Chapter Five Household Savings and Investment Decisions Multiple Choice 1.Getting a professional degree can be evaluated as a)a social security decision b)an investment in human capital c)an investment in a consumer durable d)a tax exempt decision Answer:(b) 2.Suppose you will face a tax rate of 20%before and after retirement.The interest rate is 8%. You are 30 years before your retirement date and invest $10,000 to a tax deferred retirement plan.If you choose to withdraw the total accumulated amount at retirement,what will you be left with after paying taxes? a)$51,445 b) $64.000 c) $80,501 d)$100.627 Answer:(c) 3.Suppose you will face a tax rate of 20%before and after retirement.The interest rate is 8%. You are 30 years before your retirement date and have $10,000 to invest.If you invest this in an ordinary savings plan instead of a tax deferred retirement plan,what amount will you have accumulated at retirement? a)$51,445 b)$64.000 c)$80,501 d)$100,627 Answer:(a) 5-1

5-1 Chapter Five Household Savings and Investment Decisions Multiple Choice 1. Getting a professional degree can be evaluated as ________. a) a social security decision b) an investment in human capital c) an investment in a consumer durable d) a tax exempt decision Answer: (b) 2. Suppose you will face a tax rate of 20% before and after retirement. The interest rate is 8%. You are 30 years before your retirement date and invest $10,000 to a tax deferred retirement plan. If you choose to withdraw the total accumulated amount at retirement, what will you be left with after paying taxes? a) $51,445 b) $64,000 c) $80,501 d) $100,627 Answer: (c) 3. Suppose you will face a tax rate of 20% before and after retirement. The interest rate is 8%. You are 30 years before your retirement date and have $10,000 to invest. If you invest this in an ordinary savings plan instead of a tax deferred retirement plan, what amount will you have accumulated at retirement? a) $51,445 b) $64,000 c) $80,501 d) $100,627 Answer: (a)

4.When your tax rate remains unchanged,the benefit of tax deferral can be summarized in the rule,"deferral earns you a)the after-tax rate of return before tax b)the pretax rate of return after tax c)the after-tax rate of return after tax d)the pretax rate of return before tax Answer:(b) 5.From an economic perspective,professional training should be undertaken if the exceeds the a)future value of the benefit;present value of the costs b)present value of the benefits;future value of the costs c)future value of the benefits;future value of the costs d)present value of the benefits;future value of the costs Answer:(d) 6.Suppose you will face a tax rate of 30%before and after retirement.The interest rate is 6%. You are 35 years before your retirement date and $2,000 to a tax deferred retirement plan.If you choose to withdraw the total accumulated amount at retirement,what will you be left with after paying taxes? a)$7,532 b)$10,760 c)$12,298 d)$15,372 Answer:(b) 7.Kecia is currently thirty years old and she plans to retire at age sixty.She is expected to live to age eighty-five.Her labor income is $45,000 per year and she intends to maintain a constant level of real consumption spending over the next fifty-five years.Assuming a real interest rate of 4%per year,no taxes,and no growth in real labor income,what is the value of Kecia's human capital? a) $31,797 b)$35,196 c)$778,141 d)$994,888 Answer:(c) 5-2

5-2 4. When your tax rate remains unchanged, the benefit of tax deferral can be summarized in the rule, “deferral earns you ________.” a) the after-tax rate of return before tax b) the pretax rate of return after tax c) the after-tax rate of return after tax d) the pretax rate of return before tax Answer: (b) 5. From an economic perspective, professional training should be undertaken if the ________ exceeds the ________. a) future value of the benefit; present value of the costs b) present value of the benefits; future value of the costs c) future value of the benefits; future value of the costs d) present value of the benefits; future value of the costs Answer: (d) 6. Suppose you will face a tax rate of 30% before and after retirement. The interest rate is 6%. You are 35 years before your retirement date and $2,000 to a tax deferred retirement plan. If you choose to withdraw the total accumulated amount at retirement, what will you be left with after paying taxes? a) $7,532 b) $10,760 c) $12,298 d) $15,372 Answer: (b) 7. Kecia is currently thirty years old and she plans to retire at age sixty. She is expected to live to age eighty-five. Her labor income is $45,000 per year and she intends to maintain a constant level of real consumption spending over the next fifty-five years. Assuming a real interest rate of 4% per year, no taxes, and no growth in real labor income, what is the value of Kecia’s human capital? a) $31,797 b) $35,196 c) $778,141 d) $994,888 Answer: (c)

8.Kecia is currently thirty years old and she plans to retire at age sixty.She is expected to live to age eighty-five.Her labor income is $45,000 per year and she intends to maintain a constant level of real consumption spending over the next fifty-five years.Assuming a real interest rate of 4%per year,no taxes,and no growth in real labor income,what is the value of Kecia's permanent income? a)$31,797 b) $35,196 c) $778,141 d)$994,888 Answer:(b) 9.Oscar is currently thirty-five year old,plans to retire at age sixty-five,and to live to age eighty-five.His labor income is $40,000 per year,and he intends to maintain a constant level of real consumption spending over the next fifty years.Assuming a real interest rate of 4% per year,no taxes,and no growth in real labor income,what is the value of Oscar's human capital? a)$884,344 b) $691,681 c) $39,999 d)$32,198 Answer:(b) 10.Oscar is currently thirty-five year old,plans to retire at age sixty-five,and to live to age eighty-five.His labor income is $40,000 per year,and he intends to maintain a constant level of real consumption spending over the next fifty years.Assuming a real interest rate of 4% per year,no taxes,and no growth in real labor income,what is the value of Oscar's permanent income? a)$884,344 b) $691.,681 c) $39.999 d) $32,198 Answer:(d) 5-3

5-3 8. Kecia is currently thirty years old and she plans to retire at age sixty. She is expected to live to age eighty-five. Her labor income is $45,000 per year and she intends to maintain a constant level of real consumption spending over the next fifty-five years. Assuming a real interest rate of 4% per year, no taxes, and no growth in real labor income, what is the value of Kecia’s permanent income? a) $31,797 b) $35,196 c) $778,141 d) $994,888 Answer: (b) 9. Oscar is currently thirty-five year old, plans to retire at age sixty-five, and to live to age eighty-five. His labor income is $40,000 per year, and he intends to maintain a constant level of real consumption spending over the next fifty years. Assuming a real interest rate of 4% per year, no taxes, and no growth in real labor income, what is the value of Oscar’s human capital? a) $884,344 b) $691,681 c) $39,999 d) $32,198 Answer: (b) 10. Oscar is currently thirty-five year old, plans to retire at age sixty-five, and to live to age eighty-five. His labor income is $40,000 per year, and he intends to maintain a constant level of real consumption spending over the next fifty years. Assuming a real interest rate of 4% per year, no taxes, and no growth in real labor income, what is the value of Oscar’s permanent income? a) $884,344 b) $691,681 c) $39,999 d) $32,198 Answer: (d)

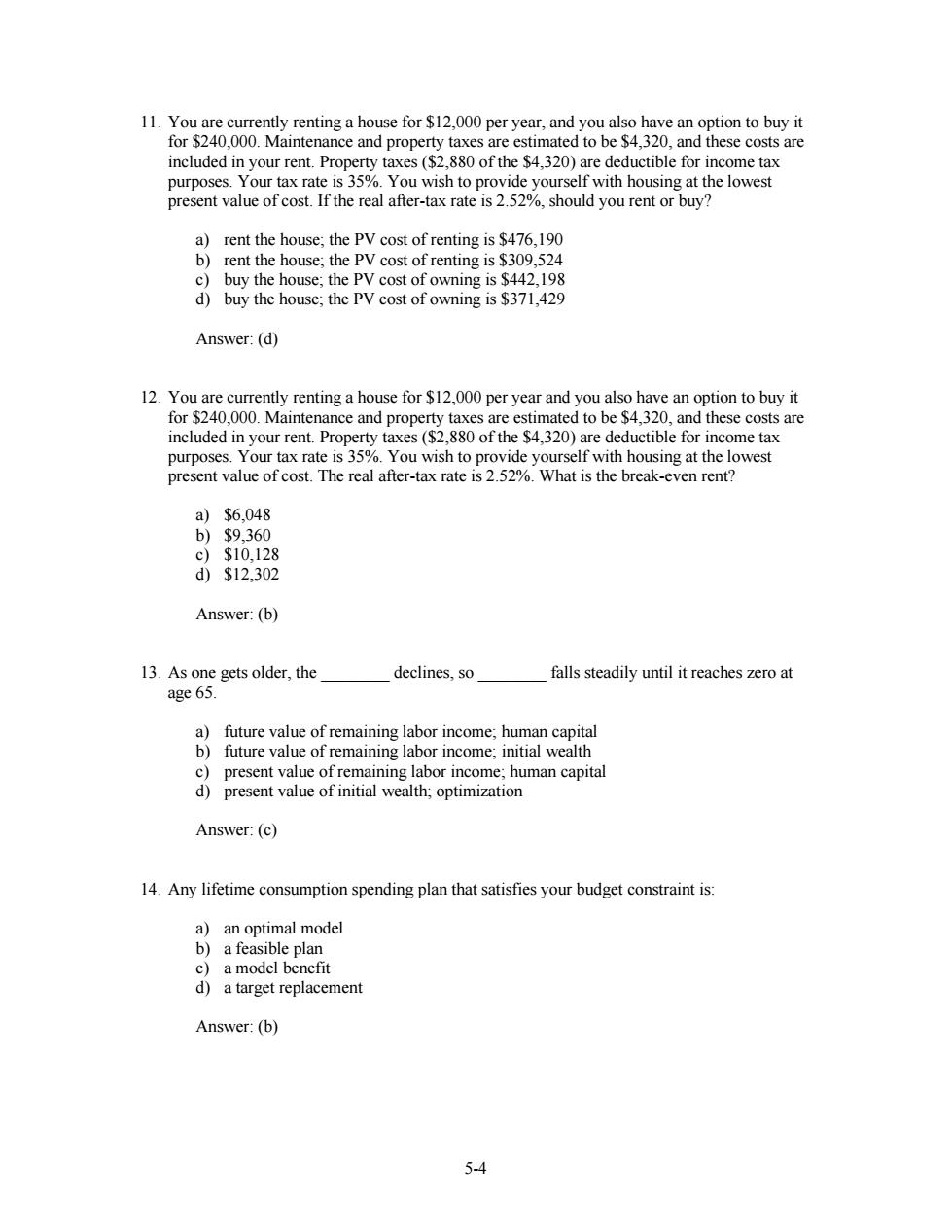

11.You are currently renting a house for $12,000 per year,and you also have an option to buy it for $240,000.Maintenance and property taxes are estimated to be $4,320,and these costs are included in your rent.Property taxes($2,880 of the $4,320)are deductible for income tax purposes.Your tax rate is 35%.You wish to provide yourself with housing at the lowest present value of cost.If the real after-tax rate is 2.52%,should you rent or buy? a)rent the house;the PV cost of renting is $476,190 b)rent the house;the PV cost of renting is $309,524 c) buy the house;the PV cost of owning is $442,198 d)buy the house;the PV cost of owning is $371,429 Answer:(d) 12.You are currently renting a house for $12,000 per year and you also have an option to buy it for $240,000.Maintenance and property taxes are estimated to be $4,320,and these costs are included in your rent.Property taxes($2,880 of the $4,320)are deductible for income tax purposes.Your tax rate is 35%.You wish to provide yourself with housing at the lowest present value of cost.The real after-tax rate is 2.52%.What is the break-even rent? a)$6,048 b)$9,360 c)$10,128 d)$12,302 Answer:(b) 13.As one gets older,the declines,so falls steadily until it reaches zero at age 65. a)future value of remaining labor income;human capital b)future value of remaining labor income;initial wealth c)present value of remaining labor income;human capital d)present value of initial wealth;optimization Answer:(c) 14.Any lifetime consumption spending plan that satisfies your budget constraint is: a)an optimal model b)a feasible plan c)a model benefit d)a target replacement Answer:(b) 5-4

5-4 11. You are currently renting a house for $12,000 per year, and you also have an option to buy it for $240,000. Maintenance and property taxes are estimated to be $4,320, and these costs are included in your rent. Property taxes ($2,880 of the $4,320) are deductible for income tax purposes. Your tax rate is 35%. You wish to provide yourself with housing at the lowest present value of cost. If the real after-tax rate is 2.52%, should you rent or buy? a) rent the house; the PV cost of renting is $476,190 b) rent the house; the PV cost of renting is $309,524 c) buy the house; the PV cost of owning is $442,198 d) buy the house; the PV cost of owning is $371,429 Answer: (d) 12. You are currently renting a house for $12,000 per year and you also have an option to buy it for $240,000. Maintenance and property taxes are estimated to be $4,320, and these costs are included in your rent. Property taxes ($2,880 of the $4,320) are deductible for income tax purposes. Your tax rate is 35%. You wish to provide yourself with housing at the lowest present value of cost. The real after-tax rate is 2.52%. What is the break-even rent? a) $6,048 b) $9,360 c) $10,128 d) $12,302 Answer: (b) 13. As one gets older, the ________ declines, so ________ falls steadily until it reaches zero at age 65. a) future value of remaining labor income; human capital b) future value of remaining labor income; initial wealth c) present value of remaining labor income; human capital d) present value of initial wealth; optimization Answer: (c) 14. Any lifetime consumption spending plan that satisfies your budget constraint is: a) an optimal model b) a feasible plan c) a model benefit d) a target replacement Answer: (b)

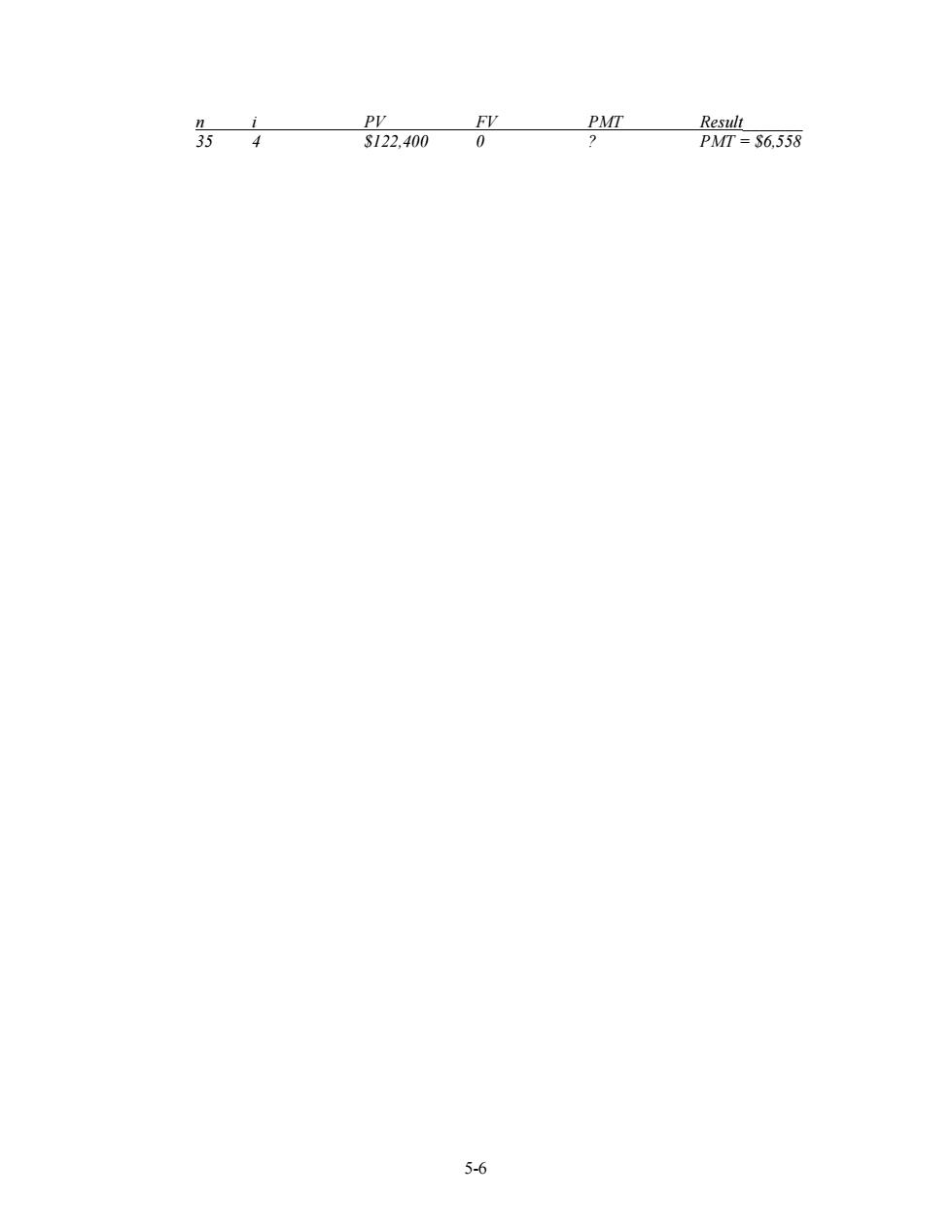

15.There is an advantage to tax deferred retirement savings plans for those when the money is withdrawn. a)who will be in a lower tax bracket b)who will be in the same tax bracket c)both (a)and(b) d)neither (a)nor (b) Answer:(c) Longer Problems 1.Tamara is currently twenty-eight years old,plans to retire at age seventy and to live to age ninety.Her labor income is $50,000 per year,and she intends to maintain a constant level of real consumption spending over the next sixty-two years.Assume no taxes,no growth in real labor income and a real interest rate of 4%per year. (a)What is the value of Tamara's human capital? (b)What is the value of Tamara's permanent income? Answer: (a)N PV FV PMT Result 42 2 2 S50.000 PV= SL,009,281 (b)N PV FV PMT Result 62 S1,009,281 0 PMT= S44,261 The value of Tamara's human capital is $1,009,281 The value of Tamara's permanent income is $44,261 2.You have just turned twenty-eight years of age and feel it is necessary to upgrade your qualifications.After some consideration,you feel that undertaking full-time study for an MBA degree is one alternative.For the two years of full-time study,tuition and living expenses will be $25,000 per year.In addition,you will have to give up your current job with a salary of $35,000 per year.Assume all cash flows occur at the end of the year.Assume a real interest rate of 4%per year,ignoring taxes.Also assume that the salary increase is at a constant real amount that starts after you complete your degree (at the end of the year following graduation)and lasts until retirement at age sixty-five.In order to justify the investment,by how much does your salary have to increase as a result of getting the MBA degree? Answer: Find the FV of tuition and foregone salary at the end of two years: PV FV PMT Result 2 4 0 2 60,000 FV=S122.400 Find the increase in salary that has this amount as its PV: 5-5

5-5 15. There is an advantage to tax deferred retirement savings plans for those ________ when the money is withdrawn. a) who will be in a lower tax bracket b) who will be in the same tax bracket c) both (a) and (b) d) neither (a) nor (b) Answer: (c) Longer Problems 1. Tamara is currently twenty-eight years old, plans to retire at age seventy and to live to age ninety. Her labor income is $50,000 per year, and she intends to maintain a constant level of real consumption spending over the next sixty-two years. Assume no taxes, no growth in real labor income and a real interest rate of 4% per year. (a) What is the value of Tamara’s human capital? (b) What is the value of Tamara’s permanent income? Answer: (a) N I PV FV PMT Result 42 4 ? 0 $50,000 PV = $1,009,281 (b) N I PV FV PMT Result 62 4 $1,009,281 0 ? PMT = $44,261 The value of Tamara’s human capital is $1,009,281 The value of Tamara’s permanent income is $44,261 2. You have just turned twenty-eight years of age and feel it is necessary to upgrade your qualifications. After some consideration, you feel that undertaking full-time study for an MBA degree is one alternative. For the two years of full-time study, tuition and living expenses will be $25,000 per year. In addition, you will have to give up your current job with a salary of $35,000 per year. Assume all cash flows occur at the end of the year. Assume a real interest rate of 4% per year, ignoring taxes. Also assume that the salary increase is at a constant real amount that starts after you complete your degree (at the end of the year following graduation) and lasts until retirement at age sixty-five. In order to justify the investment, by how much does your salary have to increase as a result of getting the MBA degree? Answer: Find the FV of tuition and foregone salary at the end of two years: N i PV FV PMT Result________ 2 4 0 ? 60,000 FV = $122,400 Find the increase in salary that has this amount as its PV:

PV FV PMT Result 35 4 S122,400 PMT=S6,558 5-6

5-6 n i PV FV PMT Result_______ 35 4 $122,400 0 ? PMT = $6,558

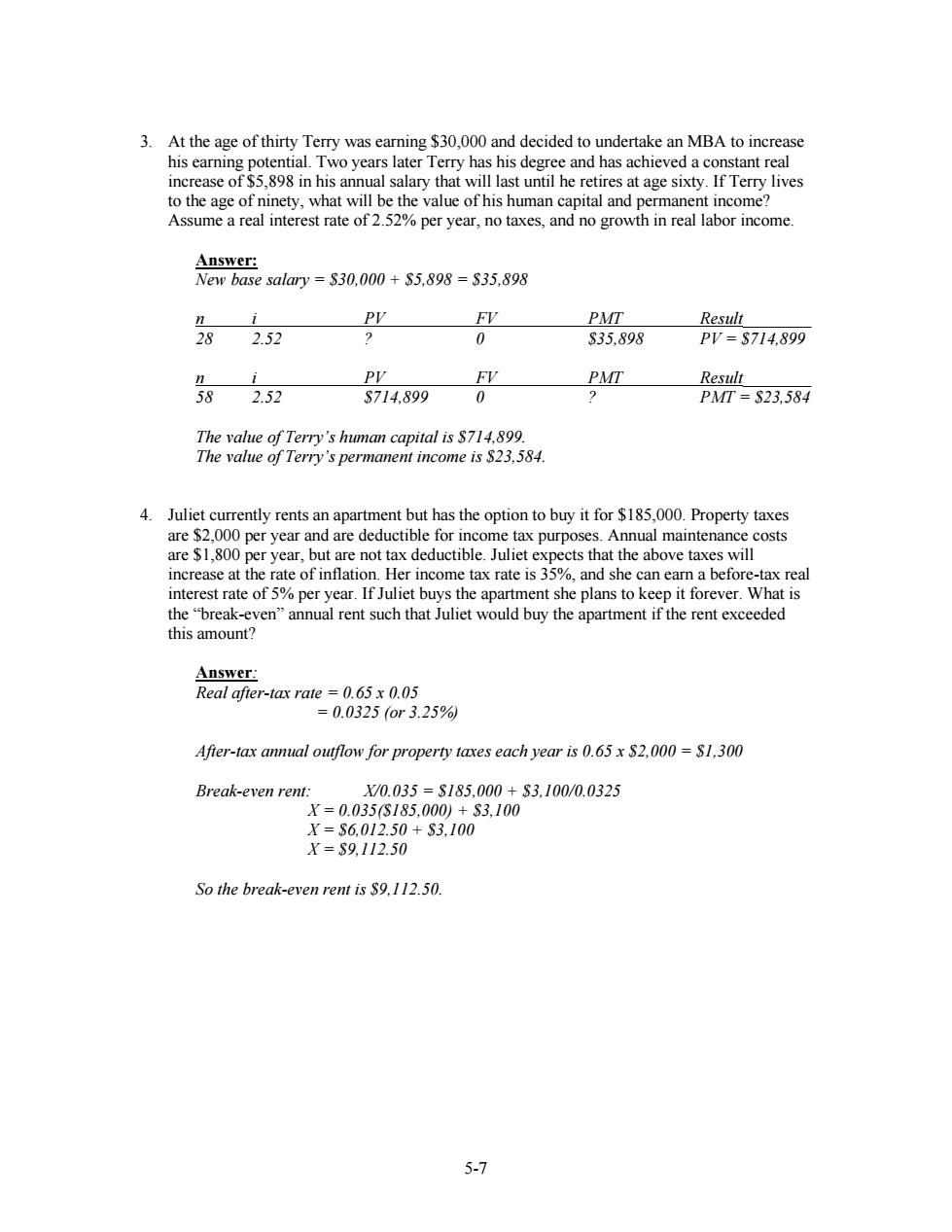

3.At the age of thirty Terry was earning $30,000 and decided to undertake an MBA to increase his earning potential.Two years later Terry has his degree and has achieved a constant real increase of $5,898 in his annual salary that will last until he retires at age sixty.If Terry lives to the age of ninety,what will be the value of his human capital and permanent income? Assume a real interest rate of 2.52%per year,no taxes,and no growth in real labor income. Answer: New base salary S30,000 S5,898=$35,898 PV FV PMT Result 28 2.52 0 S35,898 PV=S714,899 n i PV FV PMT Result 58 2.52 S714,899 0 PMT=S23,584 The value of Terry's human capital is $714,899. The value of Terry's permanent income is $23,584. 4.Juliet currently rents an apartment but has the option to buy it for $185,000.Property taxes are $2,000 per year and are deductible for income tax purposes.Annual maintenance costs are $1,800 per year,but are not tax deductible.Juliet expects that the above taxes will increase at the rate of inflation.Her income tax rate is 35%,and she can earn a before-tax real interest rate of 5%per year.If Juliet buys the apartment she plans to keep it forever.What is the"break-even"annual rent such that Juliet would buy the apartment if the rent exceeded this amount? Answer: Real after-tax rate =0.65 x 0.05 =0.0325or3.25% After-tax annual outflow for property taxes each year is 0.65x $2,000=$1,300 Break-even rent: X0.035=S185,000+S3,100/0.0325 X=0.035S185,000)+S3,100 X=S6,012.50+S3,100 X=S9.112.50 So the break-even rent is $9,112.50. 5-7

5-7 3. At the age of thirty Terry was earning $30,000 and decided to undertake an MBA to increase his earning potential. Two years later Terry has his degree and has achieved a constant real increase of $5,898 in his annual salary that will last until he retires at age sixty. If Terry lives to the age of ninety, what will be the value of his human capital and permanent income? Assume a real interest rate of 2.52% per year, no taxes, and no growth in real labor income. Answer: New base salary = $30,000 + $5,898 = $35,898 n i PV FV PMT Result________ 28 2.52 ? 0 $35,898 PV = $714,899 n i PV FV PMT Result________ 58 2.52 $714,899 0 ? PMT = $23,584 The value of Terry’s human capital is $714,899. The value of Terry’s permanent income is $23,584. 4. Juliet currently rents an apartment but has the option to buy it for $185,000. Property taxes are $2,000 per year and are deductible for income tax purposes. Annual maintenance costs are $1,800 per year, but are not tax deductible. Juliet expects that the above taxes will increase at the rate of inflation. Her income tax rate is 35%, and she can earn a before-tax real interest rate of 5% per year. If Juliet buys the apartment she plans to keep it forever. What is the “break-even” annual rent such that Juliet would buy the apartment if the rent exceeded this amount? Answer: Real after-tax rate = 0.65 x 0.05 = 0.0325 (or 3.25%) After-tax annual outflow for property taxes each year is 0.65 x $2,000 = $1,300 Break-even rent: X/0.035 = $185,000 + $3,100/0.0325 X = 0.035($185,000) + $3,100 X = $6,012.50 + $3,100 X = $9,112.50 So the break-even rent is $9,112.50