正在加载图片...

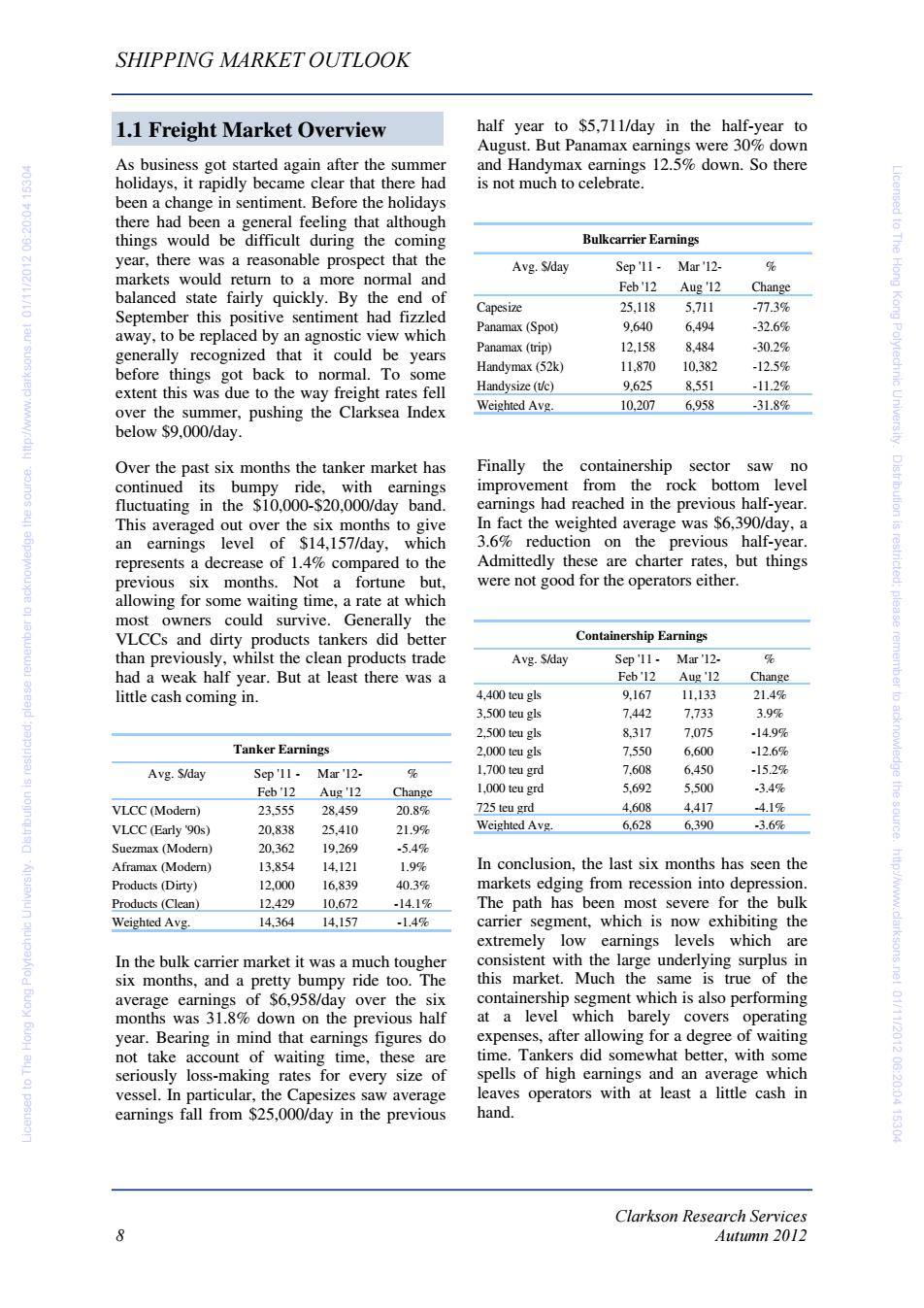

SHIPPING MARKET OUTLOOK 1.1 Freight Market Overview half year to $5,711/day in the half-year to August.But Panamax earnings were 30%down As business got started again after the summer and Handymax earnings 12.5%down.So there holidays,it rapidly became clear that there had is not much to celebrate. been a change in sentiment.Before the holidays there had been a general feeling that although things would be difficult during the coming Bulkcarrier Earnings censed to The year,there was a reasonable prospect that the Avg.S/day Sep'11- Mar'12- markets would return to a more normal and Feb'12 Hong balanced state fairly quickly.By the end of Aug'12 Change Capesize 25,118 5.711 -77.3% September this positive sentiment had fizzled Panamax(Spot) 9.640 6.494 -32.6% away,to be replaced by an agnostic view which generally recognized that it could be years Panamax (trip) 12,158 8.484 -30.2% before things got back to normal.To some Handymax(52k) 11.870 10,382 -12.5% extent this was due to the way freight rates fell Handysize (t/c) 9.625 8.551 -11.2% over the summer,pushing the Clarksea Index Weighted Avg. 10,207 6.958 -31.8% Kong Polytechnic University. below $9,000/day. Over the past six months the tanker market has Finally the containership sector saw no continued its bumpy ride,with earnings improvement from the rock bottom level fluctuating in the $10,000-$20,000/day band. earnings had reached in the previous half-year. Distribution This averaged out over the six months to give In fact the weighted average was $6,390/day,a an earnings level of $14,157/day,which 3.6%reduction on the previous half-year. represents a decrease of 1.4%compared to the Admittedly these are charter rates,but things were not good for the operators either. is restricted: previous six months.Not a fortune but, allowing for some waiting time,a rate at which most owners could survive.Generally the please VLCCs and dirty products tankers did better Containership Earnings 雪 than previously,whilst the clean products trade Avg.S/day Sep'1l-Mar'12- % had a weak half year.But at least there was a Feb'12 Aug'12 Change ember little cash coming in. 4,400 teu gls 9.167 11.133 21.4% 3.500 teu gls 7.442 7,733 3.9% 2,500 teu gls 8317 7.075 -14.9% Tanker Earnings 2.000 teu gls 7550 6,600 12.6% acknowledge Avg.S/day Sep'll- Mr'12. % 1,700 teu grd 7,608 6,450 15.2% Feb'12 Aug'12 Change 1,000 teu grd 5.692 5.500 -3.4% VLCC (Modern) 23,555 28.459 20.8% 725 teu grd 4,608 4,417 4.1% VLCC (Early '90s) 20,838 25,410 21.9% Weighted Avg. 6,628 6390 -3.6% the source Suezmax(Modern) 20,362 19.269 -5.4% Aframax(Modern) 13,854 14.121 1.9% In conclusion,the last six months has seen the Products(Dirty)) 12.000 16,839 40.3% markets edging from recession into depression. Products(Clean) 12.429 10.672 -14.1% The path has been most severe for the bulk Weighted Avg. 14.364 14,157 -1.4% carrier segment,which is now exhibiting the extremely low earnings levels which are In the bulk carrier market it was a much tougher consistent with the large underlying surplus in six months,and a pretty bumpy ride too.The this market.Much the same is true of the average earnings of $6,958/day over the six containership segment which is also performing months was 31.8%down on the previous half at a level which barely covers operating year.Bearing in mind that earnings figures do expenses,after allowing for a degree of waiting not take account of waiting time,these are time.Tankers did somewhat better,with some seriously loss-making rates for every size of spells of high earnings and an average which http://www.clarksons.nel 01/11/2012 06:20:04 15304 vessel.In particular,the Capesizes saw average leaves operators with at least a little cash in earnings fall from $25,000/day in the previous hand. Clarkson Research Services Autumn 2012Clarkson Research Services 8 Autumn 2012 SHIPPING MARKET OUTLOOK As business got started again after the summer holidays, it rapidly became clear that there had been a change in sentiment. Before the holidays there had been a general feeling that although things would be difficult during the coming year, there was a reasonable prospect that the markets would return to a more normal and balanced state fairly quickly. By the end of September this positive sentiment had fizzled away, to be replaced by an agnostic view which generally recognized that it could be years before things got back to normal. To some extent this was due to the way freight rates fell over the summer, pushing the Clarksea Index below $9,000/day. Over the past six months the tanker market has continued its bumpy ride, with earnings fluctuating in the $10,000-$20,000/day band. This averaged out over the six months to give an earnings level of $14,157/day, which represents a decrease of 1.4% compared to the previous six months. Not a fortune but, allowing for some waiting time, a rate at which most owners could survive. Generally the VLCCs and dirty products tankers did better than previously, whilst the clean products trade had a weak half year. But at least there was a little cash coming in. In the bulk carrier market it was a much tougher six months, and a pretty bumpy ride too. The average earnings of $6,958/day over the six months was 31.8% down on the previous half year. Bearing in mind that earnings figures do not take account of waiting time, these are seriously loss-making rates for every size of vessel. In particular, the Capesizes saw average earnings fall from $25,000/day in the previous half year to $5,711/day in the half-year to August. But Panamax earnings were 30% down and Handymax earnings 12.5% down. So there is not much to celebrate. Finally the containership sector saw no improvement from the rock bottom level earnings had reached in the previous half-year. In fact the weighted average was $6,390/day, a 3.6% reduction on the previous half-year. Admittedly these are charter rates, but things were not good for the operators either. In conclusion, the last six months has seen the markets edging from recession into depression. The path has been most severe for the bulk carrier segment, which is now exhibiting the extremely low earnings levels which are consistent with the large underlying surplus in this market. Much the same is true of the containership segment which is also performing at a level which barely covers operating expenses, after allowing for a degree of waiting time. Tankers did somewhat better, with some spells of high earnings and an average which leaves operators with at least a little cash in hand. 1.1 Freight Market Overview Tanker Earnings Avg. $/day Sep '11 - Mar '12- % Feb '12 Aug '12 Change VLCC (Modern) 23,555 28,459 20.8% VLCC (Early '90s) 20,838 25,410 21.9% Suezmax (Modern) 20,362 19,269 -5.4% Aframax (Modern) 13,854 14,121 1.9% Products (Dirty) 12,000 16,839 40.3% Products (Clean) 12,429 10,672 -14.1% Weighted Avg. 14,364 14,157 -1.4% Bulkcarrier Earnings Avg. $/day Sep '11 - Mar '12- % Feb '12 Aug '12 Change Capesize 25,118 5,711 -77.3% Panamax (Spot) 9,640 6,494 -32.6% Panamax (trip) 12,158 8,484 -30.2% Handymax (52k) 11,870 10,382 -12.5% Handysize (t/c) 9,625 8,551 -11.2% Weighted Avg. 10,207 6,958 -31.8% Containership Earnings Avg. $/day Sep '11 - Mar '12- % Feb '12 Aug '12 Change 4,400 teu gls 9,167 11,133 21.4% 3,500 teu gls 7,442 7,733 3.9% 2,500 teu gls 8,317 7,075 -14.9% 2,000 teu gls 7,550 6,600 -12.6% 1,700 teu grd 7,608 6,450 -15.2% 1,000 teu grd 5,692 5,500 -3.4% 725 teu grd 4,608 4,417 -4.1% Weighted Avg. 6,628 6,390 -3.6% Licensed to The Hong Kong Polytechnic University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 01/11/2012 06:20:04 15304 Licensed to The Hong Kong Polytechnic University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 01/11/2012 06:20:04 15304