正在加载图片...

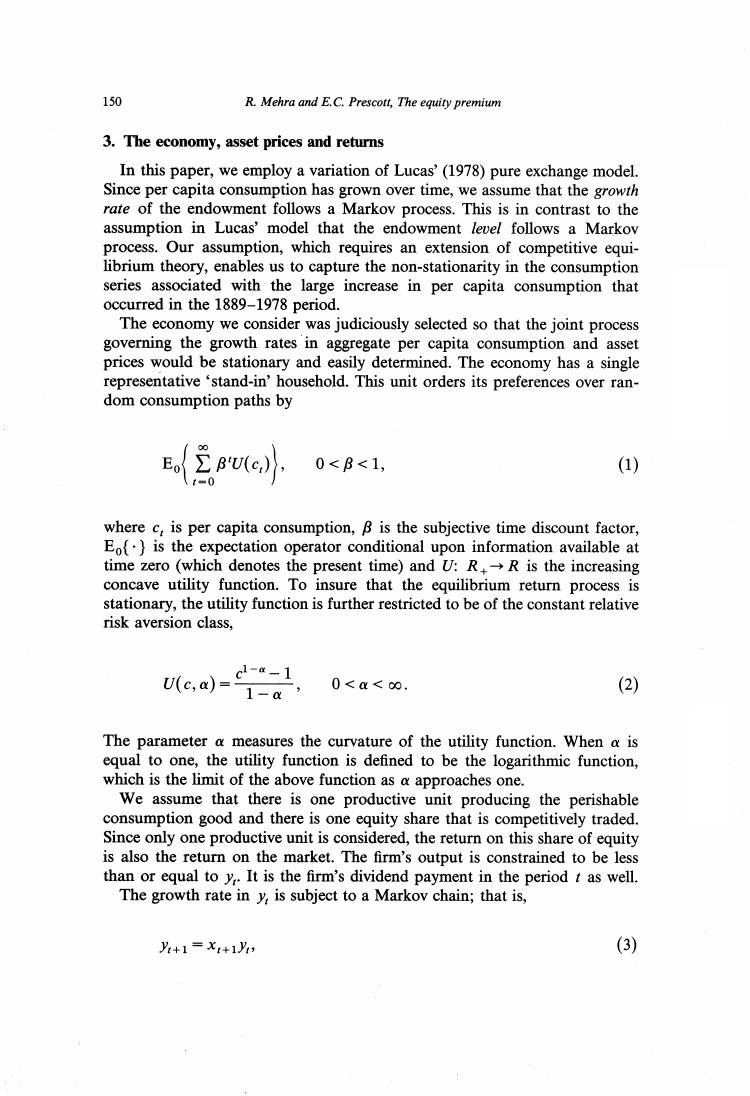

150 R.Mehra and E.C.Prescott,The equity premium 3.The economy,asset prices and returns In this paper,we employ a variation of Lucas'(1978)pure exchange model. Since per capita consumption has grown over time,we assume that the growth rate of the endowment follows a Markov process.This is in contrast to the assumption in Lucas'model that the endowment level follows a Markov process.Our assumption,which requires an extension of competitive equi- librium theory,enables us to capture the non-stationarity in the consumption series associated with the large increase in per capita consumption that occurred in the 1889-1978 period. The economy we consider was judiciously selected so that the joint process governing the growth rates in aggregate per capita consumption and asset prices would be stationary and easily determined.The economy has a single representative'stand-in'household.This unit orders its preferences over ran- dom consumption paths by e 0<B<1, (1) where c,is per capita consumption,B is the subjective time discount factor, Eof}is the expectation operator conditional upon information available at time zero (which denotes the present time)and U:RR is the increasing concave utility function.To insure that the equilibrium return process is stationary,the utility function is further restricted to be of the constant relative risk aversion class, U(c,a)=c--1 1-a3 0<a<0 (2) The parameter a measures the curvature of the utility function.When a is equal to one,the utility function is defined to be the logarithmic function, which is the limit of the above function as a approaches one. We assume that there is one productive unit producing the perishable consumption good and there is one equity share that is competitively traded. Since only one productive unit is considered,the return on this share of equity is also the return on the market.The firm's output is constrained to be less than or equal to y.It is the firm's dividend payment in the period t as well. The growth rate in y,is subject to a Markov chain;that is, y+1=X+1乃, (3)