正在加载图片...

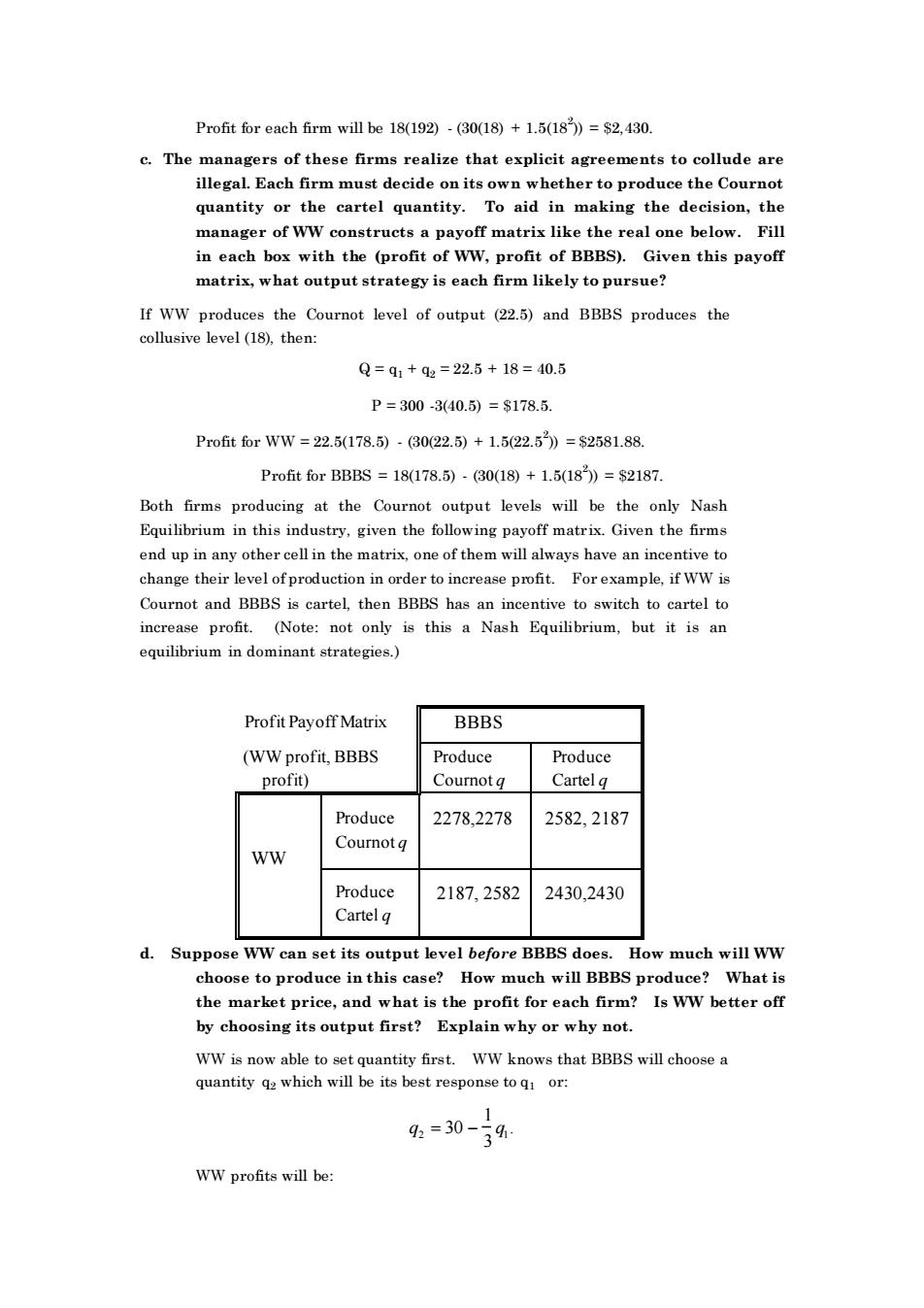

Profit for each firm will be 18(192)-(30(18)+1.5(18)=$2,430 c.The managers of these firms realize that explicit agreements to collude are illegal.Each firm must ecide n it whethert pr ce the quantity or the cartel quantity.To aid in making the decision,th manager of WW constructs a payoff matrix like the real one below.Fill in each box with the (profit of WW,profit of BBBS).Given this payoff matrix,what output strategy is each firm likely to pursue? If WW produces the Cournot level of output (225)and BBBS produces the (18).then Q=91+qe=22.5+18=40.5 P=300-340.5)=8178.5. Profit for WW=22.5(178.5)·(30(22.5)+1.522.5》=$2581.88. Profit for BBBS=18(178.5).30(18)+1.5185)=s2187. Both firms producing at the Cournot output levels will be the only Nash Equilibrium in this industry,given the following payoff matrix.Given the firms end up in any other cell in the matrix,one of them will always have an incentive to change their level ofproduction in order to increase profit.For example,if WW is Cournot and BBBS is cartel,then BBBS has an incentive to switch to cartel to increase profit. (Note:not only is this a Nash Equilibrium,but it is an equilibrium in dominant strategies.) Profit Payoff Matrix BBBS (WW profit.BBBS Produce Produce profit) Cartelg Produce 2278,2278 2582,2187 Cournot o Produce 2187,2582 2430,2430 Cartel g d.Suppose WW can set its output level before BBBS does.How much will Ww choose to produce in this case?How much will BBBS produce?What is the market price,and what is the profit for each firm?Is WW better off by che ing its s output first? Explain why or why not WW is now able to WW knows that BBBS will choose quantity g w response toqor 2=30-794 WW profits will be:Profit for each firm will be 18(192) - (30(18) + 1.5(182 )) = $2,430. c. The managers of these firms realize that explicit agreements to collude are illegal. Each firm must decide on its own whether to produce the Cournot quantity or the cartel quantity. To aid in making the decision, the manager of WW constructs a payoff matrix like the real one below. Fill in each box with the (profit of WW, profit of BBBS). Given this payoff matrix, what output strategy is each firm likely to pursue? If WW produces the Cournot level of output (22.5) and BBBS produces the collusive level (18), then: Q = q1 + q2 = 22.5 + 18 = 40.5 P = 300 -3(40.5) = $178.5. Profit for WW = 22.5(178.5) - (30(22.5) + 1.5(22.52 )) = $2581.88. Profit for BBBS = 18(178.5) - (30(18) + 1.5(182 )) = $2187. Both firms producing at the Cournot output levels will be the only Nash Equilibrium in this industry, given the following payoff matrix. Given the firms end up in any other cell in the matrix, one of them will always have an incentive to change their level of production in order to increase profit. For example, if WW is Cournot and BBBS is cartel, then BBBS has an incentive to switch to cartel to increase profit. (Note: not only is this a Nash Equilibrium, but it is an equilibrium in dominant strategies.) Profit Payoff Matrix BBBS (WW profit, BBBS profit) Produce Cournot q Produce Cartel q WW Produce Cournot q 2278,2278 2582, 2187 Produce Cartel q 2187, 2582 2430,2430 d. Suppose WW can set its output level before BBBS does. How much will WW choose to produce in this case? How much will BBBS produce? What is the market price, and what is the profit for each firm? Is WW better off by choosing its output first? Explain why or why not. WW is now able to set quantity first. WW knows that BBBS will choose a quantity q2 which will be its best response to q1 or: q2 = 30 − 1 3 q1 . WW profits will be: