正在加载图片...

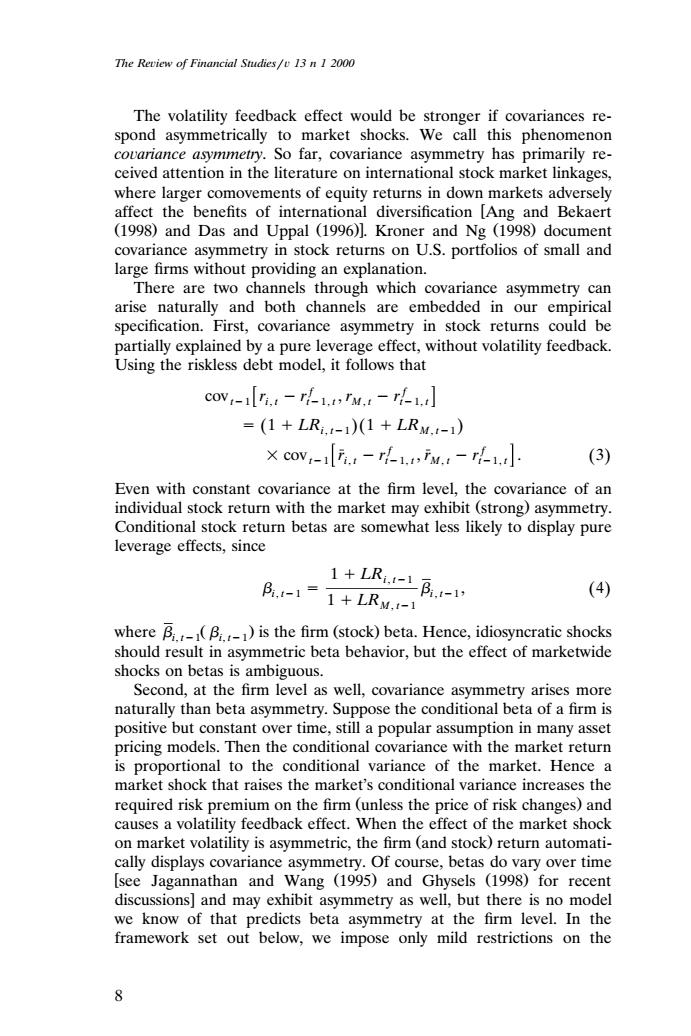

The Review of Financial Studies/v 13 n 1 2000 The volatility feedback effect would be stronger if covariances re- spond asymmetrically to market shocks.We call this phenomenon covariance asymmetry.So far,covariance asymmetry has primarily re- ceived attention in the literature on international stock market linkages, where larger comovements of equity returns in down markets adversely affect the benefits of international diversification [Ang and Bekaert (1998)and Das and Uppal (1996)].Kroner and Ng (1998)document covariance asymmetry in stock returns on U.S.portfolios of small and large firms without providing an explanation. There are two channels through which covariance asymmetry can arise naturally and both channels are embedded in our empirical specification.First,covariance asymmetry in stock returns could be partially explained by a pure leverage effect,without volatility feedback. Using the riskless debt model,it follows that cov-1i.-rf1 M.- =(1+LR,-1)1+LRM,4-) ×cov-i.,-f,iM,-h1, (3) Even with constant covariance at the firm level,the covariance of an individual stock return with the market may exhibit(strong)asymmetry. Conditional stock return betas are somewhat less likely to display pure leverage effects,since 1+LRi.-LB.-1, B.-1=1+LRM-1 (4) where B(B)is the firm (stock)beta.Hence,idiosyncratic shocks should result in asymmetric beta behavior,but the effect of marketwide shocks on betas is ambiguous. Second,at the firm level as well,covariance asymmetry arises more naturally than beta asymmetry.Suppose the conditional beta of a firm is positive but constant over time,still a popular assumption in many asset pricing models.Then the conditional covariance with the market return is proportional to the conditional variance of the market.Hence a market shock that raises the market's conditional variance increases the required risk premium on the firm (unless the price of risk changes)and causes a volatility feedback effect.When the effect of the market shock on market volatility is asymmetric,the firm(and stock)return automati- cally displays covariance asymmetry.Of course,betas do vary over time [see Jagannathan and Wang (1995)and Ghysels (1998)for recent discussions]and may exhibit asymmetry as well,but there is no model we know of that predicts beta asymmetry at the firm level.In the framework set out below,we impose only mild restrictions on the 8The Reiew of Financial Studies 13 n 1 2000 The volatility feedback effect would be stronger if covariances respond asymmetrically to market shocks. We call this phenomenon coariance asymmetry. So far, covariance asymmetry has primarily received attention in the literature on international stock market linkages, where larger comovements of equity returns in down markets adversely affect the benefits of international diversification Ang and Bekaert Ž. Ž. 1998 and Das and Uppal 1996 . Kroner and Ng 1998 document Ž . covariance asymmetry in stock returns on U.S. portfolios of small and large firms without providing an explanation. There are two channels through which covariance asymmetry can arise naturally and both channels are embedded in our empirical specification. First, covariance asymmetry in stock returns could be partially explained by a pure leverage effect, without volatility feedback. Using the riskless debt model, it follows that f f cov r r , r r t1 i, t t1, t M , t t1, t Ž .Ž . 1 LRi, t1 1 LRM , t1 f f cov r r , r r . 3Ž . t1 i, t t1, t M , t t1, t Even with constant covariance at the firm level, the covariance of an individual stock return with the market may exhibit strong asymmetry. Ž . Conditional stock return betas are somewhat less likely to display pure leverage effects, since 1 LRi, t1 , 4Ž . i, t1 i, t1 1 LRM , t1 where Ž . Ž. is the firm stock beta. Hence, idiosyncratic shocks i, t1 i, t1 should result in asymmetric beta behavior, but the effect of marketwide shocks on betas is ambiguous. Second, at the firm level as well, covariance asymmetry arises more naturally than beta asymmetry. Suppose the conditional beta of a firm is positive but constant over time, still a popular assumption in many asset pricing models. Then the conditional covariance with the market return is proportional to the conditional variance of the market. Hence a market shock that raises the market’s conditional variance increases the required risk premium on the firm unless the price of risk changes and Ž . causes a volatility feedback effect. When the effect of the market shock on market volatility is asymmetric, the firm and stock return automati- Ž . cally displays covariance asymmetry. Of course, betas do vary over time see Jagannathan and Wang 1995 and Ghysels 1998 for recent Ž. Ž. discussions and may exhibit asymmetry as well, but there is no model we know of that predicts beta asymmetry at the firm level. In the framework set out below, we impose only mild restrictions on the 8�����