Chapter Three Managing Financial Health and Performance Multiple Choice 1.For a corporation,net worth is called (a)net income (b)assets (c)stockholder's equity (d)retained earnings Answer:(c) 2.On a company's published balance sheet,the value of assets,liabilities and net worth,are measured at (a)expected market value (b)current book value (c)current market value (d)historical acquisition costs Answer:(d) 3.Noncurrent assets typically consist of (a)accounts payable (b)receivables and inventories (c)cash and marketable securities (d)property,plant,and equipment Answer:(d) 3-1

3-1 Chapter Three Managing Financial Health and Performance Multiple Choice 1. For a corporation, net worth is called ________. (a) net income (b) assets (c) stockholder’s equity (d) retained earnings Answer: (c) 2. On a company’s published balance sheet, the value of assets, liabilities and net worth, are measured at ________. (a) expected market value (b) current book value (c) current market value (d) historical acquisition costs Answer: (d) 3. Noncurrent assets typically consist of ________. (a) accounts payable (b) receivables and inventories (c) cash and marketable securities (d) property, plant, and equipment Answer: (d)

4.The difference between a firm's current assets and its current liabilities is called (a)net worth (b)net working capital (c)net income (d)stockholder's equity Answer:(b) 5. is the difference between revenues and cost of goods sold. (a)Operating income (b)Gross margin (c)Taxable income (d)Change in retained earnings Answer:(b) 6.Although it differs from the income statement,the statement of cash flows is a useful supplement to the income statement because: (a)it focuses attention on what is happening to the firm's cash position over time (b)it avoids the judgments about revenue and expense recognition that go into the income statement (c)it is influenced by accrual accounting decisions (d)(a)and(b) Answer:(d) 7.The value of goodwill is the difference between the of the acquisition and its (a)market price,book value (b)amortized value,market price (c)historical acquisition cost,book value (d)market price,after tax value Answer:(a) 8.At the beginning of 19X7 Success Galore has a market price of $250 per share and at the end of the year $225.50.Cash dividends for the year are $7.50 per share.Compute the total shareholder returns. (a)6.8% (b)-6.8% (c)12.8% (d)-12.8% 3-2

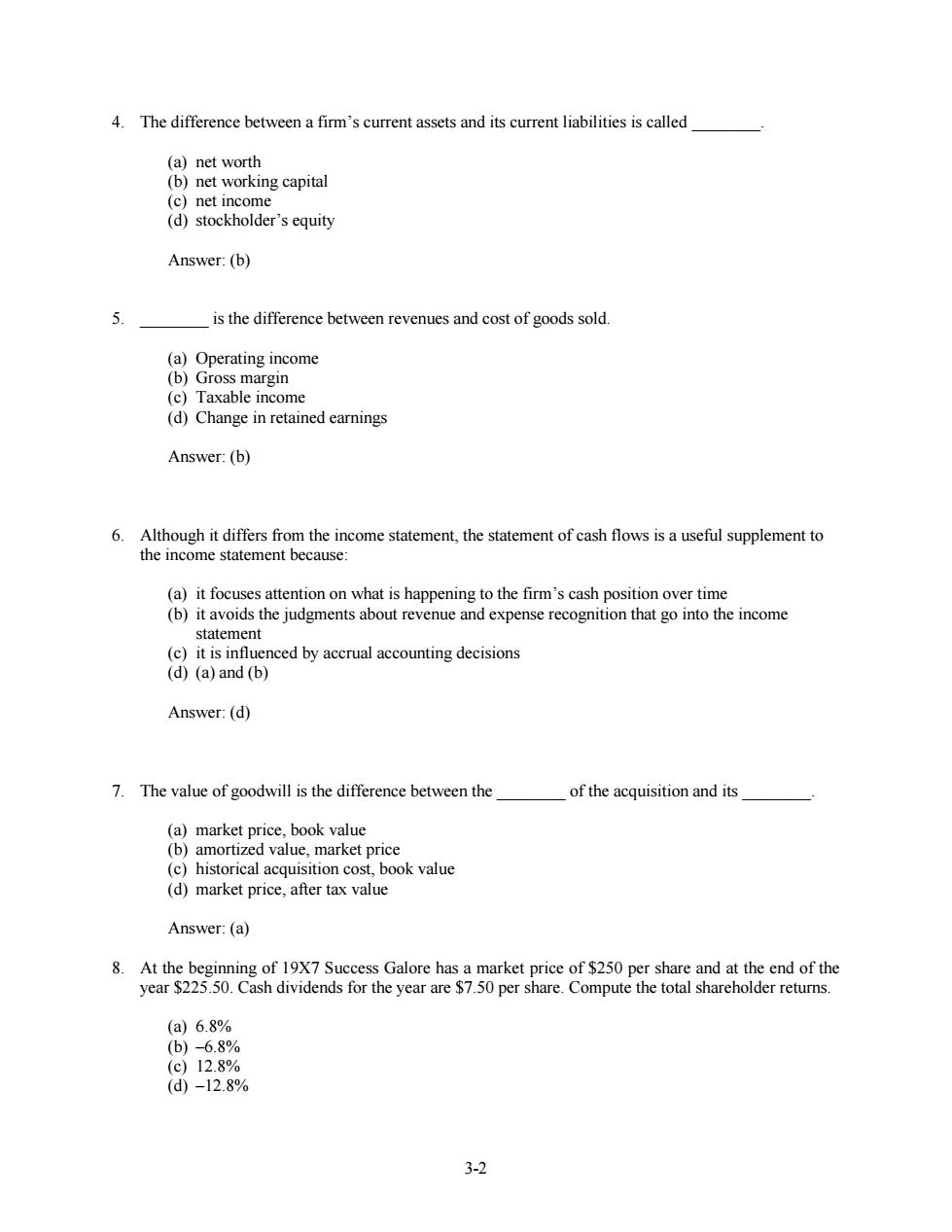

3-2 4. The difference between a firm’s current assets and its current liabilities is called ________. (a) net worth (b) net working capital (c) net income (d) stockholder’s equity Answer: (b) 5. ________ is the difference between revenues and cost of goods sold. (a) Operating income (b) Gross margin (c) Taxable income (d) Change in retained earnings Answer: (b) 6. Although it differs from the income statement, the statement of cash flows is a useful supplement to the income statement because: (a) it focuses attention on what is happening to the firm’s cash position over time (b) it avoids the judgments about revenue and expense recognition that go into the income statement (c) it is influenced by accrual accounting decisions (d) (a) and (b) Answer: (d) 7. The value of goodwill is the difference between the ________ of the acquisition and its ________. (a) market price, book value (b) amortized value, market price (c) historical acquisition cost, book value (d) market price, after tax value Answer: (a) 8. At the beginning of 19X7 Success Galore has a market price of $250 per share and at the end of the year $225.50. Cash dividends for the year are $7.50 per share. Compute the total shareholder returns. (a) 6.8% (b) –6.8% (c) 12.8% (d) –12.8%

Answer:(b) 9.Asset turnover ratios (a)assess the firm's profitability (b)assess the firm's ability to use its assets productively in generating revenue (c)highlight the capital structure of the firm (d)measure the ability of the firm to meet its short-term obligations Answer:(b) Use the information below for BGB Manufacturing to answer Questions 10-14. Exhibit for BGB Manufacturing 1997-1999 Balance Sheet(All figures in 1997 1998 1999 millions) Cash marketable securities 1.0 2.0 5.0 Accounts receivable,net 2.0 3.0 4.0 Inventories 3.0 4.7 8.0 Total current assets 6.0 9.7 17.0 Property Plant Equipment, 14.0 13.0 12.0 net Total assets 20.0 22.7 29.0 Accounts payable 2.0 1.5 1.0 Other short term liabilities 2.0 2.5 3.0 Total current liabilities 4.0 4.0 4.0 Long term debt(bonds) 10.0 10.0 10.0 Total liabilities 14.0 14.0 14.0 Stockholder's equity 6.0 8.7 15.0 Total liabilities equity 20.0 22.7 29.0 Income Statement(All 1997 1998 1999 figures in millions) Revenues,net 10.0 15.0 25.0 Cost of Sales 5.0 7.0 10.0 Selling,Gen Admin 1.0 1.5 2.0 Expenses EBIT 4.0 6.5 13.0 Total Interest 1.5 2.0 2.5 EBT 2.5 4.5 10.5 3-3

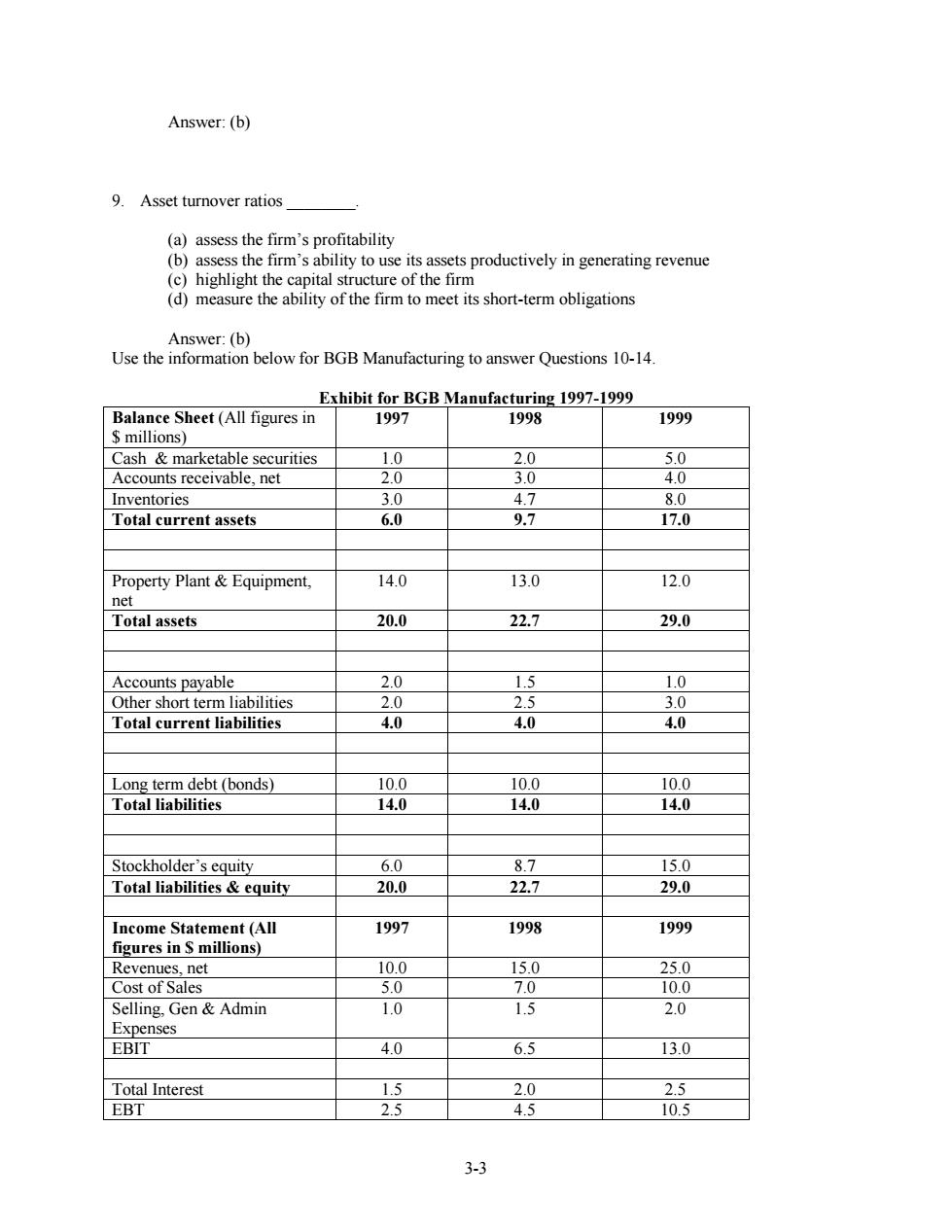

3-3 Answer: (b) 9. Asset turnover ratios ________. (a) assess the firm’s profitability (b) assess the firm’s ability to use its assets productively in generating revenue (c) highlight the capital structure of the firm (d) measure the ability of the firm to meet its short-term obligations Answer: (b) Use the information below for BGB Manufacturing to answer Questions 10-14. Exhibit for BGB Manufacturing 1997-1999 Balance Sheet (All figures in $ millions) 1997 1998 1999 Cash & marketable securities 1.0 2.0 5.0 Accounts receivable, net 2.0 3.0 4.0 Inventories 3.0 4.7 8.0 Total current assets 6.0 9.7 17.0 Property Plant & Equipment, net 14.0 13.0 12.0 Total assets 20.0 22.7 29.0 Accounts payable 2.0 1.5 1.0 Other short term liabilities 2.0 2.5 3.0 Total current liabilities 4.0 4.0 4.0 Long term debt (bonds) 10.0 10.0 10.0 Total liabilities 14.0 14.0 14.0 Stockholder’s equity 6.0 8.7 15.0 Total liabilities & equity 20.0 22.7 29.0 Income Statement (All figures in $ millions) 1997 1998 1999 Revenues, net 10.0 15.0 25.0 Cost of Sales 5.0 7.0 10.0 Selling, Gen & Admin Expenses 1.0 1.5 2.0 EBIT 4.0 6.5 13.0 Total Interest 1.5 2.0 2.5 EBT 2.5 4.5 10.5

Taxes (@40%) 1.0 1.8 4.2 EAT 1.5 2.7 6.3 10.Calculate the current ratio for BGB Manufacturing for 1998. (a)1.5 times (b)2.43 times (c)3.19 times (d)4.25 times Answer:(b) 11.Calculate the quick ratio for BGB Manufacturing for 1997. (a)0.25 times (b)0.5 times (c)0.75 times (d)1.5 times Answer:(c) 12.From the perspective of a bank loan officer from 1997 to the present,which of the following statements best summarizes the information revealed by the current ratio and quick ratio for BGB Manufacturing? (a)The ability of the firm to meet its long-term obligations has deteriorated. (b)The ability of the firm to meet its short-term obligations has improved. (c)The ability of the firm to meet its short-term obligations has deteriorated. (d)The ability of the firm to meet its long-term obligations has improved. Answer:(b) 13.Calculate the debt ratio for BGB Manufacturing for 1999 (a)0.14% (b)0.24% (c)0.48% (d0.82% Answer:(c) 14.Calculate the times interest earned(TIE)ratio for BGB Manufacturing for 1998. (a)2.25 times (b)2.7 times (c)3.25 times (d)5.2 times Answer:(c) 3-4

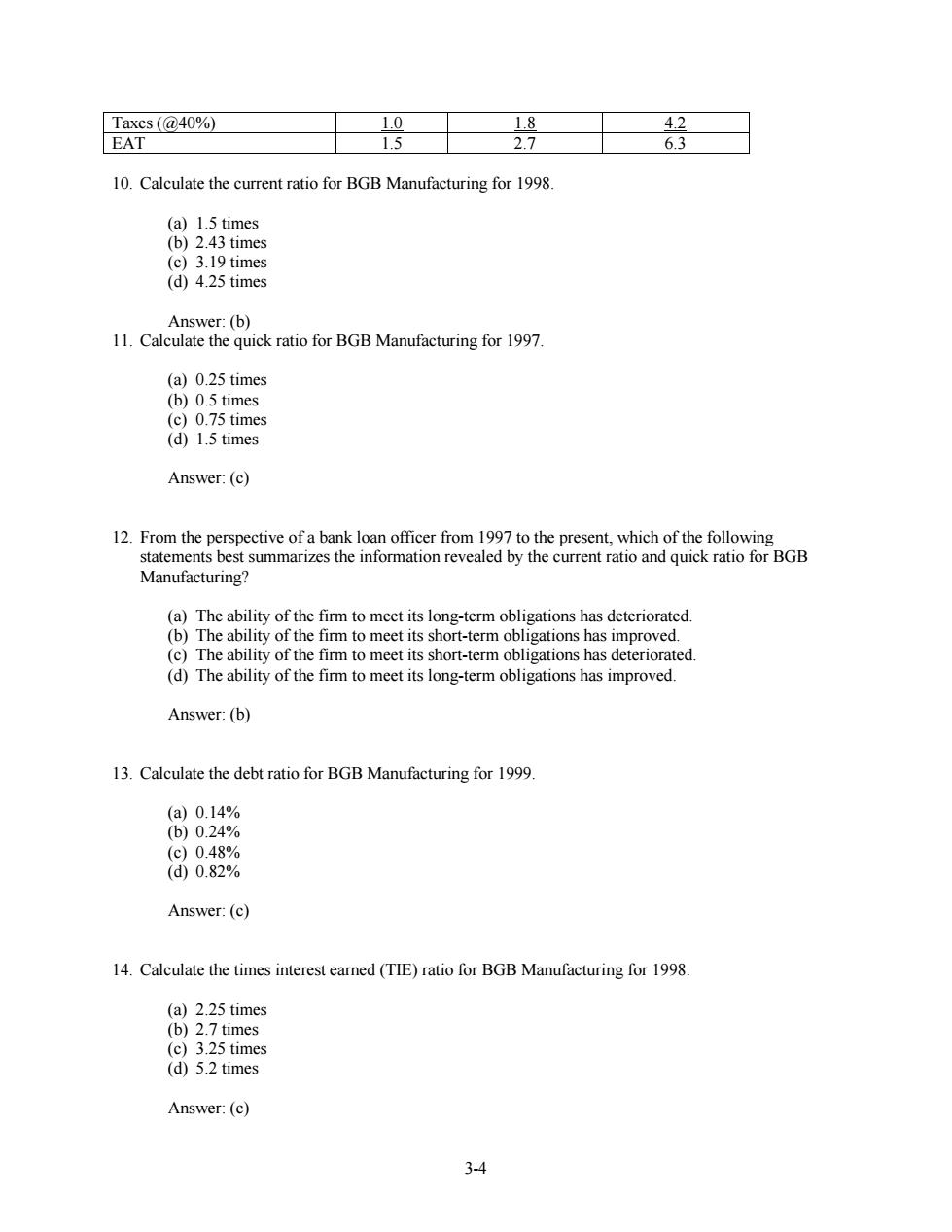

3-4 Taxes (@40%) 1.0 1.8 4.2 EAT 1.5 2.7 6.3 10. Calculate the current ratio for BGB Manufacturing for 1998. (a) 1.5 times (b) 2.43 times (c) 3.19 times (d) 4.25 times Answer: (b) 11. Calculate the quick ratio for BGB Manufacturing for 1997. (a) 0.25 times (b) 0.5 times (c) 0.75 times (d) 1.5 times Answer: (c) 12. From the perspective of a bank loan officer from 1997 to the present, which of the following statements best summarizes the information revealed by the current ratio and quick ratio for BGB Manufacturing? (a) The ability of the firm to meet its long-term obligations has deteriorated. (b) The ability of the firm to meet its short-term obligations has improved. (c) The ability of the firm to meet its short-term obligations has deteriorated. (d) The ability of the firm to meet its long-term obligations has improved. Answer: (b) 13. Calculate the debt ratio for BGB Manufacturing for 1999. (a) 0.14% (b) 0.24% (c) 0.48% (d) 0.82% Answer: (c) 14. Calculate the times interest earned (TIE) ratio for BGB Manufacturing for 1998. (a) 2.25 times (b) 2.7 times (c) 3.25 times (d) 5.2 times Answer: (c)

15.If a firm's total asset turnover ratio is 3.0: (a)its average total assets are one-sixth of its annual sales (b)its average total assets are three times its annual sales (c)its annual sales are three times its average total assets (d)its annual sales are one-third of its total assets Answer:(c) 16.A firm has a P/E of 9 and a market to book ratio of 2.5.If EPS are $3.50,what is the book value per share? (a)$8.75 (b)$12.60 (c)$31.50 (d$78.75 Answer:(b) 17.If the average total assets for the Heartland Corporation are $660 million and EAT are $100 million, calculate its ROA.Assume a tax rate of 40%and interest of $3 million. (a15.15% (b)15.6% (c)25.15% (d)25.71% Answer:(d) 18.The beginning of year receivables for a firm are $40 million.If the receivables turnover for the firm is 4.2 times and its sales are $220 million,calculate the firm's end of year receivables. (a)$24.76 million (b)$52.38 million (c)$64.76 million (d)$168 million Answer:(c) 19.In developing a financial plan,the first step is to: (a)distribute rewards and punishments to relevant parties (b)develop the firm's strategic plan (c)establish specific performance targets for the firm and its suppliers (d)adjust targets based on the previous year's data Answer:(b) 3-5

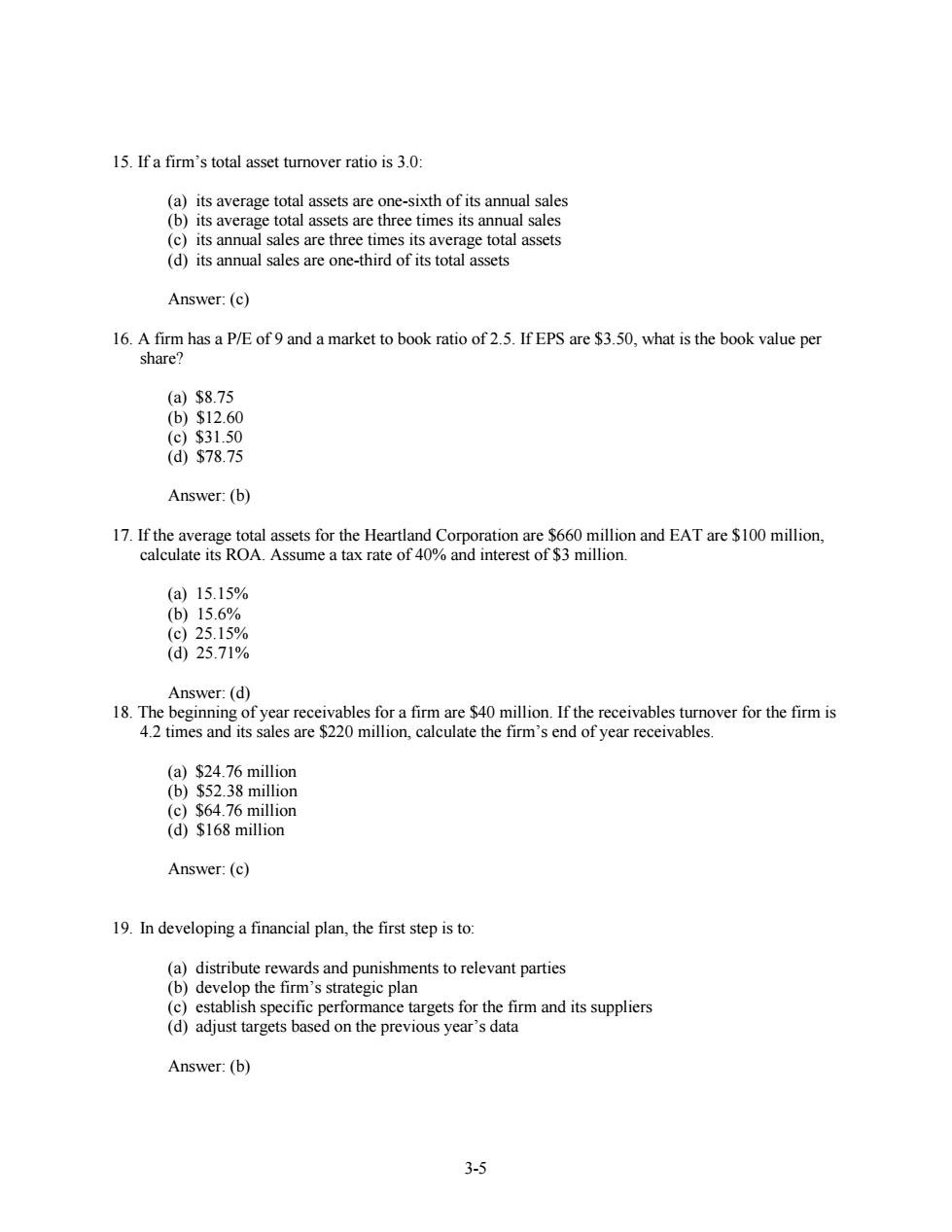

3-5 15. If a firm’s total asset turnover ratio is 3.0: (a) its average total assets are one-sixth of its annual sales (b) its average total assets are three times its annual sales (c) its annual sales are three times its average total assets (d) its annual sales are one-third of its total assets Answer: (c) 16. A firm has a P/E of 9 and a market to book ratio of 2.5. If EPS are $3.50, what is the book value per share? (a) $8.75 (b) $12.60 (c) $31.50 (d) $78.75 Answer: (b) 17. If the average total assets for the Heartland Corporation are $660 million and EAT are $100 million, calculate its ROA. Assume a tax rate of 40% and interest of $3 million. (a) 15.15% (b) 15.6% (c) 25.15% (d) 25.71% Answer: (d) 18. The beginning of year receivables for a firm are $40 million. If the receivables turnover for the firm is 4.2 times and its sales are $220 million, calculate the firm’s end of year receivables. (a) $24.76 million (b) $52.38 million (c) $64.76 million (d) $168 million Answer: (c) 19. In developing a financial plan, the first step is to: (a) distribute rewards and punishments to relevant parties (b) develop the firm’s strategic plan (c) establish specific performance targets for the firm and its suppliers (d) adjust targets based on the previous year’s data Answer: (b)

20.The planning horizon is an important component of the financial planning process.Generally,the longer the horizon: (a)the less detailed the financial plan (b)the more detailed the financial plan (c)the more performance targets the financial plan will include (d)the less a financial plan is needed Answer:(a) 21.Forecasting sales for the next year and assuming that most of the items on the income statement and balance sheet will maintain the same ratio to sales as in the previous year is called the method. (a)forecast ratio (b)percent-of-sales (c)planning horizon (d)financial predictor Answer:(b) 22.Using the percent-of-sales method,which of the following variables are typically assumed to increase proportionately with sales? (a) costs (b) EBIT (c) assets (d) all of the above Answer:(d) 23.Which is the correct formula for calculating a firm's sustainable growth rate? (a)sustainable growth rate earnings retention rate x ROE (b)sustainable growth rate=earnings retention rate x ROI (c)sustainable growth rate=(1-dividend payout)x ROE x ROI (d)sustainable growth rate share repurchase rate x ROI Answer:(a) 24. Lucinda Inc.has the following fixed ratios: Asset Turnover=0.6 Times per Year Debt/Equity Ratio=1.5 Dividend Payout Ratio =0.53 ROE=25%per Year 3-6

3-6 20. The planning horizon is an important component of the financial planning process. Generally, the longer the horizon: (a) the less detailed the financial plan (b) the more detailed the financial plan (c) the more performance targets the financial plan will include (d) the less a financial plan is needed Answer: (a) 21. Forecasting sales for the next year and assuming that most of the items on the income statement and balance sheet will maintain the same ratio to sales as in the previous year is called the _______________ method. (a) forecast ratio (b) percent-of-sales (c) planning horizon (d) financial predictor Answer: (b) 22. Using the percent-of-sales method, which of the following variables are typically assumed to increase proportionately with sales? (a) costs (b) EBIT (c) assets (d) all of the above Answer: (d) 23. Which is the correct formula for calculating a firm’s sustainable growth rate? (a)sustainable growth rate = earnings retention rate x ROE (b)sustainable growth rate = earnings retention rate x ROI (c)sustainable growth rate = (1 – dividend payout) x ROE x ROI (d)sustainable growth rate = share repurchase rate x ROI Answer: (a) 24. Lucinda Inc. has the following fixed ratios: Asset Turnover = 0.6 Times per Year Debt/Equity Ratio = 1.5 Dividend Payout Ratio = 0.53 ROE = 25% per Year

What is the sustainable growth rate for this firm? (a)10% (b)11.75% (c)15% (d)39.75% Answer:(b) 25.If a firm's working capital need is permanent rather than seasonal,the firm (a)will usually seek short-term financing for it (b)will not seek financing at all (c)will revise its strategic plan immediately (d)will usually seek long-term financing for it Answer:(d) 26.The cash cycle time begins with and ends with (a)payment of cash to suppliers,liquidation of inventory (b)receipt of cash from customers,payment of cash to suppliers (c)payment of cash to suppliers,receipt of cash from customers (d)selling of purchase on credit,receipt of cash from customers Answer:(c) Short Problems 1.Explain why the market price of a company's stock does not necessarily equal its book value. Answer: The book value does not include all of a firm's assets and liabilities. The assets and liabilities included on a firm's official balance sheet are (for the most part)valued at original acquisition cost less depreciation,rather than at current market values. 2.As a financial document,what purpose does the statement of cash flows serve?What is a benefit of the statement of cash flows? 3-7

3-7 What is the sustainable growth rate for this firm? (a) 10% (b) 11.75% (c) 15% (d) 39.75% Answer: (b) 25. If a firm’s working capital need is permanent rather than seasonal, the firm ________. (a) will usually seek short-term financing for it (b) will not seek financing at all (c) will revise its strategic plan immediately (d) will usually seek long-term financing for it Answer: (d) 26. The cash cycle time begins with ________and ends with ________. (a) payment of cash to suppliers, liquidation of inventory (b) receipt of cash from customers, payment of cash to suppliers (c) payment of cash to suppliers, receipt of cash from customers (d) selling of purchase on credit, receipt of cash from customers Answer: (c) Short Problems 1. Explain why the market price of a company’s stock does not necessarily equal its book value. Answer: The book value does not include all of a firm’s assets and liabilities. The assets and liabilities included on a firm’s official balance sheet are (for the most part) valued at original acquisition cost less depreciation, rather than at current market values. 2. As a financial document, what purpose does the statement of cash flows serve? What is a benefit of the statement of cash flows?

Answer:The statement of cash flows gives a summary of cash flows from operating,investing,and financing activities for a period of time.The statement of cash flows focuses attention on what is happening to the firm's cash position over time and it also avoids judgements about revene and expense recognition that go into the income statement.A benefit of the statement of cash flows is that it is not influenced by accrual accounting decisions. 3.What are the three types of benchmarks? Answer: Financial ratios ofother companies for the same period of time. Financial ratios of the company itself in previous time periods. Information extracted from financial markets such as asset prices or interest rates. 4.You invest in a stock that costs $215.50.It pays a cash dividend during the year of $12.20 and you expect its price to be $229 at year's end.What is the total shareholder return? Answer: Total Shareholder returns Ending Price of a Share-Beginning Price of Share Cash Dividend Beginning Price of Share =S229-S215.50+S12.20 S215.50 =11.93% 5.In 19X7,Slater Inc.had a net income of $30.3 million,assets of $560 million,and shareholders equity of $400 million.Calculate its return on equity. Answer: Return on equity Net Income Shareholders'Equity =S30.3 S400 =7.58% 6.You work at FaxMeSoon Corporation and are analyzing the results of 19x8 and are preparing pro forma statements for 19x9.The company anticipates an increase in total assets of $60 million,an increase in retained earnings of $30 million,and an increase in accounts payable of $45 million. Assume that other than the payables,the firm's liabilities include short term and long term debt,and that common stock and retained earnings make up the company's equity. a. Calculate the amount of external funding required in 19 x 9. b. Comment on the situation obtained in part a. 3-8

3-8 Answer: The statement of cash flows gives a summary of cash flows from operating, investing, and financing activities for a period of time. The statement of cash flows focuses attention on what is happening to the firm’s cash position over time and it also avoids judgements about revenue and expense recognition that go into the income statement. A benefit of the statement of cash flows is that it is not influenced by accrual accounting decisions. 3. What are the three types of benchmarks? Answer: Financial ratios of other companies for the same period of time. Financial ratios of the company itself in previous time periods. Information extracted from financial markets such as asset prices or interest rates. 4. You invest in a stock that costs $215.50. It pays a cash dividend during the year of $12.20 and you expect its price to be $229 at year’s end. What is the total shareholder return? Answer: Total Shareholder returns = Ending Price of a Share – Beginning Price of Share + Cash Dividend Beginning Price of Share = $229 - $215.50 + $12.20 $215.50 = 11.93% 5. In 19X7, Slater Inc. had a net income of $30.3 million, assets of $560 million, and shareholders equity of $400 million. Calculate its return on equity. Answer: Return on equity = Net Income Shareholders’ Equity = $30.3 $400 = 7.58% 6. You work at FaxMeSoon Corporation and are analyzing the results of 19x8 and are preparing pro forma statements for 19x9. The company anticipates an increase in total assets of $60 million, an increase in retained earnings of $30 million, and an increase in accounts payable of $45 million. Assume that other than the payables, the firm’s liabilities include short term and long term debt, and that common stock and retained earnings make up the company’s equity. a. Calculate the amount of external funding required in 19 x 9. b. Comment on the situation obtained in part a

Answer: a. Amount change in assets-increase in retained earnings-increase in payables $60 million-$30 million-$45 million =-$15 million b. The company can take some of the retained earnings and pay it out as dividend,or it could use it to reduce any of the payables,short-term debt,or long-term debt. 7.The Wright Way Inc.has an inventory period of 61 days,a receivables period of 67 days and a payables period of 45 days.Compute the cash cycle time. Answer: Cash cycle time Inventory period Receivables period-Payables period =61+67-45 =83 days 3-9

3-9 Answer: a. Amount = change in assets – increase in retained earnings – increase in payables = $60 million - $30 million - $45 million = - $15 million b. The company can take some of the retained earnings and pay it out as dividend, or it could use it to reduce any of the payables, short-term debt, or long-term debt. 7. The Wright Way Inc. has an inventory period of 61 days, a receivables period of 67 days and a payables period of 45 days. Compute the cash cycle time. Answer: Cash cycle time = Inventory period + Receivables period – Payables period = 61 + 67 - 45 = 83 days