正在加载图片...

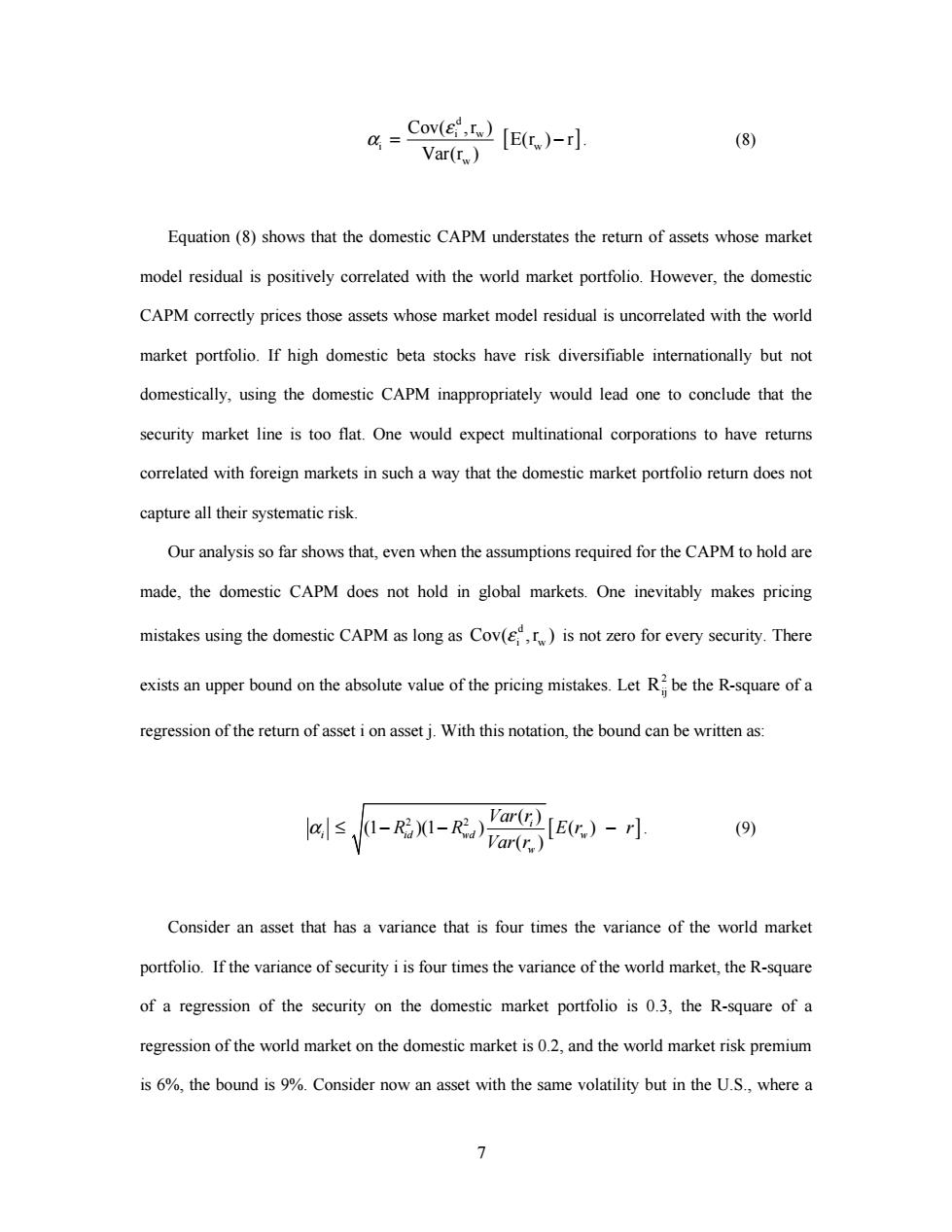

=Cov(e)[E()-r]. (8) Var(r) Equation(8)shows that the domestic CAPM understates the return of assets whose market model residual is positively correlated with the world market portfolio.However,the domestic CAPM correctly prices those assets whose market model residual is uncorrelated with the world market portfolio.If high domestic beta stocks have risk diversifiable internationally but not domestically,using the domestic CAPM inappropriately would lead one to conclude that the security market line is too flat.One would expect multinational corporations to have returns correlated with foreign markets in such a way that the domestic market portfolio return does not capture all their systematic risk. Our analysis so far shows that,even when the assumptions required for the CAPM to hold are made,the domestic CAPM does not hold in global markets.One inevitably makes pricing mistakes using the domestic CAPM as long as Cov()is not zero for every security.There exists an upper bound on the absolute value of the pricing mistakes.Let Rbe the R-square of a regression of the return of asset i on asset j.With this notation,the bound can be written as: 风≤-R-心E)-1 (9) Consider an asset that has a variance that is four times the variance of the world market portfolio.If the variance of security i is four times the variance of the world market,the R-square of a regression of the security on the domestic market portfolio is 0.3,the R-square of a regression of the world market on the domestic market is 0.2,and the world market risk premium is 6%,the bound is 9%.Consider now an asset with the same volatility but in the U.S.,where a 77 [ ] d i w i w w Cov( , r ) E(r ) r Var(r ) ε α = − . (8) Equation (8) shows that the domestic CAPM understates the return of assets whose market model residual is positively correlated with the world market portfolio. However, the domestic CAPM correctly prices those assets whose market model residual is uncorrelated with the world market portfolio. If high domestic beta stocks have risk diversifiable internationally but not domestically, using the domestic CAPM inappropriately would lead one to conclude that the security market line is too flat. One would expect multinational corporations to have returns correlated with foreign markets in such a way that the domestic market portfolio return does not capture all their systematic risk. Our analysis so far shows that, even when the assumptions required for the CAPM to hold are made, the domestic CAPM does not hold in global markets. One inevitably makes pricing mistakes using the domestic CAPM as long as d Cov( ,r ) i w ε is not zero for every security. There exists an upper bound on the absolute value of the pricing mistakes. Let 2 Rij be the R-square of a regression of the return of asset i on asset j. With this notation, the bound can be written as: [ ] 2 2 ( ) (1 )(1 ) ( ) ( ) i i id wd w w Var r R R Er r Var r α ≤− − − . (9) Consider an asset that has a variance that is four times the variance of the world market portfolio. If the variance of security i is four times the variance of the world market, the R-square of a regression of the security on the domestic market portfolio is 0.3, the R-square of a regression of the world market on the domestic market is 0.2, and the world market risk premium is 6%, the bound is 9%. Consider now an asset with the same volatility but in the U.S., where a