正在加载图片...

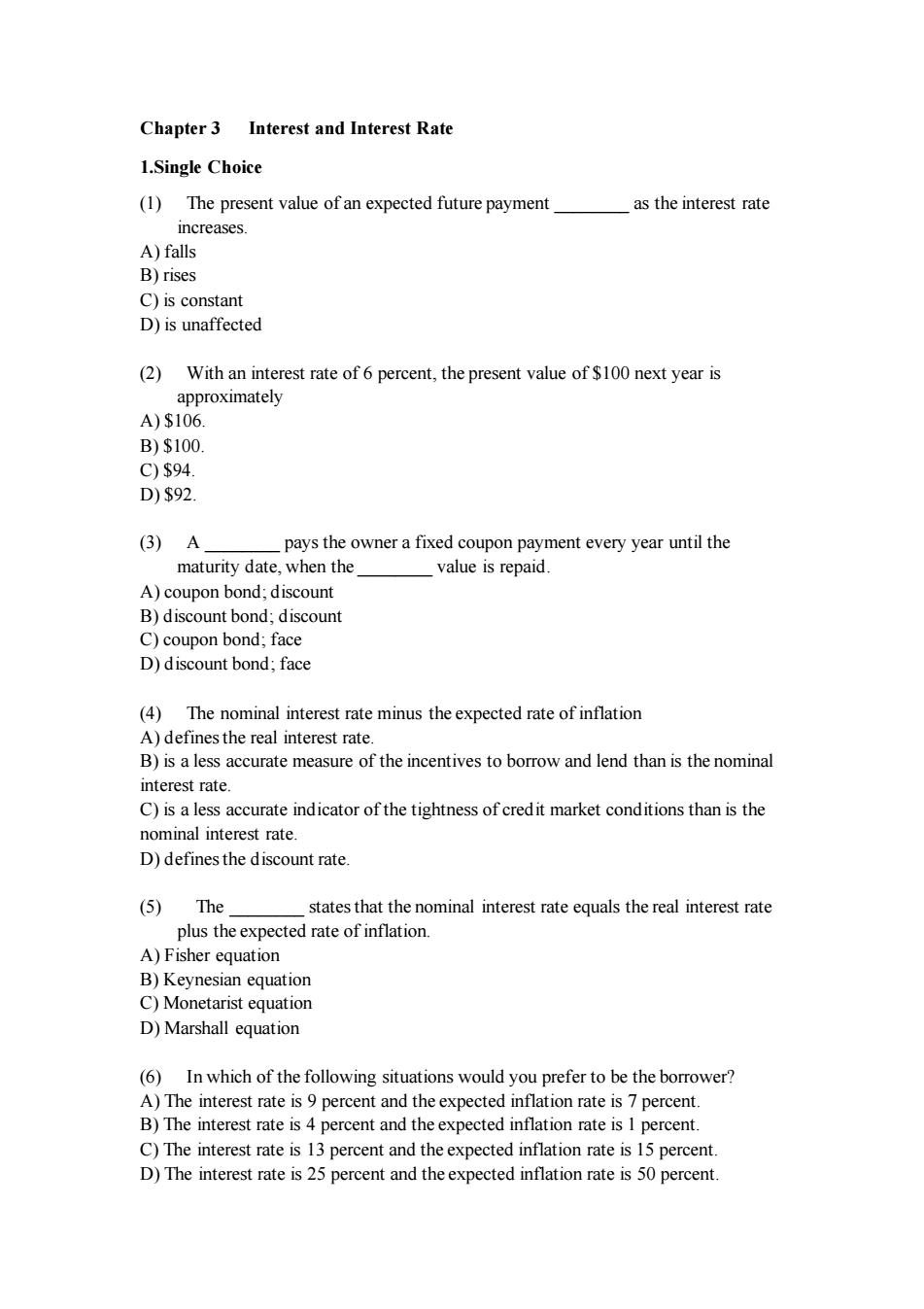

Chapter 3 Interest and Interest Rate 1.Single Choice (1)The present value of an expected future payment as the interest rate increases. A)falls B)rises C)is constant D)is unaffected (2)With an interest rate of 6 percent,the present value of $100 next year is approximately A)$106 B)$100 C)$94 D)$92. (3)A pays the owner a fixed coupon payment every year until the maturity date,when the value is repaid. A)coupon bond;discount B)discount bond;discount C)coupon bond;face D)discount bond;face (4)The nominal interest rate minus the expected rate of inflation A)defines the real interest rate. B)is a less accurate measure of the incentives to borrow and lend than is the nominal interest rate. C)is a less accurate indicator of the tightness of credit market conditions than is the nominal interest rate. D)defines the discount rate. (5)The states that the nominal interest rate equals the real interest rate plus the expected rate of inflation. A)Fisher equation B)Keynesian equation C)Monetarist equation D)Marshall equation (6)In which of the following situations would you prefer to be the borrower? A)The interest rate is 9 percent and the expected inflation rate is 7 percent. B)The interest rate is 4 percent and the expected inflation rate is 1 percent C)The interest rate is 13 percent and the expected inflation rate is 15 percent. D)The interest rate is 25 percent and the expected inflation rate is 50 percent.Chapter 3 Interest and Interest Rate 1.Single Choice (1) The present value of an expected future payment ________ as the interest rate increases. A) falls B) rises C) is constant D) is unaffected (2) With an interest rate of 6 percent, the present value of $100 next year is approximately A) $106. B) $100. C) $94. D) $92. (3) A ________ pays the owner a fixed coupon payment every year until the maturity date, when the ________ value is repaid. A) coupon bond; discount B) discount bond; discount C) coupon bond; face D) discount bond; face (4) The nominal interest rate minus the expected rate of inflation A) defines the real interest rate. B) is a less accurate measure of the incentives to borrow and lend than is the nominal interest rate. C) is a less accurate indicator of the tightness of credit market conditions than is the nominal interest rate. D) defines the discount rate. (5) The ________ states that the nominal interest rate equals the real interest rate plus the expected rate of inflation. A) Fisher equation B) Keynesian equation C) Monetarist equation D) Marshall equation (6) In which of the following situations would you prefer to be the borrower? A) The interest rate is 9 percent and the expected inflation rate is 7 percent. B) The interest rate is 4 percent and the expected inflation rate is 1 percent. C) The interest rate is 13 percent and the expected inflation rate is 15 percent. D) The interest rate is 25 percent and the expected inflation rate is 50 percent