Berkshire's Performance vs.the &P500 Annual Percentage Change Bin Per-s n S&P 500 of with nd 75194 L.8266 19% Note rs with thes 1965amd196 d9/30:1967, 1ded12/31.S3 culated using the numbe e are pre-t the s are afte d ha SR

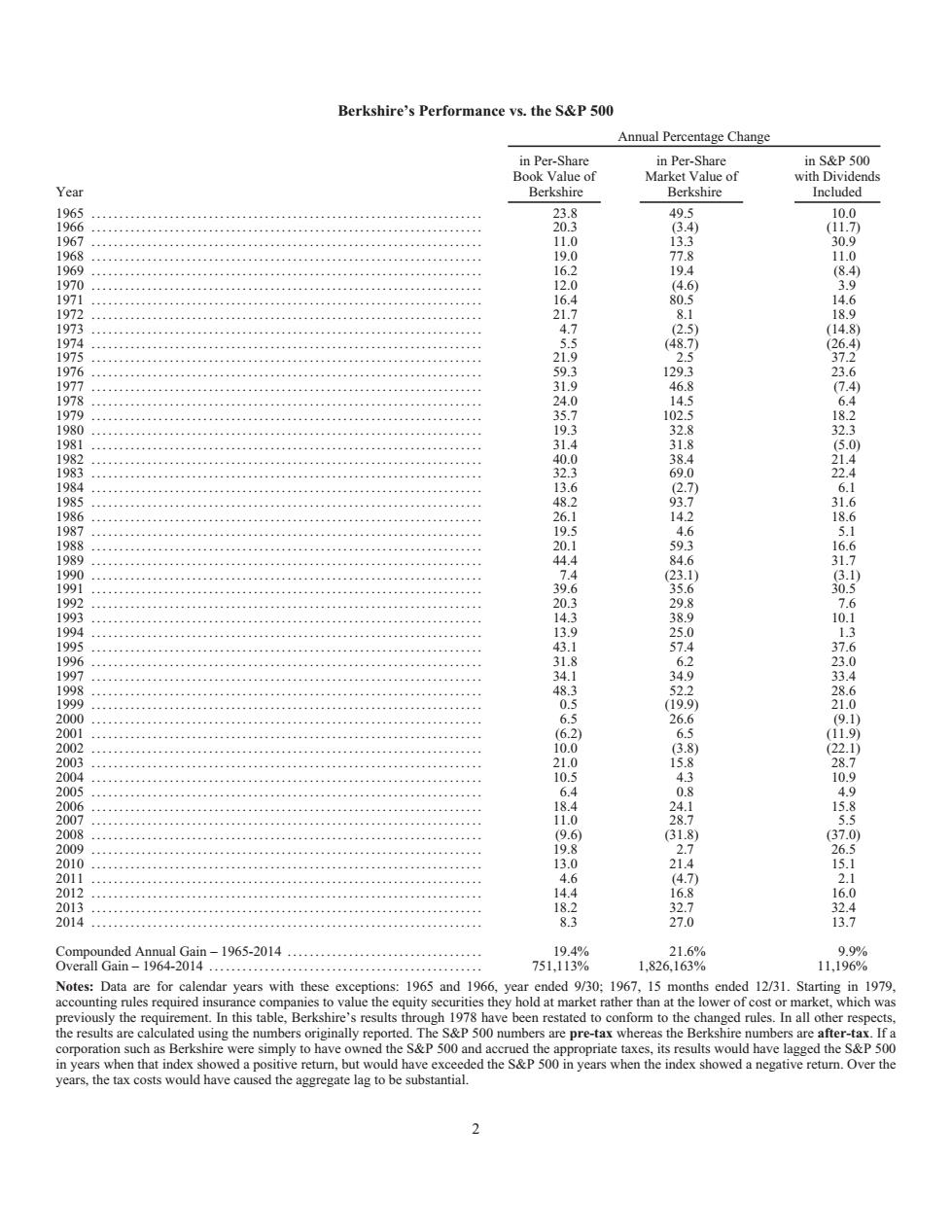

Berkshire’s Performance vs. the S&P 500 Annual Percentage Change Year in Per-Share Book Value of Berkshire in Per-Share Market Value of Berkshire in S&P 500 with Dividends Included 1965 ...................................................................... 23.8 49.5 10.0 1966 ...................................................................... 20.3 (3.4) (11.7) 1967 ...................................................................... 11.0 13.3 30.9 1968 ...................................................................... 19.0 77.8 11.0 1969 ...................................................................... 16.2 19.4 (8.4) 1970 ...................................................................... 12.0 (4.6) 3.9 1971 ...................................................................... 16.4 80.5 14.6 1972 ...................................................................... 21.7 8.1 18.9 1973 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.7 (2.5) (14.8) 1974 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.5 (48.7) (26.4) 1975 ...................................................................... 21.9 2.5 37.2 1976 ...................................................................... 59.3 129.3 23.6 1977 ...................................................................... 31.9 46.8 (7.4) 1978 ...................................................................... 24.0 14.5 6.4 1979 ...................................................................... 35.7 102.5 18.2 1980 ...................................................................... 19.3 32.8 32.3 1981 ...................................................................... 31.4 31.8 (5.0) 1982 ...................................................................... 40.0 38.4 21.4 1983 ...................................................................... 32.3 69.0 22.4 1984 ...................................................................... 13.6 (2.7) 6.1 1985 ...................................................................... 48.2 93.7 31.6 1986 ...................................................................... 26.1 14.2 18.6 1987 ...................................................................... 19.5 4.6 5.1 1988 ...................................................................... 20.1 59.3 16.6 1989 ...................................................................... 44.4 84.6 31.7 1990 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.4 (23.1) (3.1) 1991 ...................................................................... 39.6 35.6 30.5 1992 ...................................................................... 20.3 29.8 7.6 1993 ...................................................................... 14.3 38.9 10.1 1994 ...................................................................... 13.9 25.0 1.3 1995 ...................................................................... 43.1 57.4 37.6 1996 ...................................................................... 31.8 6.2 23.0 1997 ...................................................................... 34.1 34.9 33.4 1998 ...................................................................... 48.3 52.2 28.6 1999 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.5 (19.9) 21.0 2000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.5 26.6 (9.1) 2001 ...................................................................... (6.2) 6.5 (11.9) 2002 ...................................................................... 10.0 (3.8) (22.1) 2003 ...................................................................... 21.0 15.8 28.7 2004 ...................................................................... 10.5 4.3 10.9 2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.4 0.8 4.9 2006 ...................................................................... 18.4 24.1 15.8 2007 ...................................................................... 11.0 28.7 5.5 2008 ...................................................................... (9.6) (31.8) (37.0) 2009 ...................................................................... 19.8 2.7 26.5 2010 ...................................................................... 13.0 21.4 15.1 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.6 (4.7) 2.1 2012 ...................................................................... 14.4 16.8 16.0 2013 ...................................................................... 18.2 32.7 32.4 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.3 27.0 13.7 Compounded Annual Gain – 1965-2014 ................................... 19.4% 21.6% 9.9% Overall Gain – 1964-2014 ................................................. 751,113% 1,826,163% 11,196% Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market rather than at the lower of cost or market, which was previously the requirement. In this table, Berkshire’s results through 1978 have been restated to conform to the changed rules. In all other respects, the results are calculated using the numbers originally reported. The S&P 500 numbers are pre-tax whereas the Berkshire numbers are after-tax. If a corporation such as Berkshire were simply to have owned the S&P 500 and accrued the appropriate taxes, its results would have lagged the S&P 500 in years when that index showed a positive return, but would have exceeded the S&P 500 in years when the index showed a negative return. Over the years, the tax costs would have caused the aggregate lag to be substantial. 2

y Gnd it page 24 ful t 920h BERKSHIRE HATHAWAY INC To the Shareholders of Berkshire Hathaway Inc. 183b L:L per-share book value has grown from $19 to $146,186,a rate of 19.4%compounded annually. During our tenure.we have consistently compared the vearly performance of the S&P 500 to the change in Berkshire's per-share book value.We've done that bec ause book value has been a crude,but useful,tracking device for the number that really counts:intrinsic business value In our early decades,the relationship between book value and intrinsic value was much close than it i value were"marked to market Today.our emphasis has shifted in a major way to owning and operating large businesses.Many of these are worth far mor than their cost-based carrying value.But that amount is neve y人meod With th nges in intrinsic value.Over tim ger, intrinsic value over the past 50 years is roughly equal to the 1,826,163%gain in market price of the company's shares. All per-share figures used in this report apply to Berkshire's A shares.Figures for the B shares are 1/1500h of those shown for A

A note to readers: Fifty years ago, today’s management took charge at Berkshire. For this Golden Anniversary, Warren Buffett and Charlie Munger each wrote his views of what has happened at Berkshire during the past 50 years and what each expects during the next 50. Neither changed a word of his commentary after reading what the other had written. Warren’s thoughts begin on page 24 and Charlie’s on page 39. Shareholders, particularly new ones, may find it useful to read those letters before reading the report on 2014, which begins below. BERKSHIRE HATHAWAY INC. To the Shareholders of Berkshire Hathaway Inc.: Berkshire’s gain in net worth during 2014 was $18.3 billion, which increased the per-share book value of both our Class A and Class B stock by 8.3%. Over the last 50 years (that is, since present management took over), per-share book value has grown from $19 to $146,186, a rate of 19.4% compounded annually.* During our tenure, we have consistently compared the yearly performance of the S&P 500 to the change in Berkshire’s per-share book value. We’ve done that because book value has been a crude, but useful, tracking device for the number that really counts: intrinsic business value. In our early decades, the relationship between book value and intrinsic value was much closer than it is now. That was true because Berkshire’s assets were then largely securities whose values were continuously restated to reflect their current market prices. In Wall Street parlance, most of the assets involved in the calculation of book value were “marked to market.” Today, our emphasis has shifted in a major way to owning and operating large businesses. Many of these are worth far more than their cost-based carrying value. But that amount is never revalued upward no matter how much the value of these companies has increased. Consequently, the gap between Berkshire’s intrinsic value and its book value has materially widened. With that in mind, we have added a new set of data – the historical record of Berkshire’s stock price – to the performance table on the facing page. Market prices, let me stress, have their limitations in the short term. Monthly or yearly movements of stocks are often erratic and not indicative of changes in intrinsic value. Over time, however, stock prices and intrinsic value almost invariably converge. Charlie Munger, Berkshire Vice Chairman and my partner, and I believe that has been true at Berkshire: In our view, the increase in Berkshire’s per-share intrinsic value over the past 50 years is roughly equal to the 1,826,163% gain in market price of the company’s shares. * All per-share figures used in this report apply to Berkshire’s A shares. Figures for the B shares are 1/1500th of those shown for A. 3

The Year at Berkshire It was a good year for Berkshire on all major fronts,except one.Here are the important developments: had a record $12.4 ergy r in the Lubrizol and Marmon. Of the five,ony Berkshire Hathaway Energy,then earning$393 million.was owned by usadecade ag e purchased another he nve on an h,BNS number outstanding by6.1%nother words,the $12 billion gain in aual earnings delivered Berkshire by If the ll.T omy cd already closed or are under contract. ,o disappointed many of its customers.These shippers depend on us,and service failres can L has spent in a single year and is a truly extraordinary amount,whether compared to revenues,eamings or depreciation charges Though weather,which was particularly severe last year,will always cause railroads a variety of op can't be done ovemight The extensive work rquired to increase system capacity sometimes disrupt operations whil r,our outsi Our many dozens of smaller non-insurance businesses earned $5.1 billion las p from $4.7 billion in p,we have two Hre,as with our Powerhouse Fiveexp further gains in015.Withn this grou n ihon an x tha en $25 This colle eration again operated at an underwriting profit in 2014-that makes 12 years in a row During that 12-year stretch,our float to us ut can invest for Be has grown from generates significant investment income because of the assets it allows us to hold. lerer ll i the Goden ivearyeiers included later in ths repor.ll camings are sis unless otherwise designate

The Year at Berkshire It was a good year for Berkshire on all major fronts, except one. Here are the important developments: ‹ Our “Powerhouse Five” – a collection of Berkshire’s largest non-insurance businesses – had a record $12.4 billion of pre-tax earnings in 2014, up $1.6 billion from 2013.* The companies in this sainted group are Berkshire Hathaway Energy (formerly MidAmerican Energy), BNSF, IMC (I’ve called it Iscar in the past), Lubrizol and Marmon. Of the five, only Berkshire Hathaway Energy, then earning $393 million, was owned by us a decade ago. Subsequently we purchased another three of the five on an all-cash basis. In acquiring the fifth, BNSF, we paid about 70% of the cost in cash and, for the remainder, issued Berkshire shares that increased the number outstanding by 6.1%. In other words, the $12 billion gain in annual earnings delivered Berkshire by the five companies over the ten-year span has been accompanied by only minor dilution. That satisfies our goal of not simply increasing earnings, but making sure we also increase per-share results. If the U.S. economy continues to improve in 2015, we expect earnings of our Powerhouse Five to improve as well. The gain could reach $1 billion, in part because of bolt-on acquisitions by the group that have already closed or are under contract. ‹ Our bad news from 2014 comes from our group of five as well and is unrelated to earnings. During the year, BNSF disappointed many of its customers. These shippers depend on us, and service failures can badly hurt their businesses. BNSF is, by far, Berkshire’s most important non-insurance subsidiary and, to improve its performance, we will spend $6 billion on plant and equipment in 2015. That sum is nearly 50% more than any other railroad has spent in a single year and is a truly extraordinary amount, whether compared to revenues, earnings or depreciation charges. Though weather, which was particularly severe last year, will always cause railroads a variety of operating problems, our responsibility is to do whatever it takes to restore our service to industry-leading levels. That can’t be done overnight: The extensive work required to increase system capacity sometimes disrupts operations while it is underway. Recently, however, our outsized expenditures are beginning to show results. During the last three months, BNSF’s performance metrics have materially improved from last year’s figures. ‹ Our many dozens of smaller non-insurance businesses earned $5.1 billion last year, up from $4.7 billion in 2013. Here, as with our Powerhouse Five, we expect further gains in 2015. Within this group, we have two companies that last year earned between $400 million and $600 million, six that earned between $250 million and $400 million, and seven that earned between $100 million and $250 million. This collection of businesses will increase in both number and earnings. Our ambitions have no finish line. ‹ Berkshire’s huge and growing insurance operation again operated at an underwriting profit in 2014 – that makes 12 years in a row – and increased its float. During that 12-year stretch, our float – money that doesn’t belong to us but that we can invest for Berkshire’s benefit – has grown from $41 billion to $84 billion. Though neither that gain nor the size of our float is reflected in Berkshire’s earnings, float generates significant investment income because of the assets it allows us to hold. * Throughout this letter, as well as in the “Golden Anniversary” letters included later in this report, all earnings are stated on a pre-tax basis unless otherwise designated. 4

$2.7 billion .While Charlie and I search for new businesses to buy,our many subsidiaries are regularly making bolt-on scheduled to cost $7.8 on in ag or thes until th ranged ee Marmon's iurisdiction. Charlie and I encourage bolt-ons.if they are sensibly-priced.(Most deals offered us aren't.)They deploy capital in activities that fit with our existing businesses and that will be managed by our 。网ma的C particularly to ini hie 20 Ca o in th would work well from both a personal and financial standpoint.And it most definitely has. I'm no. assed to admit that Hein zis run far better under Ale L风h血山oam女 We wi 0,1n es to the king v with Rerkshire also has fine nerships with Mars a limited to friendly transactions. In Octobe we ontracted to buy Van Tuyl Automotive,a group of 78 automobile dealerships that is that if he sel his Larry and his dad,Cecil,spent 62 years building the group,following a strategy that made owner-partners of all loc Cre er.Van Tuyl is argest nigures that are In recent vears.Jeff Rachor has worked alongside Larry.a successful arrangement that will continue.There eabout 100 dealerships in the couny and hipranserh vant auto manulacturer.Ber is to ma build a business that before long will be multiples the size of Van Tuyl's9billion of sales. With the acquisition of Van Tuyl,Berkshire now owns 9Vc anies that would be listed on the Fortune 500 were they independent (Heinz is the).That leaves 490 fish in the sea.Our lines are out. 5

Meanwhile, our underwriting profit totaled $24 billion during the twelve-year period, including $2.7 billion earned in 2014. And all of this began with our 1967 purchase of National Indemnity for $8.6 million. ‹ While Charlie and I search for new businesses to buy, our many subsidiaries are regularly making bolt-on acquisitions. Last year was particularly fruitful: We contracted for 31 bolt-ons, scheduled to cost $7.8 billion in aggregate. The size of these transactions ranged from $400,000 to $2.9 billion. However, the largest acquisition, Duracell, will not close until the second half of this year. It will then be placed under Marmon’s jurisdiction. Charlie and I encourage bolt-ons, if they are sensibly-priced. (Most deals offered us aren’t.) They deploy capital in activities that fit with our existing businesses and that will be managed by our corps of expert managers. This means no more work for us, yet more earnings, a combination we find particularly appealing. We will make many more of these bolt-on deals in future years. ‹ Two years ago my friend, Jorge Paulo Lemann, asked Berkshire to join his 3G Capital group in the acquisition of Heinz. My affirmative response was a no-brainer: I knew immediately that this partnership would work well from both a personal and financial standpoint. And it most definitely has. I’m not embarrassed to admit that Heinz is run far better under Alex Behring, Chairman, and Bernardo Hees, CEO, than would be the case if I were in charge. They hold themselves to extraordinarily high performance standards and are never satisfied, even when their results far exceed those of competitors. We expect to partner with 3G in more activities. Sometimes our participation will only involve a financing role, as was the case in the recent acquisition of Tim Hortons by Burger King. Our favored arrangement, however, will usually be to link up as a permanent equity partner (who, in some cases, contributes to the financing of the deal as well). Whatever the structure, we feel good when working with Jorge Paulo. Berkshire also has fine partnerships with Mars and Leucadia, and we may form new ones with them or with other partners. Our participation in any joint activities, whether as a financing or equity partner, will be limited to friendly transactions. ‹ In October, we contracted to buy Van Tuyl Automotive, a group of 78 automobile dealerships that is exceptionally well-run. Larry Van Tuyl, the company’s owner, and I met some years ago. He then decided that if he were ever to sell his company, its home should be Berkshire. Our purchase was recently completed, and we are now “car guys.” Larry and his dad, Cecil, spent 62 years building the group, following a strategy that made owner-partners of all local managers. Creating this mutuality of interests proved over and over to be a winner. Van Tuyl is now the fifth-largest automotive group in the country, with per-dealership sales figures that are outstanding. In recent years, Jeff Rachor has worked alongside Larry, a successful arrangement that will continue. There are about 17,000 dealerships in the country, and ownership transfers always require approval by the relevant auto manufacturer. Berkshire’s job is to perform in a manner that will cause manufacturers to welcome further purchases by us. If we do this – and if we can buy dealerships at sensible prices – we will build a business that before long will be multiples the size of Van Tuyl’s $9 billion of sales. With the acquisition of Van Tuyl, Berkshire now owns 91⁄2 companies that would be listed on the Fortune 500 were they independent (Heinz is the 1⁄2). That leaves 4901⁄2 fish in the sea. Our lines are out. 5

till untapped.Through dumb luc ndwere forever graefu for the saggring dvantagehsao has given ●Berkshire's totaled a rec rd340 409 from last going crazy. Berkshire inreased st last year in each of its"Big Four"inv 01)Meamwhile.stcpurchasCoca-Cola.American ExpresWells Fargo raised our percentage ownership of each.Our equity in Coca-Cola grew from our int our owne nies in aggregate,each incr ase of one-tenth of a percent in our ownership raises vonderful company to owning 100%of a so-so business.It's better to have a partial interest in the Hope Diamond than to own all of a rhinestone. If Berkshire's yearend holdings are used as the marker,our portion n of the "Big Four's"2014 earnings orediscontinuedo (o 3.3b n only thre year.(Again,three years ago the dividends were $862 million.)But make no mistake:The $3.I billion of these companies'earnings we don't report are every bit as valuable to us as the portion Berkshire records. The eamings these investees retain are ofen used for repurchases of their own stock a move tha C.0 ate will g substantially over time a for the group,in part because of he strong dollar).If gains.(For the package of four,our unrealized gains already totaled $42 billion at yearend.) Our flexibility in capital allocation -our willingness to invest large sums passively in non-controlled businesses-give a significant advantage over companies that limit themsel can ng s or passive investments doubles ou ve mentioned in the past that m experience has made me a bette e to the other. And Schwed's wonderful b ok,Wher .If you haven't read Schwed's book,buy a copy at our annual meeting.Its wisdom and humor are

‹ Our subsidiaries spent a record $15 billion on plant and equipment during 2014, well over twice their depreciation charges. About 90% of that money was spent in the United States. Though we will always invest abroad as well, the mother lode of opportunities runs through America. The treasures that have been uncovered up to now are dwarfed by those still untapped. Through dumb luck, Charlie and I were born in the United States, and we are forever grateful for the staggering advantages this accident of birth has given us. ‹ Berkshire’s yearend employees – including those at Heinz – totaled a record 340,499, up 9,754 from last year. The increase, I am proud to say, included no gain at headquarters (where 25 people work). No sense going crazy. ‹ Berkshire increased its ownership interest last year in each of its “Big Four” investments – American Express, Coca-Cola, IBM and Wells Fargo. We purchased additional shares of IBM (increasing our ownership to 7.8% versus 6.3% at yearend 2013). Meanwhile, stock repurchases at Coca-Cola, American Express and Wells Fargo raised our percentage ownership of each. Our equity in Coca-Cola grew from 9.1% to 9.2%, our interest in American Express increased from 14.2% to 14.8% and our ownership of Wells Fargo grew from 9.2% to 9.4%. And, if you think tenths of a percent aren’t important, ponder this math: For the four companies in aggregate, each increase of one-tenth of a percent in our ownership raises Berkshire’s portion of their annual earnings by $50 million. These four investees possess excellent businesses and are run by managers who are both talented and shareholder-oriented. At Berkshire, we much prefer owning a non-controlling but substantial portion of a wonderful company to owning 100% of a so-so business. It’s better to have a partial interest in the Hope Diamond than to own all of a rhinestone. If Berkshire’s yearend holdings are used as the marker, our portion of the “Big Four’s” 2014 earnings before discontinued operations amounted to $4.7 billion (compared to $3.3 billion only three years ago). In the earnings we report to you, however, we include only the dividends we receive – about $1.6 billion last year. (Again, three years ago the dividends were $862 million.) But make no mistake: The $3.1 billion of these companies’ earnings we don’t report are every bit as valuable to us as the portion Berkshire records. The earnings these investees retain are often used for repurchases of their own stock – a move that enhances Berkshire’s share of future earnings without requiring us to lay out a dime. Their retained earnings also fund business opportunities that usually turn out to be advantageous. All that leads us to expect that the per-share earnings of these four investees, in aggregate, will grow substantially over time (though 2015 will be a tough year for the group, in part because of the strong dollar). If the expected gains materialize, dividends to Berkshire will increase and, even more important, so will our unrealized capital gains. (For the package of four, our unrealized gains already totaled $42 billion at yearend.) Our flexibility in capital allocation – our willingness to invest large sums passively in non-controlled businesses – gives us a significant advantage over companies that limit themselves to acquisitions they can operate. Our appetite for either operating businesses or passive investments doubles our chances of finding sensible uses for Berkshire’s endless gusher of cash. ‹ I’ve mentioned in the past that my experience in business helps me as an investor and that my investment experience has made me a better businessman. Each pursuit teaches lessons that are applicable to the other. And some truths can only be fully learned through experience. (In Fred Schwed’s wonderful book, Where Are the Customers’ Yachts?, a Peter Arno cartoon depicts a puzzled Adam looking at an eager Eve, while a caption says, “There are certain things that cannot be adequately explained to a virgin either by words or pictures.” If you haven’t read Schwed’s book, buy a copy at our annual meeting. Its wisdom and humor are truly priceless.) 6

A skill investment managers,to each have oversight of at least one of our businesses.A sensible opportunity for them to c o so open up a ew montns ago w nwe agreed to purc ase tw S100 million annually on about $12 million of net tangible assets I've asked Todd and Ted to each take on one as Chairman.in which role they will function in the ve and,more ong the Late in 2009 NS Berkshire's history.At the time.I called the transaction an"all in wager on the economic future of the United States. That kind of commitment was nothing new for us.We've been making similar wagers ever since Buffet to Charlie and I have yc prosperity to be very close toasur Indeed,who has ever dur 238 year pare our My prcn coud no vdremed19 of the wrl thr uld happily buy -way t inue to w is magic. Gains won't co me in a 1y号 our governme Charli nd I power of our ma hrough bolt-on acqul ons;(3)ber om the growth of our inve shire shar larg ing vital roles in our r econ omy.Ho mes and autos will remain central to the lives of mo nsurance wil Intrinsic Business Value Chanie ad tale abou immmse ue camar te u preca of the -that eys toa of Berkshire's intrinsi value.That discussion is reproduced in full on pages 123-124. Here is an update of the two quantitative factors:In 2014 our per-share investments increased 8.4%to $140,123,and our earnings from businesses other than insurance and investments increased 19%to $10,847 per share. 7

Among Arno’s “certain things,” I would include two separate skills, the evaluation of investments and the management of businesses. I therefore think it’s worthwhile for Todd Combs and Ted Weschler, our two investment managers, to each have oversight of at least one of our businesses. A sensible opportunity for them to do so opened up a few months ago when we agreed to purchase two companies that, though smaller than we would normally acquire, have excellent economic characteristics. Combined, the two earn $100 million annually on about $125 million of net tangible assets. I’ve asked Todd and Ted to each take on one as Chairman, in which role they will function in the very limited way that I do with our larger subsidiaries. This arrangement will save me a minor amount of work and, more important, make the two of them even better investors than they already are (which is to say among the best). ************ Late in 2009, amidst the gloom of the Great Recession, we agreed to buy BNSF, the largest purchase in Berkshire’s history. At the time, I called the transaction an “all-in wager on the economic future of the United States.” That kind of commitment was nothing new for us. We’ve been making similar wagers ever since Buffett Partnership Ltd. acquired control of Berkshire in 1965. For good reason, too: Charlie and I have always considered a “bet” on ever-rising U.S. prosperity to be very close to a sure thing. Indeed, who has ever benefited during the past 238 years by betting against America? If you compare our country’s present condition to that existing in 1776, you have to rub your eyes in wonder. In my lifetime alone, real per-capita U.S. output has sextupled. My parents could not have dreamed in 1930 of the world their son would see. Though the preachers of pessimism prattle endlessly about America’s problems, I’ve never seen one who wishes to emigrate (though I can think of a few for whom I would happily buy a one-way ticket). The dynamism embedded in our market economy will continue to work its magic. Gains won’t come in a smooth or uninterrupted manner; they never have. And we will regularly grumble about our government. But, most assuredly, America’s best days lie ahead. With this tailwind working for us, Charlie and I hope to build Berkshire’s per-share intrinsic value by (1) constantly improving the basic earning power of our many subsidiaries; (2) further increasing their earnings through bolt-on acquisitions; (3) benefiting from the growth of our investees; (4) repurchasing Berkshire shares when they are available at a meaningful discount from intrinsic value; and (5) making an occasional large acquisition. We will also try to maximize results for you by rarely, if ever, issuing Berkshire shares. Those building blocks rest on a rock-solid foundation. A century hence, BNSF and Berkshire Hathaway Energy will still be playing vital roles in our economy. Homes and autos will remain central to the lives of most families. Insurance will continue to be essential for both businesses and individuals. Looking ahead, Charlie and I see a world made to order for Berkshire. We feel fortunate to be entrusted with its management. Intrinsic Business Value As much as Charlie and I talk about intrinsic business value, we cannot tell you precisely what that number is for Berkshire shares (nor, in fact, for any other stock). In our 2010 annual report, however, we laid out the three elements – one of them qualitative – that we believe are the keys to a sensible estimate of Berkshire’s intrinsic value. That discussion is reproduced in full on pages 123-124. Here is an update of the two quantitative factors: In 2014 our per-share investments increased 8.4% to $140,123, and our earnings from businesses other than insurance and investments increased 19% to $10,847 per share. 7

Since 1970.our per-share investments have increased at a rate of1 compounded annually,and ou sectors,but ou 率市率市南中率市南中率市 nc Now,let's exami the the I view them(though there are important and end ngadvantages to having them all under one roof).Our goal is to provide you with the informa have if our pos s were reversed,with you being the Insurance Let's look first at insurance,Berkshire's core operation.That industry has been the engine that has simplicity itself. Jack inga who was the controing shareholder of the two compan nies came to my minutes later,we had a deal.Neither of Jack's companies had ever had an g firm. t ask y Io That co-2 : Indemnity today has GAAP (generally accepted accounting principles)et worth,which exceeds that of any other insurer in the world surers get to】 dolaAndwe havegrth folwing blow Year Float fin millions) 1970 1980 27 83.921 On the insurance operation are almost certain to g ata good clip.National reinsurance division,however,is dLofnnofcomtaswhoenbetdnsdbwmward1fwedonmeepenmceadodlmennd is a key pillar in Berkshire's economic fortress

Since 1970, our per-share investments have increased at a rate of 19% compounded annually, and our earnings figure has grown at a 20.6% clip. It is no coincidence that the price of Berkshire stock over the ensuing 44 years has increased at a rate very similar to that of our two measures of value. Charlie and I like to see gains in both sectors, but our main focus is to build operating earnings. That’s why we were pleased to exchange our Phillips 66 and Graham Holdings stock for operating businesses last year and to contract with Procter and Gamble to acquire Duracell by means of a similar exchange set to close in 2015. ************ Now, let’s examine the four major sectors of our operations. Each has vastly different balance sheet and income characteristics from the others. So we’ll present them as four separate businesses, which is how Charlie and I view them (though there are important and enduring advantages to having them all under one roof). Our goal is to provide you with the information we would wish to have if our positions were reversed, with you being the reporting manager and we the absentee shareholders. (But don’t get any ideas!) Insurance Let’s look first at insurance, Berkshire’s core operation. That industry has been the engine that has propelled our expansion since 1967, when we acquired National Indemnity and its sister company, National Fire & Marine, for $8.6 million. Though that purchase had monumental consequences for Berkshire, its execution was simplicity itself. Jack Ringwalt, a friend of mine who was the controlling shareholder of the two companies, came to my office saying he would like to sell. Fifteen minutes later, we had a deal. Neither of Jack’s companies had ever had an audit by a public accounting firm, and I didn’t ask for one. My reasoning: (1) Jack was honest and (2) He was also a bit quirky and likely to walk away if the deal became at all complicated. On pages 128-129, we reproduce the 11⁄2-page purchase agreement we used to finalize the transaction. That contract was homemade: Neither side used a lawyer. Per page, this has to be Berkshire’s best deal: National Indemnity today has GAAP (generally accepted accounting principles) net worth of $111 billion, which exceeds that of any other insurer in the world. One reason we were attracted to the property-casualty business was its financial characteristics: P/C insurers receive premiums upfront and pay claims later. In extreme cases, such as those arising from certain workers’ compensation accidents, payments can stretch over many decades. This collect-now, pay-later model leaves P/C companies holding large sums – money we call “float” – that will eventually go to others. Meanwhile, insurers get to invest this float for their benefit. Though individual policies and claims come and go, the amount of float an insurer holds usually remains fairly stable in relation to premium volume. Consequently, as our business grows, so does our float. And how we have grown, as the following table shows: Year Float (in $ millions) 1970 $ 39 1980 237 1990 1,632 2000 27,871 2010 65,832 2014 83,921 Further gains in float will be tough to achieve. On the plus side, GEICO and our new commercial insurance operation are almost certain to grow at a good clip. National Indemnity’s reinsurance division, however, is party to a number of run-off contracts whose float drifts downward. If we do in time experience a decline in float, it will be very gradual – at the outside no more than 3% in any year. The nature of our insurance contracts is such that we can never be subject to immediate demands for sums that are large compared to our cash resources. This strength is a key pillar in Berkshire’s economic fortress. 8

and.better yet.get paid for holding it. Unfortunately.the wish of all insurers to achieve this happy result creates intense competition.so w rance industry the float stry payits c nies subnormal worth as compared toother businesses.The prolonged period of o interest rate od ha ned by poor underwriting results.That message i f affect?When Berkshire'sae.the B it should instead be iewed as a revolvir fund.Daily,we pay old claim nd rel ted expens a huge S as surely,we e ecause new business is almost cert n to deliver a subs A partial offset to this overstated liability is a $15.5 billion"g dwill"asset that we incurred in buying companies and s book value.In very large part,t on its true value.For example.ifan in urance comr ny sustains large and prolonged underwriting losses. goodwill asset carried on the books should be deemed valueless,whatever its original cost. Fortunately,that does not describe Berkshire.Charlie and I believe the true economic value of our what we v e an insuranc which we agree)this excess value will ever be entered on our books.But I can assure you that it's real.That's one reason-a huge reason-why we believe Berkshire's intrinsic business value substantially exceeds its book value. the yAalannes most important,brains in a manner unique in the insurance business.Yet he never exposes Berkshire to risks that are inappropriate in relation to our resources. 9

If our premiums exceed the total of our expenses and eventual losses, we register an underwriting profit that adds to the investment income our float produces. When such a profit is earned, we enjoy the use of free money – and, better yet, get paid for holding it. Unfortunately, the wish of all insurers to achieve this happy result creates intense competition, so vigorous indeed that it frequently causes the P/C industry as a whole to operate at a significant underwriting loss. This loss, in effect, is what the industry pays to hold its float. Competitive dynamics almost guarantee that the insurance industry, despite the float income all its companies enjoy, will continue its dismal record of earning subnormal returns on tangible net worth as compared to other American businesses. The prolonged period of low interest rates our country is now dealing with causes earnings on float to decrease, thereby exacerbating the profit problems of the industry. As noted in the first section of this report, Berkshire has now operated at an underwriting profit for twelve consecutive years, our pre-tax gain for the period having totaled $24 billion. Looking ahead, I believe we will continue to underwrite profitably in most years. Doing so is the daily focus of all of our insurance managers, who know that while float is valuable, its benefits can be drowned by poor underwriting results. That message is given at least lip service by all insurers; at Berkshire it is a religion. So how does our float affect intrinsic value? When Berkshire’s book value is calculated, the full amount of our float is deducted as a liability, just as if we had to pay it out tomorrow and could not replenish it. But to think of float as strictly a liability is incorrect; it should instead be viewed as a revolving fund. Daily, we pay old claims and related expenses – a huge $22.7 billion to more than six million claimants in 2014 – and that reduces float. Just as surely, we each day write new business and thereby generate new claims that add to float. If our revolving float is both costless and long-enduring, which I believe it will be, the true value of this liability is dramatically less than the accounting liability. Owing $1 that in effect will never leave the premises – because new business is almost certain to deliver a substitute – is worlds different from owing $1 that will go out the door tomorrow and not be replaced. The two types of liabilities are treated as equals, however, under GAAP. A partial offset to this overstated liability is a $15.5 billion “goodwill” asset that we incurred in buying our insurance companies and that increases book value. In very large part, this goodwill represents the price we paid for the float-generating capabilities of our insurance operations. The cost of the goodwill, however, has no bearing on its true value. For example, if an insurance company sustains large and prolonged underwriting losses, any goodwill asset carried on the books should be deemed valueless, whatever its original cost. Fortunately, that does not describe Berkshire. Charlie and I believe the true economic value of our insurance goodwill – what we would happily pay for float of similar quality were we to purchase an insurance operation possessing it – to be far in excess of its historic carrying value. Under present accounting rules (with which we agree) this excess value will never be entered on our books. But I can assure you that it’s real. That’s one reason – a huge reason – why we believe Berkshire’s intrinsic business value substantially exceeds its book value. ************ Berkshire’s attractive insurance economics exist only because we have some terrific managers running disciplined operations that possess hard-to-replicate business models. Let me tell you about the major units. First by float size is the Berkshire Hathaway Reinsurance Group, managed by Ajit Jain. Ajit insures risks that no one else has the desire or the capital to take on. His operation combines capacity, speed, decisiveness and, most important, brains in a manner unique in the insurance business. Yet he never exposes Berkshire to risks that are inappropriate in relation to our resources. 9

Indeed,we are far more co ve in avoiding risk than most large ins For example if th 然高 Ibe far in the red,if no Hathaway Specialty Insurance("BHSI").This initiative took us into commercial insurance,where we were instantly insurance.We repeat last year's prediction that BHSI will be a major asset for Berkshire,one that will generate olume in the billions within a few years We have another reinsurance powerhouse in General Re,managed by Tad Montross. At bottom,a sound insurance operation needs to adhere to four disciplines.It must (1)understand all exposures that might cause policy to incur losses;(2)conservatively assess the likelihood of any exposure actually ble c t if it does;(3 set a premi operating expense nd 4emne6wl ofit after bot premium can't be obtained. Many insu pass the first three tests and flunk the fourth.They simply can't turn their back on busin urance c nents,and it shows in his results.General Re's huge en con -ne leadership I we expect t and profblcom. rchased General Re it wa beset b roblems that caused nager than I ony When cost adv d ced bameecN ne le t bu aute mramce Alma everyoeouh.lie for most families. er can save money by insuring with GEICO.So stop reading and go to geico.com or call 800-368-2734

Indeed, we are far more conservative in avoiding risk than most large insurers. For example, if the insurance industry should experience a $250 billion loss from some mega-catastrophe – a loss about triple anything it has ever experienced – Berkshire as a whole would likely record a significant profit for the year because of its many streams of earnings. We would also remain awash in cash and be looking for large opportunities in a market that might well have gone into shock. Meanwhile, other major insurers and reinsurers would be far in the red, if not facing insolvency. Ajit’s underwriting skills are unmatched. His mind, moreover, is an idea factory that is always looking for more lines of business he can add to his current assortment. Last year I told you about his formation of Berkshire Hathaway Specialty Insurance (“BHSI”). This initiative took us into commercial insurance, where we were instantly welcomed by both major insurance brokers and corporate risk managers throughout America. Previously, we had written only a few specialized lines of commercial insurance. BHSI is led by Peter Eastwood, an experienced underwriter who is widely respected in the insurance world. During 2014, Peter expanded his talented group, moving into both international business and new lines of insurance. We repeat last year’s prediction that BHSI will be a major asset for Berkshire, one that will generate volume in the billions within a few years. ************ We have another reinsurance powerhouse in General Re, managed by Tad Montross. At bottom, a sound insurance operation needs to adhere to four disciplines. It must (1) understand all exposures that might cause a policy to incur losses; (2) conservatively assess the likelihood of any exposure actually causing a loss and the probable cost if it does; (3) set a premium that, on average, will deliver a profit after both prospective loss costs and operating expenses are covered; and (4) be willing to walk away if the appropriate premium can’t be obtained. Many insurers pass the first three tests and flunk the fourth. They simply can’t turn their back on business that is being eagerly written by their competitors. That old line, “The other guy is doing it, so we must as well,” spells trouble in any business, but in none more so than insurance. Tad has observed all four of the insurance commandments, and it shows in his results. General Re’s huge float has been considerably better than cost-free under his leadership, and we expect that, on average, to continue. We are particularly enthusiastic about General Re’s international life reinsurance business, which has grown consistently and profitably since we acquired the company in 1998. It can be remembered that soon after we purchased General Re, it was beset by problems that caused commentators – and me as well, briefly – to believe I had made a huge mistake. That day is long gone. General Re is now a gem. ************ Finally, there is GEICO, the insurer on which I cut my teeth 64 years ago. GEICO is managed by Tony Nicely, who joined the company at 18 and completed 53 years of service in 2014. Tony became CEO in 1993, and since then the company has been flying. There is no better manager than Tony. When I was first introduced to GEICO in January 1951, I was blown away by the huge cost advantage the company enjoyed compared to the expenses borne by the giants of the industry. It was clear to me that GEICO would succeed because it deserved to succeed. No one likes to buy auto insurance. Almost everyone, though, likes to drive. The insurance consequently needed is a major expenditure for most families. Savings matter to them – and only a low-cost operation can deliver these. Indeed, at least 40% of the people reading this letter can save money by insuring with GEICO. So stop reading and go to geico.com or call 800-368-2734. 10

GEICO e to ros Our gecko nevertire 0w9 can save mportant mo ey.Ine gecko, fame nor does he have an agent to constantly remind us how valuable he is.I love the little guy. 水中水中水中水中率中中中 In addition to our three maior insurance c ions.we own a group of smaller companies.most of them plying their trade in od th insurance world.n aggregate these co panies are a gr inderstentd hice。an und n.Cha nd It their managers. Underwriting Profit Yearend Float in millions 2014 201 014 2013 s60 S42 S37.231 277 281 19.280 20.013 GEICO 1,159 1,12 13.569 12,56 Other Primary 62 43 S2.668 S3.089 S83.921 S77.240 来来来来来来来来家来家来 omises.The"customer"pays money now;the insurer promises to mise will not be tested for decades.(Think of life insurance bought by people in their 20s)Therefore,both the ability and willingness of the insurer to pay,even if economic chaos prevails when payment time arrives,is all-important spromises have no qual,a fact years by certain of the world's largest and miohecmed reinsurer.They needed the right one,though:If a reinsurer fails to pay a loss,the original insurer is still on the hook e, wn th In fact.I know of only eight P/C policies in history that had a single t emium exceeding SI billion.And yes,all eight were written by Berkshire.Certain of these contracts will require us to make substantial payments 50

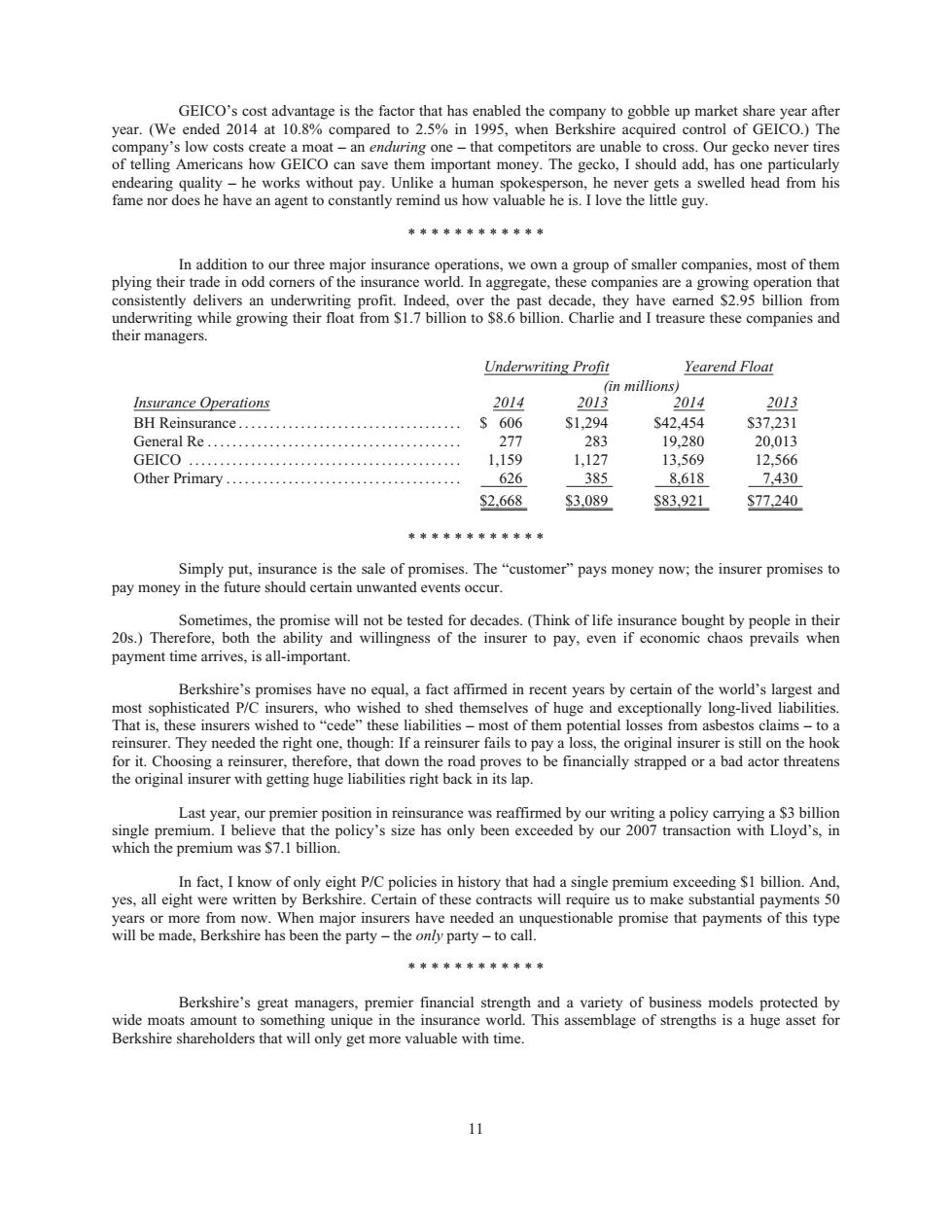

GEICO’s cost advantage is the factor that has enabled the company to gobble up market share year after year. (We ended 2014 at 10.8% compared to 2.5% in 1995, when Berkshire acquired control of GEICO.) The company’s low costs create a moat – an enduring one – that competitors are unable to cross. Our gecko never tires of telling Americans how GEICO can save them important money. The gecko, I should add, has one particularly endearing quality – he works without pay. Unlike a human spokesperson, he never gets a swelled head from his fame nor does he have an agent to constantly remind us how valuable he is. I love the little guy. ************ In addition to our three major insurance operations, we own a group of smaller companies, most of them plying their trade in odd corners of the insurance world. In aggregate, these companies are a growing operation that consistently delivers an underwriting profit. Indeed, over the past decade, they have earned $2.95 billion from underwriting while growing their float from $1.7 billion to $8.6 billion. Charlie and I treasure these companies and their managers. Underwriting Profit Yearend Float (in millions) Insurance Operations 2014 2013 2014 2013 BH Reinsurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 606 $1,294 $42,454 $37,231 General Re . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 277 283 19,280 20,013 GEICO ............................................ 1,159 1,127 13,569 12,566 Other Primary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 626 385 8,618 7,430 $2,668 $3,089 $83,921 $77,240 ************ Simply put, insurance is the sale of promises. The “customer” pays money now; the insurer promises to pay money in the future should certain unwanted events occur. Sometimes, the promise will not be tested for decades. (Think of life insurance bought by people in their 20s.) Therefore, both the ability and willingness of the insurer to pay, even if economic chaos prevails when payment time arrives, is all-important. Berkshire’s promises have no equal, a fact affirmed in recent years by certain of the world’s largest and most sophisticated P/C insurers, who wished to shed themselves of huge and exceptionally long-lived liabilities. That is, these insurers wished to “cede” these liabilities – most of them potential losses from asbestos claims – to a reinsurer. They needed the right one, though: If a reinsurer fails to pay a loss, the original insurer is still on the hook for it. Choosing a reinsurer, therefore, that down the road proves to be financially strapped or a bad actor threatens the original insurer with getting huge liabilities right back in its lap. Last year, our premier position in reinsurance was reaffirmed by our writing a policy carrying a $3 billion single premium. I believe that the policy’s size has only been exceeded by our 2007 transaction with Lloyd’s, in which the premium was $7.1 billion. In fact, I know of only eight P/C policies in history that had a single premium exceeding $1 billion. And, yes, all eight were written by Berkshire. Certain of these contracts will require us to make substantial payments 50 years or more from now. When major insurers have needed an unquestionable promise that payments of this type will be made, Berkshire has been the party – the only party – to call. ************ Berkshire’s great managers, premier financial strength and a variety of business models protected by wide moats amount to something unique in the insurance world. This assemblage of strengths is a huge asset for Berkshire shareholders that will only get more valuable with time. 11