正在加载图片...

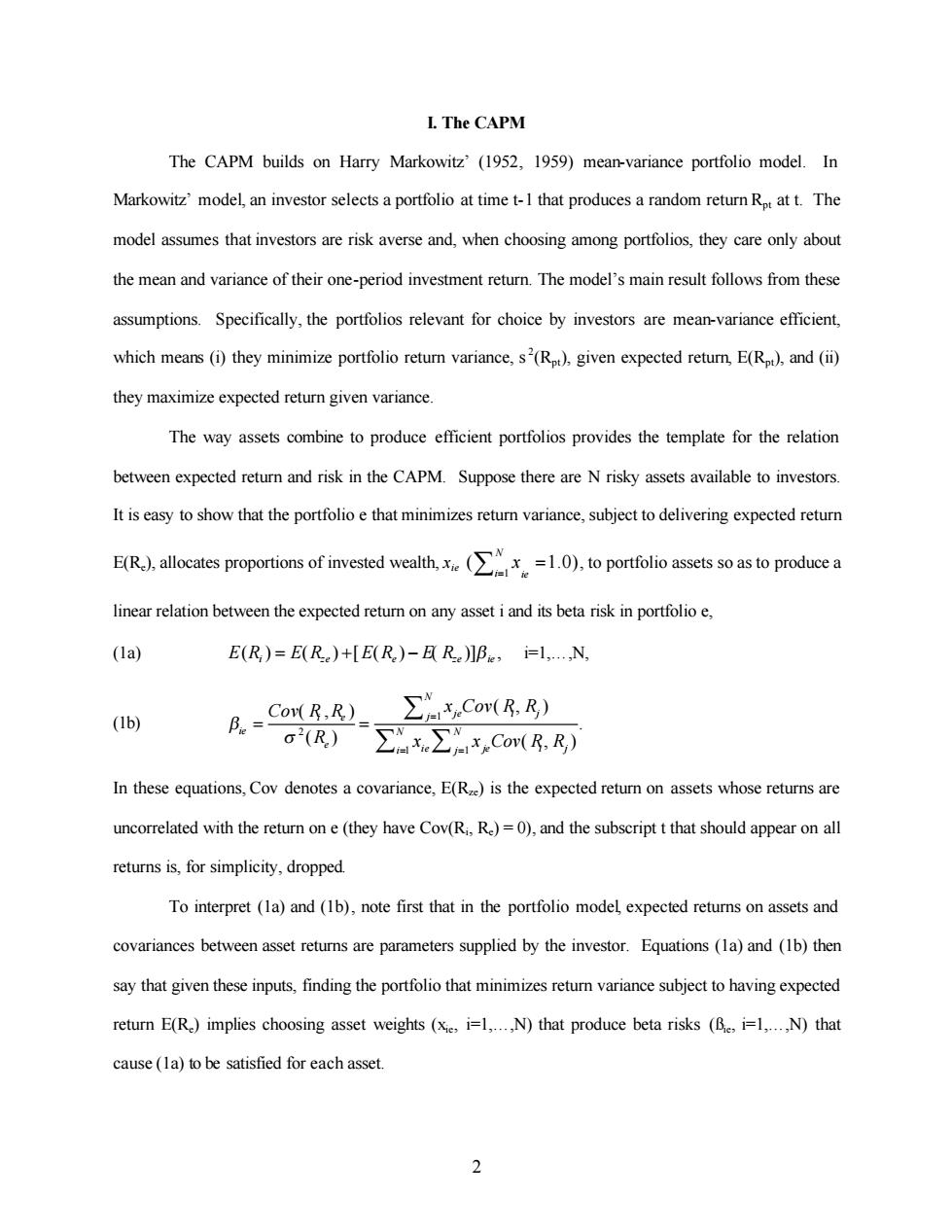

I.The CAPM The CAPM builds on Harry Markowitz'(1952,1959)mean-variance portfolio model.In Markowitz'model,an investor selects a portfolio at time t-I that produces a random return Rt at t.The model assumes that investors are risk averse and,when choosing among portfolios,they care only about the mean and variance of their one-period investment return.The model's main result follows from these assumptions.Specifically,the portfolios relevant for choice by investors are mean-variance efficient. which means(i)they minimize portfolio return variance,s(Rpt),given expected return,E(Rpt),and(i) they maximize expected return given variance. The way assets combine to produce efficient portfolios provides the template for the relation between expected return and risk in the CAPM.Suppose there are N risky assets available to investors. It is easy to show that the portfolio e that minimizes return variance,subject to delivering expected return E(R)allocates proportions of invested wealth(1.0).toportfolioassets soas toproducea linear relation between the expected return on any asset i and its beta risk in portfolio e, (1a E(R)=E(R)+[E(R)-E R)]Bi,i=1,...N, (1b) Cov(R,R) Cov(B.R) σ2(R) ∑x∑x,Cor(R,R) In these equations,Cov denotes a covariance,E(R)is the expected return on assets whose returns are uncorrelated with the return on e(they have Cov(Ri,R)=0),and the subscript t that should appear on all returns is,for simplicity,dropped. To interpret (la)and (1b),note first that in the portfolio model expected returns on assets and covariances between asset returns are parameters supplied by the investor.Equations (1a)and (1b)then say that given these inputs,finding the portfolio that minimizes return variance subject to having expected return E(R)implies choosing asset weights (xie,i=1,...,N)that produce beta risks (B,i=1,...,N)that cause(la)to be satisfied for each asset. 22 I. The CAPM The CAPM builds on Harry Markowitz’ (1952, 1959) mean-variance portfolio model. In Markowitz’ model, an investor selects a portfolio at time t-1 that produces a random return Rpt at t. The model assumes that investors are risk averse and, when choosing among portfolios, they care only about the mean and variance of their one-period investment return. The model’s main result follows from these assumptions. Specifically, the portfolios relevant for choice by investors are mean-variance efficient, which means (i) they minimize portfolio return variance, s 2 (Rpt), given expected return, E(Rpt), and (ii) they maximize expected return given variance. The way assets combine to produce efficient portfolios provides the template for the relation between expected return and risk in the CAPM. Suppose there are N risky assets available to investors. It is easy to show that the portfolio e that minimizes return variance, subject to delivering expected return E(Re), allocates proportions of invested wealth, xie 1 ( 1.0) N i ie x = å = , to portfolio assets so as to produce a linear relation between the expected return on any asset i and its beta risk in portfolio e, (1a) ( ) ( ) [ ( ) ( )] , E Ri =+- E Rze E Re E Rze bie i=1,…,N, (1b) 1 2 1 1 ( , ) (,) . ( ) ( , ) N je i j i e j ie N N e ie je i j i j CovRR x CovRR R x x CovRR b s = = = = = å å å In these equations, Cov denotes a covariance, E(Rze) is the expected return on assets whose returns are uncorrelated with the return on e (they have Cov(Ri , Re) = 0), and the subscript t that should appear on all returns is, for simplicity, dropped. To interpret (1a) and (1b), note first that in the portfolio model, expected returns on assets and covariances between asset returns are parameters supplied by the investor. Equations (1a) and (1b) then say that given these inputs, finding the portfolio that minimizes return variance subject to having expected return E(Re) implies choosing asset weights (xie, i=1,…,N) that produce beta risks (ßie, i=1,…,N) that cause (1a) to be satisfied for each asset