -0.8 6 6 9 3 886 466 86 200 MA12 MA1 Fig.2.Plot of moving average 12(MA12)and moving average I(MAl)of historical log-price-eamning ratio in panamax market. signals in the second-hand market.A positive difference between the slow and the fast MA series signals a sell decision,while a negative difference signals a buy decision.If investors do not hold a position in the shipping market then we assume that they invest their funds in treasury-bills. In assessing the performance of our strategies,we also consider transaction costs,the income from operat- ing the vessels in the charter markets as well as the depreciation in the value of the vessel.More specifically: transaction costs are incurred every time a buy or sell decision is implemented;they typically come in the form of brokerage commission for the sale and purchase shipbrokers who arrange the deals.Operating profits are calculated as the difference between monthly charter earnings and operating expenses for each month the ves- sel is in our portfolio.Finally,depreciation represents the reduction in the value of the vessel due to wear and tear each month the investor holds the vessel in his/her portfolio.This is estimated as the average decline in the value between a 5-year old and a 10-year old vessel and is 0.5%per month for each type of vessel.It should also be noted that the proposed strategy is structured and implemented in a way that is entirely forward look- ing.In other words,investment decisions at any point in time are decided on the basis of information that is available to investors at that specific point in time.This way we provide a more realistic and accurate repre- sentation regarding the performance of the trading strategies. We then apply the outlined MA trading model to each sub-market within the dry bulk shipping sector.For comparison purposes we also consider the performance of a benchmark buy-and-hold strategy.This strategy mimics the behaviour of a ship operating company which owns a ship and operates her in the charter market throughout her economic life.Hence,the performance of this strategy reflects primarily the income from the operation of the vessel in the charter market.Since in the"buy and hold"'strategy one is always an investor in the market,it is an appropriate benchmark for the proposed dynamic trading strategy which suggests invest- ing in the shipping market only when the timing is right.Table 4 presents the annualized mean returns,annu- alized standard deviations of returns and Sharpe ratios,which scale the mean returns by their standard deviations,for the different strategies.It can be noted that both the MA(6,1)and MA(12,1)strategies out-per- form the buy and hold strategy as indicated by the Sharpe ratios across all markets.For example,when MA(12,1)trading rule is applied,the Sharpe ratios for handysize,panamax and capesize investments increased to 0.667,0.982 and 0.798,respectively,reflecting the joint effect of increase in mean returns and reduction in standard deviations of return on the investment in each market.It can also be seen that the gain through such investment strategies and trading rules is greater in the markets for larger vessels due to higher volatility in these markets compared to the market for handysize vessels and better or more frequent trading opportunities arising due to such variation in prices. 11 Monthly time-charter earnings are estimated on the assumption that the vessel will be on-hire 29 days per month or 348 days per year. The remaining 17 days per year represent time off-hire for repairs and maintenance.signals in the second-hand market. A positive difference between the slow and the fast MA series signals a sell decision, while a negative difference signals a buy decision. If investors do not hold a position in the shipping market then we assume that they invest their funds in treasury-bills. In assessing the performance of our strategies, we also consider transaction costs, the income from operating the vessels in the charter markets as well as the depreciation in the value of the vessel. More specifically: transaction costs are incurred every time a buy or sell decision is implemented; they typically come in the form of brokerage commission for the sale and purchase shipbrokers who arrange the deals. Operating profits are calculated as the difference between monthly charter earnings and operating expenses for each month the vessel is in our portfolio.11 Finally, depreciation represents the reduction in the value of the vessel due to wear and tear each month the investor holds the vessel in his/her portfolio. This is estimated as the average decline in the value between a 5-year old and a 10-year old vessel and is 0.5% per month for each type of vessel. It should also be noted that the proposed strategy is structured and implemented in a way that is entirely forward looking. In other words, investment decisions at any point in time are decided on the basis of information that is available to investors at that specific point in time. This way we provide a more realistic and accurate representation regarding the performance of the trading strategies. We then apply the outlined MA trading model to each sub-market within the dry bulk shipping sector. For comparison purposes we also consider the performance of a benchmark buy-and-hold strategy. This strategy mimics the behaviour of a ship operating company which owns a ship and operates her in the charter market throughout her economic life. Hence, the performance of this strategy reflects primarily the income from the operation of the vessel in the charter market. Since in the ‘‘buy and hold’’ strategy one is always an investor in the market, it is an appropriate benchmark for the proposed dynamic trading strategy which suggests investing in the shipping market only when the timing is right. Table 4 presents the annualized mean returns, annualized standard deviations of returns and Sharpe ratios, which scale the mean returns by their standard deviations, for the different strategies. It can be noted that both the MA(6, 1) and MA(12, 1) strategies out-perform the buy and hold strategy as indicated by the Sharpe ratios across all markets. For example, when MA(12, 1) trading rule is applied, the Sharpe ratios for handysize, panamax and capesize investments increased to 0.667, 0.982 and 0.798, respectively, reflecting the joint effect of increase in mean returns and reduction in standard deviations of return on the investment in each market. It can also be seen that the gain through such investment strategies and trading rules is greater in the markets for larger vessels due to higher volatility in these markets compared to the market for handysize vessels and better or more frequent trading opportunities arising due to such variation in prices. -1 -0.8 -0.6 -0.4 -0.2 0 0.2 0.4 0.6 0.8 1976-01 1977-06 1978-11 1980-04 1981-09 1983-02 1984-07 1985-12 1987-05 1988-10 1990-03 1991-08 1993-01 1994-06 1995-11 1997-04 1998-09 2000-02 2001-07 2002-12 2004-05 MA12 MA1 Fig. 2. Plot of moving average 12 (MA12) and moving average 1 (MA1) of historical log-price–earning ratio in panamax market. 11 Monthly time-charter earnings are estimated on the assumption that the vessel will be on-hire 29 days per month or 348 days per year. The remaining 17 days per year represent time off-hire for repairs and maintenance. 136 A.H. Alizadeh, N.K. Nomikos / Transportation Research Part B 41 (2007) 126–143