正在加载图片...

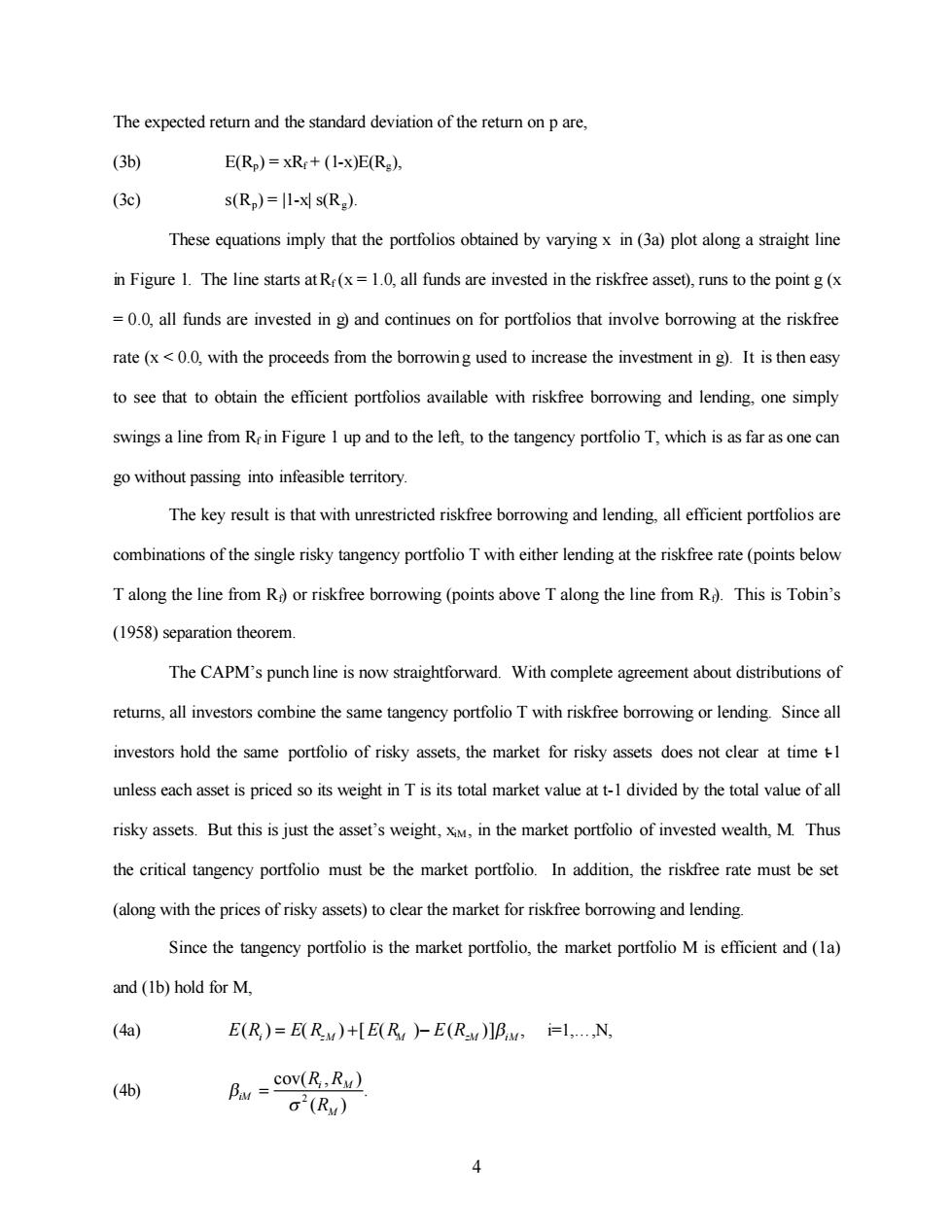

The expected return and the standard deviation of the return on p are, (3b) E(Rp)=xRr+(1-x)E(Rg), (3c) s(Rp)=1-x s(R2). These equations imply that the portfolios obtained by varying x in (3a)plot along a straight line in Figure 1.The line starts at Rr(x=1.0,all funds are invested in the riskfree asset),runs to the point g(x =0.0,all funds are invested in g)and continues on for portfolios that involve borrowing at the riskfree rate (x<0.0,with the proceeds from the borrowing used to increase the investment in g).It is then easy to see that to obtain the efficient portfolios available with riskfree borrowing and lending,one simply swings a line from Rr in Figure I up and to the left,to the tangency portfolio T,which is as far as one can go without passing into infeasible territory. The key result is that with unrestricted riskfree borrowing and lending,all efficient portfolios are combinations of the single risky tangency portfolio T with either lending at the riskfree rate(points below T along the line from R or riskfree borrowing(points above T along the line from R.This is Tobin's (1958)separation theorem. The CAPM's punch line is now straightforward.With complete agreement about distributions of returns,all investors combine the same tangency portfolio T with riskfree borrowing or lending.Since all investors hold the same portfolio of risky assets,the market for risky assets does not clear at time +I unless each asset is priced so its weight in T is its total market value at t-1 divided by the total value of all risky assets.But this is just the asset's weight,xiM,in the market portfolio of invested wealth,M.Thus the critical tangency portfolio must be the market portfolio.In addition,the riskfree rate must be set (along with the prices of risky assets)to clear the market for riskfree borrowing and lending Since the tangency portfolio is the market portfolio,the market portfolio M is efficient and(la) and (1b)hold for M, (4a) E(R)=E(RM)+[E(R )-E(RM)]BM i=1.....N, (46b) Ba =Cov(R.Ru) G2(R) 又4 The expected return and the standard deviation of the return on p are, (3b) E(Rp) = xRf + (1-x)E(Rg), (3c) s(Rp) = |1-x| s(Rg). These equations imply that the portfolios obtained by varying x in (3a) plot along a straight line in Figure 1. The line starts at Rf (x = 1.0, all funds are invested in the riskfree asset), runs to the point g (x = 0.0, all funds are invested in g) and continues on for portfolios that involve borrowing at the riskfree rate (x < 0.0, with the proceeds from the borrowing used to increase the investment in g). It is then easy to see that to obtain the efficient portfolios available with riskfree borrowing and lending, one simply swings a line from Rf in Figure 1 up and to the left, to the tangency portfolio T, which is as far as one can go without passing into infeasible territory. The key result is that with unrestricted riskfree borrowing and lending, all efficient portfolios are combinations of the single risky tangency portfolio T with either lending at the riskfree rate (points below T along the line from Rf) or riskfree borrowing (points above T along the line from Rf). This is Tobin’s (1958) separation theorem. The CAPM’s punch line is now straightforward. With complete agreement about distributions of returns, all investors combine the same tangency portfolio T with riskfree borrowing or lending. Since all investors hold the same portfolio of risky assets, the market for risky assets does not clear at time t-1 unless each asset is priced so its weight in T is its total market value at t-1 divided by the total value of all risky assets. But this is just the asset’s weight, xiM, in the market portfolio of invested wealth, M. Thus the critical tangency portfolio must be the market portfolio. In addition, the riskfree rate must be set (along with the prices of risky assets) to clear the market for riskfree borrowing and lending. Since the tangency portfolio is the market portfolio, the market portfolio M is efficient and (1a) and (1b) hold for M, (4a) ( ) ( ) [ ()( )] , E Ri =+- E RzM M E R E RzM biM i=1,…,N, (4b) 2 cov( , ) . ( ) i M iM M R R R b s =