Chapter Two Financial Markets and Institutions Multiple Choice 1.A market that has no one specific location is termed a(n) market. (a)over-the-counter (b)geographic location (c)intermediary (d)conceptual Answer:(a) 2.Incentive problems take a variety of forms and include: (a)moral hazard (b)adverse selection (c)principal-agent (d)all of the above Answer:(d) 4.The problem exists when having insurance against some risk causes the insured party to take greater risk or to take less care in preventing the event that gives rise to the loss. (a)moral hazard (b)adverse selection (c)principal-agent (d)all of the above Answer:(a) 2-1

2-1 Chapter Two Financial Markets and Institutions Multiple Choice 1. A market that has no one specific location is termed a(n) ________ market. (a) over-the-counter (b) geographic location (c) intermediary (d) conceptual Answer: (a) 2. Incentive problems take a variety of forms and include: (a) moral hazard (b) adverse selection (c) principal-agent (d) all of the above Answer: (d) 4. The ________ problem exists when having insurance against some risk causes the insured party to take greater risk or to take less care in preventing the event that gives rise to the loss. (a) moral hazard (b) adverse selection (c) principal-agent (d) all of the above Answer: (a)

5.Life annuities are examples of problems. (a)moral hazard (b)adverse selection (c)principal-agent (d)all of the above Answer:(b) 6 means giving the lender the right to seize specific business assets in the event of default. (a)Increasing moral hazard (b)Increasing adverse selection (c)Collateralization of loans (d)All of the above Answer:(c) 7. instruments are also called fixed-income instruments. (a)Debt (b)Equity (c)Derivative (d)All of the above Answer:(a) 8.The market for short-term debt(less than one year)is called the market,and the market for long-term debt and equity securities is called the market. (a)capital;money (b)money;capital (c)fixed-income;money (d)derivative;equity Answer:(b) 2-2

2-2 5. Life annuities are examples of ________ problems. (a) moral hazard (b) adverse selection (c) principal-agent (d) all of the above Answer: (b) 6. ________ means giving the lender the right to seize specific business assets in the event of default. (a) Increasing moral hazard (b) Increasing adverse selection (c) Collateralization of loans (d) All of the above Answer: (c) 7. ________ instruments are also called fixed-income instruments. (a) Debt (b) Equity (c) Derivative (d) All of the above Answer: (a) 8. The market for short-term debt (less than one year) is called the ________ market, and the market for long-term debt and equity securities is called the ________ market. (a) capital; money (b) money; capital (c) fixed-income; money (d) derivative; equity Answer: (b)

9 securities are financial instruments that derive their value from the prices of one or more other assets (a)Debt (b)Equity (c)Derivative (d)Fixed-income Answer:(c) 10.A call option gives its holder the right to some asset at a specified price on or before some specified expiration date. (a)sell (b)buy (c)loan (d)borrow Answer:(b) 11.A put option gives its holder the right to some asset at a specified price on or before some specified expiration date. (a)sell (b)buy (c)loan (d)borrow Answer:(a) 12. contracts oblige one party to the contract to buy,and the other party to sell,some asset at a specified price on some specified date. (a)Options (b)Uncertainty (c)Money market (d)Forward Answer:(d) 2-3

2-3 9. ________ securities are financial instruments that derive their value from the prices of one or more other assets. (a) Debt (b) Equity (c) Derivative (d) Fixed-income Answer: (c) 10. A call option gives its holder the right to ________ some asset at a specified price on or before some specified expiration date. (a) sell (b) buy (c) loan (d) borrow Answer: (b) 11. A put option gives its holder the right to ________ some asset at a specified price on or before some specified expiration date. (a) sell (b) buy (c) loan (d) borrow Answer: (a) 12. ________ contracts oblige one party to the contract to buy, and the other party to sell, some asset at a specified price on some specified date. (a) Options (b) Uncertainty (c) Money market (d) Forward Answer: (d)

13.The curve depicts the relation between interest rates on fixed-income instruments issued by the U.S.Treasury and the maturity of the instrument. (a)long-term (b)short-term (c)yield (d)exchange rate Answer:(c) 14.If the short-term rates are higher than the long-term rates,then the yield curve is (a)upward sloping (b)downward sloping (c)horizontal (d)vertical Answer:(b) Questions 15 and 16 are intended to be calculated as a pair. 15.Suppose you are a French investor,who wants a safe investment in terms of francs.You are investing for one year and the interest rate on a one-year French government bond is 5%and at the same time it is 9%on a U.S.government bond.The exchange rate is currently 6.15 French francs to the dollar. Suppose you invest $1,000 in a U.S.bond.Also suppose that a year from now the French franc/dollar exchange rate is 6.50 French francs to the dollar.What will be the realized French franc rate of return on the U.S.bond? (a)5.69% (b)9.00% (c)15.2% (d7.00% Answer:(c) 16.In question 15,what would the exchange rate at year's end have to be in order for the French investor to earn exactly 4%per year on the investment in U.S.bonds? (a)6.20FF/$ (b)5.87FF/$ (c)6.40FF/$ (d)5.42FF/$ Answer:(b) 2-4

2-4 13. The ________ curve depicts the relation between interest rates on fixed-income instruments issued by the U.S. Treasury and the maturity of the instrument. (a) long-term (b) short-term (c) yield (d) exchange rate Answer: (c) 14. If the short-term rates are higher than the long-term rates, then the yield curve is ________. (a) upward sloping (b) downward sloping (c) horizontal (d) vertical Answer: (b) Questions 15 and 16 are intended to be calculated as a pair. 15. Suppose you are a French investor, who wants a safe investment in terms of francs. You are investing for one year and the interest rate on a one-year French government bond is 5% and at the same time it is 9% on a U.S. government bond. The exchange rate is currently 6.15 French francs to the dollar. Suppose you invest $1,000 in a U.S. bond. Also suppose that a year from now the French franc/dollar exchange rate is 6.50 French francs to the dollar. What will be the realized French franc rate of return on the U.S. bond? (a) 5.69% (b) 9.00% (c) 15.2% (d) 7.00% Answer: (c) 16. In question 15, what would the exchange rate at year’s end have to be in order for the French investor to earn exactly 4% per year on the investment in U.S. bonds? (a) 6.20 FF/$ (b) 5.87 FF/$ (c) 6.40 FF/$ (d) 5.42 FF/$ Answer: (b)

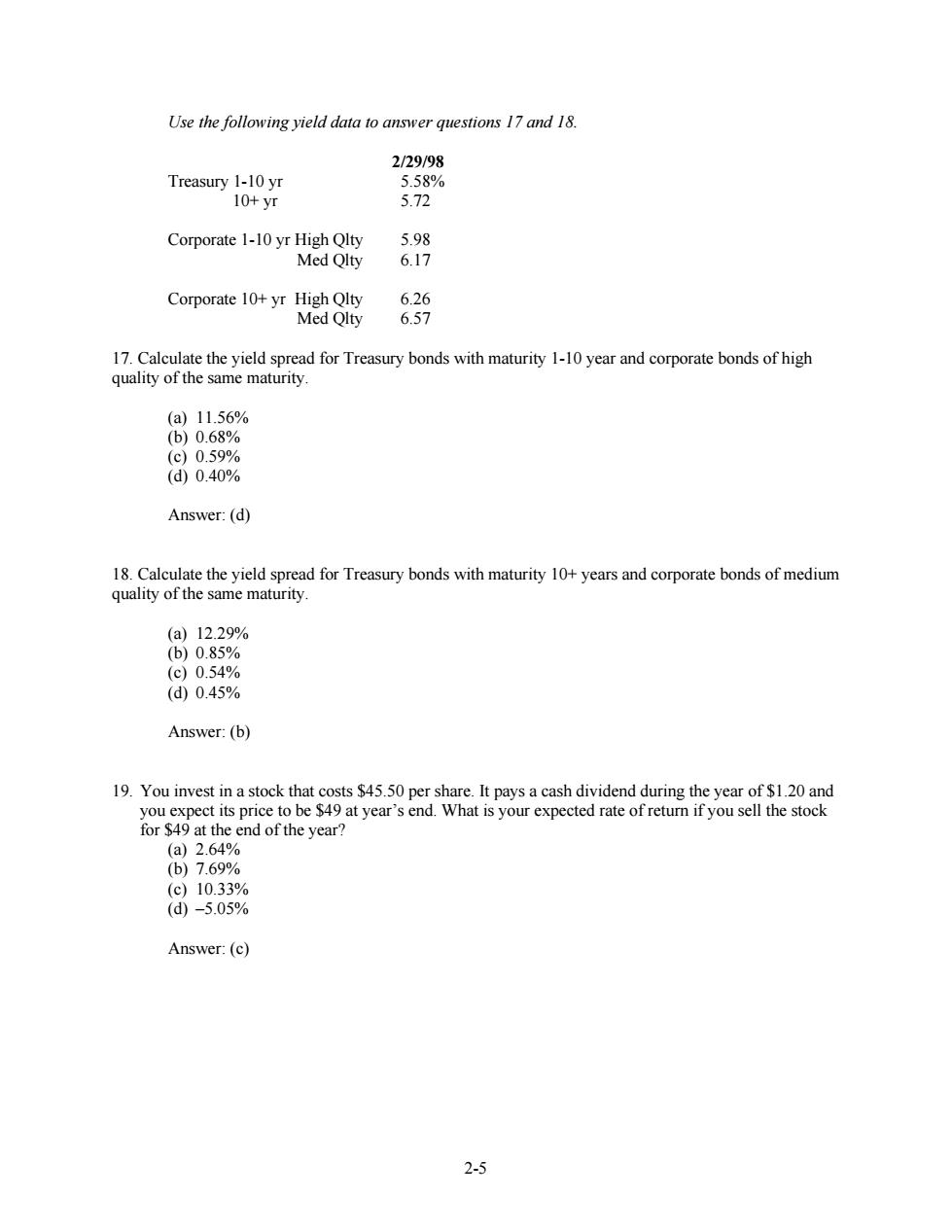

Use the following yield data to answer questions 17 and 18. 2/29/98 Treasury 1-10 yr 5.58% 10+yr 5.72 Corporate 1-10 yr High Qlty 5.98 Med Qlty 6.17 Corporate 10+yr High Qlty 6.26 Med Olty 6.57 17.Calculate the yield spread for Treasury bonds with maturity 1-10 year and corporate bonds of high quality of the same maturity. (a)11.56% (b)0.68% (c)0.59% (d0.40% Answer:(d) 18.Calculate the yield spread for Treasury bonds with maturity 10+years and corporate bonds of medium quality of the same maturity. (a)12.29% (b)0.85% (c)0.54% (d0.45% Answer:(b) 19.You invest in a stock that costs $45.50 per share.It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year's end.What is your expected rate of return if you sell the stock for $49 at the end of the year? (a)2.64% (b)7.69% (c)10.33% (d)-5.05% Answer:(c) 2-5

2-5 Use the following yield data to answer questions 17 and 18. 2/29/98 Treasury 1-10 yr 5.58% 10+ yr 5.72 Corporate 1-10 yr High Qlty 5.98 Med Qlty 6.17 Corporate 10+ yr High Qlty 6.26 Med Qlty 6.57 17. Calculate the yield spread for Treasury bonds with maturity 1-10 year and corporate bonds of high quality of the same maturity. (a) 11.56% (b) 0.68% (c) 0.59% (d) 0.40% Answer: (d) 18. Calculate the yield spread for Treasury bonds with maturity 10+ years and corporate bonds of medium quality of the same maturity. (a) 12.29% (b) 0.85% (c) 0.54% (d) 0.45% Answer: (b) 19. You invest in a stock that costs $45.50 per share. It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year’s end. What is your expected rate of return if you sell the stock for $49 at the end of the year? (a) 2.64% (b) 7.69% (c) 10.33% (d) –5.05% Answer: (c)

20.You invest in a stock that costs $45.50 per share.It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year's end.What is your expected rate of return if you do not sell the stock at the end of the year? (a)2.64% (b)7.69% (c)10.33% (d-5.05% Answer:(c) 21.You invest in a stock that costs $45.50 per share.It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year's end.What is your realized rate of return if the stock's price is actually $42 at year's end? (a)-5.05% (b)18.02% (c)10.33% (d5.05% Answer:(a) 22.The the standard deviation,the the volatility of the rate of return. (a)higher,lower (b)lower,higher (c)higher,higher (d)none of the above Answer:(c) 23. is an investment strategy that seeks to match the returns of a specified stock market index. (a)Indexing (b)Benchmarking (c)Replicating (d)Diversifying Answer:(a) 2-6

2-6 20. You invest in a stock that costs $45.50 per share. It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year’s end. What is your expected rate of return if you do not sell the stock at the end of the year? (a) 2.64% (b) 7.69% (c) 10.33% (d) –5.05% Answer: (c) 21. You invest in a stock that costs $45.50 per share. It pays a cash dividend during the year of $1.20 and you expect its price to be $49 at year’s end. What is your realized rate of return if the stock’s price is actually $42 at year’s end? (a) –5.05% (b) 18.02% (c) 10.33% (d) 5.05% Answer: (a) 22. The ________ the standard deviation, the ________ the volatility of the rate of return. (a) higher, lower (b) lower, higher (c) higher, higher (d) none of the above Answer: (c) 23. ________ is an investment strategy that seeks to match the returns of a specified stock market index. (a) Indexing (b) Benchmarking (c) Replicating (d) Diversifying Answer: (a)

24.Suppose the risk-free nominal interest rate on a one-year U.S.Treasury bill is 7%per year and the expected rate of inflation is 3%per year.What is the expected real rate of return on the T-bill? (a)4% (b)3.88% (c)1.34% (d3.74% Answer:(b) 25.Suppose the risk-free nominal interest rate on a one-year U.S.Treasury bill is 6%per year and the expected rate of inflation is 4%per year.What is the expected real rate of return on the T-bill? (a)2% (b)5% (c)1.92% (d1.89% Answer:(c) 26.Suppose that the real rate of interest on a TIPS is 4.5%per year and the expected rate of inflation in the U.S.is 5%per year.What is the expected nominal rate of return on these bonds? (a)0.476% (b)4.75% (c)9.73% (d9.75% Answer:(c) 27.Currently you have a bank account containing $6,000,which earns interest at a rate of 4%per year. You also have an unpaid balance on your credit card of $3,000 on which you are paying an interest rate of 18%per year.If the time frame is one year,the arbitrage opportunity you face is: (a)$420 (b)$540 (c)$120 (d$300 Answer:(a) 2-7

2-7 24. Suppose the risk-free nominal interest rate on a one-year U.S. Treasury bill is 7% per year and the expected rate of inflation is 3% per year. What is the expected real rate of return on the T-bill? (a) 4% (b) 3.88% (c) 1.34% (d) 3.74% Answer: (b) 25. Suppose the risk-free nominal interest rate on a one-year U.S. Treasury bill is 6% per year and the expected rate of inflation is 4% per year. What is the expected real rate of return on the T-bill? (a) 2% (b) 5% (c) 1.92% (d) 1.89% Answer: (c) 26. Suppose that the real rate of interest on a TIPS is 4.5% per year and the expected rate of inflation in the U.S. is 5% per year. What is the expected nominal rate of return on these bonds? (a) 0.476% (b) 4.75% (c) 9.73% (d) 9.75% Answer: (c) 27. Currently you have a bank account containing $6,000, which earns interest at a rate of 4% per year. You also have an unpaid balance on your credit card of $3,000 on which you are paying an interest rate of 18% per year. If the time frame is one year, the arbitrage opportunity you face is: (a) $420 (b) $540 (c) $120 (d) $300 Answer: (a)

28.A interest rate is denominated in units of some currency,whereas a interest rate is denominated in units of some commodity or"basket"of goods and services. (a)real,nominal (b)real,treasury (c)nominal,real (d)treasury,real Answer:(c) 29 are firms whose primary function is to help businesses,governments,and other entities raise funds to finance their activities by issuing securities. (a)Closed-end funds (b)Investment banks (c)Asset management funds (d)Open-end funds Answer:(b) 30.Currently,you have $24,000 in a bank account earning an interest rate of 4%per year.At the same time you have an unpaid balance on your credit card of $12,000 on which you are paying an interest rate of 18%per year.If the time frame is one year,the arbitrage opportunity you face is: (a)$2,160 (b)$1,200 (c)$480 (d$1,680 Answer:(d) 31.In the United States,the establishes the precise disclosure requirements that must be satisfied for a public offering of securities. (a)Financial Accounting Standards Board (b)World Bank (c)Federal Reserve (d)Securities and Exchange Commission Answer:(d) 2-8

2-8 28. A ________ interest rate is denominated in units of some currency, whereas a ________ interest rate is denominated in units of some commodity or “basket” of goods and services. (a) real, nominal (b) real, treasury (c) nominal, real (d) treasury, real Answer: (c) 29. ________ are firms whose primary function is to help businesses, governments, and other entities raise funds to finance their activities by issuing securities. (a) Closed-end funds (b) Investment banks (c) Asset management funds (d) Open-end funds Answer: (b) 30. Currently, you have $24,000 in a bank account earning an interest rate of 4% per year. At the same time you have an unpaid balance on your credit card of $12,000 on which you are paying an interest rate of 18% per year. If the time frame is one year, the arbitrage opportunity you face is: (a) $2,160 (b) $1,200 (c) $480 (d) $1,680 Answer: (d) 31. In the United States, the ________ establishes the precise disclosure requirements that must be satisfied for a public offering of securities. (a) Financial Accounting Standards Board (b) World Bank (c) Federal Reserve (d) Securities and Exchange Commission Answer: (d)

32.Investment professionals typically use a(n) index as a benchmark for measuring the performance of common stock mutual funds. (a)inflation adjusted (b)firm-size weighted (c)market-weighted (d)book-weighted Answer:(c) 33.The Dow Jones Industrial Index has some major defects,which include: (a)It is not broadly diversified enough to accurately reflect the wide spectrum of stocks in the United States. (b)It corresponds to a portfolio strategy that is unsuitable as a performance benchmark. (c)It only includes the 30 largest corporations. (d)(a)and (b) Answer:(d) 34.Interest-rate arbitrage is at a lower rate and at a higher rate. (a)borrowing,lending (b)borrowing,defaulting (c)defaulting,lending (d)lending,borrowing Answer:(a) 35. invest their funds in a new businesses and help the management team get the firm to the point at which it is ready to“go public..” (a)Investment banks (b)Venture capitalists (c)Asset management firms (d)Mutual funds Answer:(b) 2-9

2-9 32. Investment professionals typically use a(n) ________ index as a benchmark for measuring the performance of common stock mutual funds. (a) inflation adjusted (b) firm-size weighted (c) market-weighted (d) book-weighted Answer: (c) 33. The Dow Jones Industrial Index has some major defects, which include: (a) It is not broadly diversified enough to accurately reflect the wide spectrum of stocks in the United States. (b) It corresponds to a portfolio strategy that is unsuitable as a performance benchmark. (c) It only includes the 30 largest corporations. (d) (a) and (b) Answer: (d) 34. Interest-rate arbitrage is ________ at a lower rate and ________ at a higher rate. (a) borrowing, lending (b) borrowing, defaulting (c) defaulting, lending (d) lending, borrowing Answer: (a) 35. ________ invest their funds in a new businesses and help the management team get the firm to the point at which it is ready to “go public.” (a) Investment banks (b) Venture capitalists (c) Asset management firms (d) Mutual funds Answer: (b)

36.The case where there is an imbalance in the exchange of information about a business opportunity is known as (a)information symmetry (b)information asymmetry (c)information assets (d)(a)and(c) Answer:(b) 37.Which of the following represents a defined-contribution pension plan? (a)A pension plan into which the employer and employee make regular contributions. (b)A pension plan whose benefit is determined by a formula that takes into account years of service, wages,and salary. (c)A pension plan whose benefit formula is 1%of retirement salary for each year of service. (d)All of the above Answer:(a) 38.Which of the following are characteristic of a mutual fund? (a)professional management (b)diversification (c)efficient record keeping and administration (d)all of the above Answer:(d) 39.Net asset value is defined as the (a)future value of all assets held divided by the number of shares outstanding (b)book value of all securities held divided by the number of shares outstanding (c)market value of all securities held divided by the number of shares outstanding (d)book value of all assets held divided by the number of shares outstanding Answer:(c) 2-10

2-10 36. The case where there is an imbalance in the exchange of information about a business opportunity is known as ________. (a) information symmetry (b) information asymmetry (c) information assets (d) (a) and (c) Answer: (b) 37. Which of the following represents a defined-contribution pension plan? (a) A pension plan into which the employer and employee make regular contributions. (b) A pension plan whose benefit is determined by a formula that takes into account years of service, wages, and salary. (c) A pension plan whose benefit formula is 1% of retirement salary for each year of service. (d) All of the above Answer: (a) 38. Which of the following are characteristic of a mutual fund? (a) professional management (b) diversification (c) efficient record keeping and administration (d) all of the above Answer: (d) 39. Net asset value is defined as the ________. (a) future value of all assets held divided by the number of shares outstanding (b) book value of all securities held divided by the number of shares outstanding (c) market value of all securities held divided by the number of shares outstanding (d) book value of all assets held divided by the number of shares outstanding Answer: (c)