Chapter Thirteen Capital Market Equilibrium This chapter contains 43 multiple choice questions,19 short problems,and 9 longer problems. Multiple Choice 1.If one holds a diversified portfolio in which securities are held in the same relative proportions as in a broad market index,this is referred to as (a)eliminating (b)discounting risk (c)indexing (d)capitalizing Answer:(c) 2.The CAPM provides a way of estimating for use in a variety of financial applications. (a)actual rates of return (b)expected rates of return (c)expected standard deviation (d)actual standard deviation Answer:(b) 3.The CAPM may be used to provide (a)inputs to DCF valuation model for stocks (b)inputs to DCF valuation model for bonds (c)estimation of a"fair"rate of return on invested capital (d)both (a)and (c) Answer:(d) 13-1

13-1 Chapter Thirteen Capital Market Equilibrium This chapter contains 43 multiple choice questions, 19 short problems, and 9 longer problems. Multiple Choice 1. If one holds a diversified portfolio in which securities are held in the same relative proportions as in a broad market index, this is referred to as ________. (a) eliminating (b) discounting risk (c) indexing (d) capitalizing Answer: (c) 2. The CAPM provides a way of estimating ________ for use in a variety of financial applications. (a) actual rates of return (b) expected rates of return (c) expected standard deviation (d) actual standard deviation Answer: (b) 3. The CAPM may be used to provide ________. (a) inputs to DCF valuation model for stocks (b) inputs to DCF valuation model for bonds (c) estimation of a “fair” rate of return on invested capital (d) both (a) and (c) Answer: (d)

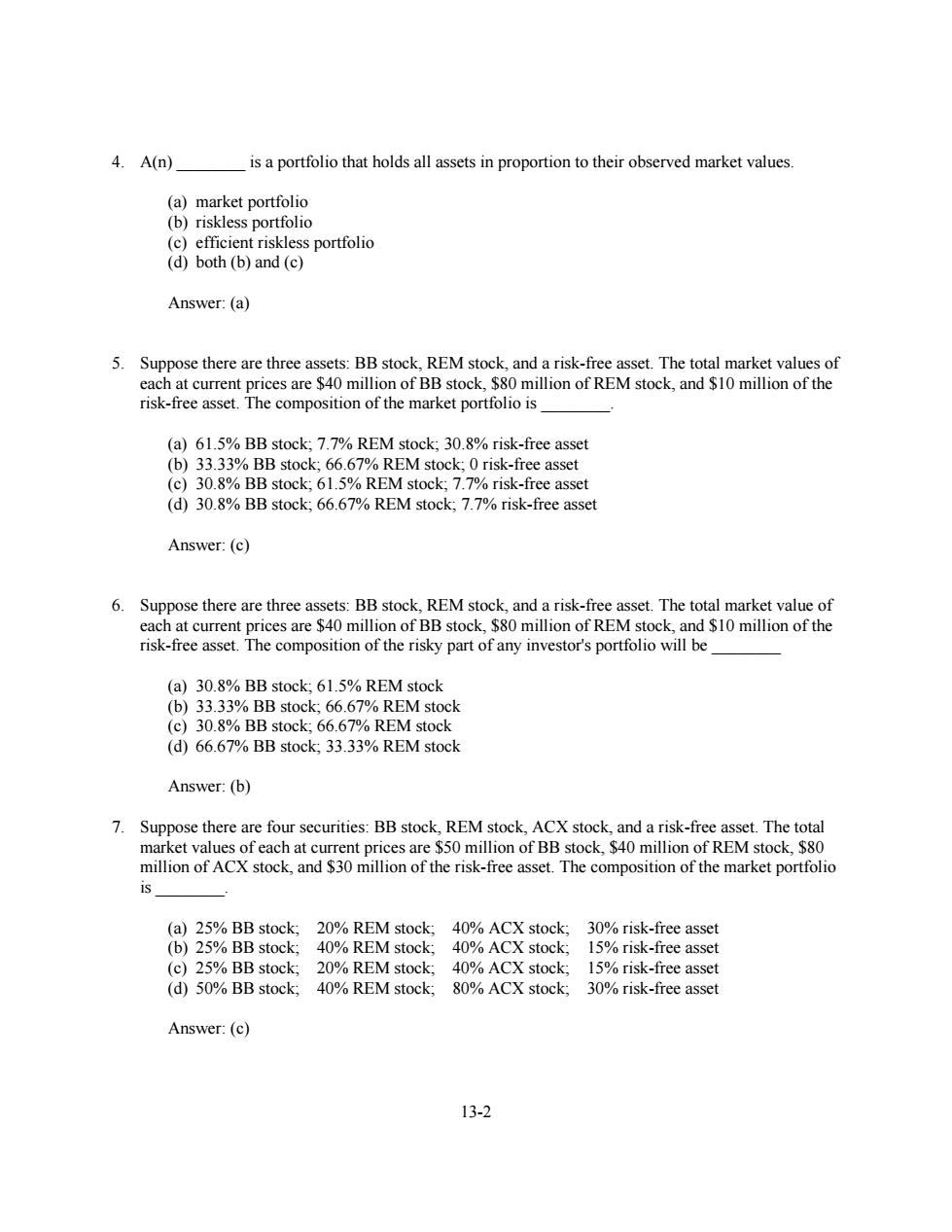

4.A(n)_ is a portfolio that holds all assets in proportion to their observed market values. (a)market portfolio (b)riskless portfolio (c)efficient riskless portfolio (d)both (b)and (c) Answer:(a) 5. Suppose there are three assets:BB stock,REM stock,and a risk-free asset.The total market values of each at current prices are $40 million of BB stock,$80 million of REM stock,and $10 million of the risk-free asset.The composition of the market portfolio is (a)61.5%BB stock;7.7%REM stock;30.8%risk-free asset (b)33.33%BB stock;66.67%REM stock;0 risk-free asset (c)30.8%BB stock;61.5%REM stock;7.7%risk-free asset (d)30.8%BB stock;66.67%REM stock;7.7%risk-free asset Answer:(c) 6.Suppose there are three assets:BB stock,REM stock,and a risk-free asset.The total market value of each at current prices are $40 million of BB stock,$80 million of REM stock,and $10 million of the risk-free asset.The composition of the risky part of any investor's portfolio will be (a)30.8%BB stock;61.5%REM stock (b)33.33%BB stock;66.67%REM stock (c)30.8%BB stock;66.67%REM stock (d)66.67%BB stock;33.33%REM stock Answer:(b) 7.Suppose there are four securities:BB stock,REM stock,ACX stock,and a risk-free asset.The total market values of each at current prices are $50 million of BB stock,$40 million of REM stock,$80 million of ACX stock,and $30 million of the risk-free asset.The composition of the market portfolio (a)25%BB stock:20%REM stock:40%ACX stock:30%risk-free asset (b)25%BB stock:40%REM stock: 40%ACX stock:15%risk-free asset (c)25%BB stock;20%REM stock:40%ACX stock: 15%risk-free asset (d)50%BB stock;40%REM stock;80%ACX stock;30%risk-free asset Answer:(c) 13-2

13-2 4. A(n) ________ is a portfolio that holds all assets in proportion to their observed market values. (a) market portfolio (b) riskless portfolio (c) efficient riskless portfolio (d) both (b) and (c) Answer: (a) 5. Suppose there are three assets: BB stock, REM stock, and a risk-free asset. The total market values of each at current prices are $40 million of BB stock, $80 million of REM stock, and $10 million of the risk-free asset. The composition of the market portfolio is ________. (a) 61.5% BB stock; 7.7% REM stock; 30.8% risk-free asset (b) 33.33% BB stock; 66.67% REM stock; 0 risk-free asset (c) 30.8% BB stock; 61.5% REM stock; 7.7% risk-free asset (d) 30.8% BB stock; 66.67% REM stock; 7.7% risk-free asset Answer: (c) 6. Suppose there are three assets: BB stock, REM stock, and a risk-free asset. The total market value of each at current prices are $40 million of BB stock, $80 million of REM stock, and $10 million of the risk-free asset. The composition of the risky part of any investor's portfolio will be ________ (a) 30.8% BB stock; 61.5% REM stock (b) 33.33% BB stock; 66.67% REM stock (c) 30.8% BB stock; 66.67% REM stock (d) 66.67% BB stock; 33.33% REM stock Answer: (b) 7. Suppose there are four securities: BB stock, REM stock, ACX stock, and a risk-free asset. The total market values of each at current prices are $50 million of BB stock, $40 million of REM stock, $80 million of ACX stock, and $30 million of the risk-free asset. The composition of the market portfolio is ________. (a) 25% BB stock; 20% REM stock; 40% ACX stock; 30% risk-free asset (b) 25% BB stock; 40% REM stock; 40% ACX stock; 15% risk-free asset (c) 25% BB stock; 20% REM stock; 40% ACX stock; 15% risk-free asset (d) 50% BB stock; 40% REM stock; 80% ACX stock; 30% risk-free asset Answer: (c)

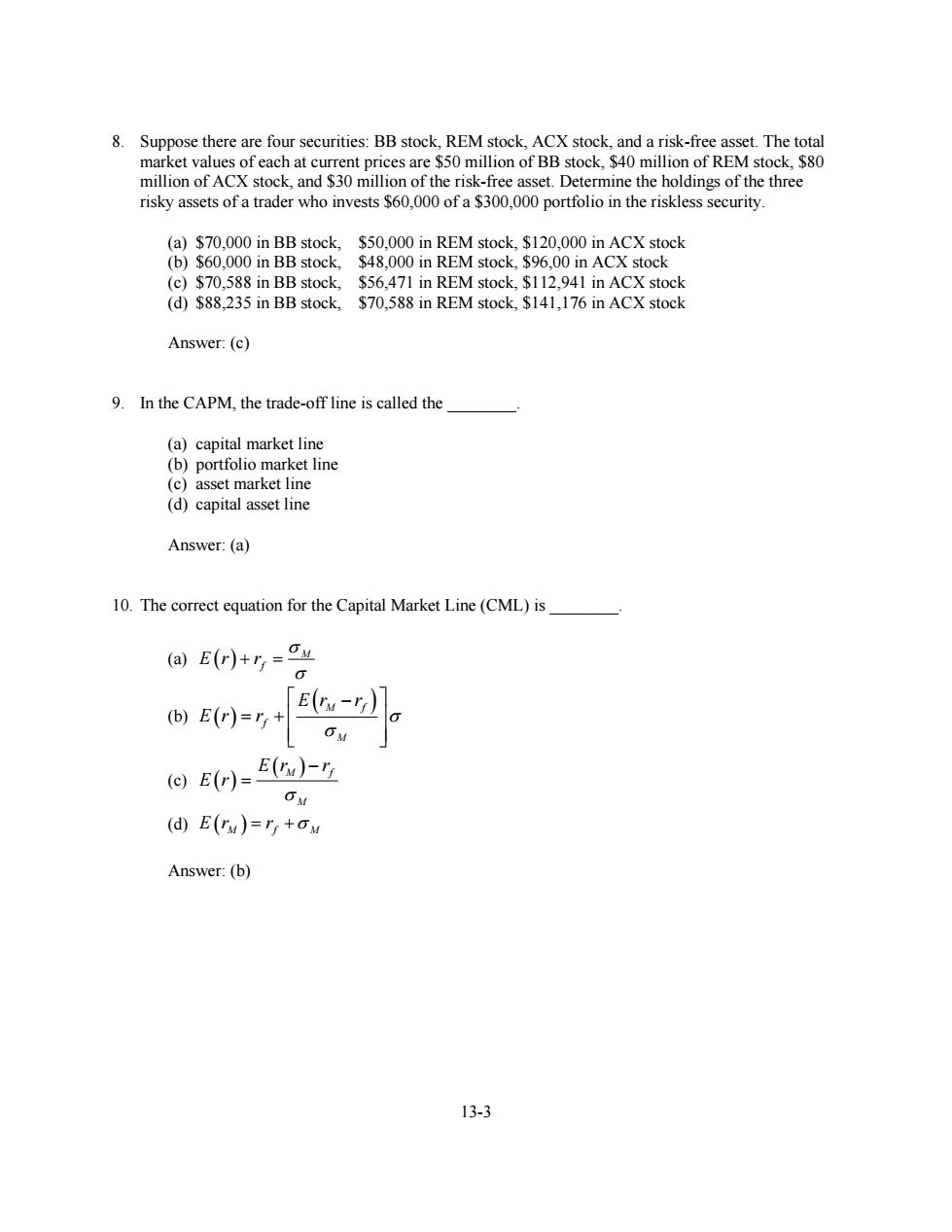

8.Suppose there are four securities:BB stock,REM stock,ACX stock,and a risk-free asset.The total market values of each at current prices are $50 million of BB stock,$40 million of REM stock,$80 million of ACX stock,and $30 million of the risk-free asset.Determine the holdings of the three risky assets of a trader who invests $60,000 of a $300,000 portfolio in the riskless security. (a)$70,000 in BB stock,$50,000 in REM stock,$120,000 in ACX stock (b)$60,000 in BB stock,$48,000 in REM stock,$96,00 in ACX stock (c)$70,588 in BB stock,$56,471 in REM stock,$112,941 in ACX stock (d)$88,235 in BB stock,$70,588 in REM stock,$141,176 in ACX stock Answer:(c) 9.In the CAPM,the trade-off line is called the (a)capital market line (b)portfolio market line (c)asset market line (d)capital asset line Answer:(a) 10.The correct equation for the Capital Market Line(CML)is a@E()+y=o4 (b)E(r)=+ E- OM (c)E(r)= E(r)- OM (d)E(r)=r+m Answer:(b) 13-3

13-3 8. Suppose there are four securities: BB stock, REM stock, ACX stock, and a risk-free asset. The total market values of each at current prices are $50 million of BB stock, $40 million of REM stock, $80 million of ACX stock, and $30 million of the risk-free asset. Determine the holdings of the three risky assets of a trader who invests $60,000 of a $300,000 portfolio in the riskless security. (a) $70,000 in BB stock, $50,000 in REM stock, $120,000 in ACX stock (b) $60,000 in BB stock, $48,000 in REM stock, $96,00 in ACX stock (c) $70,588 in BB stock, $56,471 in REM stock, $112,941 in ACX stock (d) $88,235 in BB stock, $70,588 in REM stock, $141,176 in ACX stock Answer: (c) 9. In the CAPM, the trade-off line is called the ________. (a) capital market line (b) portfolio market line (c) asset market line (d) capital asset line Answer: (a) 10. The correct equation for the Capital Market Line (CML) is ________. (a) M E r rf (b) M f f M E r r E r r (c) M f M E r r E r (d) E r r M f M Answer: (b)

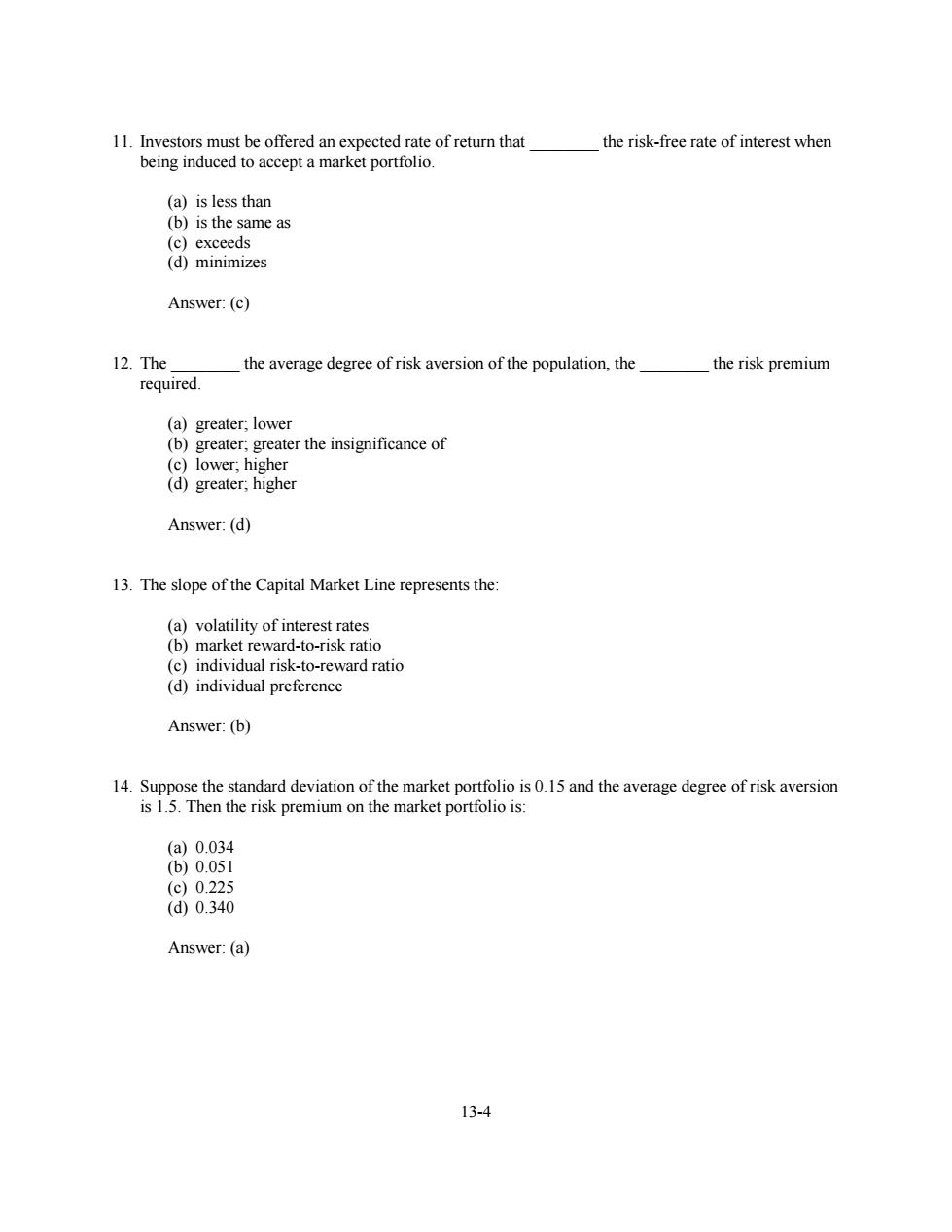

11.Investors must be offered an expected rate of return that the risk-free rate of interest when being induced to accept a market portfolio. (a)is less than (b)is the same as (c)exceeds (d)minimizes Answer:(c) 12.The the average degree of risk aversion of the population,the the risk premium required. (a)greater;lower (b)greater;greater the insignificance of (c)lower;higher (d)greater;higher Answer:(d) 13.The slope of the Capital Market Line represents the: (a)volatility of interest rates (b)market reward-to-risk ratio (c)individual risk-to-reward ratio (d)individual preference Answer:(b) 14.Suppose the standard deviation of the market portfolio is 0.15 and the average degree of risk aversion is 1.5.Then the risk premium on the market portfolio is: (a)0.034 (b)0.051 (c0.225 (d)0.340 Answer:(a) 13-4

13-4 11. Investors must be offered an expected rate of return that ________ the risk-free rate of interest when being induced to accept a market portfolio. (a) is less than (b) is the same as (c) exceeds (d) minimizes Answer: (c) 12. The ________ the average degree of risk aversion of the population, the ________ the risk premium required. (a) greater; lower (b) greater; greater the insignificance of (c) lower; higher (d) greater; higher Answer: (d) 13. The slope of the Capital Market Line represents the: (a) volatility of interest rates (b) market reward-to-risk ratio (c) individual risk-to-reward ratio (d) individual preference Answer: (b) 14. Suppose the standard deviation of the market portfolio is 0.15 and the average degree of risk aversion is 1.5. Then the risk premium on the market portfolio is: (a) 0.034 (b) 0.051 (c) 0.225 (d) 0.340 Answer: (a)

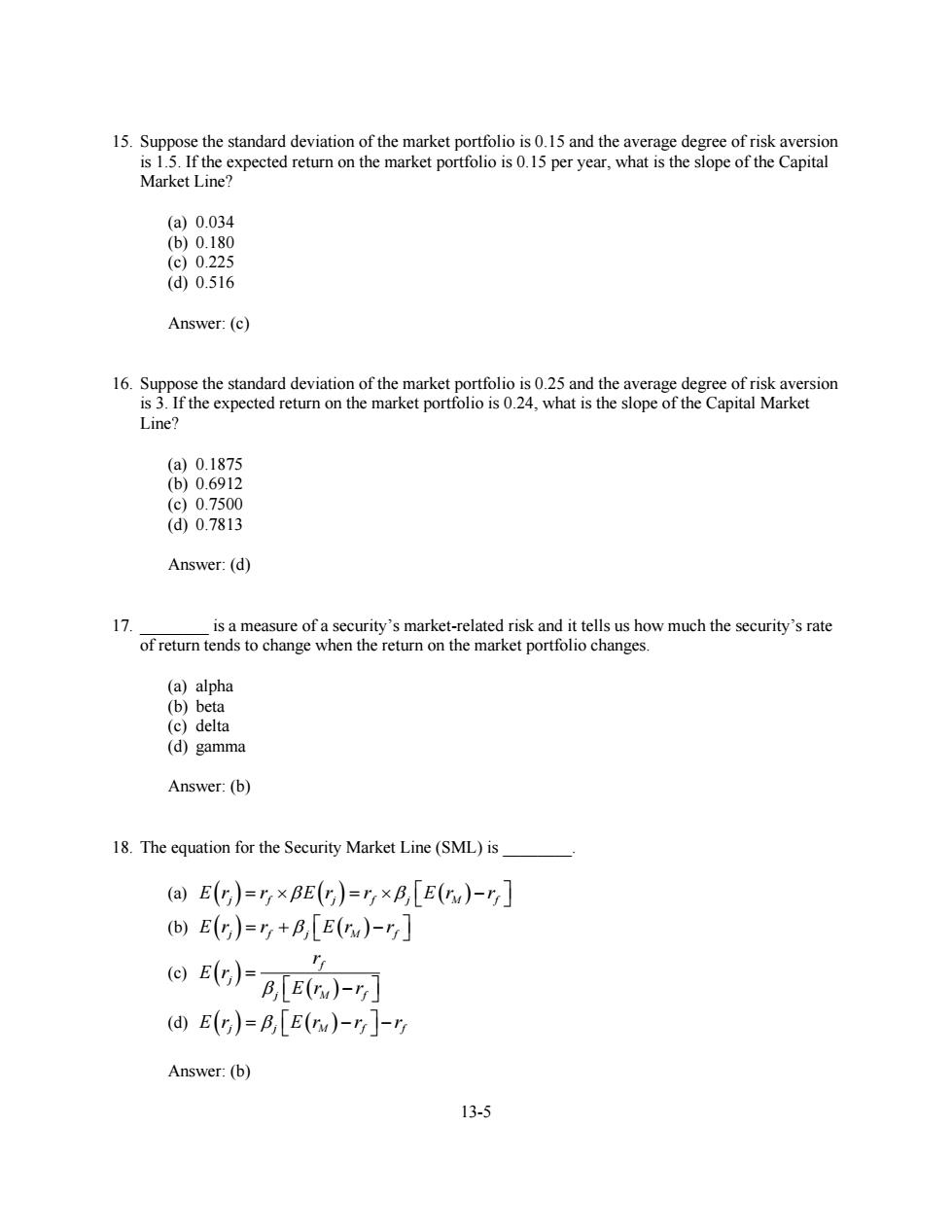

15.Suppose the standard deviation of the market portfolio is 0.15 and the average degree of risk aversion is 1.5.If the expected return on the market portfolio is 0.15 per year,what is the slope of the Capital Market Line? (a)0.034 (b)0.180 (c)0.225 (d0.516 Answer:(c) 16.Suppose the standard deviation of the market portfolio is 0.25 and the average degree of risk aversion is 3.If the expected return on the market portfolio is 0.24,what is the slope of the Capital Market Line? (a0.1875 (b)0.6912 (c)0.7500 (d0.7813 Answer:(d) 17. is a measure of a security's market-related risk and it tells us how much the security's rate of return tends to change when the return on the market portfolio changes. (a)alpha (b)beta (c)delta (d)gamma Answer:(b) 18.The equation for the Security Market Line(SML)is (a)Ey)=r×BE(g)=r×p,E(w)-y] (b)E(r)=+B,E(rx)- a(FgG-7 (@E(G)=B,E(u)-r]- Answer:(b) 13-5

13-5 15. Suppose the standard deviation of the market portfolio is 0.15 and the average degree of risk aversion is 1.5. If the expected return on the market portfolio is 0.15 per year, what is the slope of the Capital Market Line? (a) 0.034 (b) 0.180 (c) 0.225 (d) 0.516 Answer: (c) 16. Suppose the standard deviation of the market portfolio is 0.25 and the average degree of risk aversion is 3. If the expected return on the market portfolio is 0.24, what is the slope of the Capital Market Line? (a) 0.1875 (b) 0.6912 (c) 0.7500 (d) 0.7813 Answer: (d) 17. ________ is a measure of a security’s market-related risk and it tells us how much the security’s rate of return tends to change when the return on the market portfolio changes. (a) alpha (b) beta (c) delta (d) gamma Answer: (b) 18. The equation for the Security Market Line (SML) is ________. (a) E r r E r r E r r j f j f j M f (b) E r r E r r j f j M f (c) f j j M f r E r E r r (d) E r E r r r j j M f f Answer: (b)

19.If a security is more volatile than the market as a whole,it will have a beta,whereas if a security is less volatile than the market as a whole,it will have a beta (a)equal to 1;less then 1 (b)greater than 2;greater than I (c)less than 1;greater than 1 (d)greater than 1:less than 1 Answer:(d) 20.If you are examining a stock that has a beta of 2,according to the CAPM,what should be its expected rate of return?Let the market risk premium=0.07. (a)the risk-free rate plus 0.035 (b)the risk-free rate plus 0.07 (c)the risk-free rate plus 0.14 (d)the risk-free rate plus 2.00 Answer:(c) 21. refers to the difference between the average rate of return on a security or a portfolio of securities and its SML relation. a. Alpha b. Beta c. Delta d Gamma Answer:(a) 22.A beta of 1.5 for a security indicates (a)the security has below average market-related risk (b)the security has no market-related risk (c)the security has above average market-related risk (d)the security has average market-related risk Answer:(c) 13-6

13-6 19. If a security is more volatile than the market as a whole, it will have a beta ________, whereas if a security is less volatile than the market as a whole, it will have a beta ________. (a) equal to 1; less then 1 (b) greater than 2; greater than 1 (c) less than 1; greater than 1 (d) greater than 1; less than 1 Answer: (d) 20. If you are examining a stock that has a beta of 2, according to the CAPM, what should be its expected rate of return? Let the market risk premium = 0.07. (a) the risk-free rate plus 0.035 (b) the risk-free rate plus 0.07 (c) the risk-free rate plus 0.14 (d) the risk-free rate plus 2.00 Answer: (c) 21. ________ refers to the difference between the average rate of return on a security or a portfolio of securities and its SML relation. a. Alpha b. Beta c. Delta d. Gamma Answer: (a) 22. A beta of 1.5 for a security indicates ________. (a) the security has below average market-related risk (b) the security has no market-related risk (c) the security has above average market-related risk (d) the security has average market-related risk Answer: (c)

23.The risk-free rate of return for a security is 6%.The expected return on the market is 13%.What is the required rate of return for the security if it has a beta of 1.25? (a)22.25% (b)16.25% (c)14.75% (d8.75% Answer:(c) 24.Determine the beta of a portfolio consisting of the following stocks: Security Invested Beta REM 30% 1.1 ACX 20% 0.95 BGB 40% 1.2 CRY 10% 0.7 (a)0.92 (b)0.99 (c)1.07 (d)1.17 Answer:(c) 25.If the Treasury bill rate is currently 4%and the expected return on the market portfolio for the same period is 13%,determine the risk premium on the market. (a)0.52% (b)8.50% (c)9.00% (d11.00% Answer:(b) 13-7

13-7 23. The risk-free rate of return for a security is 6%. The expected return on the market is 13%. What is the required rate of return for the security if it has a beta of 1.25? (a) 22.25% (b) 16.25% (c) 14.75% (d) 8.75% Answer: (c) 24. Determine the beta of a portfolio consisting of the following stocks: Security % Invested Beta REM 30% 1.1 ACX 20% 0.95 BGB 40% 1.2 CRY 10% 0.7 (a) 0.92 (b) 0.99 (c) 1.07 (d) 1.17 Answer: (c) 25. If the Treasury bill rate is currently 4% and the expected return on the market portfolio for the same period is 13%, determine the risk premium on the market. (a) 0.52% (b) 8.50% (c) 9.00% (d) 11.00% Answer: (b)

26.If the Treasury bill rate is currently 4%and the expected return on the market portfolio for the same period is 13%,what is the equation of the CML if the standard deviation is 0.25? (a)Er)=0.04+0.36o (b)Er)=0.04+0.09o (c)Er)=0.09+0.36o (dEr)=0.09+0.16o Answer:(a) 27.Peggy has just been informed that the expected return from her portfolio is 15.5%.If 45%of Peggy's securities have an expected return of 10.8%and 25%have an expected return of 16.5%,what is the expected return of the remaining portion of Peggy's portfolio? (a)21.72% (b)19.55% (c)13.64% (d6.52% Answer:(a) 28.ZB Enterprises pays a current dividend of $1.80 and dividends are expected to grow at a rate of6% annually in the foreseeable future.ZB Enterprises has a beta of 1.1.If the risk-free rate is 8.5 and the market risk premium is 5%,at what price would a share of ZB stock be expected to sell? (a)$20.50 (b)$23.85 (c)$32.40 (d)$32.90 Answer:(b) 29.Two industrial firms are considering a merger.Drysler has a beta of 0.95 and Bendz has a beta of 1.25.Drysler's stock sells for $25 per share and there are 12 million shares outstanding.Bendz has 3 million shares outstanding and its stock sells for $50 per share.What will be the merged firm's beta if the merger is carried out? (a)1.05 (b)1.10 (c)1.54 (d)2.20 Answer:(a) 13-8

13-8 26. If the Treasury bill rate is currently 4% and the expected return on the market portfolio for the same period is 13%, what is the equation of the CML if the standard deviation is 0.25? (a) E(r) = 0.04 + 0.36σ (b) E(r) = 0.04+ 0.09σ (c) E(r) = 0.09 + 0.36σ (d) E(r) = 0.09 + 0.16σ Answer: (a) 27. Peggy has just been informed that the expected return from her portfolio is 15.5%. If 45% of Peggy's securities have an expected return of 10.8% and 25% have an expected return of 16.5%, what is the expected return of the remaining portion of Peggy's portfolio? (a) 21.72% (b) 19.55% (c) 13.64% (d) 6.52% Answer: (a) 28. ZB Enterprises pays a current dividend of $1.80 and dividends are expected to grow at a rate of 6% annually in the foreseeable future. ZB Enterprises has a beta of 1.1. If the risk-free rate is 8.5 and the market risk premium is 5%, at what price would a share of ZB stock be expected to sell? (a) $20.50 (b) $23.85 (c) $32.40 (d) $32.90 Answer: (b) 29. Two industrial firms are considering a merger. Drysler has a beta of 0.95 and Bendz has a beta of 1.25. Drysler's stock sells for $25 per share and there are 12 million shares outstanding. Bendz has 3 million shares outstanding and its stock sells for $50 per share. What will be the merged firm's beta if the merger is carried out? (a) 1.05 (b) 1.10 (c) 1.54 (d) 2.20 Answer: (a)

30.Monet Industries currently does not pay a dividend but expects to pay a dividend of $1.70 next year Thereafter,the dividend is expected to grow at a rate of 5%per year.The risk-free rate is currently 6%and the expected return on the market portfolio is 12%.What is the price you would expect to pay for a share of Monet today if the beta for this stock is 1.05? (a)$12.50 (b)$13.13 (c)$23.29 (d$24.45 Answer:(c) 31.Joe Citizen is considering venturing into the sports utility vehicle field.As a result of such a venture, the beta would increase from 1.07 to 1.15 and the expected growth rate in earnings would increase from 10%to 12%.Determine whether this is a worthwhile venture if Joe also has the following information:the risk-free rate is 6%,the current dividend is $0.95,and the expected return on the market portfolio is 13%. (a)No,it is not worthwhile since there is no change in stock price (b)Yes,it is worthwhile since the stock price increases by $21.96 (c)Yes,it is worthwhile since the stock price increases by $29.94 (d)No,it is not worthwhile-stock price decreases by $19.12 Answer:(b) 32.Consider a share of Rooble Less.If it has a beta of 0.7,and we also know that the risk-free rate is 7%, and the expected return on the market portfolio is 15%,what is the required rate of return for a share of Rooble Less stock? (a)10.5% (b)11.9% (c)12.6% (d17.5% Answer:(c) 13-9

13-9 30. Monet Industries currently does not pay a dividend but expects to pay a dividend of $1.70 next year. Thereafter, the dividend is expected to grow at a rate of 5% per year. The risk-free rate is currently 6% and the expected return on the market portfolio is 12%. What is the price you would expect to pay for a share of Monet today if the beta for this stock is 1.05? (a) $12.50 (b) $13.13 (c) $23.29 (d) $24.45 Answer: (c) 31. Joe Citizen is considering venturing into the sports utility vehicle field. As a result of such a venture, the beta would increase from 1.07 to 1.15 and the expected growth rate in earnings would increase from 10% to 12%. Determine whether this is a worthwhile venture if Joe also has the following information: the risk-free rate is 6%, the current dividend is $0.95, and the expected return on the market portfolio is 13%. (a) No, it is not worthwhile since there is no change in stock price (b) Yes, it is worthwhile since the stock price increases by $21.96 (c) Yes, it is worthwhile since the stock price increases by $29.94 (d) No, it is not worthwhile - stock price decreases by $19.12 Answer: (b) 32. Consider a share of Rooble Less. If it has a beta of 0.7, and we also know that the risk-free rate is 7%, and the expected return on the market portfolio is 15%, what is the required rate of return for a share of Rooble Less stock? (a) 10.5% (b) 11.9% (c) 12.6% (d) 17.5% Answer: (c)

33.Determine the beta of a portfolio containing the following stocks Stock Market Value Beta REM $30,000 0.82 Rooble $20,000 0.65 Drysler $40,000 1.25 Fourx $60,000 1.32 Wotan $80,000 1.65 (a)0.95 (b)1.14 (c)1.30 (d5.69 Answer:(c) 34.Kanga Enterprises stock currently sells for $33 a share and its current dividend is $1.90.Kanga enterprise stock is considered to be twice as volatile than the market as a whole.The expected return on the market portfolio is 14%and the risk-free rate is 6%.If dividends are expected to grow at a constant rate,g%,into the foreseeable future,then calculate this growth rate. (a)15.36% (b)16.24% (c)22.00% (d26.71% Answer:(a) 35.LLJ has a beta of 1.02.If the risk-free rate is 8%and the required return on LLJ's stock is 16%,what is the required rate of return of the market? (a)12.00% (b)15.84% (c)16.16% (d16.48% Answer:(b) 13-10

13-10 33. Determine the beta of a portfolio containing the following stocks ________. Stock Market Value Beta REM $30,000 0.82 Rooble $20,000 0.65 Drysler $40,000 1.25 Fourx $60,000 1.32 Wotan $80,000 1.65 (a) 0.95 (b) 1.14 (c) 1.30 (d) 5.69 Answer: (c) 34. Kanga Enterprises stock currently sells for $33 a share and its current dividend is $1.90. Kanga enterprise stock is considered to be twice as volatile than the market as a whole. The expected return on the market portfolio is 14% and the risk-free rate is 6%. If dividends are expected to grow at a constant rate, g%, into the foreseeable future, then calculate this growth rate. (a) 15.36% (b) 16.24% (c) 22.00% (d) 26.71% Answer: (a) 35. LLJ has a beta of 1.02. If the risk-free rate is 8% and the required return on LLJ’s stock is 16%, what is the required rate of return of the market? (a) 12.00% (b) 15.84% (c) 16.16% (d) 16.48% Answer: (b)