正在加载图片...

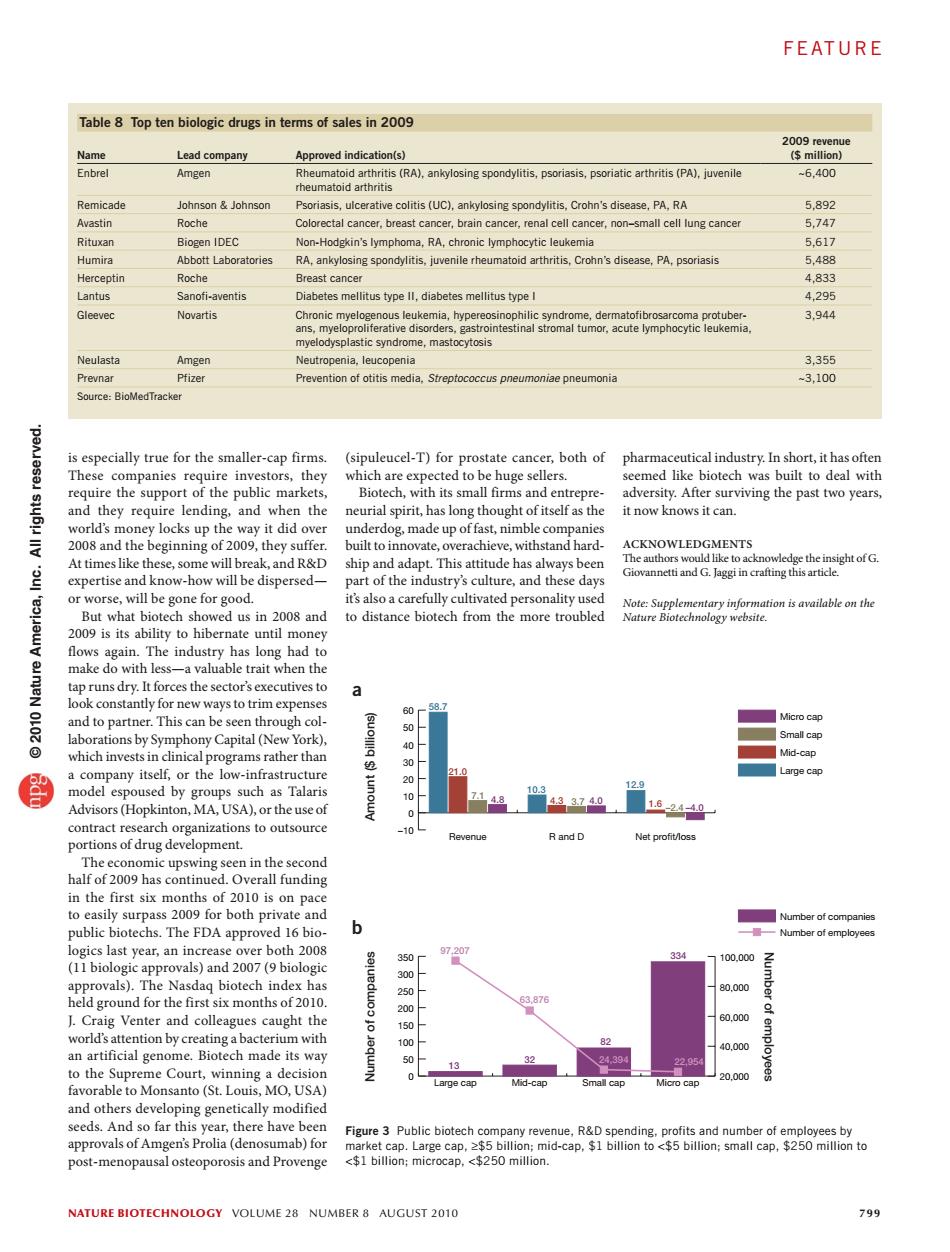

FEATURE Table 8 Top ten biologic drugs in terms of sales in 2009 2009 revenue Name Lead company Approved indication(s) (million) Enbrel Amgen Rheumatoid arthritis(RA),ankylosing spondylitis,psoriasis,psoriatic arthritis(PA),juvenile -6,400 rheumatoid arthritis Remicade JohnsonJohnson Psoriasis,ulcerative colitis (UC),ankylosing spondylitis,Crohn's disease,PA,RA 5,892 Avastin Roche Colorectal cancer,breast cancer,brain cancer,renal cell cancer,non-small cell lung cancer 5,747 Rituxan Biogen IDEC Non-Hodgkin's lymphoma,RA,chronic lymphocytic leukemia 5,617 Humira Abbott Laboratories RA,ankylosing spondylitis,juvenile rheumatoid arthritis,Crohn's disease,PA,psoriasis 5,488 Herceptin Roche Breast cancer 4,833 Lantus Sanofi-aventis Diabetes mellitus type ll,diabetes mellitus type I 4,295 Gleevec Novartis Chronic myelogenous leukemia,hypereosinophilic syndrome,dermatofibrosarcoma protuber- 3.944 ans,myeloproliferative disorders,gastrointestinal stromal tumor,acute lymphocytic leukemia, myelodysplastic syndrome,mastocytosis Neulasta Amgen Neutropenia,leucopenia 3,355 Prevnar Pfizer Prevention of otitis media.Streptococcus pneumoniae pneumonia -3,100 Source:BioMedTracker is especially true for the smaller-cap firms. (sipuleucel-T)for prostate cancer,both of pharmaceutical industry.In short,it has often These companies require investors,they which are expected to be huge sellers. seemed like biotech was built to deal with require the support of the public markets, Biotech,with its small firms and entrepre- adversity.After surviving the past two years, and they require lending,and when the neurial spirit,has long thought of itself as the it now knows it can. world's money locks up the way it did over underdog,made up of fast,nimble companies 2008 and the beginning of 2009,they suffer. built to innovate,overachieve,withstand hard- ACKNOWLEDGMENTS At times like these,some will break,and R&D ship and adapt.This attitude has always been The authors would like to acknowledge the insight of G. expertise and know-how will be dispersed- part of the industry's culture,and these days Giovannetti and G.Jaggi in crafting this article. or worse,will be gone for good. it's also a carefully cultivated personality used Note:Supplementary information is available on the But what biotech showed us in 2008 and to distance biotech from the more troubled Nature Biotechnology website. 2009 is its ability to hibernate until money flows again.The industry has long had to make do with less-a valuable trait when the tap runs dry.It forces the sector's executives to a look constantly for new ways to trim expenses 58.7 2100 and to partner.This can be seen through col- Micro cap laborations by Symphony Capital(New York), Small cap which invests in clinical programs rather than Mid-cap a company itself,or the low-infrastructure Large cap 20 model espoused by groups such as Talaris 10 Advisors (Hopkinton,MA,USA),or the use of 3.74.0 1.6 0 24- contract research organizations to outsource 0 Rand D Net profit/loss portions of drug development. The economic upswing seen in the second half of 2009 has continued.Overall funding in the first six months of 2010 is on pace to easily surpass 2009 for both private and Number of companies public biotechs.The FDA approved 16 bio- b Number of employees logics last year,an increase over both 2008 97.207 350 334 100.000 (11 biologic approvals)and 2007(9biologic approvals).The Nasdaq biotech index has 300 250 80.000 Number held ground for the first six months of 2010. 63.876 200 J.Craig Venter and colleagues caught the 6 60.000 150 world's attention by creating a bacterium with 100 82 emp 40.000 an artificial genome.Biotech made its way 50 32 13 24:394 225 to the Supreme Court,winning a decision 0 Mid-cap J20.000 Large cap cap favorable to Monsanto(St.Louis,MO,USA) Micro cap and others developing genetically modified seeds.And so far this year,there have been Figure 3 Public biotech company revenue,R&D spending,profits and number of employees by approvals of Amgen's Prolia(denosumab)for market cap.Large cap,2$5 billion;mid-cap,$1 billion to <$5 billion;small cap,$250 million to post-menopausal osteoporosis and Provenge <$1 billion;microcap,<$250 million NATURE BIOTECHNOLOGY VOLUME 28 NUMBER 8 AUGUST 2010 799nature biotechnology volume 28 number 8 august 2010 799 pharmaceutical industry. In short, it has often seemed like biotech was built to deal with adversity. After surviving the past two years, it now knows it can. ACKNOWLEDGMENTS The authors would like to acknowledge the insight of G. Giovannetti and G. Jaggi in crafting this article. Note: Supplementary information is available on the Nature Biotechnology website. (sipuleucel-T) for prostate cancer, both of which are expected to be huge sellers. Biotech, with its small firms and entrepreneurial spirit, has long thought of itself as the underdog, made up of fast, nimble companies built to innovate, overachieve, withstand hardship and adapt. This attitude has always been part of the industry’s culture, and these days it’s also a carefully cultivated personality used to distance biotech from the more troubled is especially true for the smaller-cap firms. These companies require investors, they require the support of the public markets, and they require lending, and when the world’s money locks up the way it did over 2008 and the beginning of 2009, they suffer. At times like these, some will break, and R&D expertise and know-how will be dispersed— or worse, will be gone for good. But what biotech showed us in 2008 and 2009 is its ability to hibernate until money flows again. The industry has long had to make do with less—a valuable trait when the tap runs dry. It forces the sector’s executives to look constantly for new ways to trim expenses and to partner. This can be seen through collaborations by Symphony Capital (New York), which invests in clinical programs rather than a company itself, or the low-infrastructure model espoused by groups such as Talaris Advisors (Hopkinton, MA, USA), or the use of contract research organizations to outsource portions of drug development. The economic upswing seen in the second half of 2009 has continued. Overall funding in the first six months of 2010 is on pace to easily surpass 2009 for both private and public biotechs. The FDA approved 16 biologics last year, an increase over both 2008 (11 biologic approvals) and 2007 (9 biologic approvals). The Nasdaq biotech index has held ground for the first six months of 2010. J. Craig Venter and colleagues caught the world’s attention by creating a bacterium with an artificial genome. Biotech made its way to the Supreme Court, winning a decision favorable to Monsanto (St. Louis, MO, USA) and others developing genetically modified seeds. And so far this year, there have been approvals of Amgen’s Prolia (denosumab) for post-menopausal osteoporosis and Provenge Table 8 Top ten biologic drugs in terms of sales in 2009 Name Lead company Approved indication(s) 2009 revenue ($ million) Enbrel Amgen Rheumatoid arthritis (RA), ankylosing spondylitis, psoriasis, psoriatic arthritis (PA), juvenile rheumatoid arthritis ~6,400 Remicade Johnson & Johnson Psoriasis, ulcerative colitis (UC), ankylosing spondylitis, Crohn’s disease, PA, RA 5,892 Avastin Roche Colorectal cancer, breast cancer, brain cancer, renal cell cancer, non–small cell lung cancer 5,747 Rituxan Biogen IDEC Non-Hodgkin’s lymphoma, RA, chronic lymphocytic leukemia 5,617 Humira Abbott Laboratories RA, ankylosing spondylitis, juvenile rheumatoid arthritis, Crohn’s disease, PA, psoriasis 5,488 Herceptin Roche Breast cancer 4,833 Lantus Sanofi-aventis Diabetes mellitus type II, diabetes mellitus type I 4,295 Gleevec Novartis Chronic myelogenous leukemia, hypereosinophilic syndrome, dermatofibrosarcoma protuberans, myeloproliferative disorders, gastrointestinal stromal tumor, acute lymphocytic leukemia, myelodysplastic syndrome, mastocytosis 3,944 Neulasta Amgen Neutropenia, leucopenia 3,355 Prevnar Pfizer Prevention of otitis media, Streptococcus pneumoniae pneumonia ~3,100 Source: BioMedTracker –10 0 10 20 30 40 50 60 Micro cap Small cap Mid-cap Large cap Revenue R and D Net profit/loss 0 50 100 150 200 250 300 350 Number of companies Large cap Mid-cap Small cap Micro cap 20,000 40,000 60,000 80,000 100,000 Number of employees Number of employees Number of companies Amount ($ billions) a b 58.7 21.0 7.1 4.8 10.3 4.3 3.7 4.0 12.9 1.6 –2.4 –4.0 97,207 63,876 24,394 22,954 13 32 82 334 Figure 3 Public biotech company revenue, R&D spending, profits and number of employees by market cap. Large cap, ≥$5 billion; mid-cap, $1 billion to <$5 billion; small cap, $250 million to <$1 billion; microcap, <$250 million. feat u re © 2010 Nature America, Inc. All rights reserved