Lecture 8 Valuation of Known Cash Flows:Bonds refer to Ch.8 THE COURSE OF FINANCE 2017 SPRING SJTU

Lecture 8 Valuation of Known Cash Flows: Bonds refer to Ch.8 THE COURSE OF FINANCE 2017 SPRING SJTU 1

Objectives To show how to value bonds To understand how bond prices and yields change over time THE COURSE OF FINANCE 2017 SPRING SJTU

Objectives n To show how to value bonds n To understand how bond prices and yields change over time THE COURSE OF FINANCE 2017 SPRING SJTU 2

Chapter 8 Contents 8.1 Using Present Value Formulas to Value Known Flows 8.2 The Basic Building Blocks:Pure Discount Bonds 8.3 Coupon Bonds,Current Yield,and Yield-to-Maturity 8.4 Reading Bond Listings 8.5 Why Yields for the same Maturity Differ 8.6 The Behavior of Bond Prices Over Time THE COURSE OF FINANCE 2017 SPRING SJTU

Chapter 8 Contents 8.1 Using Present Value Formulas to Value Known Flows 8.2 The Basic Building Blocks: Pure Discount Bonds 8.3 Coupon Bonds, Current Yield, and Yield-to-Maturity 8.4 Reading Bond Listings 8.5 Why Yields for the same Maturity Differ 8.6 The Behavior of Bond Prices Over Time THE COURSE OF FINANCE 2017 SPRING SJTU 3

8.1 Using Present Value Formulas to value Known Flows You have been offered the opportunity to purchase a mortgage.It was originally part of a creative financing package where the original owner financed the buyer The remaining life of the mortgage is 60 months,with payment of S400.Your required rate of return is 1.5%month THE COURSE OF FINANCE 2017 SPRING SJTU

8.1 Using Present Value Formulas to Value Known Flows You have been offered the opportunity to purchase a mortgage. It was originally part of a creative financing package where the original owner financed the buyer The remaining life of the mortgage is 60 months, with payment of $400. Your required rate of return is 1.5% / month THE COURSE OF FINANCE 2017 SPRING SJTU 4

Calculation Using the present value of an annuity formula discussed in chapter 4,you will pay no more than 四1-(j - 60 0.015 =$15,752.11 THE COURSE OF FINANCE 2017 SPRING SJTU

Calculation Using the present value of an annuity formula discussed in chapter 4, you will pay no more than THE COURSE OF FINANCE 2017 SPRING SJTU 5 $ 15 ,752 . 11 1 . 015 1 1 0 . 015 400 1 1 1 60 n i i pmt PV

Change in Required Rate If your required rate of return increased to 1.6%month PV 二 g a 60 400 0.016 =$15,354.66 THE COURSE OF FINANCE 2017 SPRING SJTU

Change in Required Rate If your required rate of return increased to 1.6% / month THE COURSE OF FINANCE 2017 SPRING SJTU 6 $ 15 ,354 . 66 1 . 016 1 1 0 . 016 400 1 1 1 60 n i i pmt PV

Using Present Value Formulas to Value Known Cash Flows Observe that the maximum you would pay for the bond has decreased -(〕 -+ 60 架-s门 -0.016 -i 400 =$15,752.11 =$15,354.66 Conclusion i PV THE COURSE OF FINANCE 2017 SPRING SJTU

Using Present Value Formulas to Value Known Cash Flows Observe that the maximum you would pay for the bond has decreased THE COURSE OF FINANCE 2017 SPRING SJTU 7 $15,752.11 1.015 1 1 0.015 400 1 1 1 60 n i i pmt PV $15,354.66 1.016 1 1 0.016 400 1 1 1 60 n i i pmt PV Conclusion : i PV

Coupon Bonds Definition A coupon bond obligates the issuer to make periodic payments of interest to the bond holder until the bond matures at which time the face value of the bond is also paid to the bond holder and the contract is satisfied THE COURSE OF FINANCE 2017 SPRING SJTU

Coupon Bonds Definition : A coupon bond obligates the issuer to make periodic payments of interest to the bond holder until the bond matures at which time the face value of the bond is also paid to the bond holder and the contract is satisfied THE COURSE OF FINANCE 2017 SPRING SJTU 8

Characteristics of Coupon Bonc Par value (face value or principal) Coupon rate(interest rate) It is the interest rate applied to the face value to compute the coupon payment Maturity (years) Current yield (coupon/bond price) Yield to Maturity (or discount rate which is also called Yield.If we have the price of the coupon bond,and the timing and magnitude of its future cash flows,so we can determine its YTM or yield. THE COURSE OF FINANCE 2017 SPRING SJTU

Characteristics of Coupon Bond Par value (face value or principal) Coupon rate(interest rate) It is the interest rate applied to the face value to compute the coupon payment Maturity (years) Current yield (coupon/bond price) Yield to Maturity (or discount rate ) which is also called Yield. If we have the price of the coupon bond, and the timing and magnitude of its future cash flows, so we can determine its YTM or yield. THE COURSE OF FINANCE 2017 SPRING SJTU 9

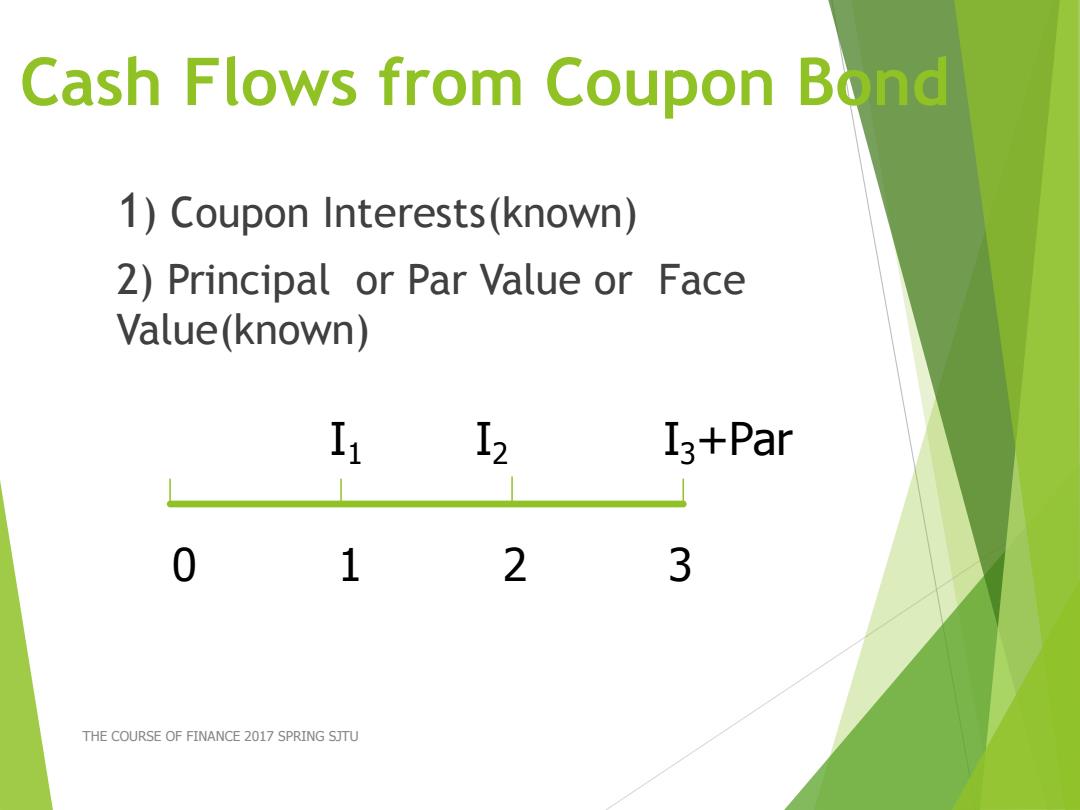

Cash Flows from Coupon Bond 1)Coupon Interests(known) 2)Principal or Par Value or Face Value(known) 1 1 I3+Par 1 2 3 THE COURSE OF FINANCE 2017 SPRING SJTU

Cash Flows from Coupon Bond 1) Coupon Interests(known) 2) Principal or Par Value or Face Value(known) THE COURSE OF FINANCE 2017 SPRING SJTU 10 I1 I2 I3+Par 0 1 2 3