正在加载图片...

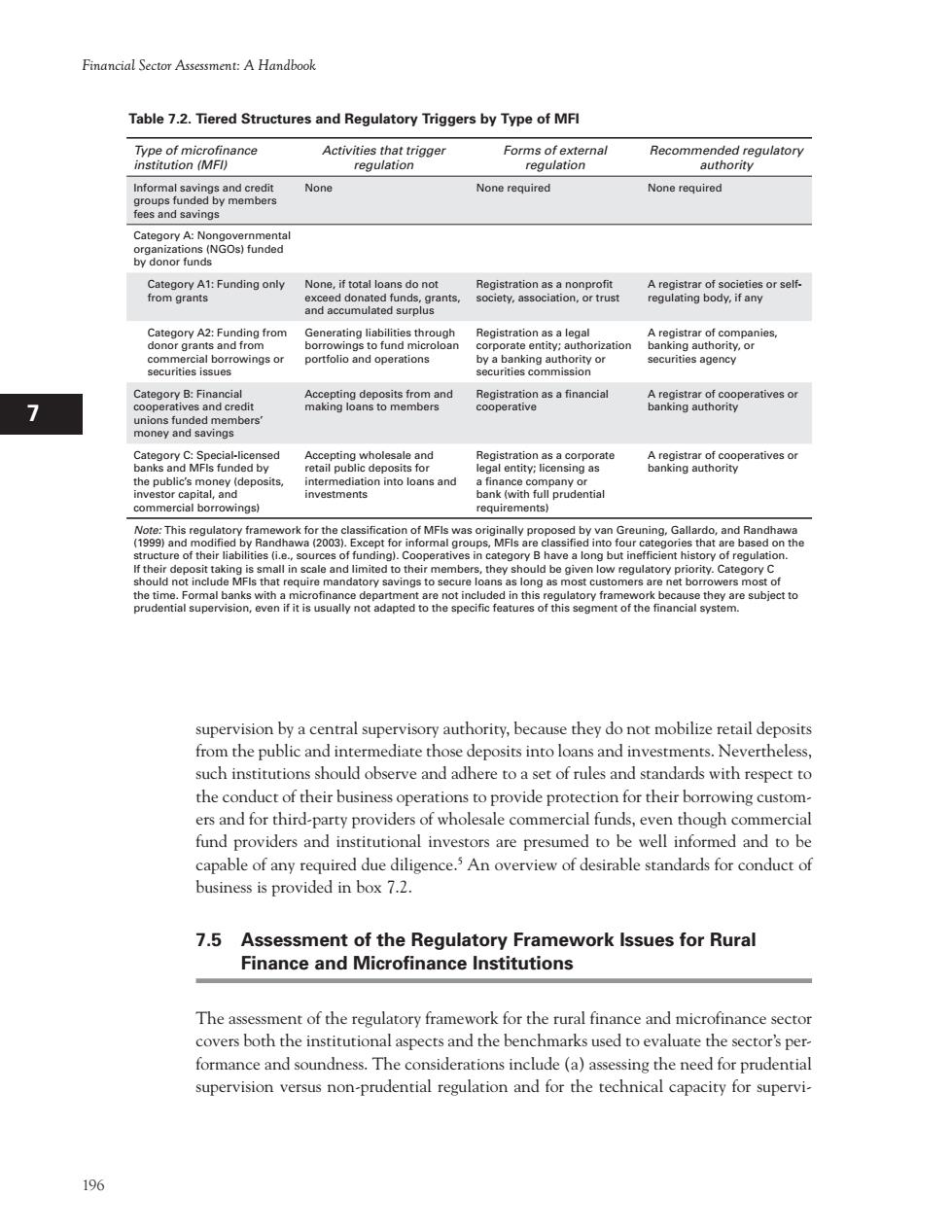

Financial Sector Assessment:A Handbook Table 7.2.Tiered Structures and Regulatory Triggers by Type of MFl Activities None None required None required None if total loans do not and cum ation A registrar of c com g8geoenend Category CSpeciaicnd wholesae and am8gaMoacpeatiresoy te on into loans and quirements work for the classi ally proposed by van Greuning,Galla rdo,and Rand habi fie sou undin gory B have a long but i ire man atory s re loa eintafopeheow8nrnigosancen8teaapeg0heopeehic98atOreeof2sa8gmetorthehancasiem ao supervision by a central supervisory authority,because they do not mobilize retail deposits from the public and intermediate those deposits into loans and investments.Nevertheless, such institutions should observe and adhere to a set of rules and standards with respect to the conduct of their business operations toprovide prorection for their borrowing custom er orhr-partypovefhmthuh fund providers and institutional investors are presumed to be well informed and to be capable of any required due diligence.An overview of desirable standards for conduct of business is provided in box 7.2. 7.5 Assessment of the Regulatory Framework Issues for Rural Finance and Microfinance Institutions The ass nt of the regulatory framework for the rural finance and microfinance secto covers both the institutional aspects and the benchmarks used to evaluate the sector's per formance and soundness.The considerations include(a)assessing the need for prudential supervision versus non-prudential regulation and for the technical capacity for supervi- 196196 Financial Sector Assessment: A Handbook 1 I H G F E D C B A 12 11 10 9 8 7 6 5 4 3 2 supervision by a central supervisory authority, because they do not mobilize retail deposits from the public and intermediate those deposits into loans and investments. Nevertheless, such institutions should observe and adhere to a set of rules and standards with respect to the conduct of their business operations to provide protection for their borrowing customers and for third-party providers of wholesale commercial funds, even though commercial fund providers and institutional investors are presumed to be well informed and to be capable of any required due diligence.5 An overview of desirable standards for conduct of business is provided in box 7.2. 7.5 Assessment of the Regulatory Framework Issues for Rural Finance and Microfinance Institutions The assessment of the regulatory framework for the rural finance and microfinance sector covers both the institutional aspects and the benchmarks used to evaluate the sector’s performance and soundness. The considerations include (a) assessing the need for prudential supervision versus non-prudential regulation and for the technical capacity for superviTable 7.2. Tiered Structures and Regulatory Triggers by Type of MFI Type of microfinance institution (MFI) Activities that trigger regulation Forms of external regulation Recommended regulatory authority Informal savings and credit groups funded by members fees and savings None None required None required Category A: Nongovernmental organizations (NGOs) funded by donor funds Category A1: Funding only from grants None, if total loans do not exceed donated funds, grants, and accumulated surplus Registration as a nonprofit society, association, or trust A registrar of societies or selfregulating body, if any Category A2: Funding from donor grants and from commercial borrowings or securities issues Generating liabilities through borrowings to fund microloan portfolio and operations Registration as a legal corporate entity; authorization by a banking authority or securities commission A registrar of companies, banking authority, or securities agency Category B: Financial cooperatives and credit unions funded members’ money and savings Accepting deposits from and making loans to members Registration as a financial cooperative A registrar of cooperatives or banking authority Category C: Special-licensed banks and MFIs funded by the public’s money (deposits, investor capital, and commercial borrowings) Accepting wholesale and retail public deposits for intermediation into loans and investments Registration as a corporate legal entity; licensing as a finance company or bank (with full prudential requirements) A registrar of cooperatives or banking authority Note: This regulatory framework for the classification of MFIs was originally proposed by van Greuning, Gallardo, and Randhawa (1999) and modified by Randhawa (2003). Except for informal groups, MFIs are classified into four categories that are based on the structure of their liabilities (i.e., sources of funding). Cooperatives in category B have a long but inefficient history of regulation. If their deposit taking is small in scale and limited to their members, they should be given low regulatory priority. Category C should not include MFIs that require mandatory savings to secure loans as long as most customers are net borrowers most of the time. Formal banks with a microfinance department are not included in this regulatory framework because they are subject to prudential supervision, even if it is usually not adapted to the specific features of this segment of the financial system