正在加载图片...

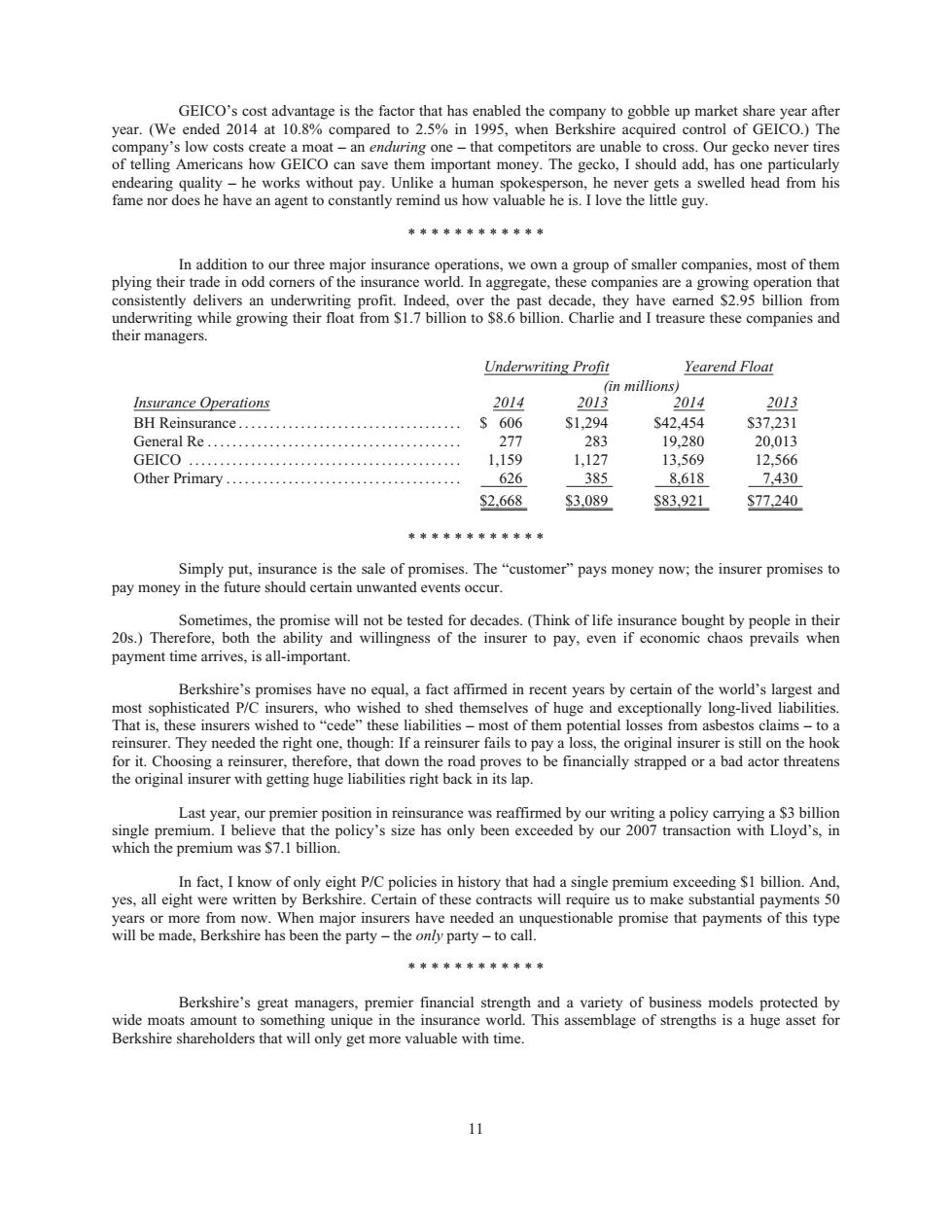

GEICO e to ros Our gecko nevertire 0w9 can save mportant mo ey.Ine gecko, fame nor does he have an agent to constantly remind us how valuable he is.I love the little guy. 水中水中水中水中率中中中 In addition to our three maior insurance c ions.we own a group of smaller companies.most of them plying their trade in od th insurance world.n aggregate these co panies are a gr inderstentd hice。an und n.Cha nd It their managers. Underwriting Profit Yearend Float in millions 2014 201 014 2013 s60 S42 S37.231 277 281 19.280 20.013 GEICO 1,159 1,12 13.569 12,56 Other Primary 62 43 S2.668 S3.089 S83.921 S77.240 来来来来来来来来家来家来 omises.The"customer"pays money now;the insurer promises to mise will not be tested for decades.(Think of life insurance bought by people in their 20s)Therefore,both the ability and willingness of the insurer to pay,even if economic chaos prevails when payment time arrives,is all-important spromises have no qual,a fact years by certain of the world's largest and miohecmed reinsurer.They needed the right one,though:If a reinsurer fails to pay a loss,the original insurer is still on the hook e, wn th In fact.I know of only eight P/C policies in history that had a single t emium exceeding SI billion.And yes,all eight were written by Berkshire.Certain of these contracts will require us to make substantial payments 50 GEICO’s cost advantage is the factor that has enabled the company to gobble up market share year after year. (We ended 2014 at 10.8% compared to 2.5% in 1995, when Berkshire acquired control of GEICO.) The company’s low costs create a moat – an enduring one – that competitors are unable to cross. Our gecko never tires of telling Americans how GEICO can save them important money. The gecko, I should add, has one particularly endearing quality – he works without pay. Unlike a human spokesperson, he never gets a swelled head from his fame nor does he have an agent to constantly remind us how valuable he is. I love the little guy. ************ In addition to our three major insurance operations, we own a group of smaller companies, most of them plying their trade in odd corners of the insurance world. In aggregate, these companies are a growing operation that consistently delivers an underwriting profit. Indeed, over the past decade, they have earned $2.95 billion from underwriting while growing their float from $1.7 billion to $8.6 billion. Charlie and I treasure these companies and their managers. Underwriting Profit Yearend Float (in millions) Insurance Operations 2014 2013 2014 2013 BH Reinsurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 606 $1,294 $42,454 $37,231 General Re . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 277 283 19,280 20,013 GEICO ............................................ 1,159 1,127 13,569 12,566 Other Primary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 626 385 8,618 7,430 $2,668 $3,089 $83,921 $77,240 ************ Simply put, insurance is the sale of promises. The “customer” pays money now; the insurer promises to pay money in the future should certain unwanted events occur. Sometimes, the promise will not be tested for decades. (Think of life insurance bought by people in their 20s.) Therefore, both the ability and willingness of the insurer to pay, even if economic chaos prevails when payment time arrives, is all-important. Berkshire’s promises have no equal, a fact affirmed in recent years by certain of the world’s largest and most sophisticated P/C insurers, who wished to shed themselves of huge and exceptionally long-lived liabilities. That is, these insurers wished to “cede” these liabilities – most of them potential losses from asbestos claims – to a reinsurer. They needed the right one, though: If a reinsurer fails to pay a loss, the original insurer is still on the hook for it. Choosing a reinsurer, therefore, that down the road proves to be financially strapped or a bad actor threatens the original insurer with getting huge liabilities right back in its lap. Last year, our premier position in reinsurance was reaffirmed by our writing a policy carrying a $3 billion single premium. I believe that the policy’s size has only been exceeded by our 2007 transaction with Lloyd’s, in which the premium was $7.1 billion. In fact, I know of only eight P/C policies in history that had a single premium exceeding $1 billion. And, yes, all eight were written by Berkshire. Certain of these contracts will require us to make substantial payments 50 years or more from now. When major insurers have needed an unquestionable promise that payments of this type will be made, Berkshire has been the party – the only party – to call. ************ Berkshire’s great managers, premier financial strength and a variety of business models protected by wide moats amount to something unique in the insurance world. This assemblage of strengths is a huge asset for Berkshire shareholders that will only get more valuable with time. 11