正在加载图片...

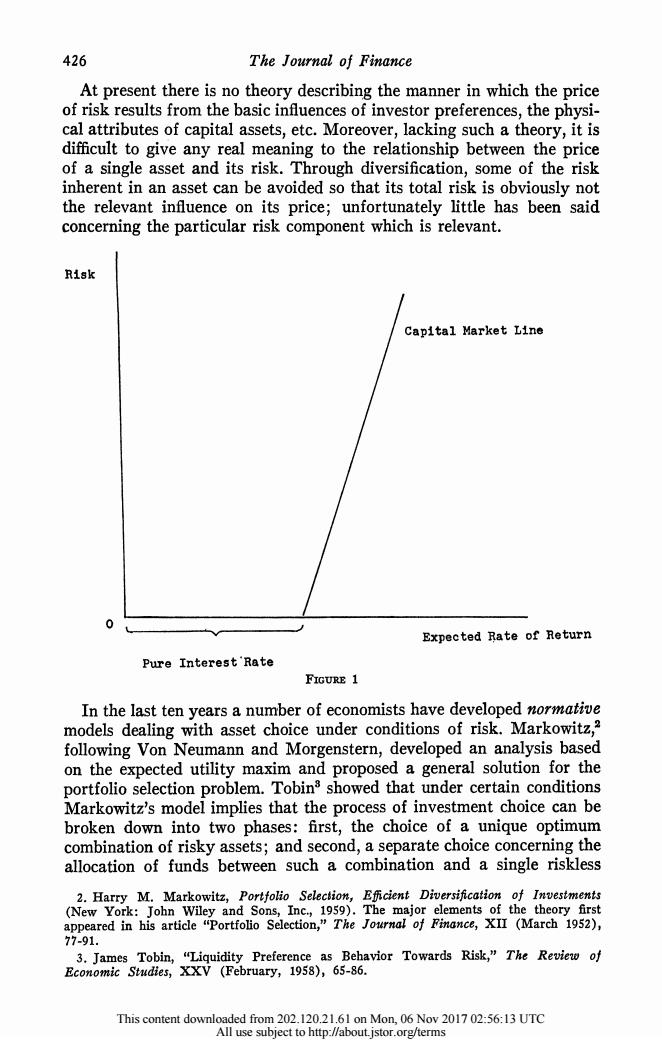

426 The Journal of Finance At present there is no theory describing the manner in which the price of risk results from the basic influences of investor preferences,the physi- cal attributes of capital assets,etc.Moreover,lacking such a theory,it is difficult to give any real meaning to the relationship between the price of a single asset and its risk.Through diversification,some of the risk inherent in an asset can be avoided so that its total risk is obviously not the relevant influence on its price;unfortunately little has been said concerning the particular risk component which is relevant. Risk Capital Market Line Expected Rate of Return Pure Interest'Rate FIGURE 1 In the last ten years a number of economists have developed normative models dealing with asset choice under conditions of risk.Markowitz,? following Von Neumann and Morgenstern,developed an analysis based on the expected utility maxim and proposed a general solution for the portfolio selection problem.Tobin3 showed that under certain conditions Markowitz's model implies that the process of investment choice can be broken down into two phases:first,the choice of a unique optimum combination of risky assets;and second,a separate choice concerning the allocation of funds between such a combination and a single riskless 2.Harry M.Markowitz,Portfolio Selection,Eficient Diversification of Investments (New York:John Wiley and Sons,Inc,1959).The major elements of the theory first appeared in his article "Portfolio Selection,"The Journal of Finance,XII (March 1952), 77-91. 3.James Tobin,"Liquidity Preference as Behavior Towards Risk,"The Review of Economic Studies,XXV (February,1958),65-86. This content downloaded from 202.120.21.61 on Mon,06 Nov 2017 02:56:13 UTC All use subject to http://about.istor.org/terms426 The Journal of Finance At present there is no theory describing the manner in which the price of risk results from the basic influences of investor preferences, the physi- cal attributes of capital assets, etc. Moreover, lacking such a theory, it is difficult to give any real meaning to the relationship between the price of a single asset and its risk. Through diversification, some of the risk inherent in an asset can be avoided so that its total risk is obviously not the relevant influence on its price; unfortunately little has been said concerning the particular risk component which is relevant. Risk Capital Market Line 0 Expected Rate of Return Pure Interest'Rate FIGURE 1 In the last ten years a number of economists have developed normative models dealing with asset choice under conditions of risk. Markowitz,2 following Von Neumann and Morgenstern, developed an analysis based on the expected utility maxim and proposed a general solution for the portfolio selection problem. Tobin' showed that under certain conditions Markowitz's model implies that the process of investment choice can be broken down into two phases: first, the choice of a unique optimum combination of risky assets; and second, a separate choice concerning the allocation of funds between such a combination and a single riskless 2. Harry M. Markowitz, Portfolio Selection, Efficient Diversification of Investments (New York: John Wiley and Sons, Inc., 1959). The major elements of the theory first appeared in his article "Portfolio Selection," The Journal of Finance, XII (March 1952), 77-91. 3. James Tobin, "Liquidity Preference as Behavior Towards Risk," The Review of Economic Studies, XXV (February, 1958), 65-86. This content downloaded from 202.120.21.61 on Mon, 06 Nov 2017 02:56:13 UTC All use subject to http://about.jstor.org/terms