Chapter Seven Principles of Market Valuation Multiple Choice 1.In regard to an asset,the is defined as the process well-informed investors must pay for it in a free and competitive market. (a)analyst value (b)technical value (c)competitive value (d)fundamental value Answer:(d) 2.In corporate finance decision making,an extremely important rule is to choose the investment that_ current shareholders'wealth. (a)minimizes (b)maximizes (c)provides zero change in (d)jeopardizes Answer:(b) 3.In asset valuation,the method used to accomplish the estimation depends on the (a)number of participants (b)quality of calculating instruments (c)richness of the information set available (d)geographic location Answer:(c) 7-1

7-1 Chapter Seven Principles of Market Valuation Multiple Choice 1. In regard to an asset, the ________ is defined as the process well-informed investors must pay for it in a free and competitive market. (a) analyst value (b) technical value (c) competitive value (d) fundamental value Answer: (d) 2. In corporate finance decision making, an extremely important rule is to choose the investment that ________ current shareholders’ wealth. (a) minimizes (b) maximizes (c) provides zero change in (d) jeopardizes Answer: (b) 3. In asset valuation, the method used to accomplish the estimation depends on the ________. (a) number of participants (b) quality of calculating instruments (c) richness of the information set available (d) geographic location Answer: (c)

4.The states that in a competitive market,if two assets are equivalent,they will tend to have the same market price. (a)Law of Real Interest Rates (b)Law of One Price (c)Law of Price Equivalency (d)Law of Futures Answer:(b) 5.The Law of One Price is enforced by a process called the purchase and immediate sale of equivalent assets in order to earn a sure profit from a difference in their prices. (a)swapping (b)maximization (c)arbitrage (d)speculation Answer:(c) 6 refers to the totality of costs such as shipping,handling,insuring,and broker fees. (a)Shipping costs (b)Transaction costs (c)Installation costs (d)Insurance costs Answer:(b) 7.The Law of One price is a statement about the price of one asset the price of another. (a)absolute to (b)relative to (c)multiplied by (d)independent of Answer:(b) 7-2

7-2 4. The ________ states that in a competitive market, if two assets are equivalent, they will tend to have the same market price. (a) Law of Real Interest Rates (b) Law of One Price (c) Law of Price Equivalency (d) Law of Futures Answer: (b) 5. The Law of One Price is enforced by a process called ________, the purchase and immediate sale of equivalent assets in order to earn a sure profit from a difference in their prices. (a) swapping (b) maximization (c) arbitrage (d) speculation Answer: (c) 6. ________ refers to the totality of costs such as shipping, handling, insuring, and broker fees. (a) Shipping costs (b) Transaction costs (c) Installation costs (d) Insurance costs Answer: (b) 7. The Law of One price is a statement about the price of one asset ________ the price of another. (a) absolute to (b) relative to (c) multiplied by (d) independent of Answer: (b)

8.If an entity borrows at a lower rate and lends at a higher rate,this is an example of (a)opportunity arbitrage (b)interest-rate arbitrage (c)exchange arbitrage (d)nominal arbitrage Answer:(b) 9.If arbitrage ensures that any three currencies are freely convertible in competitive markets, then: (a)it is enough to know only one exchange rate to determine the third (b)we can estimate two exchange rates based on one exchange rate only (c)it is enough to know the exchange rates between any two in order to determine the third (d)it is necessary to know all three rates Answer:(c) 10.Suppose you have $15,000 in a bank account earning an interest rate of 4%per year.At the same time you have an unpaid balance on your credit card of $6,000 on which you are paying an interest rate of 17%per year.What arbitrage opportunity do you face? (a)$240 per year (b)$600 per year (c)$780 per year (d))$l,020 per year Answer:(c) 11.If the dollar price of Japanese Yen is $0.009594 per Japanese Yen and the dollar price of Chinese Yuan is $0.1433 per Chinese Yuan,what is the Japanese Yen price of a Chinese Yuan?(i.e.,JPY/CNY) (a)0.001375JPY/CNY (b)0.066950JPY/CNY (c)9.594 JPY/CNY (d)14.936419JPY/CNY Answer:(d) 7-3

7-3 8. If an entity borrows at a lower rate and lends at a higher rate, this is an example of ________. (a) opportunity arbitrage (b) interest-rate arbitrage (c) exchange arbitrage (d) nominal arbitrage Answer: (b) 9. If arbitrage ensures that any three currencies are freely convertible in competitive markets, then: (a) it is enough to know only one exchange rate to determine the third (b) we can estimate two exchange rates based on one exchange rate only (c) it is enough to know the exchange rates between any two in order to determine the third (d) it is necessary to know all three rates Answer: (c) 10. Suppose you have $15,000 in a bank account earning an interest rate of 4% per year. At the same time you have an unpaid balance on your credit card of $6,000 on which you are paying an interest rate of 17% per year. What arbitrage opportunity do you face? (a) $240 per year (b) $600 per year (c) $780 per year (d) $1,020 per year Answer: (c) 11. If the dollar price of Japanese Yen is $0.009594 per Japanese Yen and the dollar price of Chinese Yuan is $0.1433 per Chinese Yuan, what is the Japanese Yen price of a Chinese Yuan? (i.e., JPY/CNY) (a) 0.001375 JPY/CNY (b) 0.066950 JPY/CNY (c) 9.594 JPY/CNY (d) 14.936419 JPY/CNY Answer: (d)

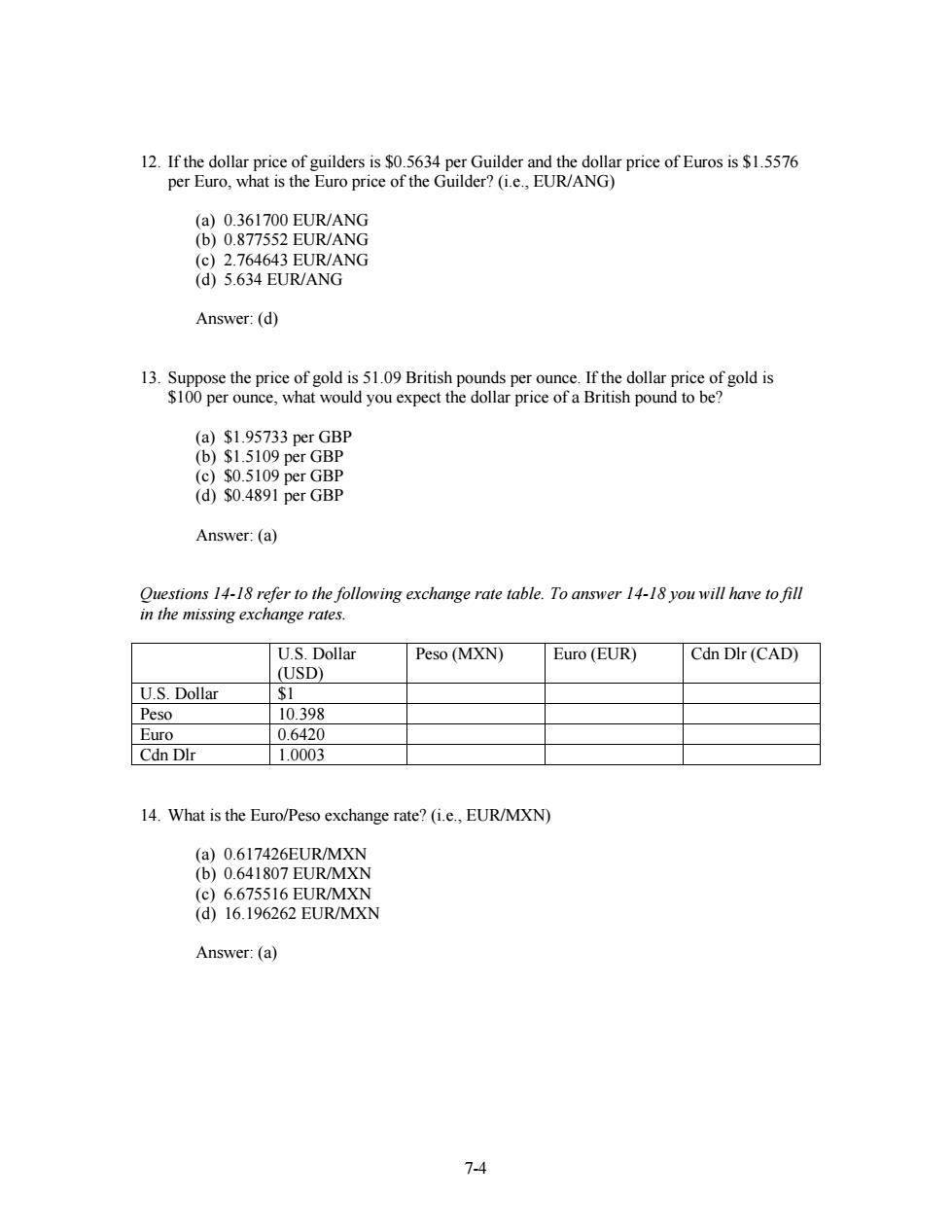

12.If the dollar price of guilders is $0.5634 per Guilder and the dollar price of Euros is $1.5576 per Euro,what is the Euro price of the Guilder?(i.e.,EUR/ANG) (a)0.361700EUR/ANG (b)0.877552EUR/ANG (c)2.764643EUR/ANG (d)5.634 EUR/ANG Answer:(d) 13.Suppose the price of gold is 51.09 British pounds per ounce.If the dollar price of gold is $100 per ounce,what would you expect the dollar price of a British pound to be? (a)$1.95733 per GBP (b)$1.5109 per GBP (c)$0.5109 per GBP (d)$0.4891 per GBP Answer:(a) Questions 14-18 refer to the following exchange rate table.To answer 14-18 you will have to fill in the missing exchange rates. U.S.Dollar Peso(MXN) Euro(EUR) Cdn DIr(CAD) (USD) U.S.Dollar $1 Peso 10.398 Euro 0.6420 Cdn DIr 1.0003 14.What is the Euro/Peso exchange rate?(i.e.,EUR/MXN) (a)0.617426EUR/MXN (b)0.641807EUR/MXN (c)6.675516EUR/MXN (d)16.196262EUR/MXN Answer:(a) 7-4

7-4 12. If the dollar price of guilders is $0.5634 per Guilder and the dollar price of Euros is $1.5576 per Euro, what is the Euro price of the Guilder? (i.e., EUR/ANG) (a) 0.361700 EUR/ANG (b) 0.877552 EUR/ANG (c) 2.764643 EUR/ANG (d) 5.634 EUR/ANG Answer: (d) 13. Suppose the price of gold is 51.09 British pounds per ounce. If the dollar price of gold is $100 per ounce, what would you expect the dollar price of a British pound to be? (a) $1.95733 per GBP (b) $1.5109 per GBP (c) $0.5109 per GBP (d) $0.4891 per GBP Answer: (a) Questions 14-18 refer to the following exchange rate table. To answer 14-18 you will have to fill in the missing exchange rates. U.S. Dollar (USD) Peso (MXN) Euro (EUR) Cdn Dlr (CAD) U.S. Dollar $1 Peso 10.398 Euro 0.6420 Cdn Dlr 1.0003 14. What is the Euro/Peso exchange rate? (i.e., EUR/MXN) (a) 0.617426EUR/MXN (b) 0.641807 EUR/MXN (c) 6.675516 EUR/MXN (d) 16.196262 EUR/MXN Answer: (a)

15.What is the Cdn Dlr/Euro exchange rate?(i.e.,CAD/EUR) (a)0.641807CAD/EUR (b)1.558099CAD/EUR (c)6.420 CAD/EUR (d)16.196262CAD/EUR Answer:(b) 16.What is the Euro/Cdn DIr exchange rate?(i.e.,EUR/CAD) (a)0.3583 EUR/CAD (b)0.641807EUR/CAD (c)1.558099EUR/CAD (d)10.394 EUR/CAD Answer:(b) 17.What is the Peso/Cdn DIr exchange rate?(i.e.,MXN/CAD) (a)0.096201MXN/CAD (b)0.641807MXN/CAD (c)10.394882MXN/CAD (d)16.196262MXN/CAD Answer:(c) 18.What is the Peso/Euro exchange rate?(i.e.,MXN/EUR) (a)0.617426MXN/EUR (b)6.675516MXN/EUR (c)15.581112MXN/EUR (d)16.196262MXN/EUR Answer:(d) 7-5

7-5 15. What is the Cdn Dlr/Euro exchange rate? (i.e., CAD/EUR) (a) 0.641807 CAD/EUR (b) 1.558099 CAD/EUR (c) 6.420 CAD/EUR (d) 16.196262 CAD/EUR Answer: (b) 16. What is the Euro/Cdn Dlr exchange rate? (i.e., EUR/CAD) (a) 0.3583 EUR/CAD (b) 0.641807 EUR/CAD (c) 1.558099 EUR/CAD (d) 10.394 EUR/CAD Answer: (b) 17. What is the Peso/Cdn Dlr exchange rate? (i.e., MXN/CAD) (a) 0.096201 MXN/CAD (b) 0.641807 MXN/CAD (c) 10.394882 MXN/CAD (d) 16.196262 MXN/CAD Answer: (c) 18. What is the Peso/Euro exchange rate? (i.e., MXN/EUR) (a) 0.617426 MXN/EUR (b) 6.675516 MXN/EUR (c) 15.581112 MXN/EUR (d) 16.196262 MXN/EUR Answer: (d)

19.You are travelling in FarOut where you can buy 130 kranes(a krane being the unit of currency of FarOut)with a U.S.dollar at official FarOut banks.Your tour guide has a relative who dabbles in the black market and this particular relative will sell you kranes for just $0.00833 each on the black market.How much will you lose or gain by exchanging $200 on the black market instead of going to the bank? (a)you would gain approximately 1,660 kranes (b)you would lose approximately 1,660 kranes (c)you would gain approximately 1,990 kranes (d)you would lose approximately 1,990 kranes Answer:(d) 20.In estimating the value of a share of a firm's stock,a simple model is to: (a)divide EPS by a P/E multiple (b)multiply EPS by a P/E multiple (c)multiply EPS by EAT (d)divide EPS by market value Answer:(b) 21.A firm's earnings per share are $6 and the industry average P/E multiple is 9.What would be an estimate of the value of a share of the firm's stock? (a)$54.00 (b)$45.00 (c)$1.50 (d)$0.67 Answer:(a) 22.The value of the asset as it appears in the financial statement is called the asset's (a)market value (b)fixed value (c)book value (d)expected value Answer:(c) 7-6

7-6 19. You are travelling in FarOut where you can buy 130 kranes (a krane being the unit of currency of FarOut) with a U.S. dollar at official FarOut banks. Your tour guide has a relative who dabbles in the black market and this particular relative will sell you kranes for just $0.00833 each on the black market. How much will you lose or gain by exchanging $200 on the black market instead of going to the bank? (a) you would gain approximately 1,660 kranes (b) you would lose approximately 1,660 kranes (c) you would gain approximately 1,990 kranes (d) you would lose approximately 1,990 kranes Answer: (d) 20. In estimating the value of a share of a firm’s stock, a simple model is to : (a) divide EPS by a P/E multiple (b) multiply EPS by a P/E multiple (c) multiply EPS by EAT (d) divide EPS by market value Answer: (b) 21. A firm’s earnings per share are $6 and the industry average P/E multiple is 9. What would be an estimate of the value of a share of the firm’s stock? (a) $54.00 (b) $45.00 (c) $1.50 (d) $0.67 Answer: (a) 22. The value of the asset as it appears in the financial statement is called the asset’s ________. (a) market value (b) fixed value (c) book value (d) expected value Answer: (c)

23.Consider the following stock market reaction to the information contained in a company's announcement.A corporation has just announced that it must pursue the issuance of company equity.We could expect to see in the price of company stock. (a)arise (b)a drop (c)a rapid rise (d)zero change Answer:(b) 24.Consider what the stock market reaction to the following announcement would be.A corporation has just announced that it is engaging in a stock split of the company's shares We could expect to see a in the overall market capitalization rate and a in the price of company stock. (a)rise:drop (b)drop;rise (c)rise;drop (d)rise;drop Answer:(a) 25.The is the proposition that an asset's current price fully reflects all publicly available information about future economic fundamentals affecting the asset's value (a)public markets hypothesis (b)efficient markets exchange rates (c)fundamental value proposition (d)efficient markets hypothesis Answer:(d) 26.The market price of an asset reflects the of all analysts'opinions with heavier weights on analysts who control large amounts of money and on those analysts who have better than average information (a)best estimate (b)weighted average (c)highest estimate (d)lowest estimate Answer:(b) 7-7

7-7 23. Consider the following stock market reaction to the information contained in a company’s announcement. A corporation has just announced that it must pursue the issuance of company equity. We could expect to see ________ in the price of company stock. (a) a rise (b) a drop (c) a rapid rise (d) zero change Answer: (b) 24. Consider what the stock market reaction to the following announcement would be. A corporation has just announced that it is engaging in a stock split of the company’s shares. We could expect to see a ________ in the overall market capitalization rate and a ________ in the price of company stock. (a) rise; drop (b) drop; rise (c) rise; drop (d) rise; drop Answer: (a) 25. The ________ is the proposition that an asset’s current price fully reflects all publicly available information about future economic fundamentals affecting the asset’s value. (a) public markets hypothesis (b) efficient markets exchange rates (c) fundamental value proposition (d) efficient markets hypothesis Answer: (d) 26. The market price of an asset reflects the ________ of all analysts’ opinions with heavier weights on analysts who control large amounts of money and on those analysts who have better than average information. (a) best estimate (b) weighted average (c) highest estimate (d) lowest estimate Answer: (b)

27.Assume that the worldwide risk-free real rate of interest is 4%per year.Inflation in Denmark is 9%per year and in the United States it is 7%per year.Assuming there is no uncertainty about inflation,what are the implied nominal interest rates denominated in Danish krone and in U.S.dollars,respectively? (a)16.63%(DKK);13.50%(USD) (b)13.50%(DKK);16.63%(USD) (c)13.36%(DKK):11.28%(USD) (d)11.28%(DKK):13.36%(USD) Answer:(c) 28.The theory states that the expected real interest rate on risk-free loans is the same all over the world. (a)nominal interest-rate parity (b)real interest-rate parity (c)efficient inflation rate parity (d)efficient market rate Answer:(b) 29 states that exchange rates adjust so as to maintain the same"real"price of a representative"basket of goods and services around the world. (a)Purchasing power parity (b)Efficient markets hypothesis (c)Market valuation model (d)Exchange rate equity Answer:(a) 30.Assume that the worldwide risk-free real rate of interest is 5%per year.Inflation in Australia is 9%per year and in Great Britain it is 12%per year.Assuming there is no uncertainty about inflation,what are the implied nominal interest rates denominated in Australian dollars and Great Britain pounds,respectively? (a)22.08%(AUD),11.45%(GBP) (b)11.45%(AUD),22.08%(GBP) (c)17.60%(AUD),14.45%(GBP) (d)14.45%(AUD),17.60%(GBP) Answer:(d) 7-8

7-8 27. Assume that the worldwide risk-free real rate of interest is 4% per year. Inflation in Denmark is 9% per year and in the United States it is 7% per year. Assuming there is no uncertainty about inflation, what are the implied nominal interest rates denominated in Danish krone and in U.S. dollars, respectively? (a) 16.63% (DKK); 13.50% (USD) (b) 13.50% (DKK); 16.63% (USD) (c) 13.36% (DKK); 11.28% (USD) (d) 11.28% (DKK); 13.36% (USD) Answer: (c) 28. The ________ theory states that the expected real interest rate on risk-free loans is the same all over the world. (a) nominal interest-rate parity (b) real interest-rate parity (c) efficient inflation rate parity (d) efficient market rate Answer: (b) 29. ________ states that exchange rates adjust so as to maintain the same “real” price of a “representative” basket of goods and services around the world. (a) Purchasing power parity (b) Efficient markets hypothesis (c) Market valuation model (d) Exchange rate equity Answer: (a) 30. Assume that the worldwide risk-free real rate of interest is 5% per year. Inflation in Australia is 9% per year and in Great Britain it is 12% per year. Assuming there is no uncertainty about inflation, what are the implied nominal interest rates denominated in Australian dollars and Great Britain pounds, respectively? (a) 22.08% (AUD), 11.45% (GBP) (b) 11.45% (AUD), 22.08% (GBP) (c) 17.60% (AUD), 14.45% (GBP) (d) 14.45% (AUD), 17.60% (GBP) Answer: (d)

Short Problems 1.Suppose you have $20,000 in a bank account earning an interest rate of 4%per year.At the same time you have an unpaid balance on your credit card of $7,000 on which you are paying an interest rate of 18%per year.What is the arbitrage opportunity you face? Answer:You could take S7,000 out ofyour bank account and pay down your credit card balance.You would give up 4%per year in interest earnings(S280)but you would save 18%per year in interest expenses ($1,260).So the arbitrage opportunity is worth S980 per year. 2.Fill in the missing exchange rates in the following table: U.S.Dollar Euro Danish Krone Japanese Yen U.S.Dollar $1 1.5576 0.2088 0.009594 Euro 0.6420 Danish Krone 4.7898 Japanese Yen 104.23 Answer: U.S.Dollar Euro Danish Krone Japanese Yen U.S.Dollar SI 1.5576 0.2088 0.009594 Euro 0.6420 1 Euro 0.1340 0.006159 Danish Krone 4.7898 7.46074 1 Krone 0.45954 Japanese Yen 104.23 162.35 21.761 Yen I 3. Suppose that the exchange rate is $0.2970 to the Israeli shekel.How could you make arbitrage profits with $10,000 if the dollar price of gold is $200 per ounce and the shekel price is 750 ILS per ounce? Answer:Take $10,000 and buy 50 ounces of gold at $200 per ounce.Sell 50 ounces of gold in Israel for 37,500 ILS (750 ILS per ounce).Take 37,500 ILS and exchange it into dollars worth $11,137.50.The arbitrage profit is $1,137.50. 4.A firm's earnings per share are $5.50 and the industry average P/E multiple is 8.What would be an estimate of the value of a share of the firm's stock?Is it possible for firms being classified in the same industry to have different price/earnings multiples? Answer: Estimated value share of stock firm's EPSx Industry average P/E 7-9

7-9 Short Problems 1. Suppose you have $20,000 in a bank account earning an interest rate of 4% per year. At the same time you have an unpaid balance on your credit card of $7,000 on which you are paying an interest rate of 18% per year. What is the arbitrage opportunity you face? Answer: You could take $7,000 out of your bank account and pay down your credit card balance. You would give up 4% per year in interest earnings ($280) but you would save 18% per year in interest expenses ($1,260). So the arbitrage opportunity is worth $980 per year. 2. Fill in the missing exchange rates in the following table: U.S. Dollar Euro Danish Krone Japanese Yen U.S. Dollar $1 1.5576 0.2088 0.009594 Euro 0.6420 Danish Krone 4.7898 Japanese Yen 104.23 Answer: U.S. Dollar Euro Danish Krone Japanese Yen U.S. Dollar $1 1.5576 0.2088 0.009594 Euro 0.6420 1 Euro 0.1340 0.006159 Danish Krone 4.7898 7.46074 1 Krone 0.45954 Japanese Yen 104.23 162.35 21.761 Yen 1 3. Suppose that the exchange rate is $0.2970 to the Israeli shekel. How could you make arbitrage profits with $10,000 if the dollar price of gold is $200 per ounce and the shekel price is 750 ILS per ounce? Answer: Take $10,000 and buy 50 ounces of gold at $200 per ounce. Sell 50 ounces of gold in Israel for 37,500 ILS (750 ILS per ounce). Take 37,500 ILS and exchange it into dollars worth $11,137.50. The arbitrage profit is $1,137.50. . 4. A firm’s earnings per share are $5.50 and the industry average P/E multiple is 8. What would be an estimate of the value of a share of the firm’s stock? Is it possible for firms being classified in the same industry to have different price/earnings multiples? Answer: Estimated value share of stock = firm’s EPS x Industry average P/E

=85.50x8 =S44.00 Firms classified as being in the same industry may have different opportunities for growth in the future and may therefore differ in their P/E multiples. 5.The P/E multiple of BHM Corporation is currently 5,while the P/E ratio of the S&P 500 is 10.What reasons could account for this difference? Answer: BHM's reported earnings may be higher than they are expected to be in the future,or they may be inflated due to special accounting methods used by BHM. BHM may be riskier than the S&P 500 either because it is in a relatively risky industry or has a relatively higher debt ratio. 6.The price of Hubris Co.stock recently jumped when the CEO for the company announced an increased dividend payment for the year.What might account for such a market reaction? Answer:The market may believe the company's future prospects look very bright (that is,higher earnings,less risk,sound growth,etc.)and that the company can sustain such an earnings growth. 7-10

7-10 = $5.50 x 8 = $44.00 Firms classified as being in the same industry may have different opportunities for growth in the future and may therefore differ in their P/E multiples. 5. The P/E multiple of BHM Corporation is currently 5, while the P/E ratio of the S&P 500 is 10. What reasons could account for this difference? Answer: BHM’s reported earnings may be higher than they are expected to be in the future, or they may be inflated due to special accounting methods used by BHM. BHM may be riskier than the S&P 500 either because it is in a relatively risky industry or has a relatively higher debt ratio. 6. The price of Hubris Co. stock recently jumped when the CEO for the company announced an increased dividend payment for the year. What might account for such a market reaction? Answer: The market may believe the company’s future prospects look very bright (that is, higher earnings, less risk, sound growth, etc.) and that the company can sustain such an earnings growth