正在加载图片...

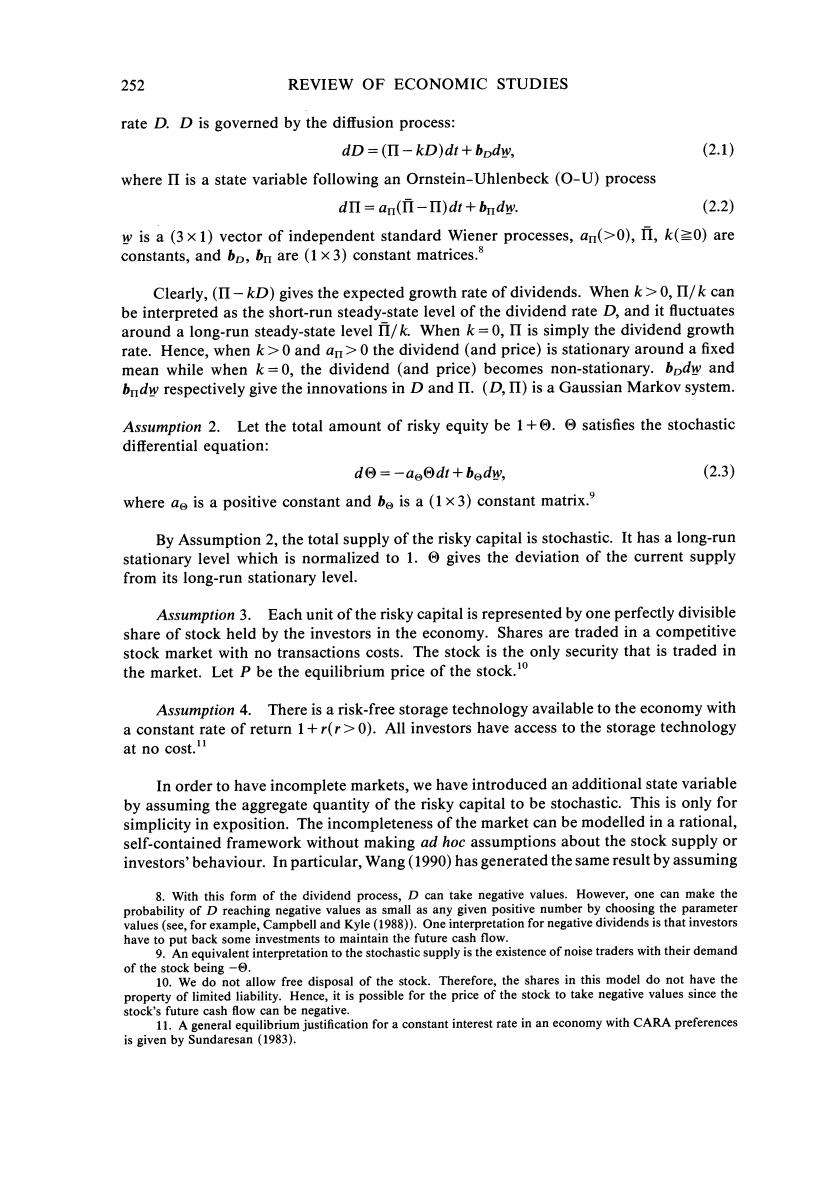

252 REVIEW OF ECONOMIC STUDIES rate D.D is governed by the diffusion process: dD=(II-kD)dt+bpdw, (2.1) where II is a state variable following an Ornstein-Uhlenbeck(O-U)process dΠ=an(n-Π)dt+bmdw. (2.2) w is a (3x1)vector of independent standard Wiener processes,an(>0),II,k(=0)are constants,and bp,bn are (1 x 3)constant matrices.3 Clearly,(II-kD)gives the expected growth rate of dividends.When k>0,II/k can be interpreted as the short-run steady-state level of the dividend rate D,and it fluctuates around a long-run steady-state level II/k.When k=0,II is simply the dividend growth rate.Hence,when k>0 and an>0 the dividend (and price)is stationary around a fixed mean while when k=0,the dividend (and price)becomes non-stationary.bpdw and bndw respectively give the innovations in D and II.(D,II)is a Gaussian Markov system. Assumption 2.Let the total amount of risky equity be 1+0.satisfies the stochastic differential equation: do=-ao⊙dt+badw, (2.3) where ae is a positive constant and be is a(1 x3)constant matrix. By Assumption 2,the total supply of the risky capital is stochastic.It has a long-run stationary level which is normalized to 1.gives the deviation of the current supply from its long-run stationary level. Assumption 3.Each unit of the risky capital is represented by one perfectly divisible share of stock held by the investors in the economy.Shares are traded in a competitive stock market with no transactions costs.The stock is the only security that is traded in the market.Let P be the equilibrium price of the stock.10 Assumption 4.There is a risk-free storage technology available to the economy with a constant rate of return 1+r(r>0).All investors have access to the storage technology at no cost.1 In order to have incomplete markets,we have introduced an additional state variable by assuming the aggregate quantity of the risky capital to be stochastic.This is only for simplicity in exposition.The incompleteness of the market can be modelled in a rational, self-contained framework without making ad hoc assumptions about the stock supply or investors'behaviour.In particular,Wang(1990)has generated the same result by assuming 8.With this form of the dividend process,D can take negative values.However,one can make the probability of D reaching negative values as small as any given positive number by choosing the parameter values(see,for example,Campbell and Kyle(1988)).One interpretation for negative dividends is that investors have to put back some investments to maintain the future cash flow. 9.An equivalent interpretation to the stochastic supply is the existence of noise traders with their demand of the stock being - 10.We do not allow free disposal of the stock.Therefore,the shares in this model do not have the property of limited liability.Hence,it is possible for the price of the stock to take negative values since the stock's future cash flow can be negative. 11.A general equilibrium justification for a constant interest rate in an economy with CARA preferences is given by Sundaresan (1983)