Lecture 9 Valuation of Common Stocks refer to ch.9 THE COURSE OF FINANCE 2017 SPRING SJTU

Lecture 9 Valuation of Common Stocks refer to ch.9 THE COURSE OF FINANCE 2017 SPRING SJTU 1

Objectives Understanding the discounting cash flow method of a stock valuation Explain how a firm's dividend policy can affect shareholder wealth. THE COURSE OF FINANCE 2017 SPRING SJTU

Objectives Explain equity evaluation Understanding the discounting cash flow method of a stock valuation Explain how a firm’s dividend policy can affect shareholder wealth. THE COURSE OF FINANCE 2017 SPRING SJTU 2

Chapter 9 Contents 9.1 Reading stock listings 9.2 The discounted dividend model 9.3 Earning and investment opportunity 9.4 A reconsideration of the price/earnings multiple approach 9.5 Does dividend policy affect shareholder wealth? THE COURSE OF FINANCE 2017 SPRING SJTU

Chapter 9 Contents 9.1 Reading stock listings 9.2 The discounted dividend model 9.3 Earning and investment opportunity 9.4 A reconsideration of the price/earnings multiple approach 9.5 Does dividend policy affect shareholder wealth? THE COURSE OF FINANCE 2017 SPRING SJTU 3

9.1 Reading Stock Listings The following newspaper stock listing is usually printed as a horizontal string of information The listing is for IBM,which is traded on the New York Stock Exchange THE COURSE OF FINANCE 2017 SPRING SJTU

9.1 Reading Stock Listings The following newspaper stock listing is usually printed as a horizontal string of information The listing is for IBM, which is traded on the New York Stock Exchange THE COURSE OF FINANCE 2017 SPRING SJTU 4

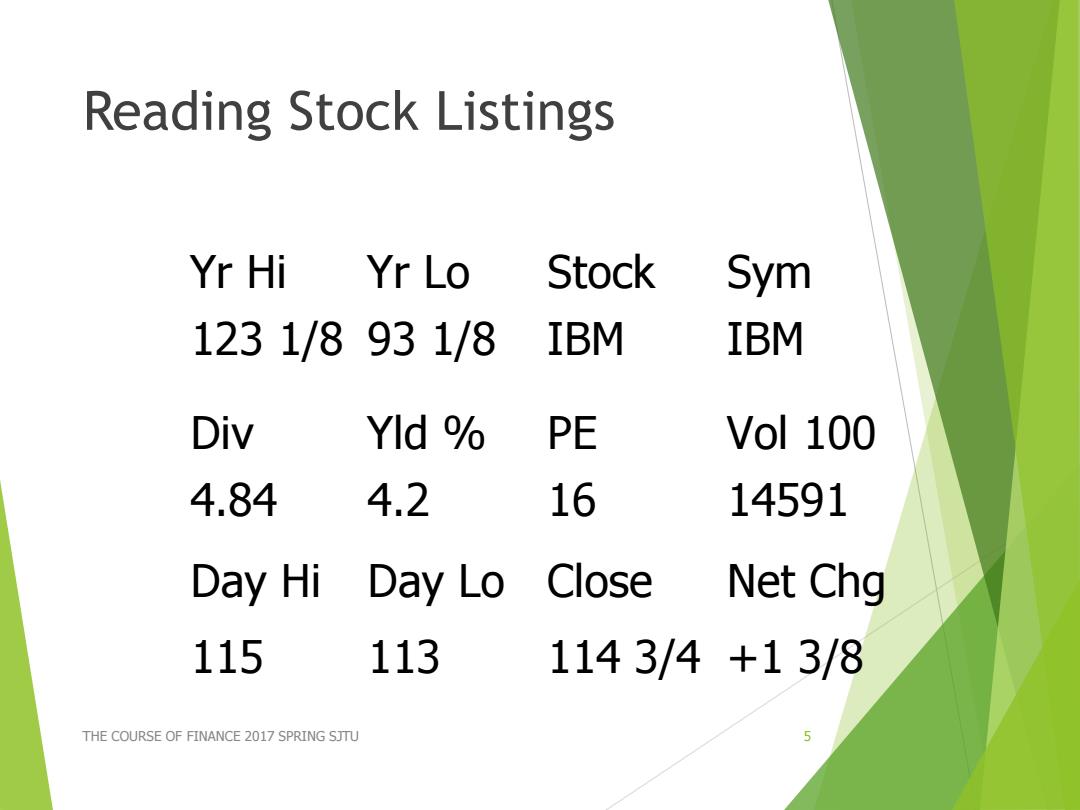

Reading Stock Listings Yr Hi Yr Lo Stock Sym 1231/8931/8 IBM IBM Div Yld PE Vol 100 4.84 4.2 16 14591 Day Hi Day Lo Close Net Chg 115 113 1143/4+13/8 THE COURSE OF FINANCE 2017 SPRING SJTU

Reading Stock Listings THE COURSE OF FINANCE 2017 SPRING SJTU 5 Yr Hi Yr Lo Stock Sym 123 1/8 93 1/8 IBM IBM Div Yld % PE Vol 100 4.84 4.2 16 14591 Day Hi Day Lo Close Net Chg 115 113 114 3/4 +1 3/8

Reading Stock Listings Hi 123 1/8:The highest price the stock has traded at over the last 52 weeks Lo =93 1/8:The lowest price the stock has traded at over the last 52 weeks Stock IBM:The stock's name Sym IBM:The stock's symbol THE COURSE OF FINANCE 2017 SPRING SJTU 6

Reading Stock Listings Hi = 123 1/8: The highest price the stock has traded at over the last 52 weeks Lo = 93 1/8: The lowest price the stock has traded at over the last 52 weeks Stock = IBM: The stock’s name Sym = IBM: The stock’s symbol THE COURSE OF FINANCE 2017 SPRING SJTU 6

Reading Stock Listings Diy 4.84:The last quarterly dividend multiplied by 4 Yld 4.2:Dividend yield; (Annualized dividend stock price) PE 16:Price-to-earnings;(Latest price -last 4 actual dividends) Vol 100s 14591*100;Volume of exchange traded shares THE COURSE OF FINANCE 2017 SPRING SJTU

Reading Stock Listings Div = 4.84: The last quarterly dividend multiplied by 4 Yld % = 4.2: Dividend yield; (Annualized dividend ÷ stock price) PE = 16: Price-to-earnings; (Latest price ÷ last 4 actual dividends) Vol 100s = 14591*100; Volume of exchange traded shares THE COURSE OF FINANCE 2017 SPRING SJTU 7

Reading Stock Listings Hi =115:Highest share price of the day Lo 113:Lowest share price of the day Close 114 3/4:Days closing share price Chg 1 3/8:Change in closing price from previous trading day THE COURSE OF FINANCE 2017 SPRING SJTU 8

Reading Stock Listings Hi = 115: Highest share price of the day Lo = 113: Lowest share price of the day Close = 114 3/4: Days closing share price Chg = 1 3/8: Change in closing price from previous trading day THE COURSE OF FINANCE 2017 SPRING SJTU 8

Observation It is usual to trade shares in round lots of 100 shares If you decide to trade shares as odd lots you will pay higher commissions Stock splits and stock dividends can cause you to hold odd lots THE COURSE OF FINANCE 2017 SPRING SJTU

Observation It is usual to trade shares in round lots of 100 shares If you decide to trade shares as odd lots you will pay higher commissions Stock splits and stock dividends can cause you to hold odd lots THE COURSE OF FINANCE 2017 SPRING SJTU 9

9.2 The Discounted Dividend Model >A discounted dividend model is any model that computes the value of a share of a stock as the present value of the expected future cash dividends THE COURSE OF FINANCE 2017 SPRING SJTU 10

9.2 The Discounted Dividend Model A discounted dividend model is any model that computes the value of a share of a stock as the present value of the expected future cash dividends THE COURSE OF FINANCE 2017 SPRING SJTU 10