Chapter Six The Analysis of Investment Projects This chapter contains 41 multiple choice problems,20 short problems and 8 longer problems. Multiple Choice 1.The objective of a firm's management is to only undertake the projects that the market value of shareholders'equity. a)decrease b)do not decrease c)change d)do not change Answer:(b) 2.The decision rule that management uses with the net present value is to undertake only those projects with NPV. a)a discounted b)a contingent c)a positive d)negative Answer:(c) 3.The NPV of a project represents the amount by which it is expected to increase a)the break-even point b)capital budgeting c)capital expenditures d)shareholder wealth Answer:(d) 6-1

6-1 Chapter Six The Analysis of Investment Projects This chapter contains 41 multiple choice problems, 20 short problems and 8 longer problems. Multiple Choice 1. The objective of a firm's management is to only undertake the projects that ________ the market value of shareholders' equity. a) decrease b) do not decrease c) change d) do not change Answer: (b) 2. The decision rule that management uses with the net present value is to undertake only those projects with ________ NPV. a) a discounted b) a contingent c) a positive d) negative Answer: (c) 3. The NPV of a project represents the amount by which it is expected to increase ________. a) the break-even point b) capital budgeting c) capital expenditures d) shareholder wealth Answer: (d)

4.Consider the following annual cash flows: Cash Flows (in thousands of dollars) 0 -2,000 1,200 2 1,500 3 1,800 Using a cost of capital of 15%,compute this project's NPV. a)$5,361,000 b)$3,548,000 c)$3,361,000 d)$1,361,000 Answer:(d) 5.Consider the following annual cash flows: Year Cash Flows (in thousands of dollars) 0 -5,000 1 4,100 2 3,800 3 3,500 Using a cost of capital of 12%,compute this project's NPV. a)$14,181,000 b)$9,181,000 c)$4,181,000 d)$3.548.000 Answer:(c) 6.A negative sign in front of a cash-flow forecast for a particular year means that it is an a)inflow b)outflow c)indeterminate flow d)more information is required to make this determination Answer:(b) 6-2

6-2 4. Consider the following annual cash flows: Year Cash Flows (in thousands of dollars) 0 –2,000 1 1,200 2 1,500 3 1,800 Using a cost of capital of 15%, compute this project's NPV. a) $5,361,000 b) $3,548,000 c) $3,361,000 d) $1,361,000 Answer: (d) 5. Consider the following annual cash flows: Year Cash Flows (in thousands of dollars) 0 –5,000 1 4,100 2 3,800 3 3,500 Using a cost of capital of 12%, compute this project's NPV. a) $14,181,000 b) $9,181,000 c) $4,181,000 d) $3,548,000 Answer: (c) 6. A negative sign in front of a cash-flow forecast for a particular year means that it is an ________. a) inflow b) outflow c) indeterminate flow d) more information is required to make this determination Answer: (b)

7.In computing a project's cost of capital the risk to use is a)the risk of the financing instruments used to fund the project b)the risk of the project's cash flows c)a risk-free rate d)a historical risk rate using T-bills Answer:(b) 6-3

6-3 7. In computing a project's cost of capital the risk to use is ________. a) the risk of the financing instruments used to fund the project b) the risk of the project's cash flows c) a risk-free rate d) a historical risk rate using T-bills Answer: (b)

8.For a project,an initial cash outlay of $1.4 million is made.In year I the expected annual cash flow is $900,000,years 2-5 the expected annual cash flow is $1,000,000 and in year 6 the expected annual cash flow is $1.3 million.A cost of capital of 15%is used.The IRR (internal rate of return)is a)72.1% b)65.8% c)51.7% d)40.0% Answer:(b) 9.An initial cash outlay of $1.4 million is made for a capital budgeting project.In year 1,the expected annual cash flow is $900,000,years 2-5,the expected annual cash flow is $1,000,000 and in year 6,the expected annual cash flow is $1.3 million.If a cost of capital of 15%is used,compute the NPV of this project. a)$1,800,000 b)$2,100,000 c)$2,427,225 d$3,296,790 Answer:(c) 10.The is defined as the annual cash payment that has a present value equal to the initial outlay a)annualized cost of debt b)cost of debt c)cost of financing d)annualized capital cost Answer:(d) 11.A project's IRR is its scale,which makes IRR not a good measure for ranking mutually exclusive projects. a)contingent on b)independent of c)inversely proportional to d)half of Answer:(b) 12.The rate is the rate that prevails in a zero-inflation scenario.The rate is the rate that one actually observes. 6-4

6-4 8. For a project, an initial cash outlay of $1.4 million is made. In year 1 the expected annual cash flow is $900,000, years 2-5 the expected annual cash flow is $1,000,000 and in year 6 the expected annual cash flow is $1.3 million. A cost of capital of 15% is used. The IRR (internal rate of return) is ________. a) 72.1% b) 65.8% c) 51.7% d) 40.0% Answer: (b) 9. An initial cash outlay of $1.4 million is made for a capital budgeting project. In year 1, the expected annual cash flow is $900,000, years 2-5, the expected annual cash flow is $1,000,000 and in year 6, the expected annual cash flow is $1.3 million. If a cost of capital of 15% is used, compute the NPV of this project. a) $1,800,000 b) $2,100,000 c) $2,427,225 d) $3,296,790 Answer: (c) 10. The ________ is defined as the annual cash payment that has a present value equal to the initial outlay. a) annualized cost of debt b) cost of debt c) cost of financing d) annualized capital cost Answer: (d) 11. A project's IRR is ________ its scale, which makes IRR not a good measure for ranking mutually exclusive projects. a) contingent on b) independent of c) inversely proportional to d) half of Answer: (b) 12. The ________ rate is the rate that prevails in a zero-inflation scenario. The ________ rate is the rate that one actually observes

a)nominal,inflation b)real,expected c)nominal,real d)real,nominal Answer:(d) 6-5

6-5 a) nominal, inflation b) real, expected c) nominal, real d) real, nominal Answer: (d)

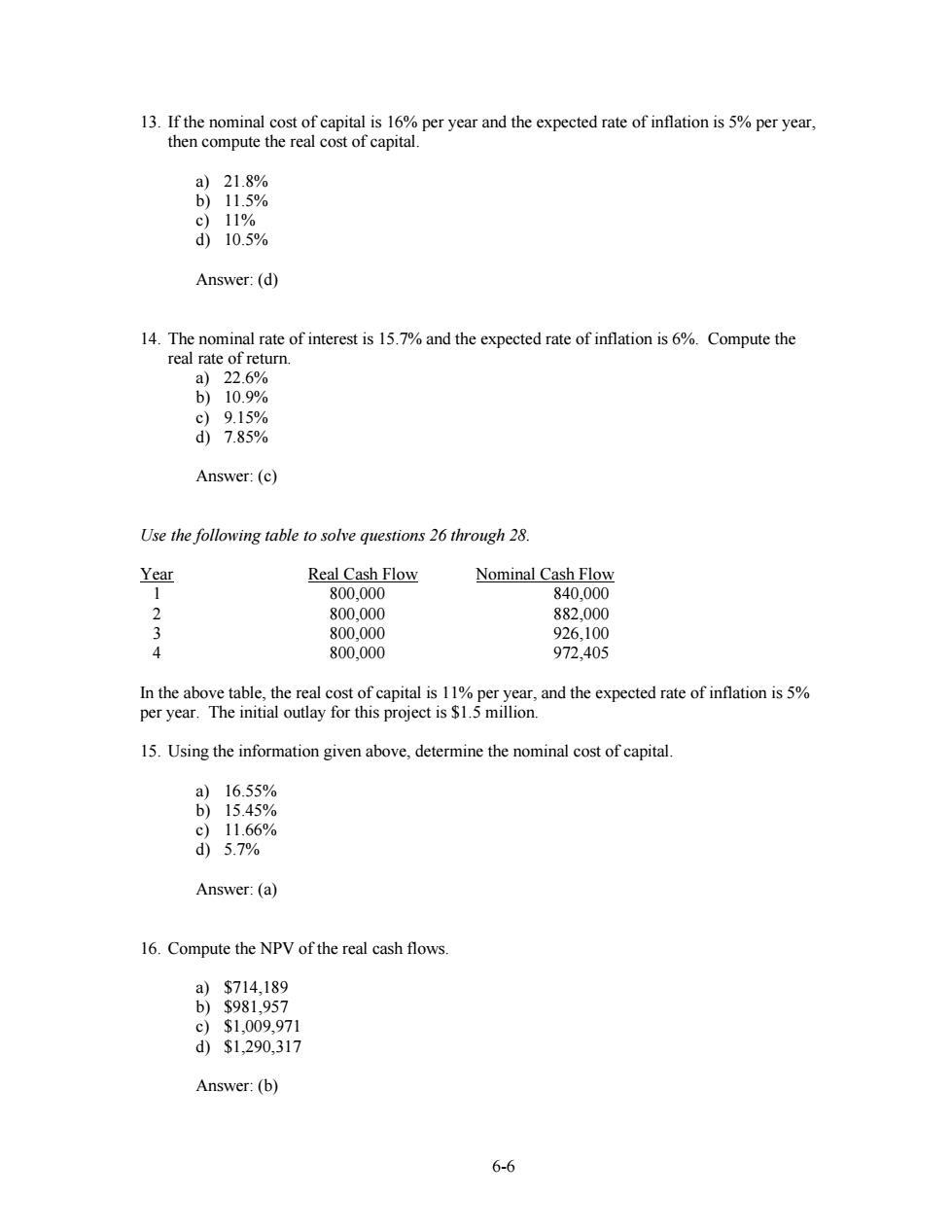

13.If the nominal cost of capital is 16%per year and the expected rate of inflation is 5%per year, then compute the real cost of capital. a)21.8% b)11.5% c)11% d)10.5% Answer:(d) 14.The nominal rate of interest is 15.7%and the expected rate of inflation is 6%.Compute the real rate of return. a)22.6% b)10.9% c)9.15% d)7.85% Answer:(c) Use the following table to solve questions 26 through 28. Year Real Cash Flow Nominal Cash Flow 1 800.000 840,000 2 800,000 882,000 3 800,000 926,100 4 800.000 972.405 In the above table,the real cost of capital is 11%per year,and the expected rate of inflation is 5% per year.The initial outlay for this project is $1.5 million. 15.Using the information given above,determine the nominal cost of capital. a16.55% b)15.45% c)11.66% d)5.7% Answer:(a) 16.Compute the NPV of the real cash flows. a)$714,189 b) $981,957 c) $1,009,971 d)$1,290,317 Answer:(b) 6-6

6-6 13. If the nominal cost of capital is 16% per year and the expected rate of inflation is 5% per year, then compute the real cost of capital. a) 21.8% b) 11.5% c) 11% d) 10.5% Answer: (d) 14. The nominal rate of interest is 15.7% and the expected rate of inflation is 6%. Compute the real rate of return. a) 22.6% b) 10.9% c) 9.15% d) 7.85% Answer: (c) Use the following table to solve questions 26 through 28. Year Real Cash Flow Nominal Cash Flow 1 800,000 840,000 2 800,000 882,000 3 800,000 926,100 4 800,000 972,405 In the above table, the real cost of capital is 11% per year, and the expected rate of inflation is 5% per year. The initial outlay for this project is $1.5 million. 15. Using the information given above, determine the nominal cost of capital. a) 16.55% b) 15.45% c) 11.66% d) 5.7% Answer: (a) 16. Compute the NPV of the real cash flows. a) $714,189 b) $981,957 c) $1,009,971 d) $1,290,317 Answer: (b)

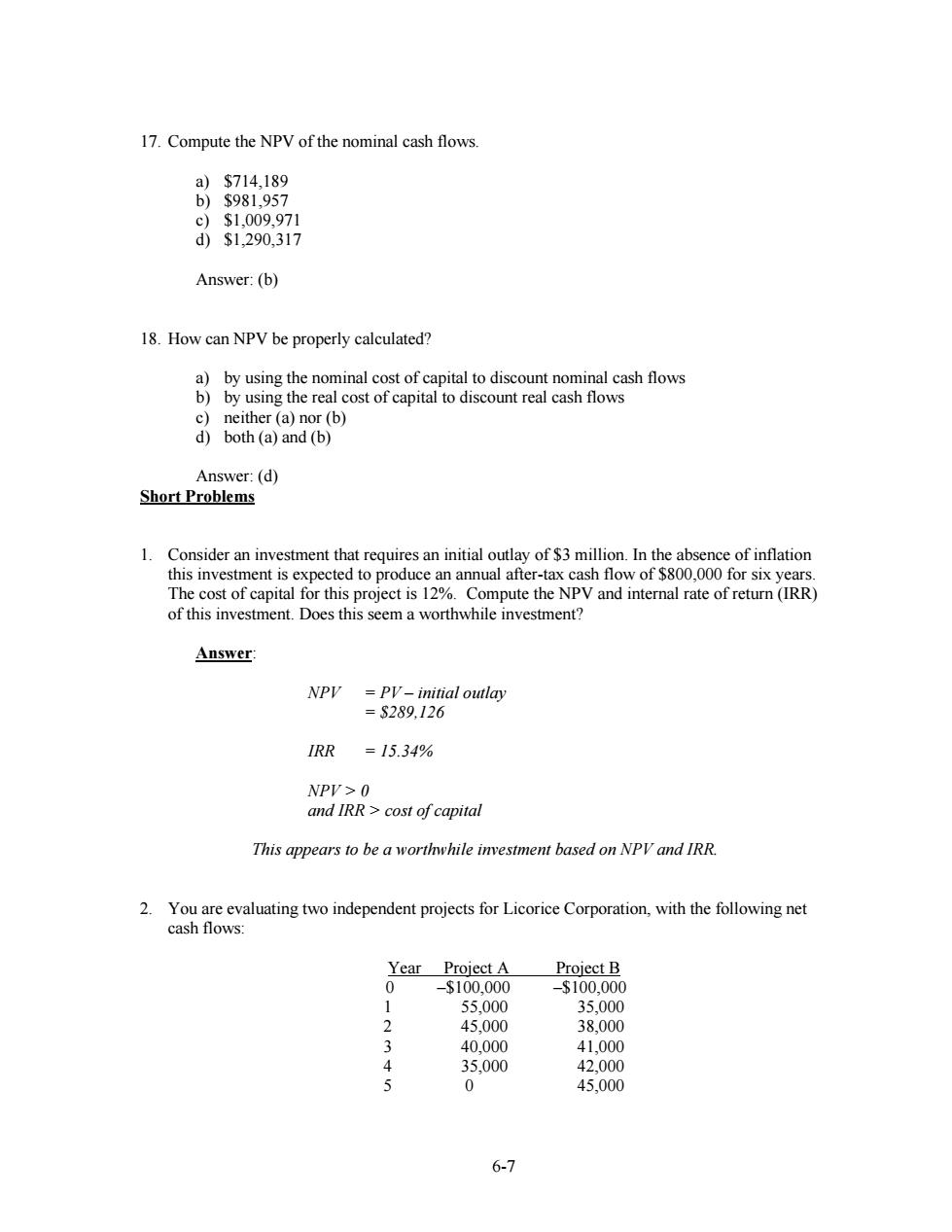

17.Compute the NPV of the nominal cash flows. a)$714,189 b)$981,957 c)$1,009.971 d)$1,290,317 Answer:(b) 18.How can NPV be properly calculated? a)by using the nominal cost of capital to discount nominal cash flows b)by using the real cost of capital to discount real cash flows c)neither (a)nor(b) d)both (a)and(b) Answer:(d) Short Problems 1.Consider an investment that requires an initial outlay of $3 million.In the absence of inflation this investment is expected to produce an annual after-tax cash flow of $800,000 for six years. The cost of capital for this project is 12%.Compute the NPV and internal rate of return (IRR) of this investment.Does this seem a worthwhile investment? Answer NPy PV-initial outlay =S289.126 IRR =15.34% NPV>0 and IRR cost of capital This appears to be a worthwhile investment based on NPV and IRR. 2.You are evaluating two independent projects for Licorice Corporation,with the following net cash flows: Year Project A Project B 0 -$100,000 -$100,000 55.000 35,000 2 45,000 38,000 3 40,000 41,000 X 35,000 42,000 5 0 45,000 6-7

6-7 17. Compute the NPV of the nominal cash flows. a) $714,189 b) $981,957 c) $1,009,971 d) $1,290,317 Answer: (b) 18. How can NPV be properly calculated? a) by using the nominal cost of capital to discount nominal cash flows b) by using the real cost of capital to discount real cash flows c) neither (a) nor (b) d) both (a) and (b) Answer: (d) Short Problems 1. Consider an investment that requires an initial outlay of $3 million. In the absence of inflation this investment is expected to produce an annual after-tax cash flow of $800,000 for six years. The cost of capital for this project is 12%. Compute the NPV and internal rate of return (IRR) of this investment. Does this seem a worthwhile investment? Answer: NPV = PV – initial outlay = $289,126 IRR = 15.34% NPV > 0 and IRR > cost of capital This appears to be a worthwhile investment based on NPV and IRR. 2. You are evaluating two independent projects for Licorice Corporation, with the following net cash flows: Year Project A Project B 0 –$100,000 –$100,000 1 55,000 35,000 2 45,000 38,000 3 40,000 41,000 4 35,000 42,000 5 0 45,000

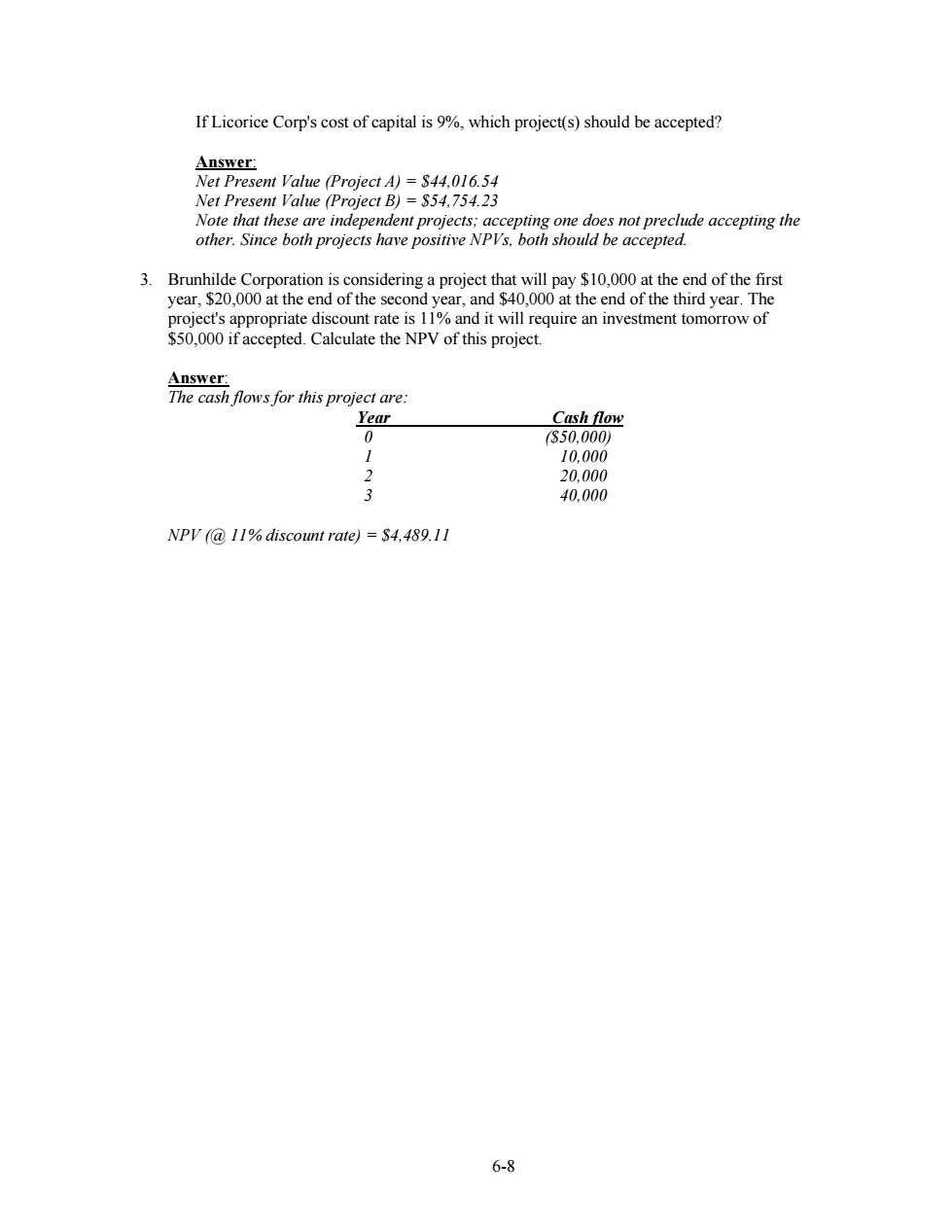

If Licorice Corp's cost of capital is 9%,which project(s)should be accepted? Answer: Net Present Value (Project A)=$44,016.54 Net Present Value (Project B)=$54,754.23 Note that these are independent projects;accepting one does not preclude accepting the other.Since both projects have positive NPVs,both should be accepted. 3.Brunhilde Corporation is considering a project that will pay $10,000 at the end of the first year,$20,000 at the end of the second year,and $40,000 at the end of the third year.The project's appropriate discount rate is 11%and it will require an investment tomorrow of $50,000 if accepted.Calculate the NPV of this project. Answer: The cash flows for this project are: Year Cash flow 0 (S50,000) 1 10.000 ) 20,000 U 40.000 NPV (11%discount rate)=S4,489.11 6-8

6-8 If Licorice Corp's cost of capital is 9%, which project(s) should be accepted? Answer: Net Present Value (Project A) = $44,016.54 Net Present Value (Project B) = $54,754.23 Note that these are independent projects; accepting one does not preclude accepting the other. Since both projects have positive NPVs, both should be accepted. 3. Brunhilde Corporation is considering a project that will pay $10,000 at the end of the first year, $20,000 at the end of the second year, and $40,000 at the end of the third year. The project's appropriate discount rate is 11% and it will require an investment tomorrow of $50,000 if accepted. Calculate the NPV of this project. Answer: The cash flows for this project are: Year Cash flow 0 ($50,000) 1 10,000 2 20,000 3 40,000 NPV (@ 11% discount rate) = $4,489.11

Longer Problems 1.Consider a project which involves an initial outlay of $5 million and which will generate an expected annual cash flow of $1.6 million.The cost of capital used is 13%.This project will last 6 years. (a) Compute the project's NPV (b) Compute the IRR Answer: a NPV =PV-Initial Outlay =$6396,080-$5,000,000 =$1,396,080 b IRR =22.56% 2. Consider the expected annual cash flows for an investment project under consideration: Year Real Cash Flow Nominal Cash Flow 900.000 963.000 2 900,000 1,030,410 J 900,000 1,102,539 4 900,000 1,179,716 5 900,000 1,262,297 In addition to the above information,the real cost of capital is 12%per year,the expected rate of inflation is 7%per year,and the initial outlay for the project is $3.5 million. Compute the net present value of the real cash flows and also compute the net present value of the nominal cash flows. Answer: NPV of real cash flows PV-Initial Outlay =-8255,701 To compute NPV of nominal cash flows we must first compute the nominal interest rate. Nominal rate =(1 Real rate)(1 Expected Inflation)-1 =19.84% The NPV of nominal cash flows PV-Initial Outlay =-8255,701 Note that this is the same result as was obtained using the real approach. 6-9

6-9 Longer Problems 1. Consider a project which involves an initial outlay of $5 million and which will generate an expected annual cash flow of $1.6 million. The cost of capital used is 13%. This project will last 6 years. (a) Compute the project's NPV (b) Compute the IRR Answer: (a) NPV = PV - Initial Outlay = $6,396,080 – $5,000,000 = $1,396,080 (b) IRR = 22.56% 2. Consider the expected annual cash flows for an investment project under consideration: Year Real Cash Flow Nominal Cash Flow 1 900,000 963,000 2 900,000 1,030,410 3 900,000 1,102,539 4 900,000 1,179,716 5 900,000 1,262,297 In addition to the above information, the real cost of capital is 12% per year, the expected rate of inflation is 7% per year, and the initial outlay for the project is $3.5 million. Compute the net present value of the real cash flows and also compute the net present value of the nominal cash flows. Answer: NPV of real cash flows = PV – Initial Outlay = -$255,701 To compute NPV of nominal cash flows we must first compute the nominal interest rate. Nominal rate = (1 + Real rate)(1 + Expected Inflation) - 1 = 19.84% The NPV of nominal cash flows = PV – Initial Outlay = - $255,701 Note that this is the same result as was obtained using the real approach