正在加载图片...

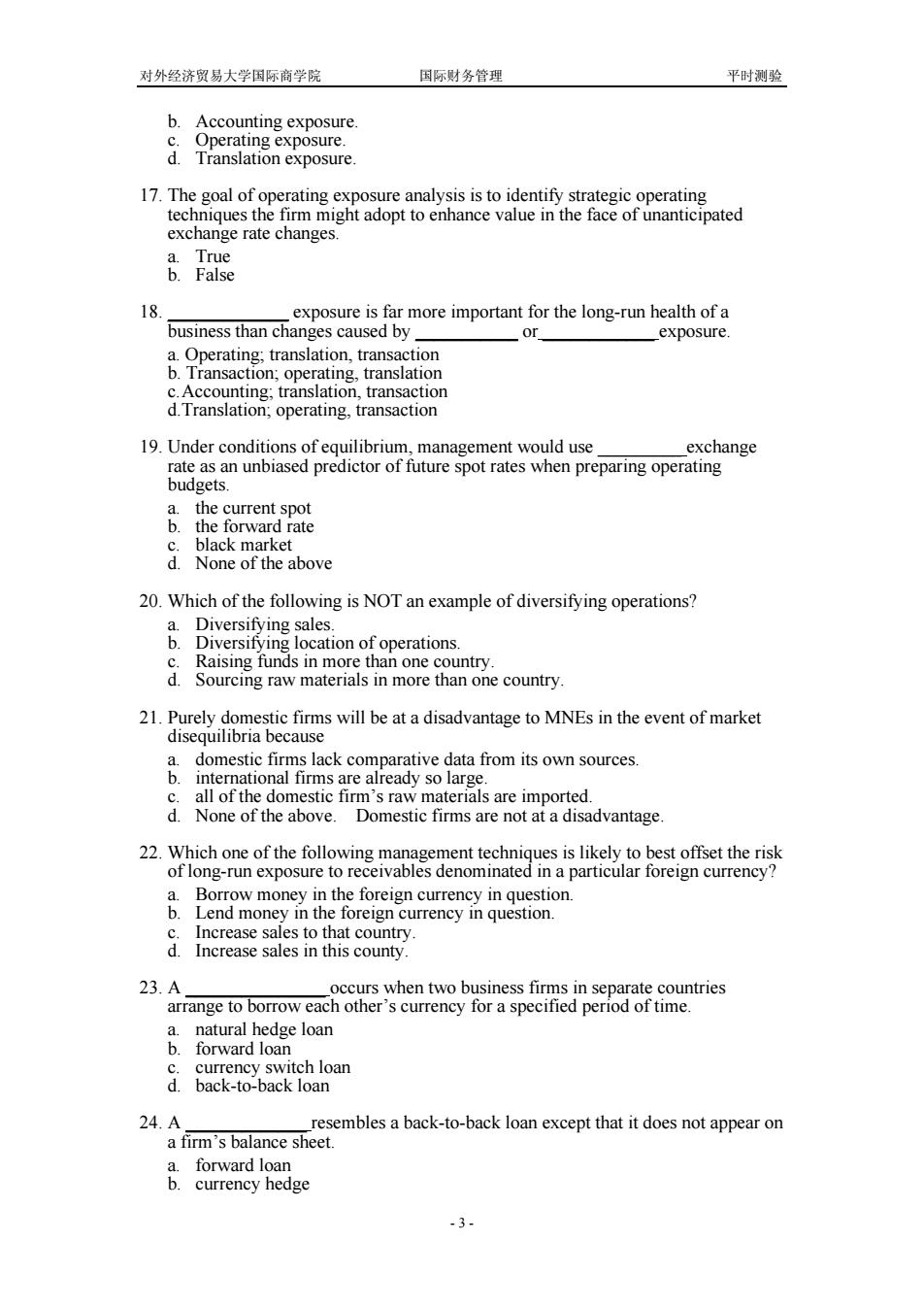

对外经济贸易大学国际商学院 国际财务管理 平时测验 b.Accounting exposure C. Operating exposure. d. Translation exposure 17.The goal of operating exposure analysis is to identify strategic operating techniques the firm might adopt to enhance value in the face of unanticipated exchange rate changes. a.True b.False 18 exposure is far more important for the long-run health of a business than changes caused by or exposure. a.Operating;translation,transaction b.Transaction;operating,translation c.Accounting;translation,transaction d.Translation;operating,transaction 19.Under conditions of equilibrium,management would use exchange rate as an unbiased predictor of future spot rates when preparing operating budgets. a. the current spot b.the forward rate C. black market d.None of the above 20.Which of the following is NOT an example of diversifying operations? a. Diversifying sales. b. Diversifying location of operations. c Raising funds in more than one country. d.Sourcing raw materials in more than one country. 21.Purely domestic firms will be at a disadvantage to MNEs in the event of market disequilibria because a. domestic firms lack comparative data from its own sources. b. international firms are already so large. c.all of the domestic firm's raw materials are imported. d. None of the above.Domestic firms are not at a disadvantage. 22.Which one of the following management techniques is likely to best offset the risk of long-run exposure to receivables denominated in a particular foreign currency? a. Borrow money in the foreign currency in question. b. Lend money in the foreign currency in question. c Increase sales to that country d.Increase sales in this county 23.A occurs when two business firms in separate countries arrange to borrow each other's currency for a specified period of time. a.natural hedge loan b.forward loan C. currency switch loan d back-to-back loan 24.A resembles a back-to-back loan except that it does not appear on a firm's balance sheet. a. forward loan b. currency hedge -3对外经济贸易大学国际商学院 国际财务管理 平时测验 b. Accounting exposure. c. Operating exposure. d. Translation exposure. 17. The goal of operating exposure analysis is to identify strategic operating techniques the firm might adopt to enhance value in the face of unanticipated exchange rate changes. a. True b. False 18. _____________ exposure is far more important for the long-run health of a business than changes caused by ___________ or ____________ exposure. a. Operating; translation, transaction b. Transaction; operating, translation c.Accounting; translation, transaction d.Translation; operating, transaction 19. Under conditions of equilibrium, management would use _________ exchange rate as an unbiased predictor of future spot rates when preparing operating budgets. a. the current spot b. the forward rate c. black market d. None of the above 20. Which of the following is NOT an example of diversifying operations? a. Diversifying sales. b. Diversifying location of operations. c. Raising funds in more than one country. d. Sourcing raw materials in more than one country. 21. Purely domestic firms will be at a disadvantage to MNEs in the event of market disequilibria because a. domestic firms lack comparative data from its own sources. b. international firms are already so large. c. all of the domestic firm’s raw materials are imported. d. None of the above. Domestic firms are not at a disadvantage. 22. Which one of the following management techniques is likely to best offset the risk of long-run exposure to receivables denominated in a particular foreign currency? a. Borrow money in the foreign currency in question. b. Lend money in the foreign currency in question. c. Increase sales to that country. d. Increase sales in this county. 23. A _______________ occurs when two business firms in separate countries arrange to borrow each other’s currency for a specified period of time. a. natural hedge loan b. forward loan c. currency switch loan d. back-to-back loan 24. A _____________ resembles a back-to-back loan except that it does not appear on a firm’s balance sheet. a. forward loan b. currency hedge - 3 -