正在加载图片...

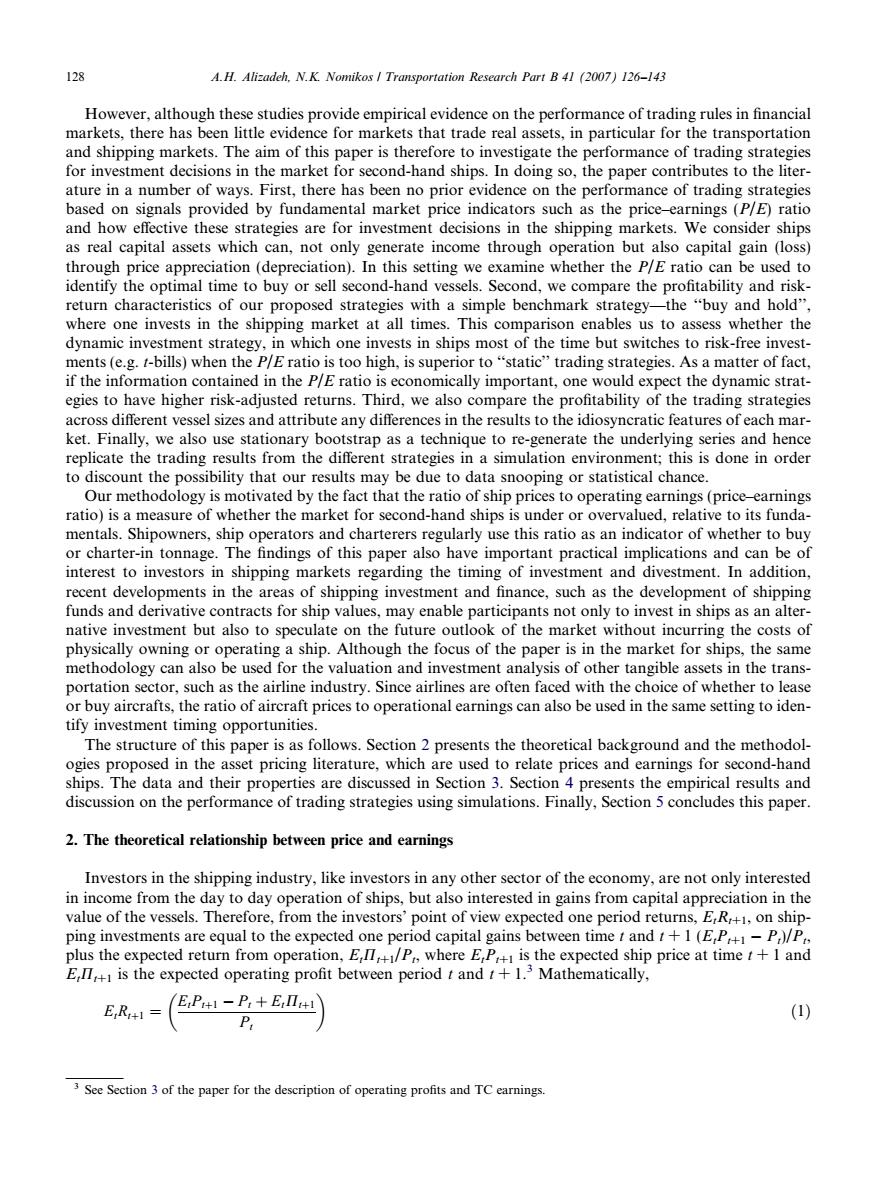

128 A.H.Alizadeh.N.K.Nomikos Transportation Research Part B 41 (2007)126-143 However,although these studies provide empirical evidence on the performance of trading rules in financial markets,there has been little evidence for markets that trade real assets,in particular for the transportation and shipping markets.The aim of this paper is therefore to investigate the performance of trading strategies for investment decisions in the market for second-hand ships.In doing so,the paper contributes to the liter- ature in a number of ways.First,there has been no prior evidence on the performance of trading strategies based on signals provided by fundamental market price indicators such as the price-earnings (P/E)ratio and how effective these strategies are for investment decisions in the shipping markets.We consider ships as real capital assets which can,not only generate income through operation but also capital gain (loss) through price appreciation(depreciation).In this setting we examine whether the P/E ratio can be used to identify the optimal time to buy or sell second-hand vessels.Second,we compare the profitability and risk- return characteristics of our proposed strategies with a simple benchmark strategy-the "buy and hold", where one invests in the shipping market at all times.This comparison enables us to assess whether the dynamic investment strategy,in which one invests in ships most of the time but switches to risk-free invest- ments(e.g.t-bills)when the P/E ratio is too high,is superior to "static"trading strategies.As a matter of fact, if the information contained in the P/E ratio is economically important,one would expect the dynamic strat- egies to have higher risk-adjusted returns.Third,we also compare the profitability of the trading strategies across different vessel sizes and attribute any differences in the results to the idiosyncratic features of each mar- ket.Finally,we also use stationary bootstrap as a technique to re-generate the underlying series and hence replicate the trading results from the different strategies in a simulation environment;this is done in order to discount the possibility that our results may be due to data snooping or statistical chance. Our methodology is motivated by the fact that the ratio of ship prices to operating earnings(price-earnings ratio)is a measure of whether the market for second-hand ships is under or overvalued,relative to its funda- mentals.Shipowners,ship operators and charterers regularly use this ratio as an indicator of whether to buy or charter-in tonnage.The findings of this paper also have important practical implications and can be of interest to investors in shipping markets regarding the timing of investment and divestment.In addition, recent developments in the areas of shipping investment and finance,such as the development of shipping funds and derivative contracts for ship values,may enable participants not only to invest in ships as an alter- native investment but also to speculate on the future outlook of the market without incurring the costs of physically owning or operating a ship.Although the focus of the paper is in the market for ships,the same methodology can also be used for the valuation and investment analysis of other tangible assets in the trans- portation sector,such as the airline industry.Since airlines are often faced with the choice of whether to lease or buy aircrafts,the ratio of aircraft prices to operational earnings can also be used in the same setting to iden- tify investment timing opportunities. The structure of this paper is as follows.Section 2 presents the theoretical background and the methodol- ogies proposed in the asset pricing literature,which are used to relate prices and earnings for second-hand ships.The data and their properties are discussed in Section 3.Section 4 presents the empirical results and discussion on the performance of trading strategies using simulations.Finally,Section 5 concludes this paper. 2.The theoretical relationship between price and earnings Investors in the shipping industry,like investors in any other sector of the economy,are not only interested in income from the day to day operation of ships,but also interested in gains from capital appreciation in the value of the vessels.Therefore,from the investors'point of view expected one period returns,E,R+1,on ship- ping investments are equal to the expected one period capital gains between time t and t+1(E,P+-P,)/P, plus the expected return from operation,E,/P,where E,P+is the expected ship price at time t+1 and E,I+is the expected operating profit between period t and t+1.3 Mathematically, E,R+1= EP+l-P,+E,Ⅱ4l P (1) 3 See Section 3 of the paper for the description of operating profits and TC earnings.However, although these studies provide empirical evidence on the performance of trading rules in financial markets, there has been little evidence for markets that trade real assets, in particular for the transportation and shipping markets. The aim of this paper is therefore to investigate the performance of trading strategies for investment decisions in the market for second-hand ships. In doing so, the paper contributes to the literature in a number of ways. First, there has been no prior evidence on the performance of trading strategies based on signals provided by fundamental market price indicators such as the price–earnings (P/E) ratio and how effective these strategies are for investment decisions in the shipping markets. We consider ships as real capital assets which can, not only generate income through operation but also capital gain (loss) through price appreciation (depreciation). In this setting we examine whether the P/E ratio can be used to identify the optimal time to buy or sell second-hand vessels. Second, we compare the profitability and riskreturn characteristics of our proposed strategies with a simple benchmark strategy—the ‘‘buy and hold’’, where one invests in the shipping market at all times. This comparison enables us to assess whether the dynamic investment strategy, in which one invests in ships most of the time but switches to risk-free investments (e.g. t-bills) when the P/E ratio is too high, is superior to ‘‘static’’ trading strategies. As a matter of fact, if the information contained in the P/E ratio is economically important, one would expect the dynamic strategies to have higher risk-adjusted returns. Third, we also compare the profitability of the trading strategies across different vessel sizes and attribute any differences in the results to the idiosyncratic features of each market. Finally, we also use stationary bootstrap as a technique to re-generate the underlying series and hence replicate the trading results from the different strategies in a simulation environment; this is done in order to discount the possibility that our results may be due to data snooping or statistical chance. Our methodology is motivated by the fact that the ratio of ship prices to operating earnings (price–earnings ratio) is a measure of whether the market for second-hand ships is under or overvalued, relative to its fundamentals. Shipowners, ship operators and charterers regularly use this ratio as an indicator of whether to buy or charter-in tonnage. The findings of this paper also have important practical implications and can be of interest to investors in shipping markets regarding the timing of investment and divestment. In addition, recent developments in the areas of shipping investment and finance, such as the development of shipping funds and derivative contracts for ship values, may enable participants not only to invest in ships as an alternative investment but also to speculate on the future outlook of the market without incurring the costs of physically owning or operating a ship. Although the focus of the paper is in the market for ships, the same methodology can also be used for the valuation and investment analysis of other tangible assets in the transportation sector, such as the airline industry. Since airlines are often faced with the choice of whether to lease or buy aircrafts, the ratio of aircraft prices to operational earnings can also be used in the same setting to identify investment timing opportunities. The structure of this paper is as follows. Section 2 presents the theoretical background and the methodologies proposed in the asset pricing literature, which are used to relate prices and earnings for second-hand ships. The data and their properties are discussed in Section 3. Section 4 presents the empirical results and discussion on the performance of trading strategies using simulations. Finally, Section 5 concludes this paper. 2. The theoretical relationship between price and earnings Investors in the shipping industry, like investors in any other sector of the economy, are not only interested in income from the day to day operation of ships, but also interested in gains from capital appreciation in the value of the vessels. Therefore, from the investors’ point of view expected one period returns, EtRt+1, on shipping investments are equal to the expected one period capital gains between time t and t +1(EtPt+1 Pt)/Pt, plus the expected return from operation, EtPt+1/Pt, where EtPt+1 is the expected ship price at time t + 1 and EtPt+1 is the expected operating profit between period t and t + 1.3 Mathematically, EtRtþ1 ¼ EtPtþ1 Pt þ EtPtþ1 Pt ð1Þ 3 See Section 3 of the paper for the description of operating profits and TC earnings. 128 A.H. Alizadeh, N.K. Nomikos / Transportation Research Part B 41 (2007) 126–143����