正在加载图片...

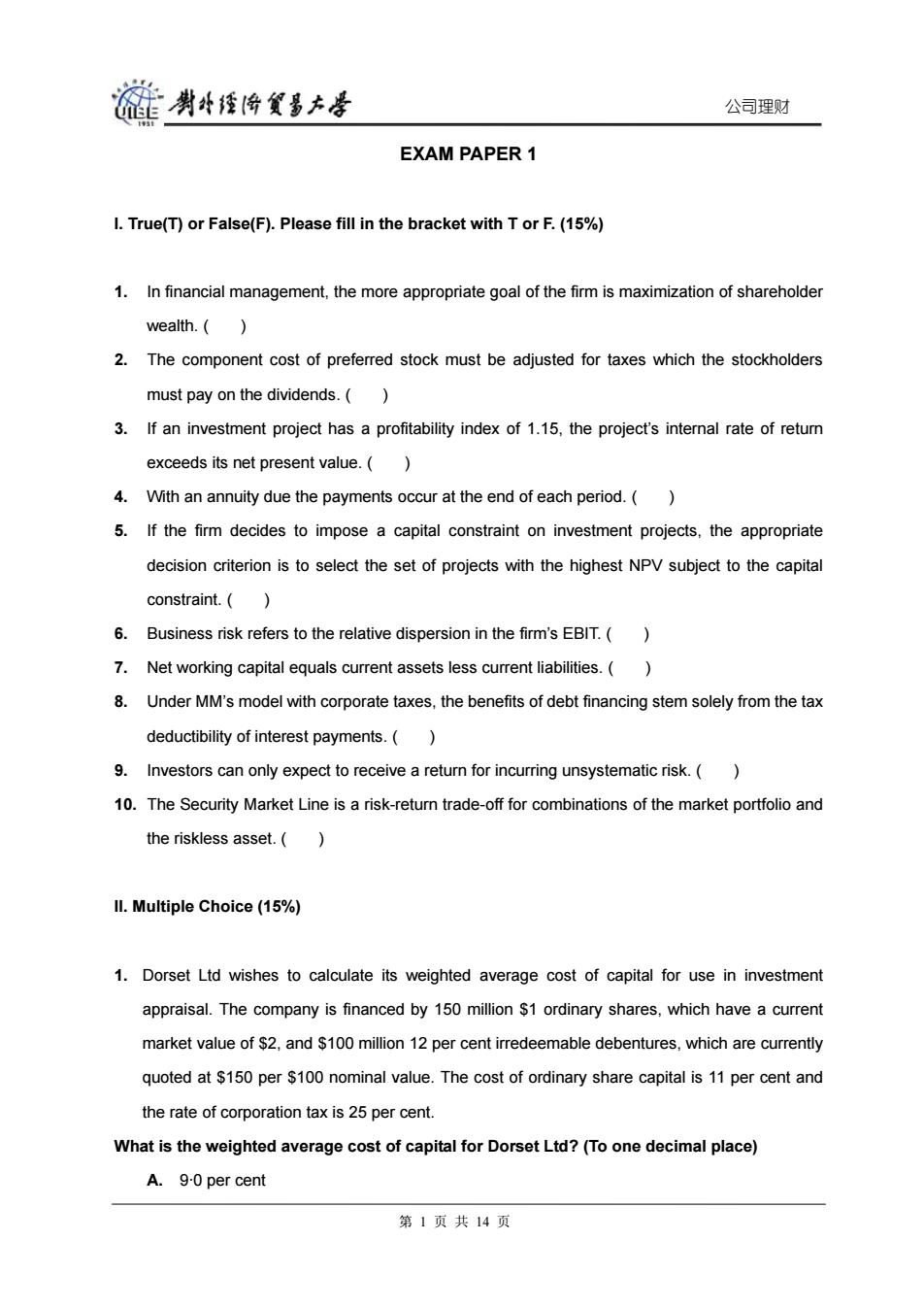

裢贵华经将贸墨去是 公司理财 EXAM PAPER 1 I.True(T)or False(F).Please fill in the bracket with T or F.(15%) 1.In financial management,the more appropriate goal of the firm is maximization of shareholder wealth.( 2.The component cost of preferred stock must be adjusted for taxes which the stockholders must pay on the dividends.( 3.If an investment project has a profitability index of 1.15,the project's internal rate of return exceeds its net present value.( 4.With an annuity due the payments occur at the end of each period. 5.If the firm decides to impose a capital constraint on investment projects,the appropriate decision criterion is to select the set of projects with the highest NPV subject to the capital constraint.() 6.Business risk refers to the relative dispersion in the firm's EBIT.( 7.Net working capital equals current assets less current liabilities.( 8.Under MM's model with corporate taxes,the benefits of debt financing stem solely from the tax deductibility of interest payments.( 9.Investors can only expect to receive a return for incurring unsystematic risk.( 10.The Security Market Line is a risk-return trade-off for combinations of the market portfolio and the riskless asset. Il.Multiple Choice(15%) 1.Dorset Ltd wishes to calculate its weighted average cost of capital for use in investment appraisal.The company is financed by 150 million $1 ordinary shares,which have a current market value of $2,and $100 million 12 per cent irredeemable debentures,which are currently quoted at $150 per $100 nominal value.The cost of ordinary share capital is 11 per cent and the rate of corporation tax is 25 per cent. What is the weighted average cost of capital for Dorset Ltd?(To one decimal place) A.9-0 per cent 第1页共14页公司理财 EXAM PAPER 1 I. True(T) or False(F). Please fill in the bracket with T or F. (15%) 1. In financial management, the more appropriate goal of the firm is maximization of shareholder wealth. ( ) 2. The component cost of preferred stock must be adjusted for taxes which the stockholders must pay on the dividends. ( ) 3. If an investment project has a profitability index of 1.15, the project’s internal rate of return exceeds its net present value. ( ) 4. With an annuity due the payments occur at the end of each period. ( ) 5. If the firm decides to impose a capital constraint on investment projects, the appropriate decision criterion is to select the set of projects with the highest NPV subject to the capital constraint. ( ) 6. Business risk refers to the relative dispersion in the firm’s EBIT. ( ) 7. Net working capital equals current assets less current liabilities. ( ) 8. Under MM’s model with corporate taxes, the benefits of debt financing stem solely from the tax deductibility of interest payments. ( ) 9. Investors can only expect to receive a return for incurring unsystematic risk. ( ) 10. The Security Market Line is a risk-return trade-off for combinations of the market portfolio and the riskless asset. ( ) II. Multiple Choice (15%) 1. Dorset Ltd wishes to calculate its weighted average cost of capital for use in investment appraisal. The company is financed by 150 million $1 ordinary shares, which have a current market value of $2, and $100 million 12 per cent irredeemable debentures, which are currently quoted at $150 per $100 nominal value. The cost of ordinary share capital is 11 per cent and the rate of corporation tax is 25 per cent. What is the weighted average cost of capital for Dorset Ltd? (To one decimal place) A. 9·0 per cent 第 1 页 共 14 页