lecture 2: Financial Markets and Institutions Objectives Understanding the functions of the financial system Knowing financial markets Knowing financial institutions Knowing rates of return THE COURSE OF FINANCE 2017 SPRING SJTU

lecture 2: Financial Markets and Institutions THE COURSE OF FINANCE 2017 SPRING SJTU 1 Objectives Understanding the functions of the financial system Knowing financial markets Knowing financial institutions Knowing rates of return

Chapter 2 Contents 2.1 What is a 2.7 Financial Intermediaries Financial System? 2.8 Financial Infrastructure 2.2 The Flow of Funds and Regulation 2.3 The Functional 2.9 Governmental Quasi Perspective Governmental Organizations 2.4 Financial Innovation the “Invisible Hand” 2.5 Financial Markets 2.6 Financial Market Rates THE COURSE OF FINANCE 2017 SPRING SJTU 2

Chapter 2 Contents 2.1 What is a Financial System? 2.2 The Flow of Funds 2.3 The Functional Perspective 2.4 Financial Innovation & the “Invisible Hand” 2.5 Financial Markets 2.6 Financial Market Rates 2.7 Financial Intermediaries 2.8 Financial Infrastructure and Regulation 2.9 Governmental & Quasi- Governmental Organizations THE COURSE OF FINANCE 2017 SPRING SJTU 2

The Financial System Financial decisions are made within the context of a financial system The financial system both constrains and enables the decision maker This chapter provides a framework for understanding how financial systems work. THE COURSE OF FINANCE 2017 SPRING SJTU 3

The Financial System Financial decisions are made within the context of a financial system The financial system both constrains and enables the decision maker This chapter provides a framework for understanding how financial systems work. THE COURSE OF FINANCE 2017 SPRING SJTU 3

2.1 What is the Financial System? A Financial System is comprised of Markets Intermediaries service firms Regulating institutions Financial activities such as the financial decisions of households,business firms,and governments are implemented in financial systems. THE COURSE OF FINANCE 2017 SPRING SJTU 4

2.1 What is the Financial System? A Financial System is comprised of Markets Intermediaries service firms Regulating institutions Financial activities such as the financial decisions of households, business firms, and governments are implemented in financial systems. THE COURSE OF FINANCE 2017 SPRING SJTU 4

Geography of Financial Markets some markets for a particular market instrument may have a well defined geographic location other market instruments are traded on over-the-counter or off-exchange markets for bonds,stocks,and foreign exchange Example:NASDAQ(National Association of Securities Dealers Automated Quotations);NEEQ(National Equities Exchange and Quotations新三板) THE COURSE OF FINANCE 2017 SPRING SJTU 5

Geography of Financial Markets some markets for a particular market instrument may have a well defined geographic location other market instruments are traded on over-the-counter or off-exchange markets for bonds, stocks, and foreign exchange Example: NASDAQ(National Association of Securities Dealers Automated Quotations); NEEQ(National Equities Exchange and Quotations新三板) THE COURSE OF FINANCE 2017 SPRING SJTU 5

Financial Institutions Financial intermediaries(全融中介) a firm whose primary business is to provide financial services and financial products Examples: bank(checking accounts支票存款,demand deposit话期存款,time deposit定期存 款loans贷款,CDs大额存单) investment company(mutual funds共同基金.) insurance company (term life insurance...) Financial service firms Accounting firms Financial advisory firms Regulatory bodies:govern all of the financial institutions SEC;China Securities Regulatory Commission NYSE New York Stock exchange;Shanghai Stock exchange Federal reserve bank;People's bank of china The Course of Finance 6

The Course of Finance 6 Financial Institutions Financial intermediaries(金融中介) a firm whose primary business is to provide financial services and financial products Examples: bank (checking accounts支票存款, demand deposit 活期存款,time deposit 定期存 款loans贷款, CDs大额存单 …) investment company (mutual funds 共同基金…) insurance company (term life insurance …) Financial service firms Accounting firms Financial advisory firms Regulatory bodies: govern all of the financial institutions SEC; China Securities Regulatory Commission NYSE New York Stock exchange; Shanghai Stock exchange Federal reserve bank; People’s bank of china

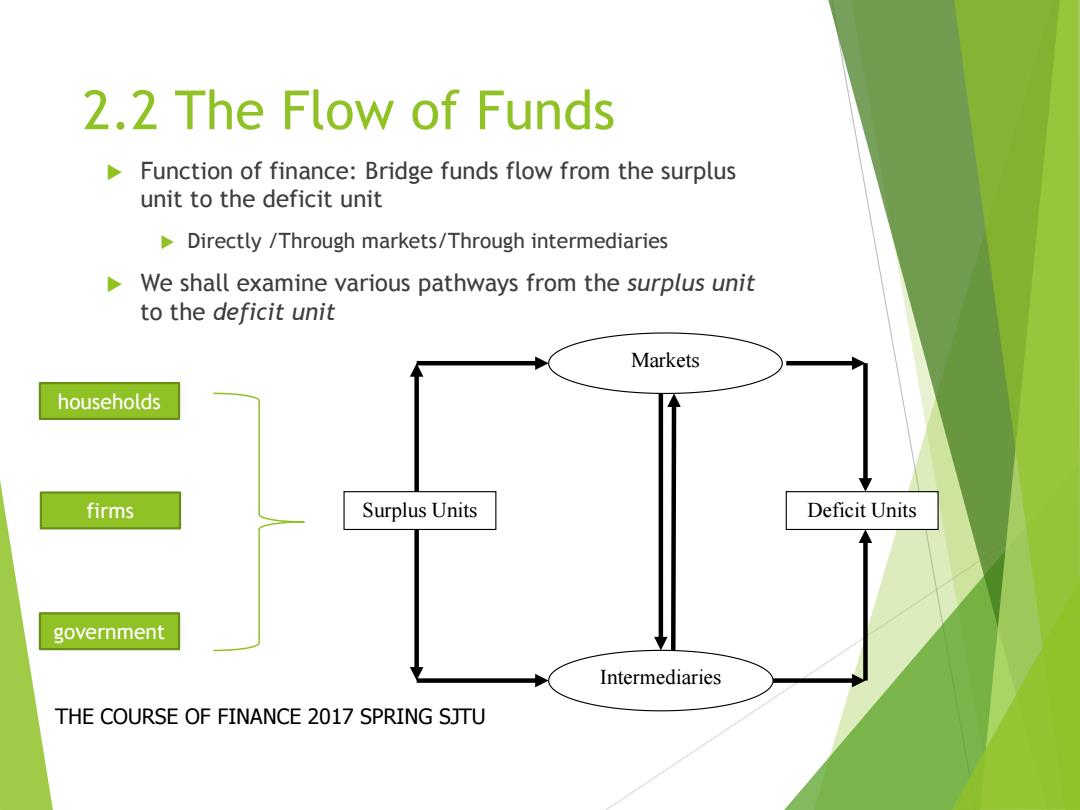

2.2 The Flow of Funds Function of finance:Bridge funds flow from the surplus unit to the deficit unit Directly /Through markets/Through intermediaries We shall examine various pathways from the surplus unit to the deficit unit Markets households firms Surplus Units Deficit Units government Intermediaries THE COURSE OF FINANCE 2017 SPRING SJTU

2.2 The Flow of Funds Function of finance: Bridge funds flow from the surplus unit to the deficit unit Directly /Through markets/Through intermediaries We shall examine various pathways from the surplus unit to the deficit unit THE COURSE OF FINANCE 2017 SPRING SJTU Markets Intermediaries Surplus Units Deficit Units households firms government

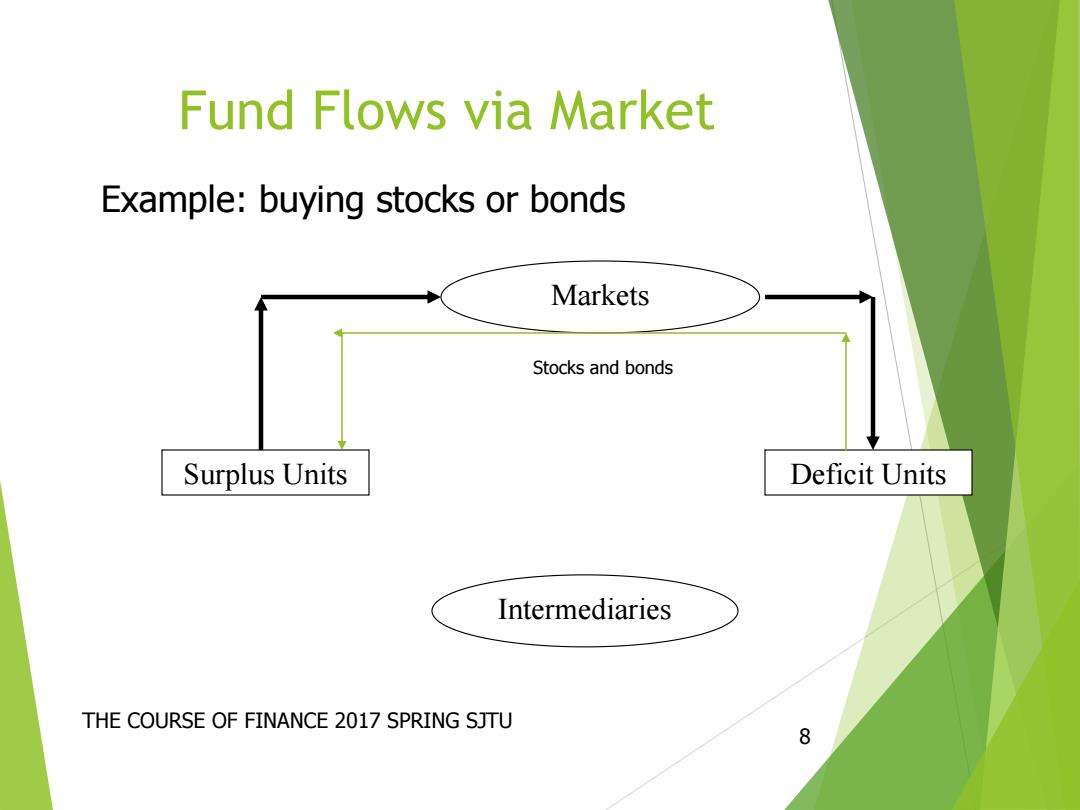

Fund Flows via Market Example:buying stocks or bonds Markets Stocks and bonds Surplus Units Deficit Units Intermediaries THE COURSE OF FINANCE 2017 SPRING SJTU 8

Fund Flows via Market THE COURSE OF FINANCE 2017 SPRING SJTU 8 Markets Intermediaries Surplus Units Deficit Units Example: buying stocks or bonds Stocks and bonds

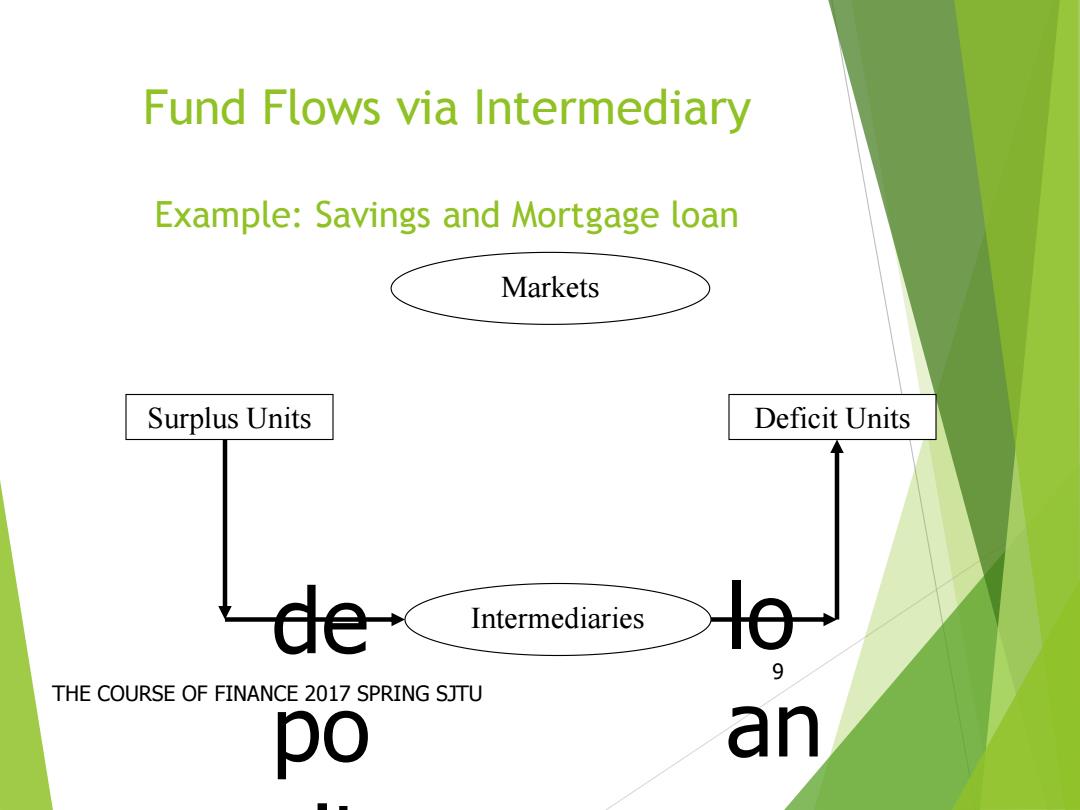

Fund Flows via Intermediary Example:Savings and Mortgage loan Markets Surplus Units Deficit Units de Intermediaries 9 THE COURSE OF FINANCE 2017 SPRING SJTU po an

Fund Flows via Intermediary Example: Savings and Mortgage loan THE COURSE OF FINANCE 2017 SPRING SJTU 9 Markets Intermediaries Surplus Units Deficit Units de po sit s lo an s

Fund Flows via Intermediary and Market Example: mutual funds Markets Surplus Units Deficit Units Intermediaries Bank THE COURSE OF FINANCE 2017 SPRING SJTU Insurance company 10

Fund Flows via Intermediary and Market THE COURSE OF FINANCE 2017 SPRING SJTU 10 Markets Intermediaries Surplus Units Deficit Units Example: mutual funds Bank Insurance company