正在加载图片...

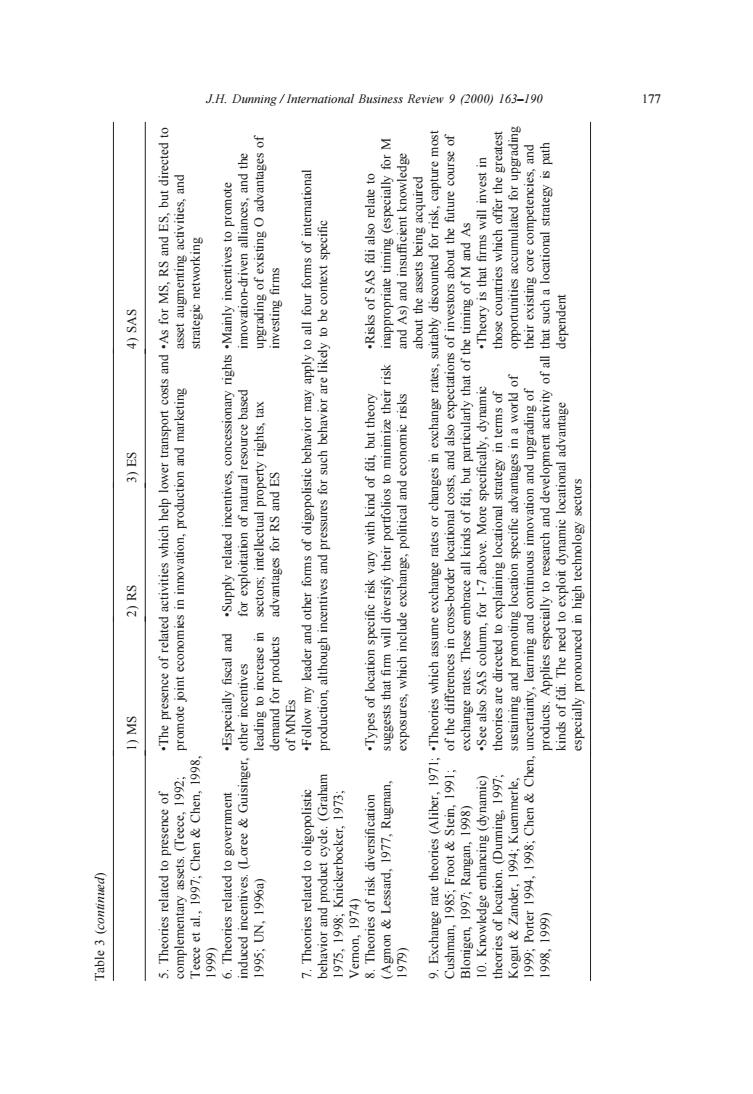

J.H.Du iness iew92000163-190 177 ¥ pue u pue uu 8°。 J.H. Dunning / International Business Review 9 (2000) 163–190 177 Table 3 (continued) 1) MS 2) RS 3) ES 4) SAS 5. Theories related to presence of •The presence of related activities which help lower transport costs and •As for MS, RS and ES, but directed to complementary assets. (Teece, 1992; promote joint economies in innovation, production and marketing asset augmenting activities, and Teece et al., 1997; Chen & Chen, 1998, strategic networking 1999) 6. Theories related to government •Especially fiscal and •Supply related incentives, concessionary rights •Mainly incentives to promote induced incentives. (Loree & Guisinger, other incentives for exploitation of natural resource based innovation-driven alliances, and the 1995; UN, 1996a) leading to increase in sectors; intellectual property rights, tax upgrading of existing O advantages of demand for products advantages for RS and ES investing firms of MNEs 7. Theories related to oligopolistic •Follow my leader and other forms of oligopolistic behavior may apply to all four forms of international behavior and product cycle. (Graham production, although incentives and pressures for such behavior are likely to be context specific 1975, 1998; Knickerbocker, 1973; Vernon, 1974) 8. Theories of risk diversification •Types of location specific risk vary with kind of fdi, but theory •Risks of SAS fdi also relate to (Agmon & Lessard, 1977, Rugman, suggests that firm will diversify their portfolios to minimize their risk inappropriate timing (especially for M 1979) exposures, which include exchange, political and economic risks and As) and insufficient knowledge about the assets being acquired 9. Exchange rate theories (Aliber, 1971; •Theories which assume exchange rates or changes in exchange rates, suitably discounted for risk, capture most Cushman, 1985; Froot & Stein, 1991; of the differences in cross-border locational costs, and also expectations of investors about the future course of Blonigen, 1997; Rangan, 1998) exchange rates. These embrace all kinds of fdi, but particularly that of the timing of M and As 10. Knowledge enhancing (dynamic) •See also SAS column, for 1-7 above. More specifically, dynamic •Theory is that firms will invest in theories of location. (Dunning, 1997; theories are directed to explaining locational strategy in terms of those countries which offer the greatest Kogut & Zander, 1994; Kuemmerle, sustaining and promoting location specific advantages in a world of opportunities accumulated for upgrading 1999; Porter 1994, 1998; Chen & Chen, uncertainty, learning and continuous innovation and upgrading of their existing core competencies, and 1998, 1999) products. Applies especially to research and development activity of all that such a locational strategy is path kinds of fdi. The need to exploit dynamic locational advantage dependent especially pronounced in high technology sectors