正在加载图片...

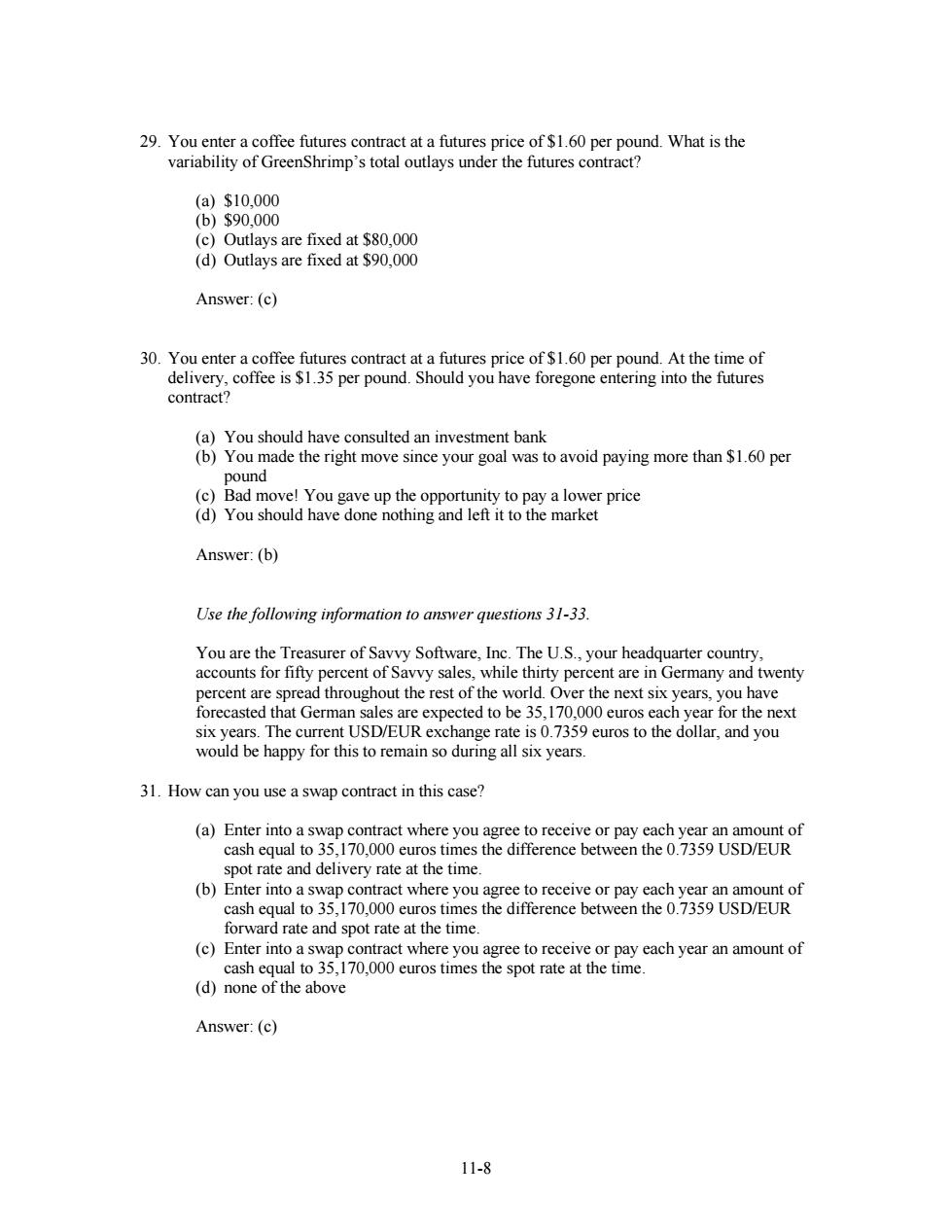

29.You enter a coffee futures contract at a futures price of $1.60 per pound.What is the variability of GreenShrimp's total outlays under the futures contract? (a)$10,000 (b)$90.000 (c)Outlays are fixed at $80,000 (d)Outlays are fixed at $90,000 Answer:(c) 30.You enter a coffee futures contract at a futures price of $1.60 per pound.At the time of delivery,coffee is $1.35 per pound.Should you have foregone entering into the futures contract? (a)You should have consulted an investment bank (b)You made the right move since your goal was to avoid paying more than $1.60 per pound (c)Bad move!You gave up the opportunity to pay a lower price (d)You should have done nothing and left it to the market Answer:(b) Use the following information to answer questions 31-33. You are the Treasurer of Savvy Software,Inc.The U.S.,your headquarter country, accounts for fifty percent of Savvy sales,while thirty percent are in Germany and twenty percent are spread throughout the rest of the world.Over the next six years,you have forecasted that German sales are expected to be 35,170,000 euros each year for the next six years.The current USD/EUR exchange rate is 0.7359 euros to the dollar,and you would be happy for this to remain so during all six years. 31.How can you use a swap contract in this case? (a)Enter into a swap contract where you agree to receive or pay each year an amount of cash equal to 35,170,000 euros times the difference between the 0.7359 USD/EUR spot rate and delivery rate at the time. (b)Enter into a swap contract where you agree to receive or pay each year an amount of cash equal to 35,170,000 euros times the difference between the 0.7359 USD/EUR forward rate and spot rate at the time. (c)Enter into a swap contract where you agree to receive or pay each year an amount of cash equal to 35,170,000 euros times the spot rate at the time. (d)none of the above Answer:(c) 11-811-8 29. You enter a coffee futures contract at a futures price of $1.60 per pound. What is the variability of GreenShrimp’s total outlays under the futures contract? (a) $10,000 (b) $90,000 (c) Outlays are fixed at $80,000 (d) Outlays are fixed at $90,000 Answer: (c) 30. You enter a coffee futures contract at a futures price of $1.60 per pound. At the time of delivery, coffee is $1.35 per pound. Should you have foregone entering into the futures contract? (a) You should have consulted an investment bank (b) You made the right move since your goal was to avoid paying more than $1.60 per pound (c) Bad move! You gave up the opportunity to pay a lower price (d) You should have done nothing and left it to the market Answer: (b) Use the following information to answer questions 31-33. You are the Treasurer of Savvy Software, Inc. The U.S., your headquarter country, accounts for fifty percent of Savvy sales, while thirty percent are in Germany and twenty percent are spread throughout the rest of the world. Over the next six years, you have forecasted that German sales are expected to be 35,170,000 euros each year for the next six years. The current USD/EUR exchange rate is 0.7359 euros to the dollar, and you would be happy for this to remain so during all six years. 31. How can you use a swap contract in this case? (a) Enter into a swap contract where you agree to receive or pay each year an amount of cash equal to 35,170,000 euros times the difference between the 0.7359 USD/EUR spot rate and delivery rate at the time. (b) Enter into a swap contract where you agree to receive or pay each year an amount of cash equal to 35,170,000 euros times the difference between the 0.7359 USD/EUR forward rate and spot rate at the time. (c) Enter into a swap contract where you agree to receive or pay each year an amount of cash equal to 35,170,000 euros times the spot rate at the time. (d) none of the above Answer: (c)