Lecture 6.: The Analysis of Investment projects (capital budgeting) Refer to ch.4&ch.6

Lecture 6: The Analysis of Investment projects (capital budgeting) 1 Refer to ch.4&ch.6

Chapter 6 Contents 6.1 The Nature of 6.6 Sensitivity Project Analysis Analysis Using Spreadsheets 6.2 Where do Investment ldeas 6.7 Analyzing Cost- come from? Reducing Projects 6.8 Projects with 6.3 The Net Present Different Lives Value Investment Rule 6.9 Ranking Mutually 6.4 Estimating a Exclusive Projects Project's Cash Flows 6.10 Inflation 6.5 Cost of Capital Capital Budgeting THE COURSE OF FINANCE 2017 SPRING SJTU ●2

Chapter 6 Contents 6.1 The Nature of Project Analysis 6.2 Where do Investment Ideas come from? 6.3 The Net Present Value Investment Rule 6.4 Estimating a Project’s Cash Flows 6.5 Cost of Capital 6.6 Sensitivity Analysis Using Spreadsheets 6.7 Analyzing Cost- Reducing Projects 6.8 Projects with Different Lives 6.9 Ranking Mutually Exclusive Projects 6.10 Inflation & Capital Budgeting THE COURSE OF FINANCE 2017 SPRING SJTU •2

Objective To show how to use discounted cash flow analysis to make investment decisions in business firms. THE COURSE OF FINANCE 2017 SPRING SJTU 3

Objective To show how to use discounted cash flow analysis to make investment decisions in business firms. THE COURSE OF FINANCE 2017 SPRING SJTU 3

Selected Contents 1.Firm's Investment Decision making rule: The Net Present Value (NPV,required) Internal Rate of Return (IRR,optional) 2.Cost of Capital D 3.Inflation Capital Budgeting The above contents are corresponding to 6.3/6.5/6.10 THE COURSE OF FINANCE 2017 SPRING SJTU 4

Selected Contents 1. Firm’s Investment Decision making rule: The Net Present Value (NPV, required) Internal Rate of Return (IRR, optional) 2.Cost of Capital 3.Inflation & Capital Budgeting The above contents are corresponding to 6.3/6.5/6.10 THE COURSE OF FINANCE 2017 SPRING SJTU 4

Firm's Investment Long term assets such as plant,equipment et. Most of them fall into three categories: New products Cost reduction Replacement THE COURSE OF FINANCE 2017 SPRING SJTU 5

Firm’s Investment Long term assets such as plant, equipment et. Most of them fall into three categories: New products Cost reduction Replacement THE COURSE OF FINANCE 2017 SPRING SJTU 5

Recall the objective of a firm Maximization of the market value of shareholders'equity In order to make it,Compute the net present value of the project's expected cash flows,and undertake only those with positive NPV THE COURSE OF FINANCE 2017 SPRING SJTU 6

Recall the objective of a firm Maximization of the market value of shareholders’ equity In order to make it, Compute the net present value of the project’s expected cash flows, and undertake only those with positive NPV THE COURSE OF FINANCE 2017 SPRING SJTU 6

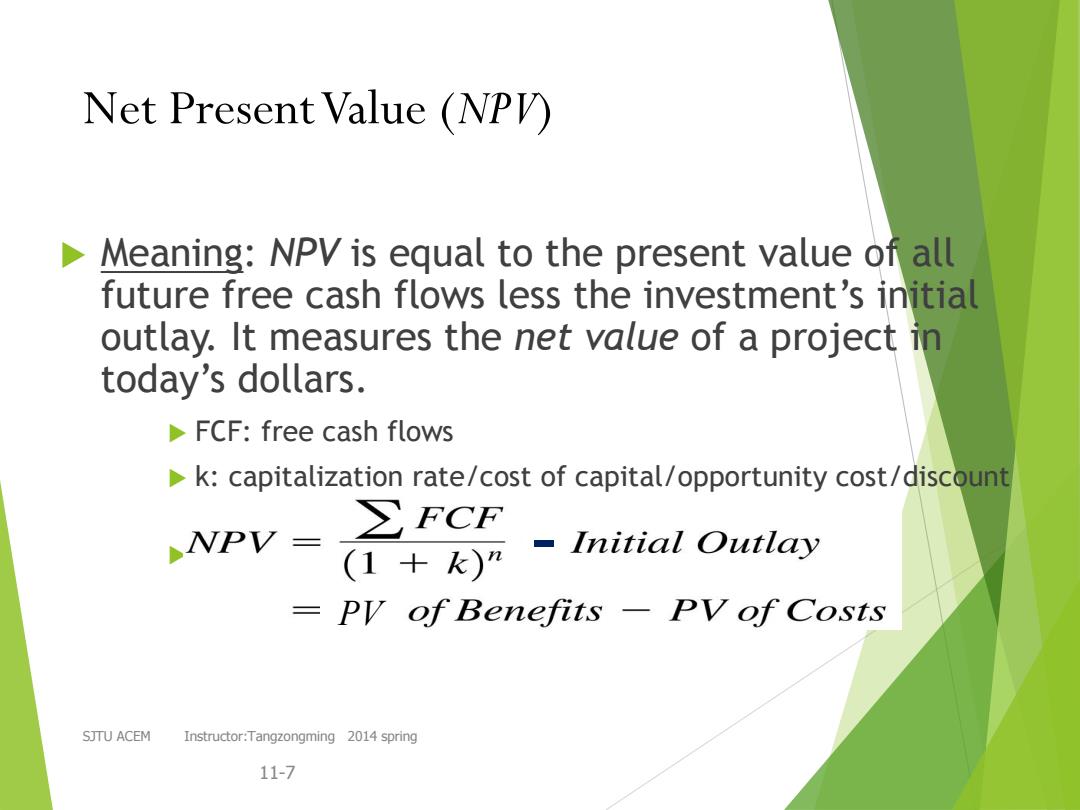

Net Present Value (NPV) Meaning:NPV is equal to the present value of all future free cash flows less the investment's initial outlay.It measures the net value of a project in today's dollars. FCF:free cash flows k:capitalization rate/cost of capital/opportunity cost/discount WPV=,之PCF (1kn -Initial Outlay =py of Benefits -PV of Costs SJTU ACEM Instructor:Tangzongming 2014 spring 11-7

Net PresentValue (NPV) Meaning: NPV is equal to the present value of all future free cash flows less the investment’s initial outlay. It measures the net value of a project in today’s dollars. FCF: free cash flows k: capitalization rate/cost of capital/opportunity cost/discount rate n: number of years SJTU ACEM Instructor:Tangzongming 2014 spring 11-7 - PV

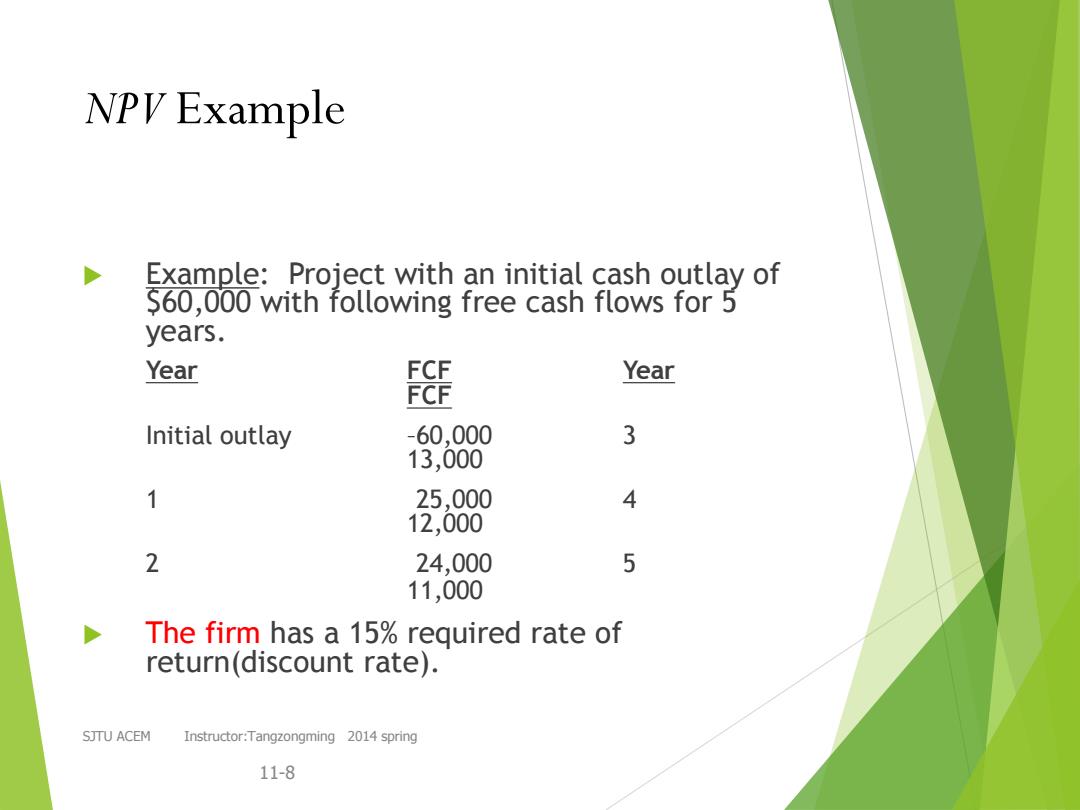

NPV Example Example:Project with an initial cash outlay of S60,000 with following free cash flows for 5 years. Year FCF Year FCF Initial outlay -60,000 3 13,000 1 25,000 4 12,000 2 24,000 5 11,000 The firm has a 15%required rate of return(discount rate). SJTU ACEM Instructor:Tangzongming 2014 spring 11-8

NPV Example Example: Project with an initial cash outlay of $60,000 with following free cash flows for 5 years. Year FCF Year FCF Initial outlay –60,000 3 13,000 1 –25,000 4 12,000 2 –24,000 5 11,000 The firm has a 15% required rate of return(discount rate). SJTU ACEM Instructor:Tangzongming 2014 spring 11-8

NPV Example ∑FCF NPV= Initial Outlay (1+k) PV of Benefits -PV of Costs PV of FCF S60,764 Subtracting the initial cash outlay of $60,000 leaves an NPV of $764. Since NPV 0,project is feasible. SJTU ACEM Instructor:Tangzongming 2014 spring 11-9

NPV Example PV of FCF = $60,764 Subtracting the initial cash outlay of $60,000 leaves an NPV of $764. Since NPV > 0, project is feasible. SJTU ACEM Instructor:Tangzongming 2014 spring 11-9 - PV

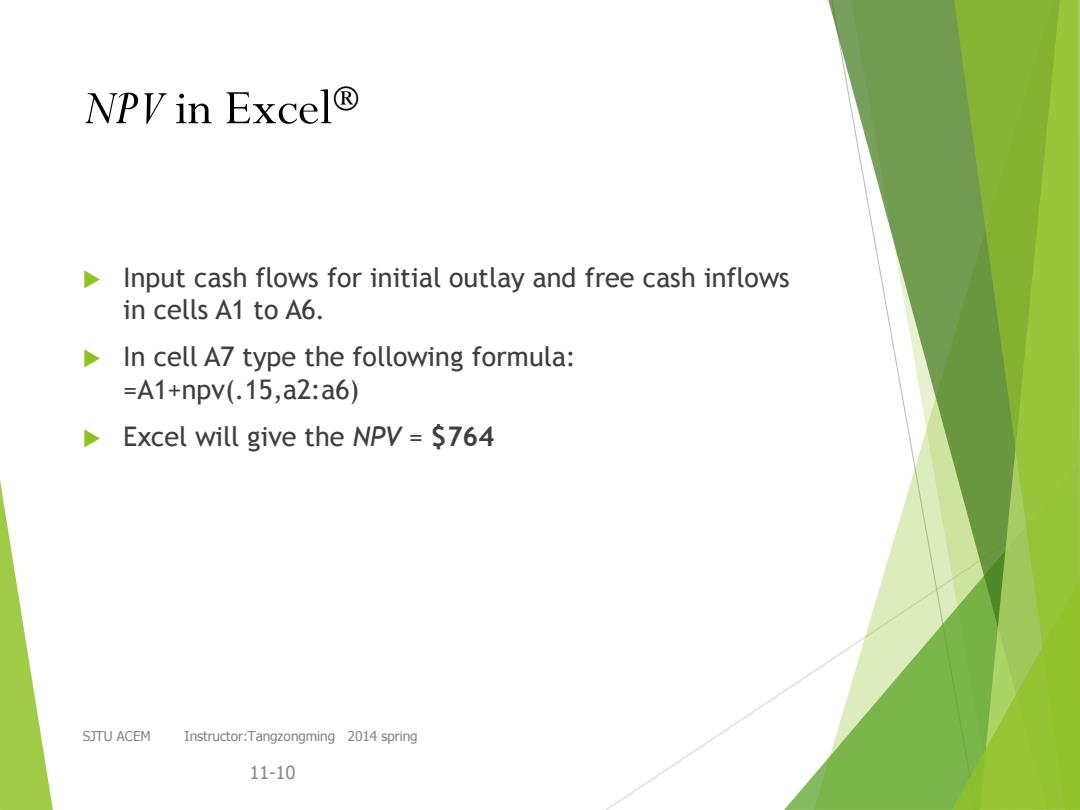

VPV in Excel® Input cash flows for initial outlay and free cash inflows in cells A1 to A6. In cell A7 type the following formula: =A1+npv(.15,a2:a6) Excel will give the NPV $764 SJTU ACEM Instructor:Tangzongming 2014 spring 11-10

NPV in Excel Input cash flows for initial outlay and free cash inflows in cells A1 to A6. In cell A7 type the following formula: =A1+npv(.15,a2:a6) Excel will give the NPV = $764 SJTU ACEM Instructor:Tangzongming 2014 spring 11-10