正在加载图片...

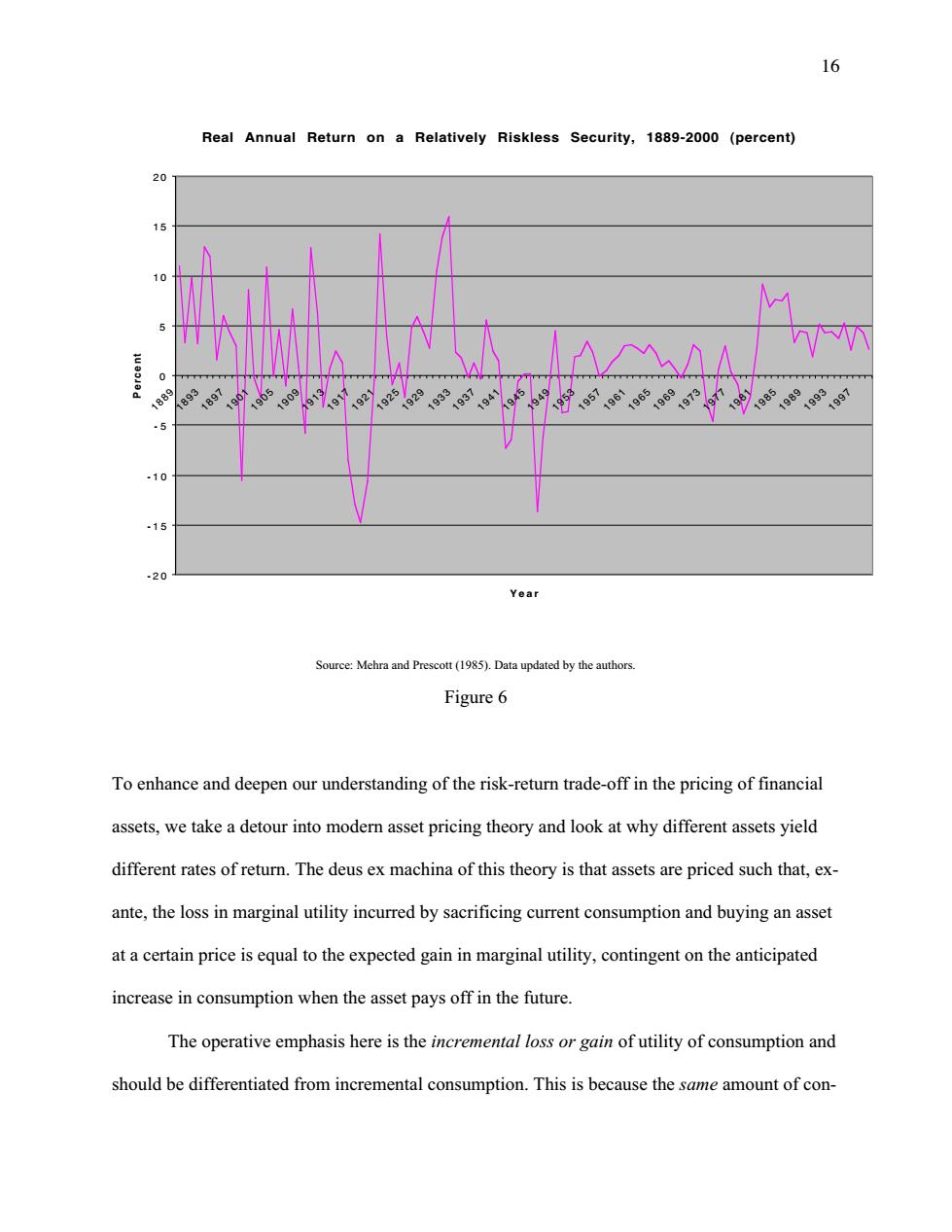

16 Real Annual Return on a Relatively Riskless Security,1889-2000 (percent) 20 15 0 1889 -5 .10 .15 .20 Year Source:Mehra and Prescott(1985).Data updated by the authors Figure 6 To enhance and deepen our understanding of the risk-return trade-off in the pricing of financial assets,we take a detour into modern asset pricing theory and look at why different assets yield different rates of return.The deus ex machina of this theory is that assets are priced such that,ex- ante,the loss in marginal utility incurred by sacrificing current consumption and buying an asset at a certain price is equal to the expected gain in marginal utility,contingent on the anticipated increase in consumption when the asset pays off in the future. The operative emphasis here is the incremental loss or gain of utility of consumption and should be differentiated from incremental consumption.This is because the same amount of con-16 Real Annual Return on a Relatively Riskless Security, 1889-2000 (percent) -20 -15 -10 - 5 0 5 1 0 1 5 2 0 1889 1893 1897 1901 1905 1909 1913 1917 1921 1925 1929 1933 1937 1941 1945 1949 1953 1957 1961 1965 1969 1973 1977 1981 1985 1989 1993 1997 Year Percent Source: Mehra and Prescott (1985). Data updated by the authors. Figure 6 To enhance and deepen our understanding of the risk-return trade-off in the pricing of financial assets, we take a detour into modern asset pricing theory and look at why different assets yield different rates of return. The deus ex machina of this theory is that assets are priced such that, exante, the loss in marginal utility incurred by sacrificing current consumption and buying an asset at a certain price is equal to the expected gain in marginal utility, contingent on the anticipated increase in consumption when the asset pays off in the future. The operative emphasis here is the incremental loss or gain of utility of consumption and should be differentiated from incremental consumption. This is because the same amount of con-