正在加载图片...

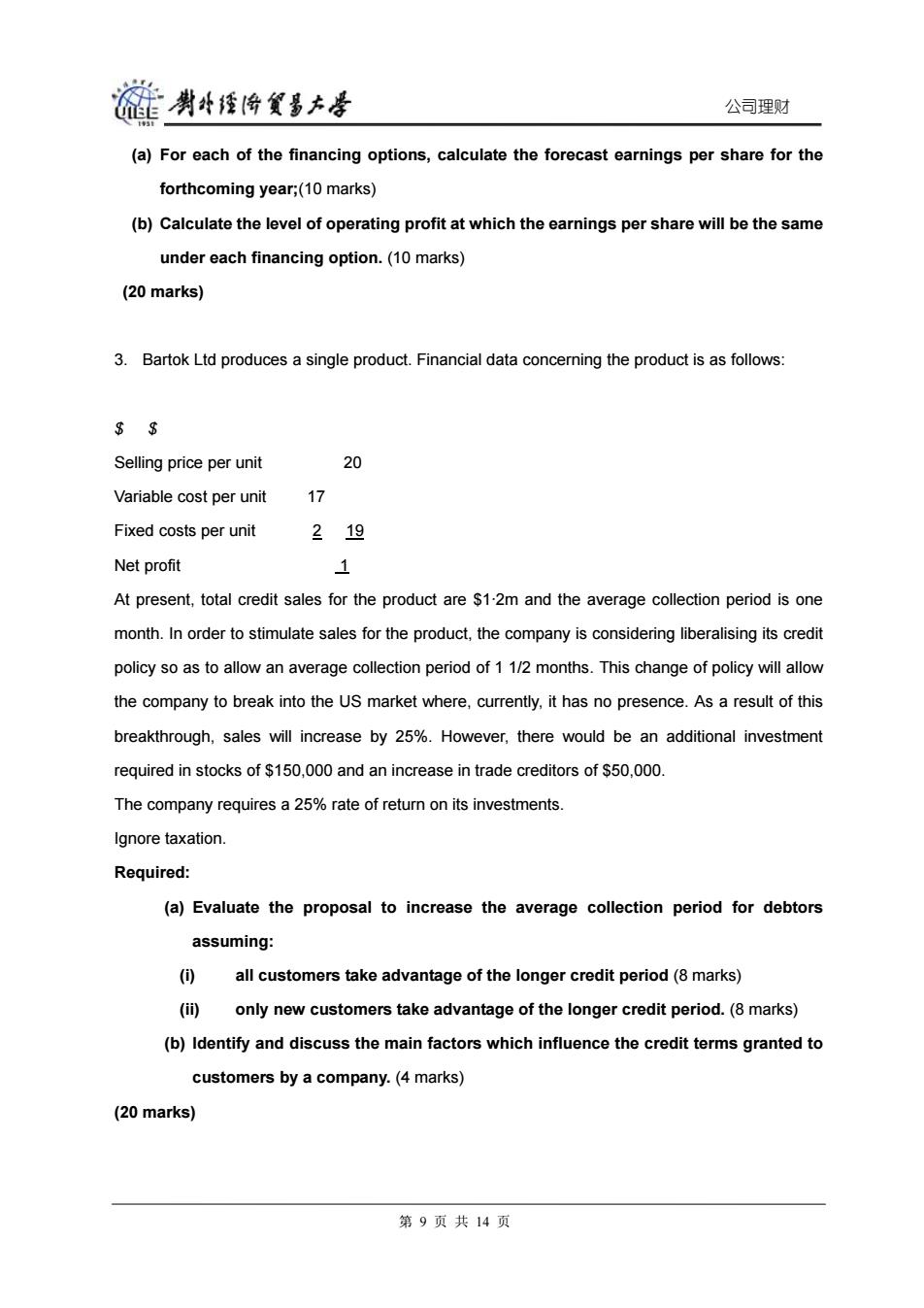

爸剥斗煙怜食多本学 公司理财 (a)For each of the financing options,calculate the forecast earnings per share for the forthcoming year;(10 marks) (b)Calculate the level of operating profit at which the earnings per share will be the same under each financing option.(10 marks) (20 marks) 3.Bartok Ltd produces a single product.Financial data concerning the product is as follows: $$ Selling price per unit 20 Variable cost per unit 17 Fixed costs per unit 219 Net profit 1 At present,total credit sales for the product are $1-2m and the average collection period is one month.In order to stimulate sales for the product,the company is considering liberalising its credit policy so as to allow an average collection period of 1 1/2 months.This change of policy will allow the company to break into the US market where,currently,it has no presence.As a result of this breakthrough,sales will increase by 25%.However,there would be an additional investment required in stocks of $150,000 and an increase in trade creditors of $50,000. The company requires a 25%rate of return on its investments. Ignore taxation. Required: (a)Evaluate the proposal to increase the average collection period for debtors assuming: () all customers take advantage of the longer credit period(8 marks) (ii)only new customers take advantage of the longer credit period.(8 marks) (b)Identify and discuss the main factors which influence the credit terms granted to customers by a company.(4 marks) (20 marks) 第9页共14页公司理财 (a) For each of the financing options, calculate the forecast earnings per share for the forthcoming year;(10 marks) (b) Calculate the level of operating profit at which the earnings per share will be the same under each financing option. (10 marks) (20 marks) 3. Bartok Ltd produces a single product. Financial data concerning the product is as follows: $ $ Selling price per unit 20 Variable cost per unit 17 Fixed costs per unit 2 19 Net profit 1 At present, total credit sales for the product are $1·2m and the average collection period is one month. In order to stimulate sales for the product, the company is considering liberalising its credit policy so as to allow an average collection period of 1 1/2 months. This change of policy will allow the company to break into the US market where, currently, it has no presence. As a result of this breakthrough, sales will increase by 25%. However, there would be an additional investment required in stocks of $150,000 and an increase in trade creditors of $50,000. The company requires a 25% rate of return on its investments. Ignore taxation. Required: (a) Evaluate the proposal to increase the average collection period for debtors assuming: (i) all customers take advantage of the longer credit period (8 marks) (ii) only new customers take advantage of the longer credit period. (8 marks) (b) Identify and discuss the main factors which influence the credit terms granted to customers by a company. (4 marks) (20 marks) 第 9 页 共 14 页