正在加载图片...

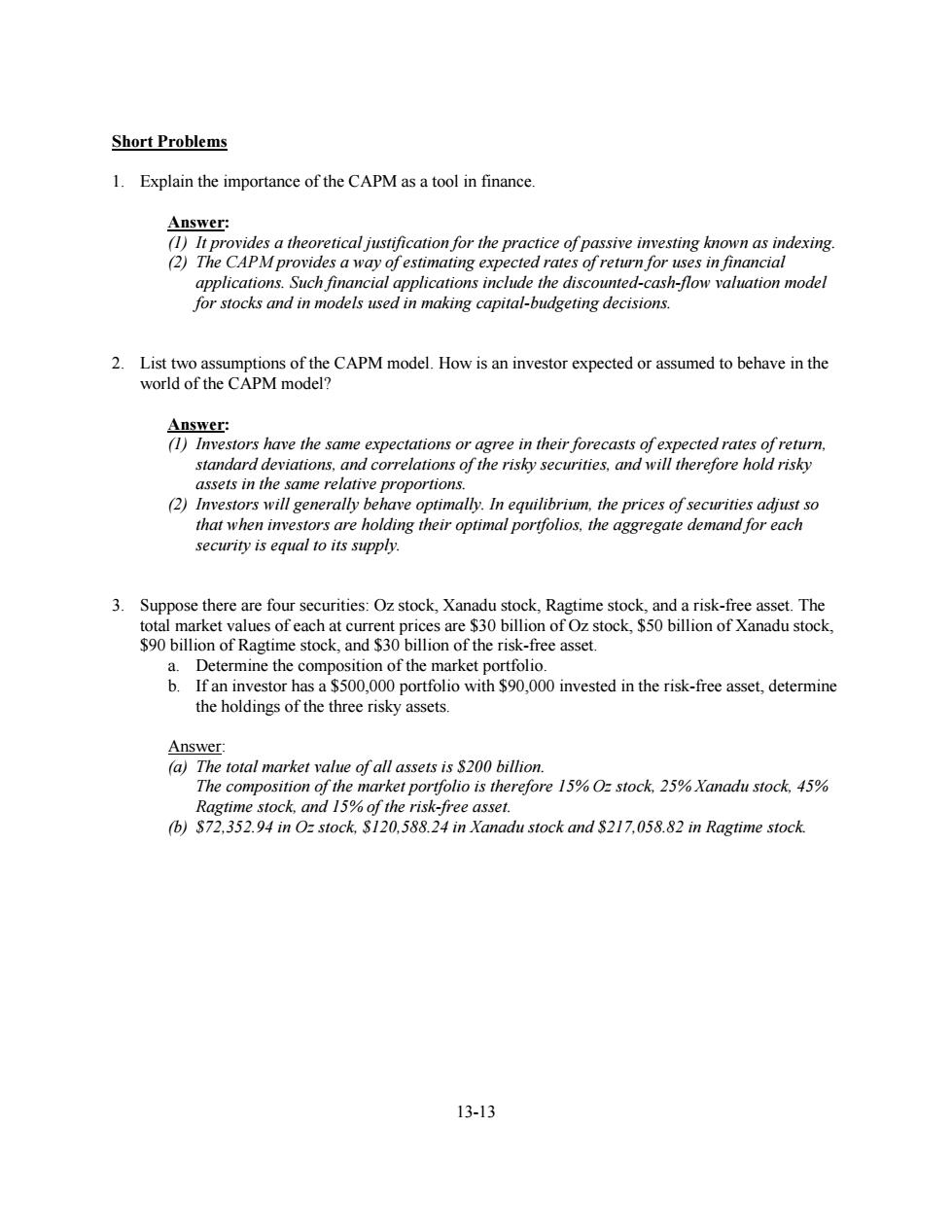

Short Problems 1.Explain the importance of the CAPM as a tool in finance. Answer: (1)It provides a theoretical justification for the practice of passive investing known as indexing (2)The CAPM provides a way of estimating expected rates of return for uses in financial applications.Such financial applications include the discounted-cash-flow valuation model for stocks and in models used in making capital-budgeting decisions. 2.List two assumptions of the CAPM model.How is an investor expected or assumed to behave in the world of the CAPM model? Answer: (1)Investors have the same expectations or agree in their forecasts of expected rates ofreturn, standard deviations,and correlations of the risky securities,and will therefore hold risky assets in the same relative proportions. (2)Investors will generally behave optimally.In equilibrium,the prices of securities adjust so that when investors are holding their optimal portfolios,the aggregate demand for each security is equal to its supply. 3.Suppose there are four securities:Oz stock,Xanadu stock,Ragtime stock,and a risk-free asset.The total market values of each at current prices are $30 billion of Oz stock,$50 billion of Xanadu stock. $90 billion of Ragtime stock,and $30 billion of the risk-free asset. a.Determine the composition of the market portfolio. b.If an investor has a $500,000 portfolio with $90,000 invested in the risk-free asset,determine the holdings of the three risky assets. Answer: (a)The total market value of all assets is $200 billion. The composition of the market portfolio is therefore 15%Oz stock,25%Xanadu stock,45% Ragtime stock,and 15%of the risk-free asset. (b)$72,352.94 in Oz stock,$120.588.24 in Xanadu stock and $217,058.82 in Ragtime stock. 13-1313-13 Short Problems 1. Explain the importance of the CAPM as a tool in finance. Answer: (1) It provides a theoretical justification for the practice of passive investing known as indexing. (2) The CAPM provides a way of estimating expected rates of return for uses in financial applications. Such financial applications include the discounted-cash-flow valuation model for stocks and in models used in making capital-budgeting decisions. 2. List two assumptions of the CAPM model. How is an investor expected or assumed to behave in the world of the CAPM model? Answer: (1) Investors have the same expectations or agree in their forecasts of expected rates of return, standard deviations, and correlations of the risky securities, and will therefore hold risky assets in the same relative proportions. (2) Investors will generally behave optimally. In equilibrium, the prices of securities adjust so that when investors are holding their optimal portfolios, the aggregate demand for each security is equal to its supply. 3. Suppose there are four securities: Oz stock, Xanadu stock, Ragtime stock, and a risk-free asset. The total market values of each at current prices are $30 billion of Oz stock, $50 billion of Xanadu stock, $90 billion of Ragtime stock, and $30 billion of the risk-free asset. a. Determine the composition of the market portfolio. b. If an investor has a $500,000 portfolio with $90,000 invested in the risk-free asset, determine the holdings of the three risky assets. Answer: (a) The total market value of all assets is $200 billion. The composition of the market portfolio is therefore 15% Oz stock, 25% Xanadu stock, 45% Ragtime stock, and 15% of the risk-free asset. (b) $72,352.94 in Oz stock, $120,588.24 in Xanadu stock and $217,058.82 in Ragtime stock