正在加载图片...

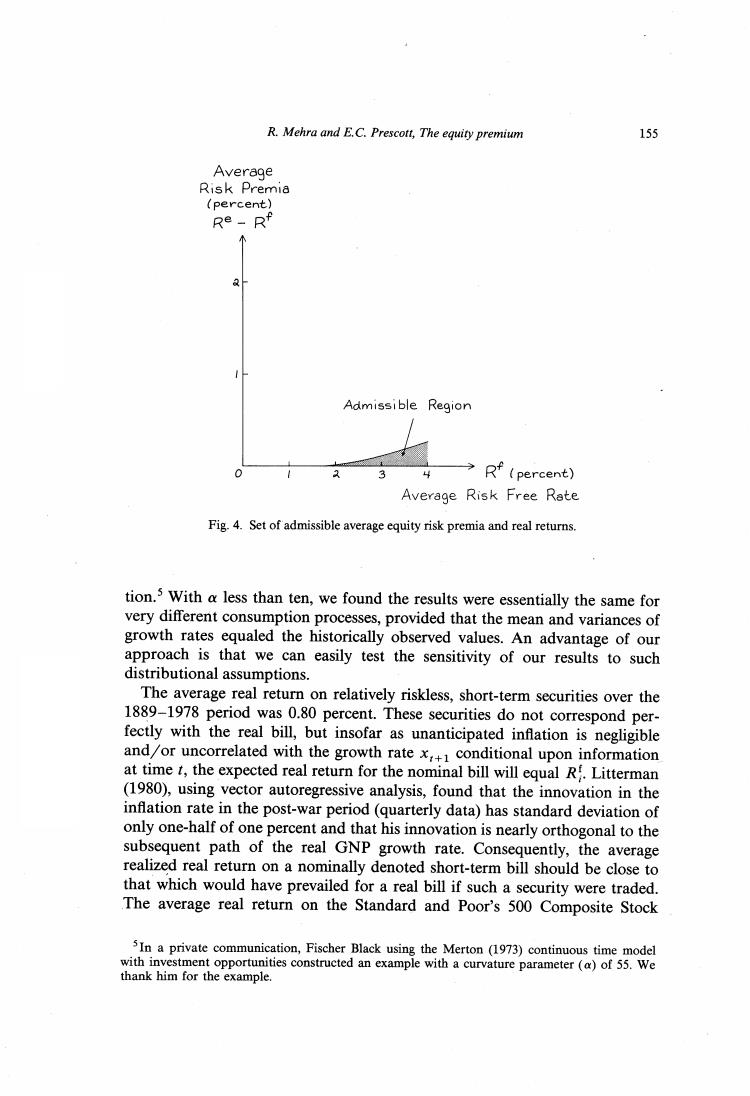

R.Mehra and E.C.Prescott,The equity premium 155 Average Risk Premia (percent) Re-R Admissible Region -Rf (percent) Average Risk Free Rate Fig.4.Set of admissible average equity risk premia and real returns. tion.5 With a less than ten,we found the results were essentially the same for very different consumption processes,provided that the mean and variances of growth rates equaled the historically observed values.An advantage of our approach is that we can easily test the sensitivity of our results to such distributional assumptions. The average real return on relatively riskless,short-term securities over the 1889-1978 period was 0.80 percent.These securities do not correspond per- fectly with the real bill,but insofar as unanticipated inflation is negligible and /or uncorrelated with the growth rate x,+1 conditional upon information at time t,the expected real return for the nominal bill will equal Rf.Litterman (1980),using vector autoregressive analysis,found that the innovation in the inflation rate in the post-war period(quarterly data)has standard deviation of only one-half of one percent and that his innovation is nearly orthogonal to the subsequent path of the real GNP growth rate.Consequently,the average realized real return on a nominally denoted short-term bill should be close to that which would have prevailed for a real bill if such a security were traded. The average real return on the Standard and Poor's 500 Composite Stock 5In a private communication,Fischer Black using the Merton (1973)continuous time model with investment opportunities constructed an example with a curvature parameter (a)of 55.We thank him for the example